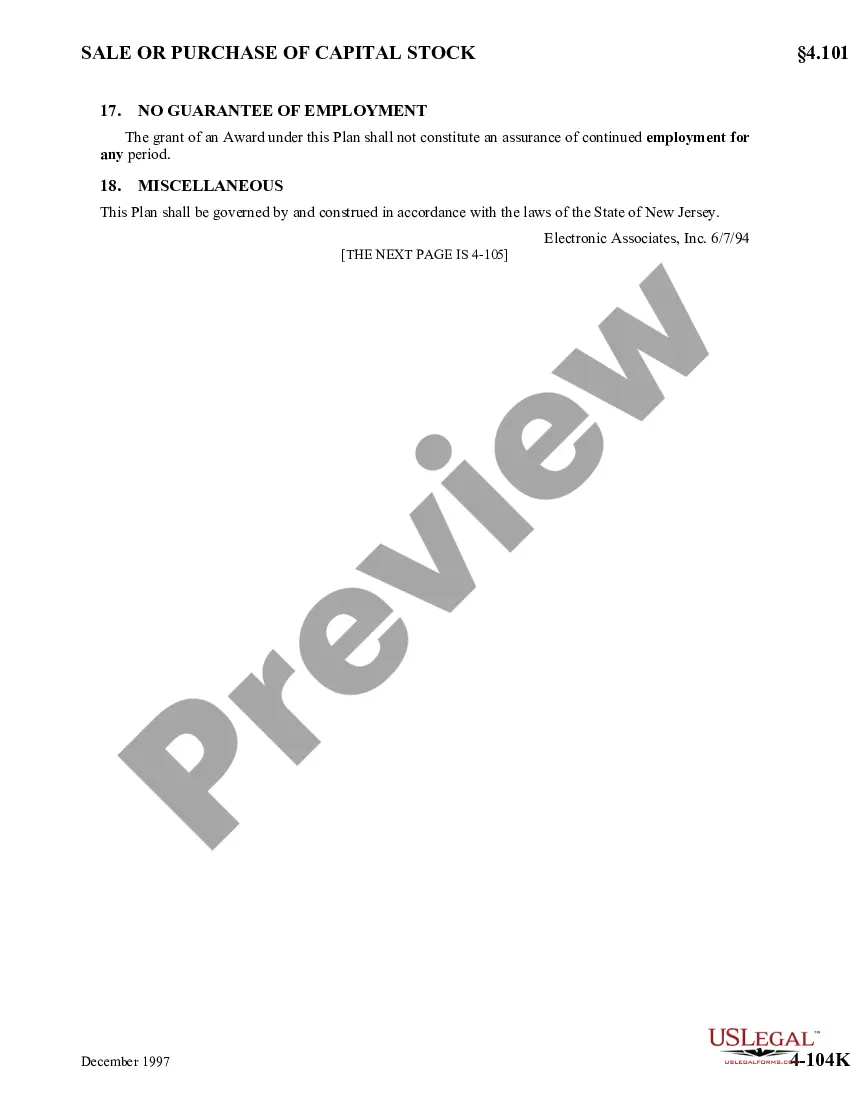

Rhode Island Equity Incentive Plan

Description

How to fill out Equity Incentive Plan?

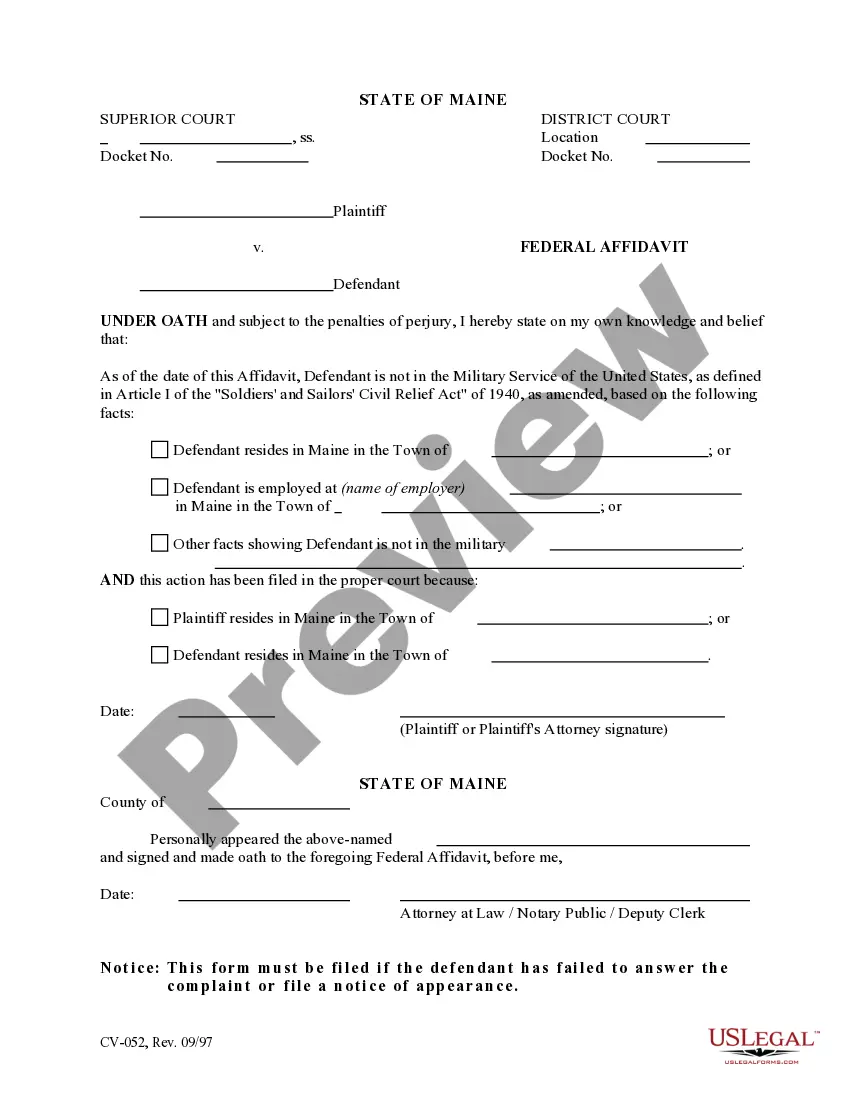

If you have to full, download, or produce lawful papers themes, use US Legal Forms, the most important selection of lawful forms, that can be found online. Make use of the site`s basic and practical research to find the paperwork you want. A variety of themes for organization and person purposes are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to find the Rhode Island Equity Incentive Plan in a few clicks.

When you are already a US Legal Forms customer, log in to the profile and click the Acquire key to get the Rhode Island Equity Incentive Plan. You can even gain access to forms you in the past acquired in the My Forms tab of the profile.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have selected the form for the right city/country.

- Step 2. Utilize the Preview solution to check out the form`s content. Do not forget about to see the description.

- Step 3. When you are not happy with the type, utilize the Research discipline on top of the screen to locate other variations in the lawful type web template.

- Step 4. Upon having discovered the form you want, click the Acquire now key. Pick the costs prepare you favor and include your references to sign up for the profile.

- Step 5. Procedure the purchase. You may use your Мisa or Ьastercard or PayPal profile to complete the purchase.

- Step 6. Find the formatting in the lawful type and download it on the gadget.

- Step 7. Comprehensive, revise and produce or sign the Rhode Island Equity Incentive Plan.

Each and every lawful papers web template you acquire is yours eternally. You might have acces to each and every type you acquired within your acccount. Click the My Forms segment and choose a type to produce or download once again.

Be competitive and download, and produce the Rhode Island Equity Incentive Plan with US Legal Forms. There are many skilled and express-distinct forms you can utilize to your organization or person needs.

Form popularity

FAQ

Eligible applicants: Low- or moderate-income (LMI) households. Owners of eligible LMI multifamily buildings. Governmental, commercial, or nonprofit entity carrying out a project for an eligible household or an owner of an eligible multifamily building.

Thanks to the newly enacted Inflation Reduction Act, Rhode Island families are eligible for hundreds of dollars a year in energy savings. This historic legislation will: Create millions of good-paying American jobs. Put the U.S. on track to reduce emissions by up to 40 percent over the next decade.

Qualified Jobs Incentive Tax Credit Expand your workforce in Rhode Island or relocate jobs from out of state, and you can receive annual, redeemable tax credits for up to 10 years with the Qualified Jobs Incentive program. Credits can equal up to $7,500 per job per year, depending on the wage level and other criteria.

Signed into law in August 2022, the Inflation Reduction Act provides tax credits and rebates to encourage Rhode Island homeowners to replace older appliances with high-efficiency equipment that does a better job at a lower operating cost.

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2.75 cents per kilowatt-hour in 2022 dollars (adjusted for inflation annually) of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and ...

A modern grid will provide resilience, reliability, security, affordability, flexibility, and sustainability, ing to the U.S. Dept. of Energy. But still, utility profits are driven by capital investments. Rhode Island Energy is allowed to recoup a 9.275% return on investment, or ROE, on authorized capital costs.

The first way to get free solar panels in Rhode Island is through the Rhode Island Renewable Energy Fund (RIRES). This program is designed to help residents and businesses reduce their energy costs by providing financial incentives for the installation of solar panels.

The Inflation Reduction Act offers homeowners up to 30% in tax credits for making energy efficiency improvements to their homes ? up to $1,200 per year!