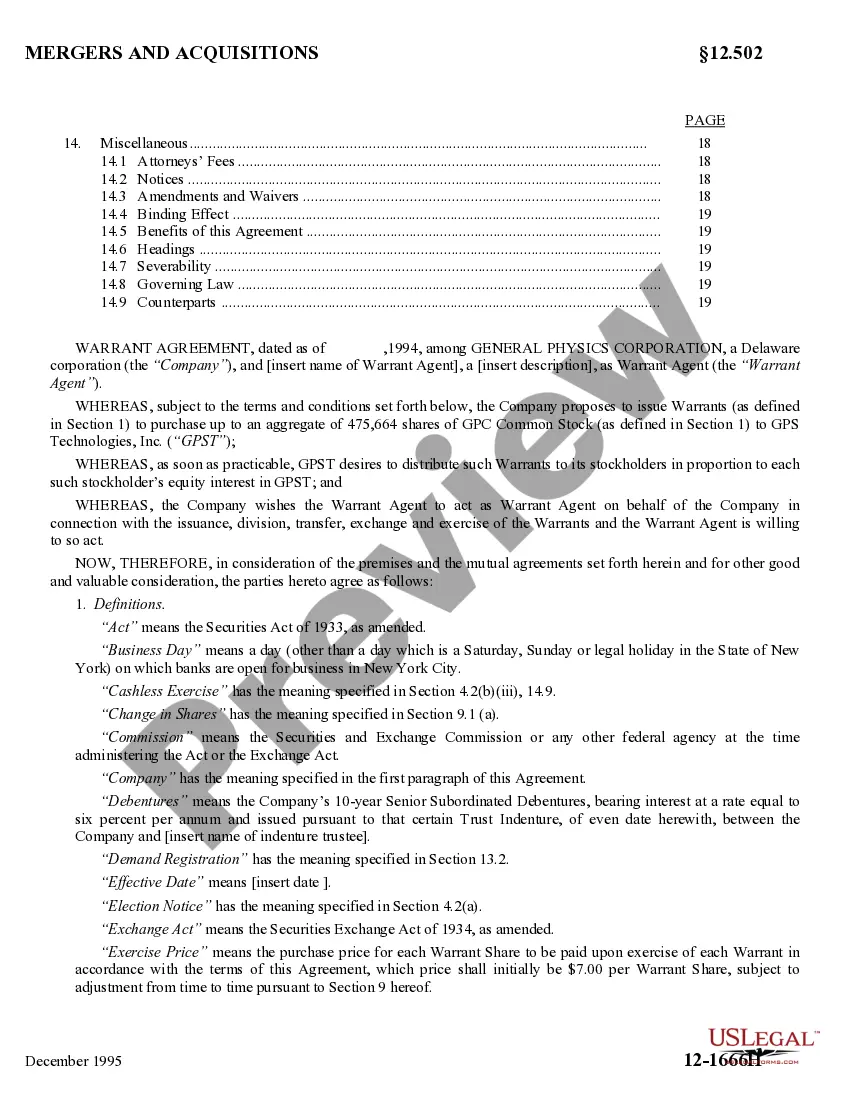

Rhode Island Second Warrant Agreement by General Physics Corp.

Description

How to fill out Second Warrant Agreement By General Physics Corp.?

If you need to full, download, or produce authorized file templates, use US Legal Forms, the biggest variety of authorized kinds, that can be found on-line. Use the site`s simple and convenient lookup to get the files you require. Numerous templates for enterprise and specific functions are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to get the Rhode Island Second Warrant Agreement by General Physics Corp. in a few click throughs.

In case you are already a US Legal Forms consumer, log in for your accounts and click on the Down load option to find the Rhode Island Second Warrant Agreement by General Physics Corp.. You may also access kinds you earlier delivered electronically inside the My Forms tab of your accounts.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape to the proper town/region.

- Step 2. Utilize the Review option to look through the form`s content material. Do not overlook to see the explanation.

- Step 3. In case you are unhappy with all the develop, make use of the Lookup discipline towards the top of the screen to discover other variations of your authorized develop design.

- Step 4. Once you have located the shape you require, click the Acquire now option. Pick the pricing plan you prefer and add your credentials to register on an accounts.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Find the structure of your authorized develop and download it on your device.

- Step 7. Complete, edit and produce or indicator the Rhode Island Second Warrant Agreement by General Physics Corp..

Every single authorized file design you acquire is your own eternally. You possess acces to every single develop you delivered electronically within your acccount. Select the My Forms segment and choose a develop to produce or download once more.

Compete and download, and produce the Rhode Island Second Warrant Agreement by General Physics Corp. with US Legal Forms. There are many professional and status-specific kinds you can use to your enterprise or specific demands.

Form popularity

FAQ

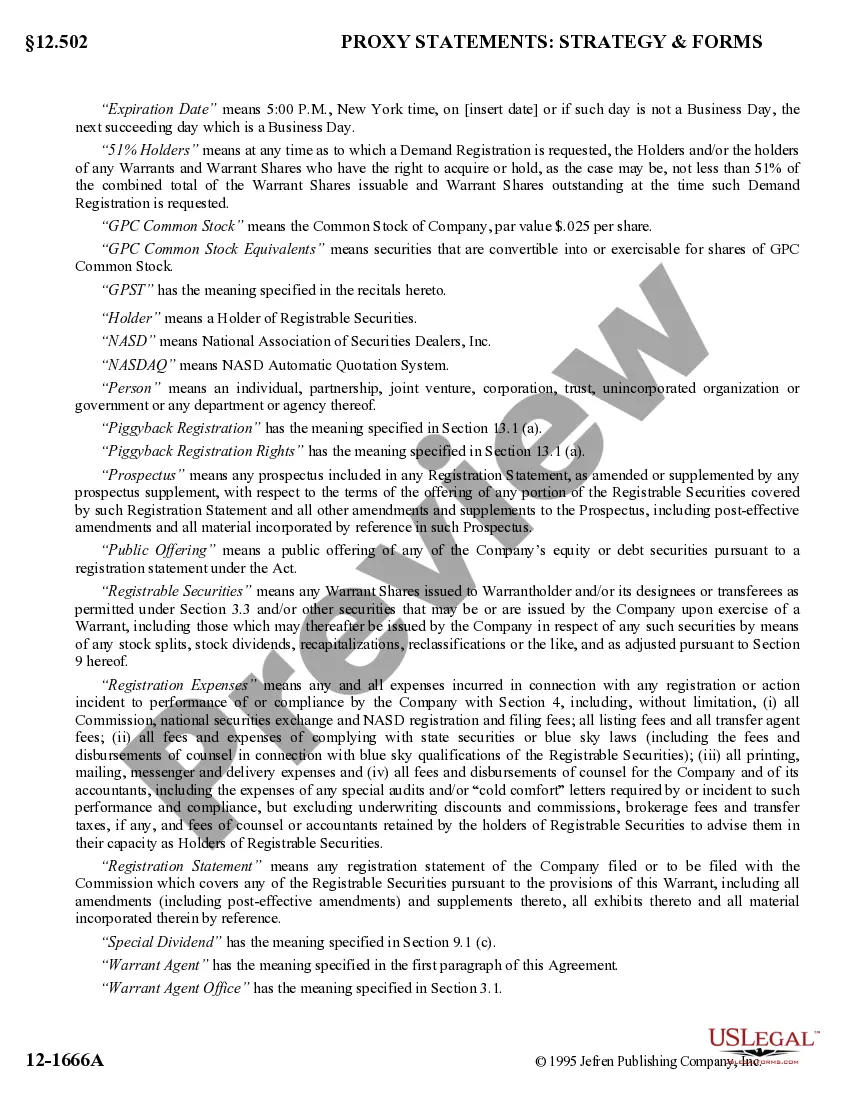

What Is Warrant Coverage? Warrant coverage is an agreement between a company and one or more shareholders where the company issues a warrant equal to some percentage of the dollar amount of an investment. Warrants, similar to options, allow investors to acquire shares at a designated price.

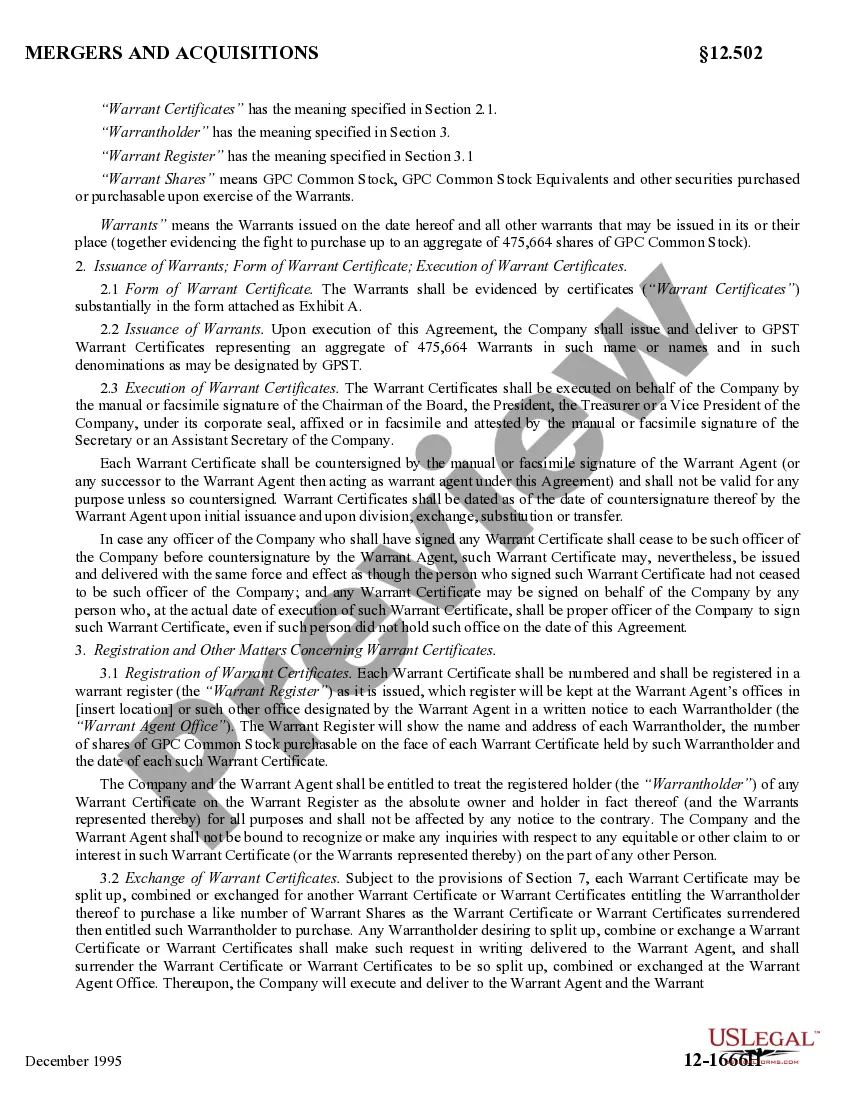

A warrant agreement is an agreement to purchase stock, also called a stock warrant. The agreement provides one party the right to purchase a company's stock at a specific price and at a specific date.

Warrants and call options are both types of securities contracts. A warrant gives the holder the right, but not the obligation, to buy common shares of stock directly from the company at a fixed price for a pre-defined time period.

Comparing Stock Warrants vs Stock Options. Stock warrants give the holder the right to buy shares of stock at a set price on a set date directly from the public company that issues them, whereas stock options convey the right to buy or sell shares on or before a specific date at a specific price.

A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

Companies often issue stock warrants by attaching the warrant to a bond or other security that they use to raise capital. The warrant helps attract investors and also represents potential future capital for the issuing company.