Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Rhode Island Special Rules for Designated Settlement Funds IRS Code 468B

Description

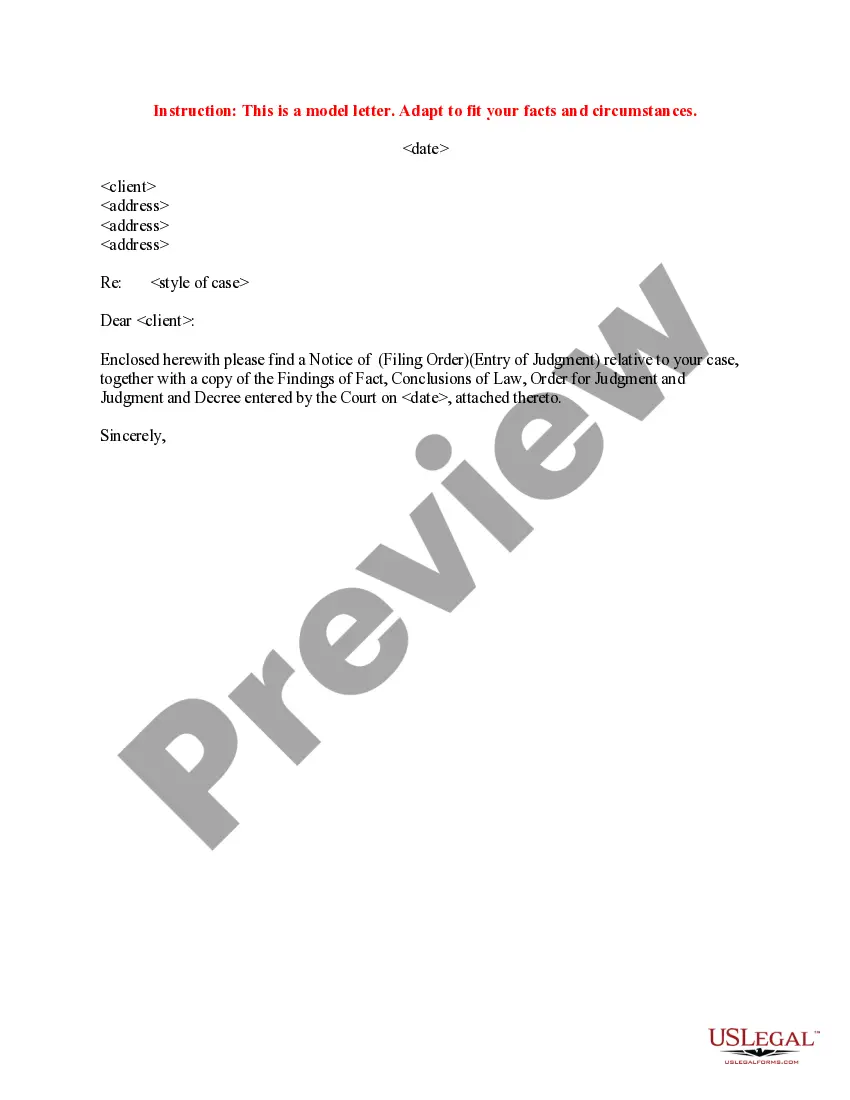

How to fill out Special Rules For Designated Settlement Funds IRS Code 468B?

You may commit hrs on-line looking for the legal file design that fits the state and federal specifications you will need. US Legal Forms gives a large number of legal kinds which can be evaluated by professionals. It is simple to download or print out the Rhode Island Special Rules for Designated Settlement Funds IRS Code 468B from the assistance.

If you already possess a US Legal Forms bank account, you are able to log in and click the Obtain button. Next, you are able to comprehensive, revise, print out, or indicator the Rhode Island Special Rules for Designated Settlement Funds IRS Code 468B. Each legal file design you purchase is yours forever. To have one more copy of the obtained develop, proceed to the My Forms tab and click the related button.

If you are using the US Legal Forms internet site for the first time, stick to the straightforward instructions listed below:

- First, make sure that you have chosen the correct file design to the area/town of your choosing. See the develop explanation to make sure you have selected the appropriate develop. If offered, take advantage of the Preview button to check with the file design as well.

- In order to get one more edition in the develop, take advantage of the Look for discipline to find the design that suits you and specifications.

- When you have found the design you want, click Buy now to carry on.

- Choose the prices program you want, type your qualifications, and sign up for your account on US Legal Forms.

- Total the purchase. You can use your Visa or Mastercard or PayPal bank account to purchase the legal develop.

- Choose the file format in the file and download it for your product.

- Make changes for your file if needed. You may comprehensive, revise and indicator and print out Rhode Island Special Rules for Designated Settlement Funds IRS Code 468B.

Obtain and print out a large number of file layouts utilizing the US Legal Forms web site, that provides the largest variety of legal kinds. Use expert and condition-distinct layouts to tackle your organization or individual requires.

Form popularity

FAQ

Line 17, code AC on Schedule K-1 of Form 1120-S is used to report the gross receipts amount for section 448(c). A shareholder needs this information to help determine if they are required to file Form 8990 (the gross receipts test).

Internal Revenue Code (IRC) § 468B provides for the taxation of designated settlement funds and directs the Department of the Treasury to prescribe regulations providing for the taxation of an escrow account, settlement fund, or similar fund, whether as a grantor trust or otherwise.

What Is a Disregarded Entity? A disregarded entity is a business with a single owner that is not separate from the owner for federal income tax purposes. This means taxes owed by this type of business are paid as part of the owner's income tax return.

Use Form 1120-S (Schedule B-1), Information on Certain Shareholders of an S Corporation, to provide the information applicable to any shareholder in the S corporation that was a disregarded entity, a trust, an estate, or a nominee or similar person at any time during the tax year.

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

The financial statement income or loss of a disregarded entity is included on Part I, line 7a or 7b, only if its financial statement income or loss is included on Part I, line 11, but not on Part I, line 4a. with its most recently filed U.S. income tax return or return of income filed prior to that day.

Line 29a. Record your total net operating loss carryovers from other tax years on line 29a. You can use your net operating loss incurred in one tax year to reduce your taxable income in another tax year. You must also attach a statement showing your net operating loss deduction computation.