Rhode Island Personal Guaranty of Another Person's Agreement to Pay Consultant

Description

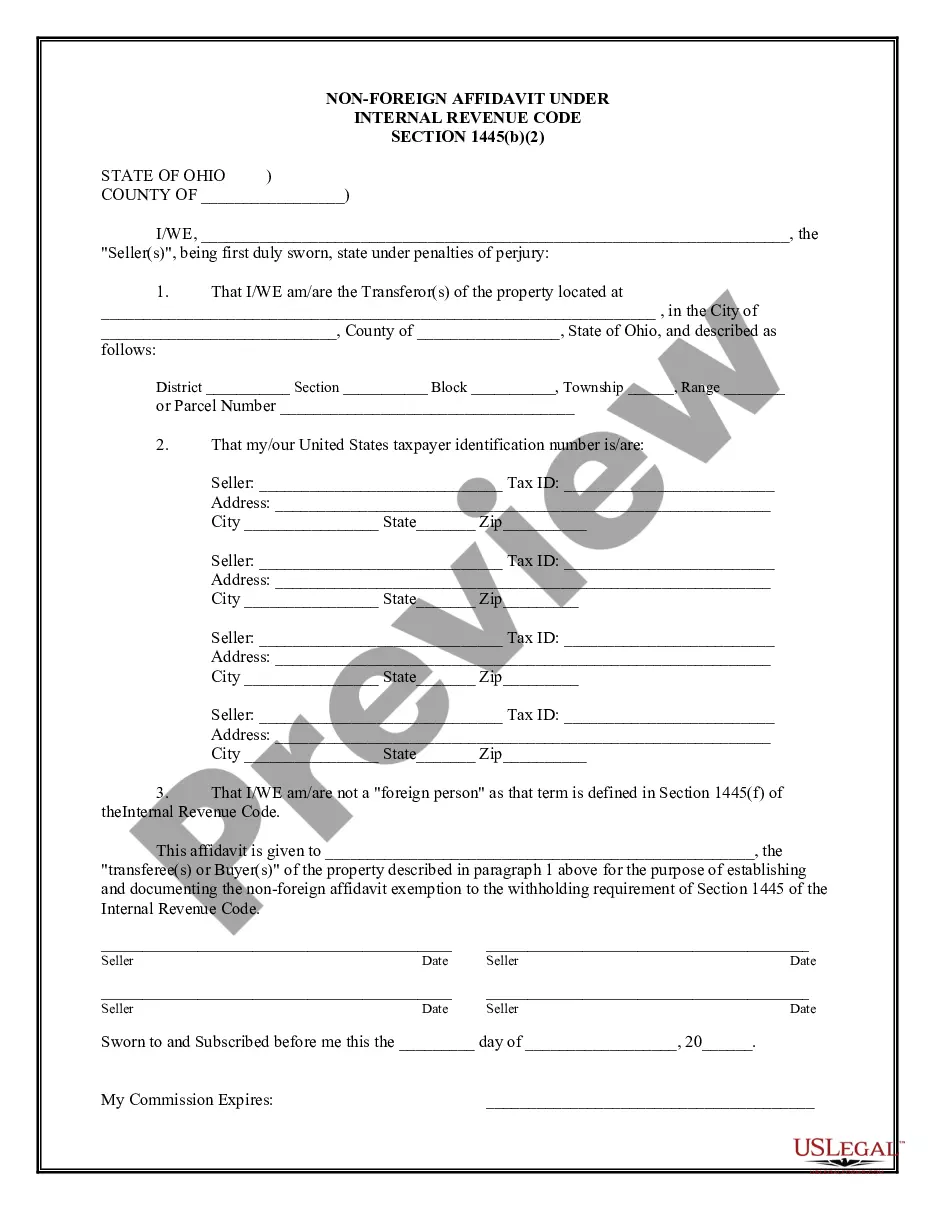

How to fill out Personal Guaranty Of Another Person's Agreement To Pay Consultant?

If you need to exhaustive, obtain, or print lawful document samples, utilize US Legal Forms, the largest collection of legal templates accessible online.

Utilize the website's user-friendly and convenient search to find the documents you require.

A range of templates for commercial and personal applications are classified by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to acquire the Rhode Island Personal Guaranty of Another Person's Agreement to Compensate Consultant in a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Rhode Island Personal Guaranty of Another Person's Agreement to Compensate Consultant.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your relevant region/country.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read through the outline.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative templates in the legal form archive.

Form popularity

FAQ

Personal guarantee: This is a signed promise that states that you will pay back your loan through personal assets that aren't legally protected from creditors. Collateral: If a business defaults or goes bankrupt, collateral is a particular asset or assets that are pledged as security for repaying the borrowed loan.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

An otherwise valid and enforceable personal guarantee can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.

Business owners can exercise their right to revoke the guarantee. Finally, business owners need to be aware that the personal guarantee may include a right to revoke. Typically, a right to revoke the guarantee does not limit the amount of the guarantor's liability as of the date of the revocation.

This Standard Document creates the guarantor's obligation to guaranty payment of the borrower's obligations under a loan agreement. This form is a personal guaranty (or guarantee) to be entered into by an individual rather than a corporate entity.

A General Security Agreement (GSA) is a contract signed between two parties a creditor (lender) and a debtor (borrower) to secure personal loans, commercial loans, and other obligations owed to a lender. General security agreements list all the assets pledged as collateral.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

Understanding Financial GuaranteesGuarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.