Rhode Island Salary Adjustment Request

Description

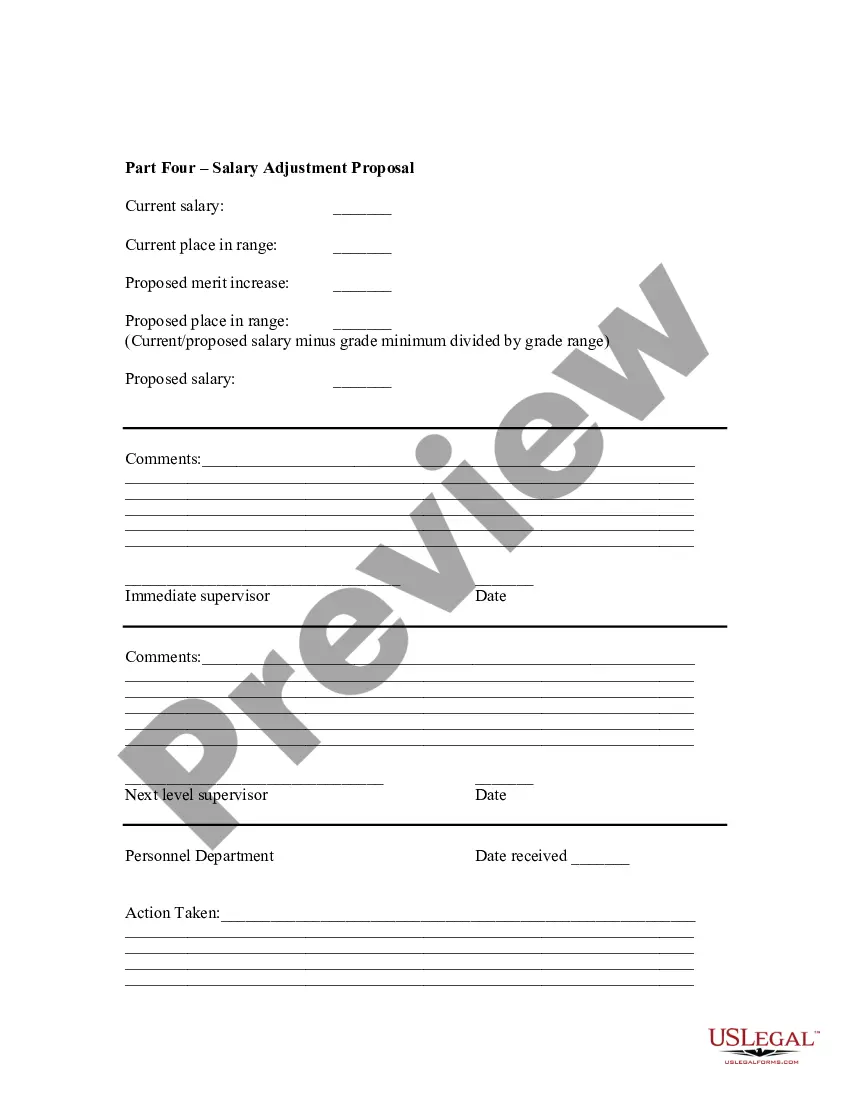

How to fill out Salary Adjustment Request?

If you need to finish, obtain, or print approved document templates, utilize US Legal Forms, the largest collection of official forms available online.

Leverage the site’s straightforward and user-friendly search to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Rhode Island Salary Adjustment Request with just a few clicks.

Every document template you acquire is yours forever. You have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Rhode Island Salary Adjustment Request with US Legal Forms. There are thousands of professional and state-specific templates you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Get button to access the Rhode Island Salary Adjustment Request.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Be sure to understand the content.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative templates.

- Step 4. Once you find the form you need, click on the Get now button. Choose your preferred payment plan and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your document and download it to your device.

- Step 7. Complete, modify, and print or sign the Rhode Island Salary Adjustment Request.

Form popularity

FAQ

Most states, including Rhode Island and Massachusetts, follow the so-called employment at will doctrine. This means that in the absence of a contract (either through a union or otherwise), an employee may be fired for any reason or no reason at all.

The SUI taxable wage base for 2021 is $24,600 ($26,100 for maximum rated employers), up from $24,000 ($25,500 for maximum rated employers) for 2020. The job development fund (JDF) tax rate remained at 0.21% for 2021. Employer SUI tax unit to be transferred back to the Rhode Island Department of Labor and Training.

It's illegal to ask for salary history in several states including California, Connecticut, Delaware, Hawaii, Massachusetts, Oregon and Vermont, which all have some form of ban for private employers.

California's ban prohibits private and public employers from seeking a candidate's pay history. Even if an employer already has that information or an applicant volunteers it, it still can't be used in determining a new hire's pay.

Like many other states' pay equity laws, the new law will prohibit you from requesting applicants' salary histories before initial employment offers and requires pay transparency in the workplace.

In Rhode Island, employers are not required to provide employees with vacation benefits, either paid or unpaid.

Law Firm in Metro Manila, Philippines Corporate, Family, IP law, and Litigation Lawyers > Philippine Legal Advice > When do You Get your Final Pay When You Resign? You should get your final pay within thirty (30) days from the date of separation or termination of employment.

How much will I receive in benefit payments? You will receive a 60% wage replacement. Your weekly benefit rate will be equal to 4.62% of the wages paid to you in the highest quarter of your Base Period (see More Details). The maximum benefit rate is $795.00 per week and the minimum benefit rate is $84.00 per week.

Final And Unclaimed Paychecks Laws In Rhode IslandRhode Island requires that final paychecks be paid on the next scheduled payday, regardless of whether the employee quit or was terminated.

If you give your employer at least 72 hours' notice, you must be paid immediately on your last day of work. Like employees who are fired or laid off, your final paycheck must include all of your accrued, unused vacation time or PTO.