Rhode Island Affidavit of No Coverage by Another Group Health Plan

Description

How to fill out Affidavit Of No Coverage By Another Group Health Plan?

Are you presently in a position that requires documentation for either business or personal uses nearly every business day.

There are numerous legal document formats accessible online, but finding reliable forms can be challenging.

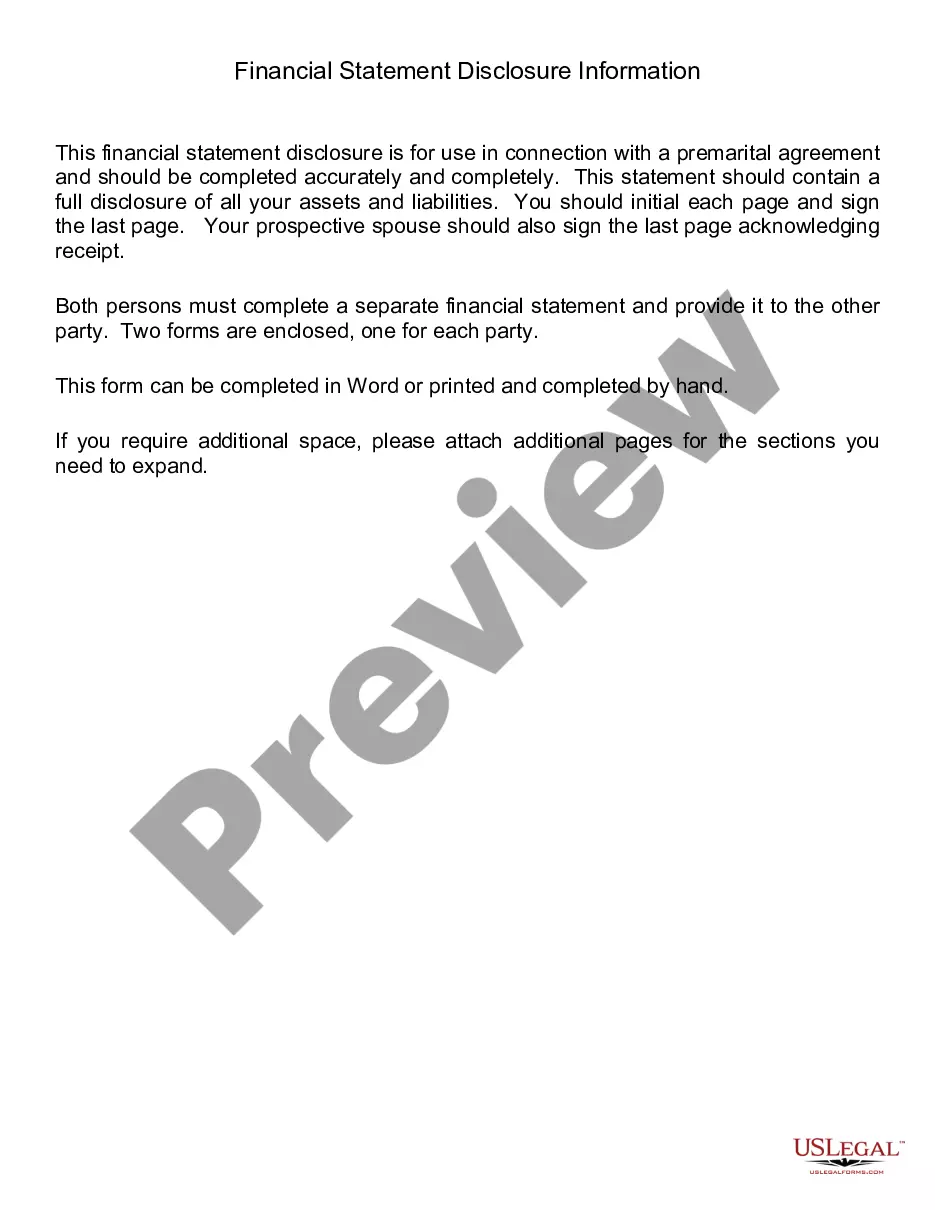

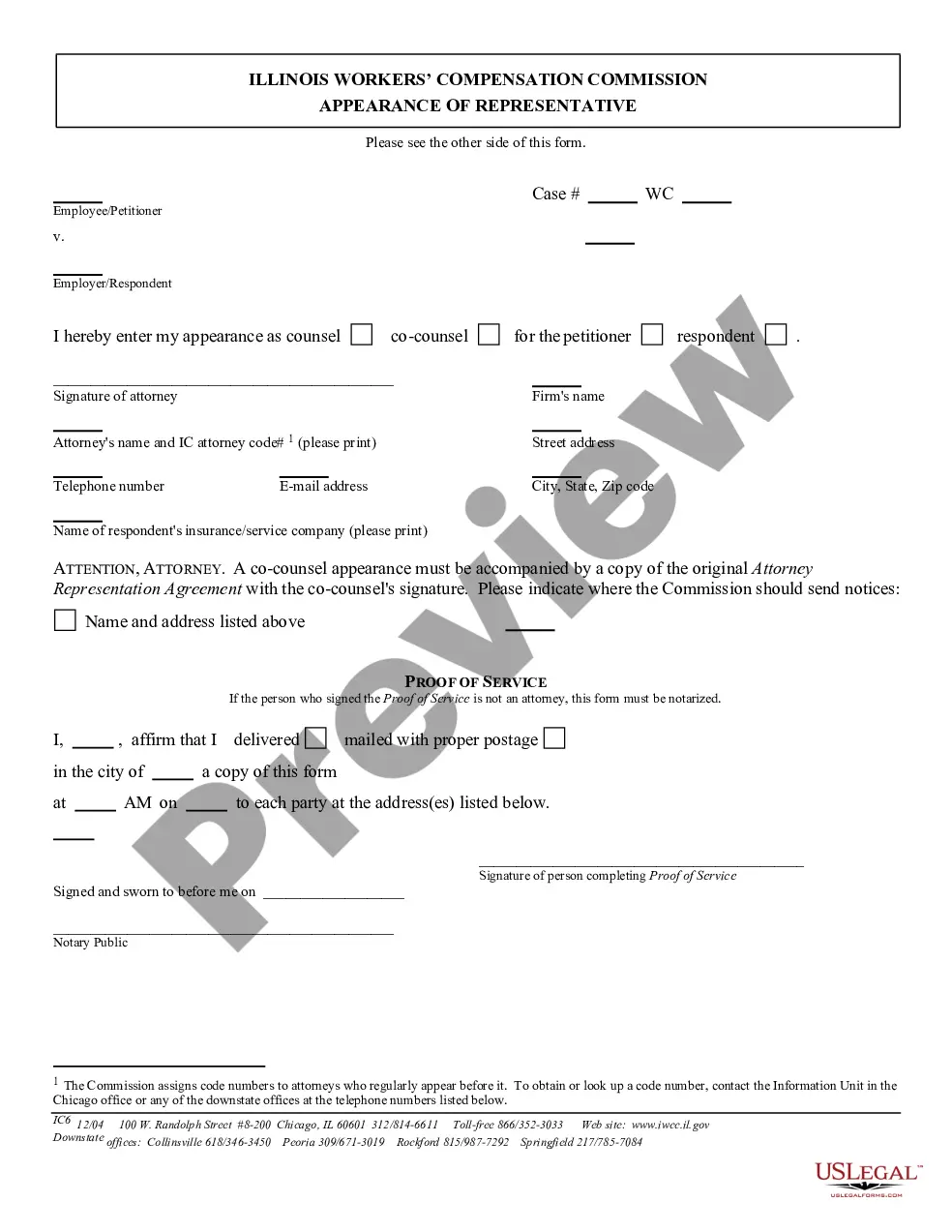

US Legal Forms offers a wide array of template forms, such as the Rhode Island Affidavit of No Coverage by Another Group Health Plan, which are designed to comply with federal and state regulations.

When you locate the appropriate form, click Purchase now.

Select the pricing plan you prefer, enter the required information to create your account, and complete the transaction using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Rhode Island Affidavit of No Coverage by Another Group Health Plan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

- Utilize the Preview option to review the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Rhode Island Medical Assistance (Medicaid)

Unlike in past tax years, if you didn't have coverage during 2021, the fee no longer applies. This means you don't need an exemption in order to avoid the penalty.

Which states have individual healthcare mandates? To date, California, the District of Columbia, Massachusetts, New Jersey, Rhode Island, and Vermont have passed state individual mandates.

If you purchase health coverage through HealthSource RI: 2022 It will count for purposes of Rhode Island's mandate and will exempt you from Rhode Island's tax penalty. 2022 You may be eligible for a federal tax credit which will reduce the cost of your premium.

Who can use HealthSource RI? People who do not receive affordable insurance through their jobs and employers with 50 or less full-time employees.

HealthSource RI was created in 2013 as a part of the implementation of the Affordable Care Act, sometimes referred to as Obamacare. HealthSource RI is one of 12 state-based health insurance marketplaces.

What Is the Penalty for Not Having Health Insurance in Rhode Island? The Rhode Island penalty amount is the same as it would have been under the federal penalty: $695 for each uninsured adult ($347.50 per child) or 2.5% of household income above the tax filing threshold, whichever is more.

Health insurance is a requirement in the state of Rhode Island. If you go without continuous health coverage, you might pay a penalty when you file your taxes for 2021.

How much is the penalty? The fee is calculated either as 2.5% of your yearly household income or per person ($695 per person and an additional $347.50 per child under age 18), whichever amount is higher.

Rhode Island Individual Mandate The penalty for failure to have ACA-compliant health insurance is the same as it would have been under the federal individual mandate. It will cost a family $695 for each uninsured adult and $347.50 for each uninsured child or 2.5% of the household income, whichever amount is greater.