Rhode Island Purchase Invoice

Description

How to fill out Purchase Invoice?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of documents for both business and personal needs, organized by categories, states, or keywords. You can find the latest editions of forms such as the Rhode Island Purchase Invoice in just minutes.

If you already have an account, Log In and download the Rhode Island Purchase Invoice from your US Legal Forms collection. The Download option will appear on each form you view. You have access to all previously downloaded documents from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the downloaded Rhode Island Purchase Invoice. Each template you saved in your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Rhode Island Purchase Invoice through US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements.

- Make sure you have selected the correct form for your city/county.

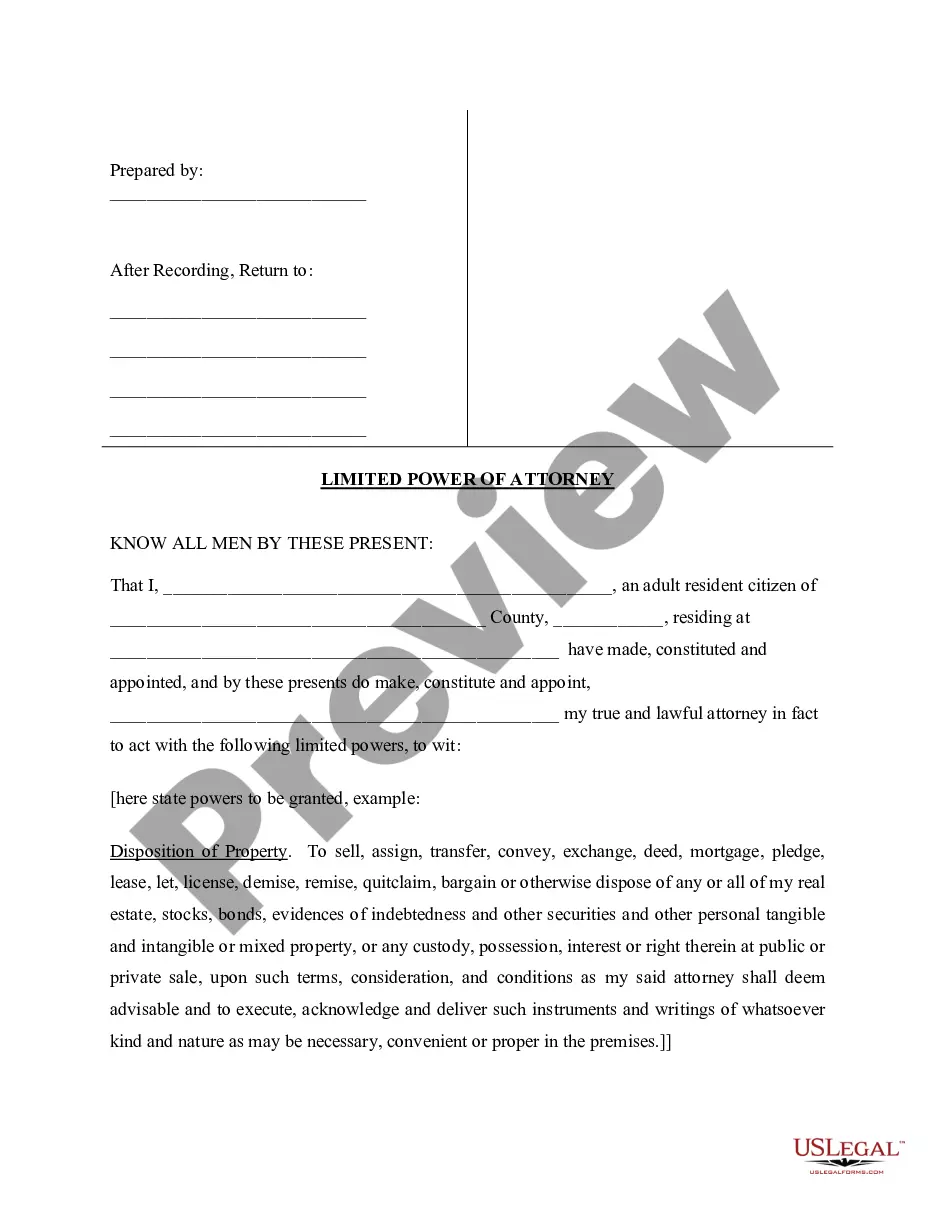

- Click on the Preview option to review the form's details.

- Read the form description to ensure you've picked the right form.

- If the form does not suit your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Download Now button.

- Then, choose the subscription plan you prefer and enter your details to create an account.

Form popularity

FAQ

Yes, Rhode Island does impose a sales tax, which is applicable to most goods and services. This means that when processing a Rhode Island Purchase Invoice, you will need to account for this tax. By staying informed about tax obligations, you can ensure accurate invoicing and financial reporting. For assistance, platforms like USLegalForms offer useful tools and information to help you comply with state regulations.

Rhode Island has a reputation for having higher than average taxes, especially regarding income and sales tax. However, businesses can still find ways to manage their tax liabilities effectively. Understanding the implications of a Rhode Island Purchase Invoice helps in making informed financial decisions. You may consider utilizing solutions like USLegalForms, which offer resources tailored to your needs.

Rhode Island is part of the United States of America. When addressing transactions within this state, businesses often need to consider local tax laws, including those related to a Rhode Island Purchase Invoice. Remember, being informed about the legal framework helps avoid potential issues down the line. USLegalForms can assist you in understanding the legal aspects relevant to your needs.

In Rhode Island, certain items are not subject to sales tax, including most groceries and prescription medications. This means that when you create a Rhode Island Purchase Invoice, you can exclude these exempt items. It is essential to be aware of these exclusions to ensure compliance and optimize your invoice. For more comprehensive guidance, USLegalForms can provide valuable templates and resources.

The state with the lowest sales tax in the United States is Delaware. While Rhode Island does impose a sales tax, it is important to note that the structure of taxes varies by state. Therefore, when handling a Rhode Island Purchase Invoice, understanding these nuances can help businesses plan their transactions effectively. If you need to navigate these tax regulations, consider using platforms like USLegalForms.

Generally, single member LLCs in Rhode Island do not need to file Form 1065. Typically, they are treated as sole proprietorships for tax purposes. However, if you have elected to be taxed as a corporation, different rules apply. It's advisable to consult a tax expert to clarify your tax filing obligations, especially regarding your Rhode Island Purchase Invoice.

You can file invoices by following a simple, systematic approach. First, gather all your Rhode Island Purchase Invoices and ensure they are complete. Then, use accounting software or online platforms that support electronic filing for faster processing. Double-check your entries to minimize errors and ensure that all necessary documents are attached.

The best way to file accounts payable invoices is to keep a streamlined process. Utilizing specialized software can help in organizing and storing your Rhode Island Purchase Invoice efficiently. Many platforms offer integrations that simplify invoice management and provide checks for accuracy. Automating this process reduces human errors and enhances overall efficiency.

Yes, most residents and businesses in Rhode Island are required to file a tax return. If you have income or conduct business activities in the state, filing is necessary. Moreover, filing your Rhode Island Purchase Invoice correctly ensures compliance and avoids potential penalties. It’s best to consult with a tax professional if you are unsure about your requirements.

Yes, you can file your Rhode Island taxes online. The Rhode Island Division of Taxation offers a user-friendly online tax filing system that simplifies the process. You can easily submit your Rhode Island Purchase Invoice and other necessary documents digitally. This online platform also provides immediate confirmation of your submission.