Rhode Island Customer Invoice

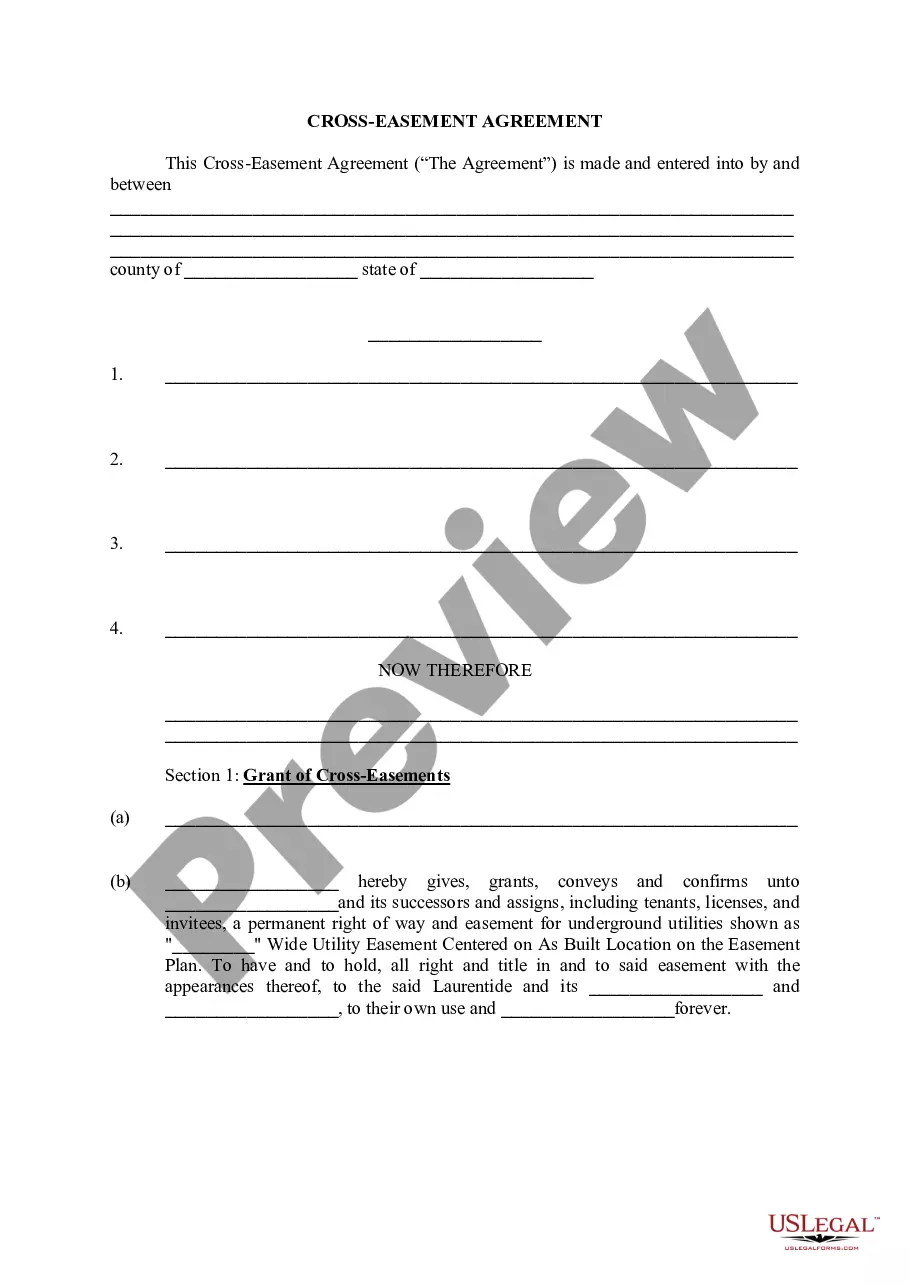

Description

How to fill out Customer Invoice?

Selecting the appropriate legal document template can be challenging.

Certainly, there are numerous templates available online, but how can you find the legal form that you need.

Use the US Legal Forms website. The platform offers countless templates, such as the Rhode Island Customer Invoice, which can be utilized for both business and personal needs. All forms are reviewed by experts and meet federal and state regulations.

If the form does not meet your criteria, use the Search field to find the appropriate document. When you are confident that the form is suitable, click the Buy now button to purchase it. Choose the pricing plan you need and fill in the required information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the legal document template you require. Complete, edit, print, and sign the acquired Rhode Island Customer Invoice. US Legal Forms is the largest repository of legal documents where you can find a wide array of document templates. Utilize the service to obtain professionally crafted paperwork that adhere to state regulations.

- If you are already a registered user, Log In to your account and click the Obtain button to access the Rhode Island Customer Invoice.

- Use your account to search for the legal forms you may have purchased previously.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, confirm that you have selected the correct form for your jurisdiction.

- You can preview the form using the Review button and read the form details to ensure it is suitable for your needs.

Form popularity

FAQ

The terms 'customer invoice' and 'supplier invoice' describe documents from opposing perspectives in the transaction process. A customer invoice is for billing the customer, while a supplier invoice is for accounting for purchases from vendors. Clarity in these documents is essential for businesses, and using platforms like uslegalforms helps streamline the creation of Rhode Island customer invoices and supplier invoices.

A customer invoice is issued by a seller to request payment from the buyer, while a vendor invoice is sent by a supplier to request payment for goods or services provided. Understanding this distinction is crucial for effective billing processes. By utilizing tools from uslegalforms, you can create accurate Rhode Island customer invoices and vendor invoices tailored to your business needs.

The primary distinction between a customer and a vendor lies in their roles in a transaction. A customer purchases goods or services, while a vendor sells them. Understanding these roles can help in accurately generating documents like a Rhode Island customer invoice, which is tailored for customers.

In Rhode Island, the Value Added Tax (VAT) is typically referred to as sales tax, which is applied to transactions involving goods and services. The current sales tax rate is 7%. Businesses need to understand this tax when issuing a Rhode Island customer invoice to ensure compliance and accuracy in billing.

In general, titles transferred in Rhode Island do not require notarization. However, it is recommended to check specific cases or additional requirements related to your situation. To ensure you have all the necessary documentation, including a Rhode Island Customer Invoice, consult USLegalForms, which offers resources to aid your title transfer.

Yes, Rhode Island recognizes out-of-state resale certificates, provided they comply with local regulations. Sellers must ensure that these certificates are valid and properly completed. To keep all your documentation in one place, consider using a Rhode Island Customer Invoice to track your transactions.

Transferring a title in Rhode Island requires submitting the completed title application to the Department of Motor Vehicles (DMV). You will need the previous title, a valid form of identification, and proof of payment for any fees. Using a Rhode Island Customer Invoice from USLegalForms can help document the sale and facilitate the title transfer process.

In Rhode Island, a bill of sale is typically needed when you transfer ownership of personal property, particularly vehicles. This document serves as proof of the sale and can help protect both the seller and the buyer. To ensure a smooth transaction, utilize a reliable Rhode Island Customer Invoice template from USLegalForms, which can simplify this process.

The mandate for Rhode Island encompasses various state laws regarding tax compliance, reporting, and electronic filing. Businesses must adhere to these regulations to avoid penalties. Leveraging the Rhode Island Customer Invoice can streamline compliance and ensure that your financial records align with state mandates.

Yes, you can file your Rhode Island taxes online through the state’s tax portal or authorized tax software. Online filing makes it easier to submit your Rhode Island Customer Invoice and ensures quicker processing of your return. Always ensure that your documents are accurate to avoid complications.