Rhode Island Assignment of Personal Property

Description

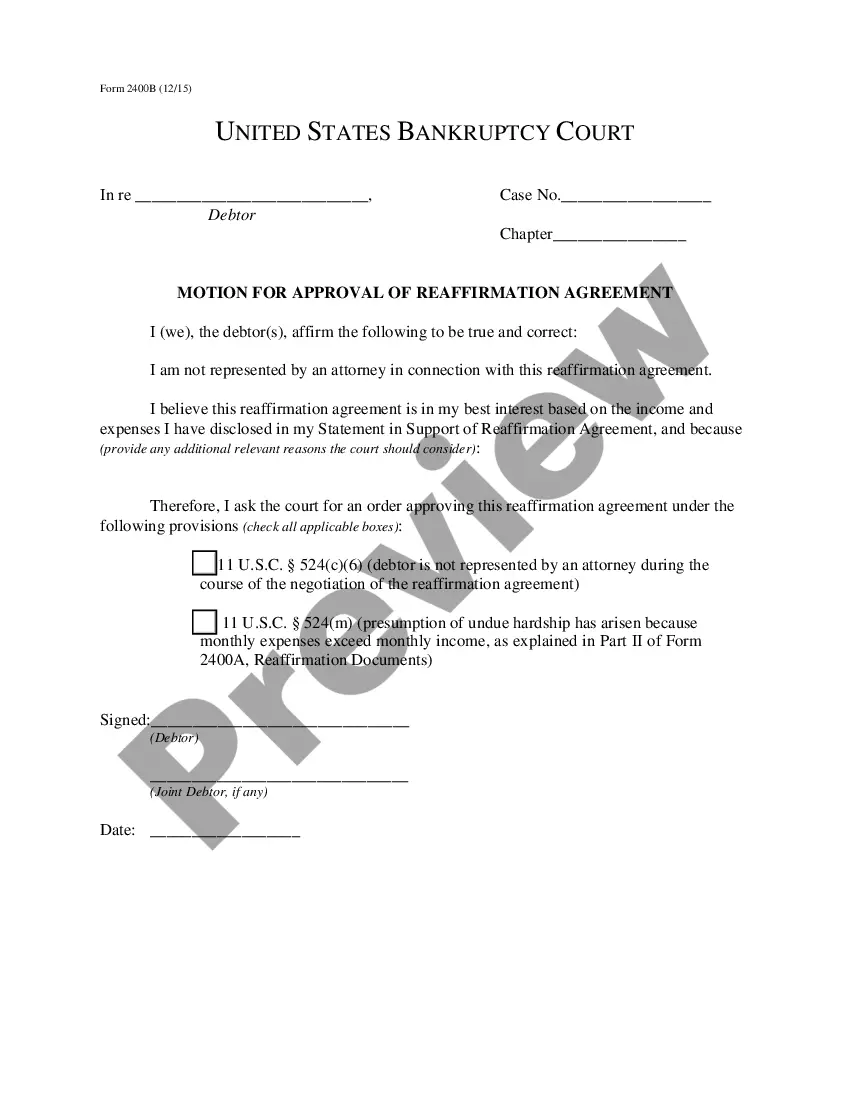

How to fill out Assignment Of Personal Property?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast array of legal form templates that you can download or print.

By utilizing the website, you can discover thousands of forms for both business and personal use, organized by categories, states, or keywords.

You can find the most recent editions of forms such as the Rhode Island Assignment of Personal Property in moments.

Read the form description to ensure you have chosen the appropriate form.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and download the Rhode Island Assignment of Personal Property from your US Legal Forms library.

- The Download button will appear on every form you access.

- You can access all previously saved forms from the My documents section of your account.

- If you are new to US Legal Forms, here are simple instructions to get you started.

- Ensure you have selected the correct form for your city/county.

- Select the Preview button to review the form's details.

Form popularity

FAQ

The seller is liable for the real estate transfer tax, although it is not uncommon for an agreement to be reached for the buyer to pay the tax. Some states require that the buyer pay the tax if the seller does not pay it or is exempt from paying it.

The deed transfer tax is known as the realty transfer tax in Rhode Island. The current rate is $2.30 per $500.00. The deed transfer tax is usually paid by seller.

(R.I. Gen. Laws § 44-9-8). Following the auction, the winning bidder gets a deed to the home, or a portion of the parcel depending on the situation, subject to the redemption period. And after the redemption period expires, the winning bidder then has to foreclose the right to redeem to get title to the property.

The Motor Vehicle Tax (commonly known as the Car Tax) is a property tax collected by each Rhode Island municipality based on the value of each motor vehicle owned. There are three components that determine how much each individual car is taxed: valuation, tax rate and exemption.

When a property is sold in Rhode Island for over $100 a transfer tax must be paid, usually by the seller (RIGL 44-25-1). Proof of payment is stamped on the deed so the recording clerk can see it was paid.

Personal Property FAQYES. It is required per RI General Law that you file an annual return with the Assessor.

What is the Real Estate Conveyance Tax Rate? The tax is two dollars and thirty cents ($2.30) for each $500 (or fraction thereof), which is paid in consideration, including any liens or encumbrances remaining at the time of sale, for the conveyance of the property or the interest in an acquired real estate company.

How do Rhode Island property taxes work? Property taxes are based on your property's "market value", or the amount the property would sell for in the open market. The state requires cities and towns to assess property once every nine years and update the assessed values on the third and sixth year.

(There is no inheritance tax in Rhode Island; that kind of tax falls on the heirs and beneficiaries, not on the estate of the person who died.) The maximum Rhode Island estate tax rate is 16%, which is significantly lower than the maximum federal estate tax rate of 40%.

Rhode Island Property Taxes Rhode Island has some of the highest property taxes in the U.S., as the state carries an average effective rate of 1.53%. That comes in as the tenth highest rate in the country.