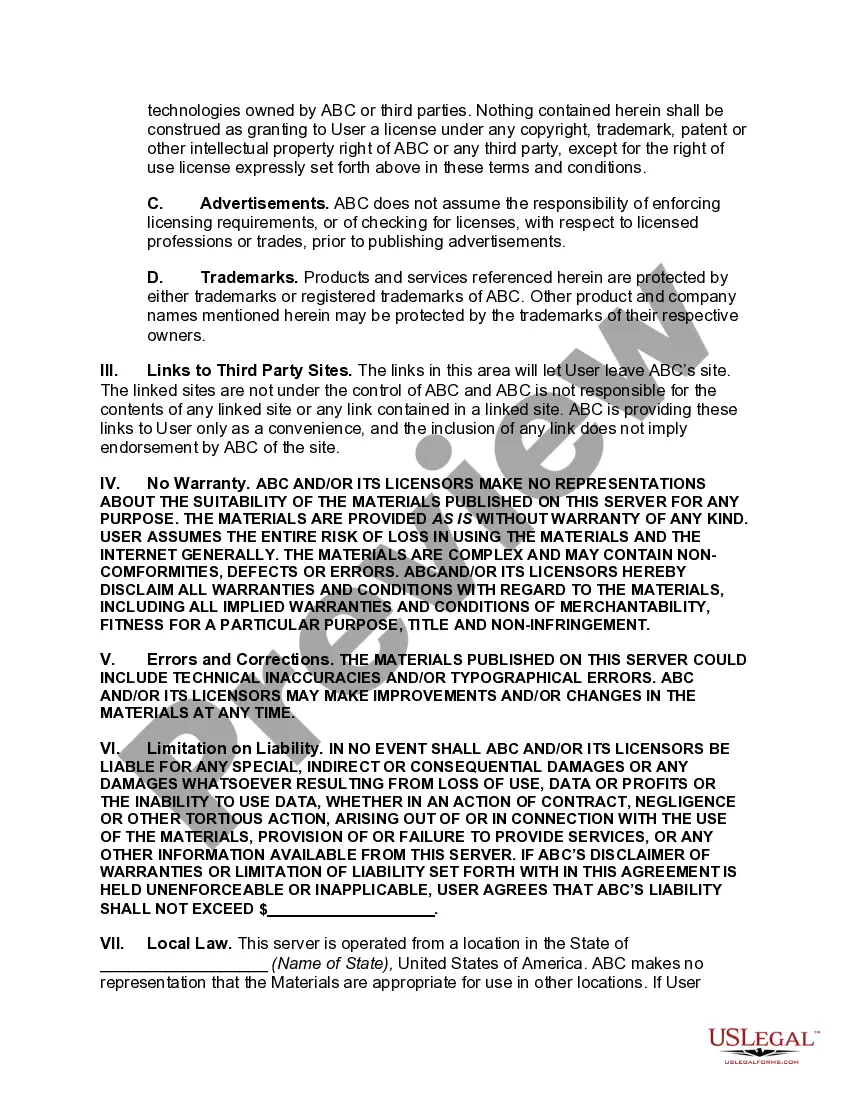

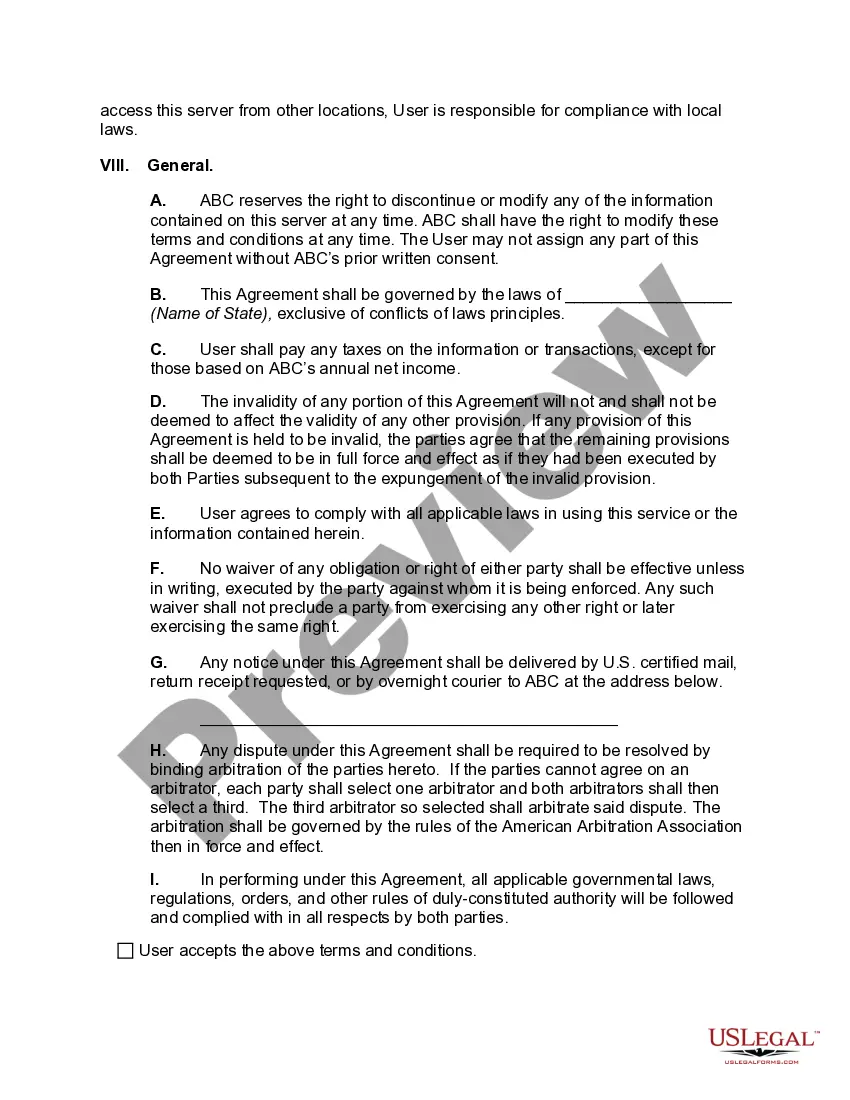

Rhode Island End User Online Services Terms and Conditions

Description

How to fill out End User Online Services Terms And Conditions?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad selection of legal templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly locate the most recent versions of forms like the Rhode Island End User Online Services Terms and Conditions.

If you already hold a monthly subscription, Log In and retrieve the Rhode Island End User Online Services Terms and Conditions from your US Legal Forms collection. The Download button is available on every form you view. You can access all previously saved forms from the My documents section of your account.

Select the format and download the form to your device.

Edit, modify, print, and sign the saved Rhode Island End User Online Services Terms and Conditions. Each template included in your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you require. Access the Rhode Island End User Online Services Terms and Conditions with US Legal Forms, which boasts the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the correct form for your city/state. Click the Review button to assess the form's content.

- Examine the form summary to confirm you have selected the appropriate form.

- If the form does not meet your needs, utilize the Search area at the top of the page to find the one that does.

- If you are content with the form, validate your choice by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

Rhode Island Tax Account NumbersThe first 9 digits of your new account number should match your federal EIN. If you already have a Rhode Island Withholding Account Number, you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829.

Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS. 1. The employer's name and address should be pre-printed on the form.

To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

Page 1. The RI-1040 Resident booklet contains returns and instructions for filing the 2021 Rhode Island Resident Individual Income Tax Return. Read the in- structions in this booklet carefully. For your convenience we have provided line by line instructions which will aid you in completing your return.

To close your business in Rhode Island, you must satisfy all filing obligations with both the RI Division of Taxation and the RI Department of State. To dissolve your business, it must be active and up to date with all filings with the RI Department of State. To verify your status, email corporations@sos.ri.gov.

Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

Why the IRS and SSA require employers to file Form W-3 When individuals file their annual tax return, they report the total income they've earned, taxes already paid (usually via employer withholding), and tax owed (or due to be refunded).

According to Rhode Island Instructions for Form RI-1040: If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return.

What is a W-3 form? Technical answer: Form W-3 is used to total up all parts of Form W-2. Both forms are filed together and sent to Social Security Administration (SSA) every year. Form W-3 is also known as Transmittal of Wage and Tax Statements.

Form 1040NR-EZ is used if your only income from US sources is salaries, tips, wages, refunds of state and local income taxes, or fellowship grants and scholarship. Most international students filing for years prior to 2020 will file Form 1040NR-EZ.