Rhode Island Software Product Sales Agreement

Description

How to fill out Software Product Sales Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of documents for both corporate and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Rhode Island Software Product Sales Agreement within moments.

If you already have a membership, Log In and download the Rhode Island Software Product Sales Agreement from your US Legal Forms collection. The Download option will appear on each document you view.

Then, select the payment plan you prefer and provide your information to register for an account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction. Select the format and download the document to your device.

- You can access all previously acquired documents in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are straightforward instructions to get started.

- Ensure you have selected the correct document for your city/state.

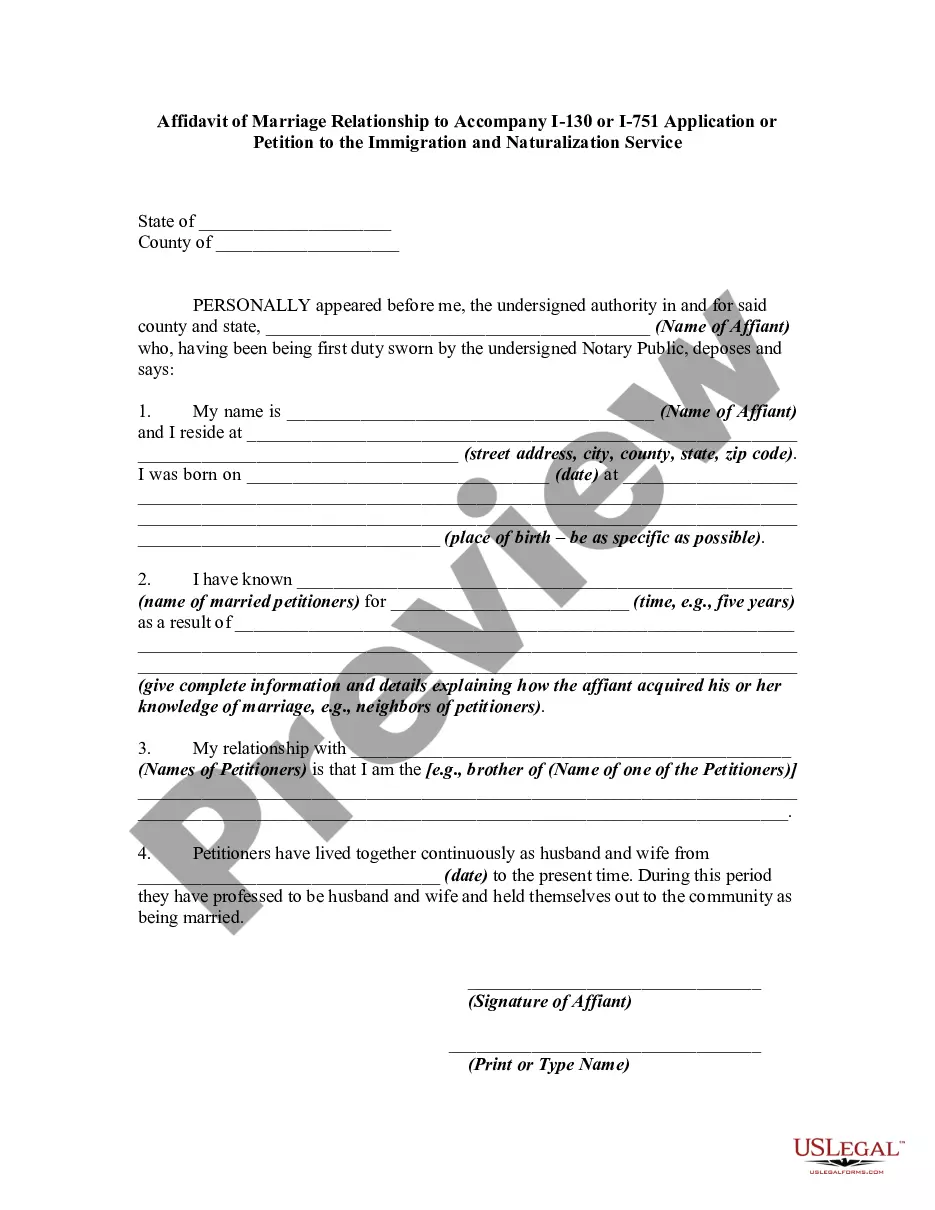

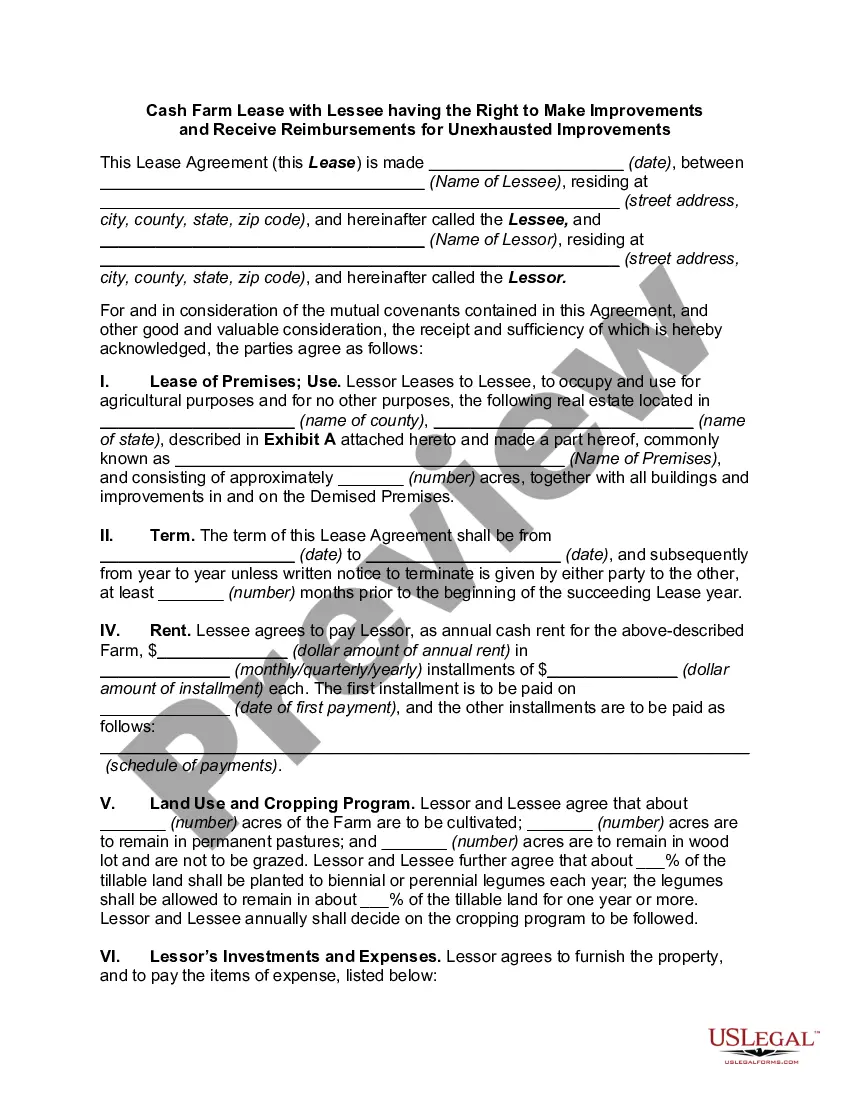

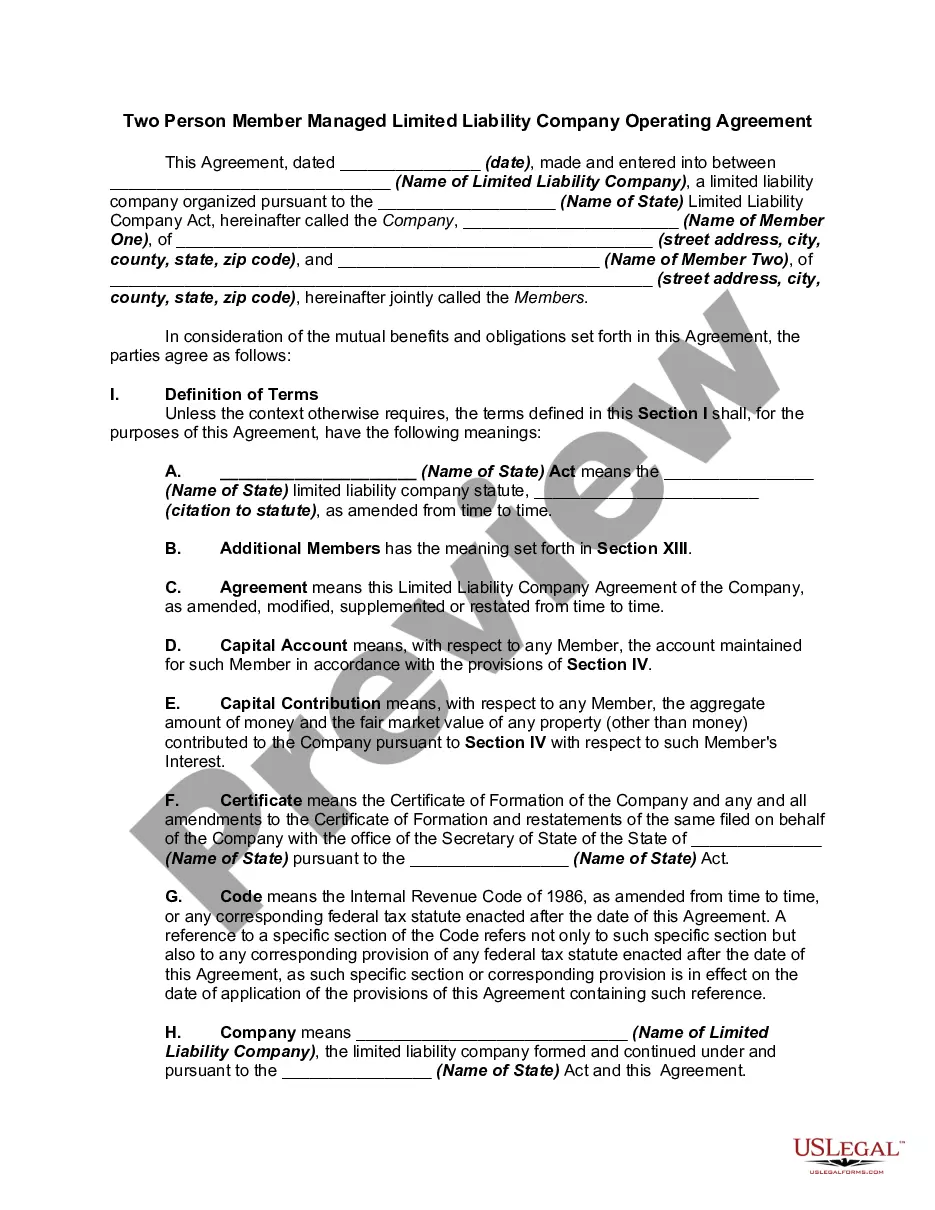

- Click the Review button to examine the contents of the document.

- Review the document summary to confirm that you have chosen the appropriate document.

- If the document does not meet your needs, use the Search box at the top of the screen to locate one that does.

- If you are satisfied with the document, confirm your choice by clicking the Get now button.

Form popularity

FAQ

The first step before filing your Sales Tax Return is to get yourself registered with Federal Board of Revenue (FBR). The registration with FBR provides you with a Sales Tax Registration Number (STRN) or User ID and password. These credentials allow access to efile portal, the online portal for filing Sales Tax Return.

Software as a Service Taxable in Rhode Island, Effective October 1, 2018. Effective October 1, 2018, Software as a Service (SaaS) is subject to Rhode Island 7% sales and use tax. Tax will apply regardless of whether access to or use of the software is permanent or temporary, and regardless of whether it is downloaded.

PURPOSE OF FORM RI-4868Use Form RI-4868 to obtain an automatic 6 month extension of time to file a Rhode Island Individual Income Tax Return. Form RI-4868 can be used to extend the filing of Form RI- 1040, Rhode Island Resident Individual Tax Return, or RI- 1040NR, Nonresident Income Tax Return.

Taxable services include, but are not limited to the furnishing of telecommunications service and cable television services. Also, if you operate an eating and/or drinking establishment you must also collect and remit the 1% local meals and beverage tax.

A. The sales tax is a levy imposed on the retail sale, rental or lease of many goods and services at a rate of 7%. Any sale is a retail sale if the property or service sold will be used and not resold in the regular course of business. The tax is collected by the vendor and remitted directly to the state.

With Online Taxes at OLT.com, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if you meet any of the following requirements: Your federal adjusted gross income for 2021 was between $16,000 and $73,000; or.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

The purchase of prescription medicine, groceries, gasoline, and clothing are tax-exempt. Some services in Rhode Island are subject to sales tax.

Requirements for prewritten software are still subject to sales and use tax regardless of the method of delivery (whether with a physical medium, downloadable or accessed via the Internet) or if possession or control is given.

How to File and Pay Sales Tax in Rhode IslandFile online File online at the Rhode Island Division of Taxation.File by mail You can use the Rhode Island Streamlined Sales Tax Return and file and pay through the mail, though you must file and pay online if your tax liability in the previous year was $200 or more.More items...