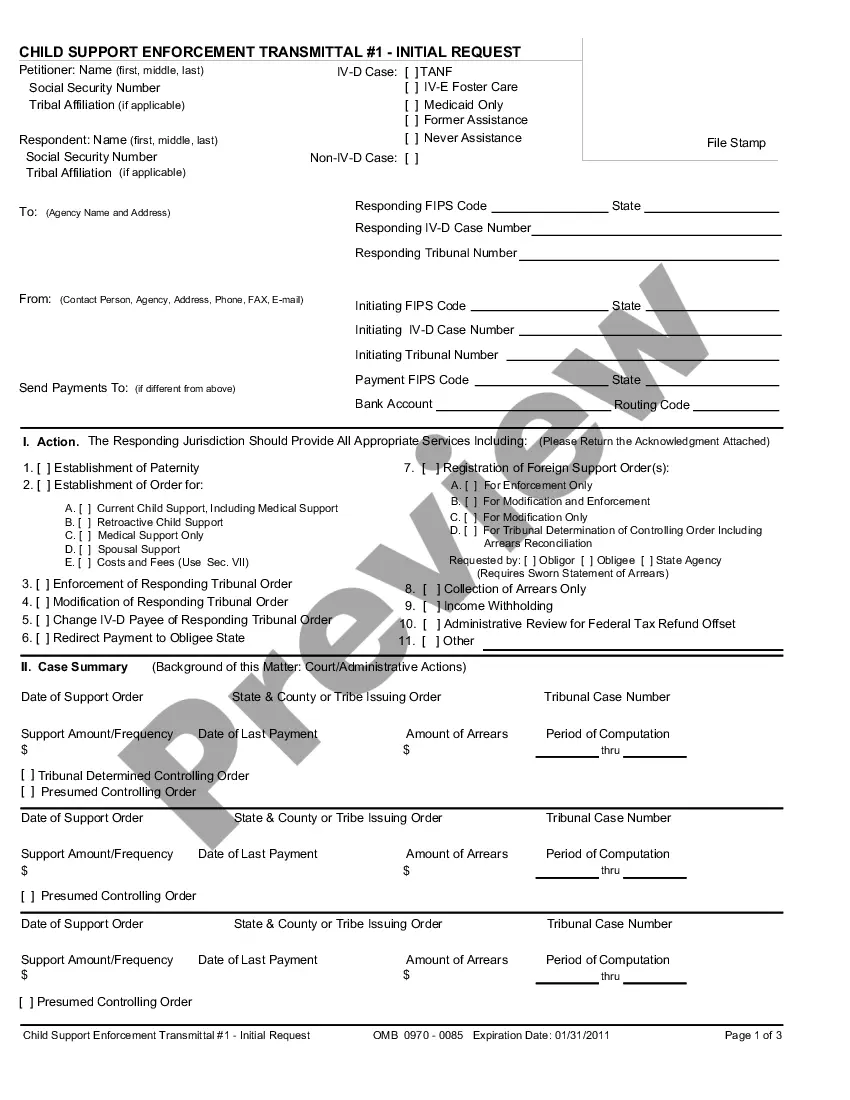

Rhode Island Balance Sheet Notes Payable

Description

How to fill out Balance Sheet Notes Payable?

You can spend hours online trying to find the legal form template that meets the state and federal regulations you require.

US Legal Forms provides thousands of legal forms that can be evaluated by experts.

You can download or print the Rhode Island Balance Sheet Notes Payable from your service.

If you want to find an alternative version of the form, use the Search area to locate the template that satisfies your needs and requirements.

- If you possess a US Legal Forms account, you may Log In and click on the Acquire button.

- Subsequently, you can complete, modify, print, or sign the Rhode Island Balance Sheet Notes Payable.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for your area/region that you choose.

- Read the form description to confirm you have selected the appropriate form.

- If available, use the Review button to browse through the document template as well.

Form popularity

FAQ

To display notes payable on a balance sheet, include it in the liabilities section, detailing the amount owed. It's important to specify whether these notes are short-term or long-term. This clarity aids in understanding your financial health in relation to Rhode Island Balance Sheet Notes Payable.

Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed.

A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months, or as a long-term liability if it is due at a later date. When a long-term note payable has a short-term component, the amount due within the next 12 months is separately stated as a short-term liability.

The order in which the current liabilities will appear on the balance sheet can vary. However, it is common to see three (listed in any order) at the top of the list: accounts payable, short-term loans payable, and the current portion of long-term debt.

Liabilities. A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date.

On a balance sheet, liabilities are typically listed in order of shortest term to longest term, which at a glance, can help you understand what is due and when.

There are several balance sheet formats available. The more common are the classified, common size, comparative, and vertical balance sheets.

The balance sheet is prepared in order to report an organization's financial position at the end of an accounting period, such as midnight on December 31. A corporation's balance sheet reports its: Assets (resources that were acquired in past transactions) Liabilities (obligations and customer deposits)

The balance sheet is a report version of the accounting equation that is balance sheet equation where the total of assets always is equal to the total of liabilities plus shareholder's capital. Assets = Liability + Capital.

Notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date.