Rhode Island Sample Letter for Closure of Estate - Request for Petition Signature

Description

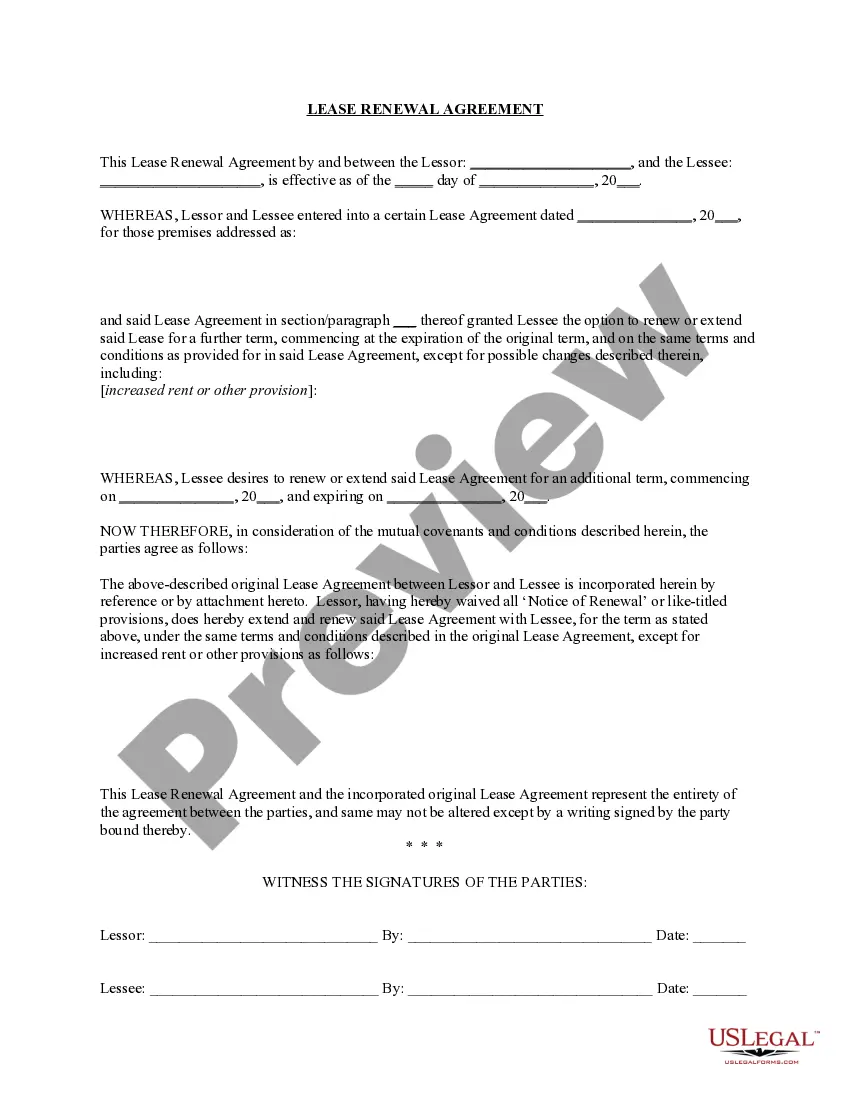

How to fill out Sample Letter For Closure Of Estate - Request For Petition Signature?

US Legal Forms - one of many most significant libraries of legal kinds in America - offers an array of legal file templates you may download or print. While using internet site, you may get a large number of kinds for organization and person reasons, sorted by types, claims, or keywords and phrases.You will discover the newest versions of kinds just like the Rhode Island Sample Letter for Closure of Estate - Request for Petition Signature within minutes.

If you already have a subscription, log in and download Rhode Island Sample Letter for Closure of Estate - Request for Petition Signature through the US Legal Forms collection. The Acquire key can look on each and every form you view. You have access to all earlier acquired kinds within the My Forms tab of the accounts.

If you want to use US Legal Forms the first time, listed here are straightforward recommendations to get you started out:

- Be sure to have picked out the best form to your city/state. Click the Preview key to check the form`s content material. See the form information to actually have chosen the correct form.

- In the event the form does not satisfy your specifications, utilize the Research area at the top of the display to obtain the one that does.

- When you are pleased with the form, validate your choice by visiting the Buy now key. Then, choose the costs program you prefer and provide your qualifications to register for an accounts.

- Method the transaction. Use your bank card or PayPal accounts to complete the transaction.

- Pick the formatting and download the form on your system.

- Make adjustments. Fill out, revise and print and sign the acquired Rhode Island Sample Letter for Closure of Estate - Request for Petition Signature.

Each design you put into your bank account lacks an expiration particular date which is yours eternally. So, if you want to download or print an additional duplicate, just proceed to the My Forms area and then click about the form you require.

Obtain access to the Rhode Island Sample Letter for Closure of Estate - Request for Petition Signature with US Legal Forms, one of the most substantial collection of legal file templates. Use a large number of specialist and status-distinct templates that fulfill your organization or person requires and specifications.

Form popularity

FAQ

In order to close a small estate, an executor must: Complete a schedule of all known assets and the estimated value of each one. File the decedent's original will with the probate court. Present the deceased's death certificate to the clerk of the probate court. Pay applicable filing fees.

You can absolutely prepare all of the probate forms yourself and do this on your own. Some states may require a lawyer for submitting them to probate court, but Rhode Island doesn't. A lawyer will save you time and headaches. A lawyer can make sure you don't make big tax mistakes or miss any deadlines.

Any Rhode Island estate larger than $15,000 is subject to probate regardless of whether the deceased had a will. The probate process verifies who will control and inherit assets from the estate.

A good starting point for accessing pre-1850 Rhode Island wills is the Rhode Island Genealogical Register, which contains Rhode Island will abstracts from the 17th century to the mid-19th century.

In Rhode Island, how long probate takes can vary significantly depending on a host of factors such as the complexity of the estate, whether there's a will, and the efficiency of the executor or administrator. On average, probate in Rhode Island may take anywhere from several months to over a year.

If a will exists, probate distributes the assets ing to the terms of the will. However, if a person dies without a will, probate allocates property, money, and other assets ing to Rhode Island intestacy laws.

In Rhode Island, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

A Rhode Island small estate affidavit is a form that can be used to speed the distribution of assets in certain estates. Any estate that is valued at less than $15,000 is considered a small estate. This helps avoid the long and costly process of traditional probate.