Rhode Island Receipt for Payment of Loss for Subrogation

Description

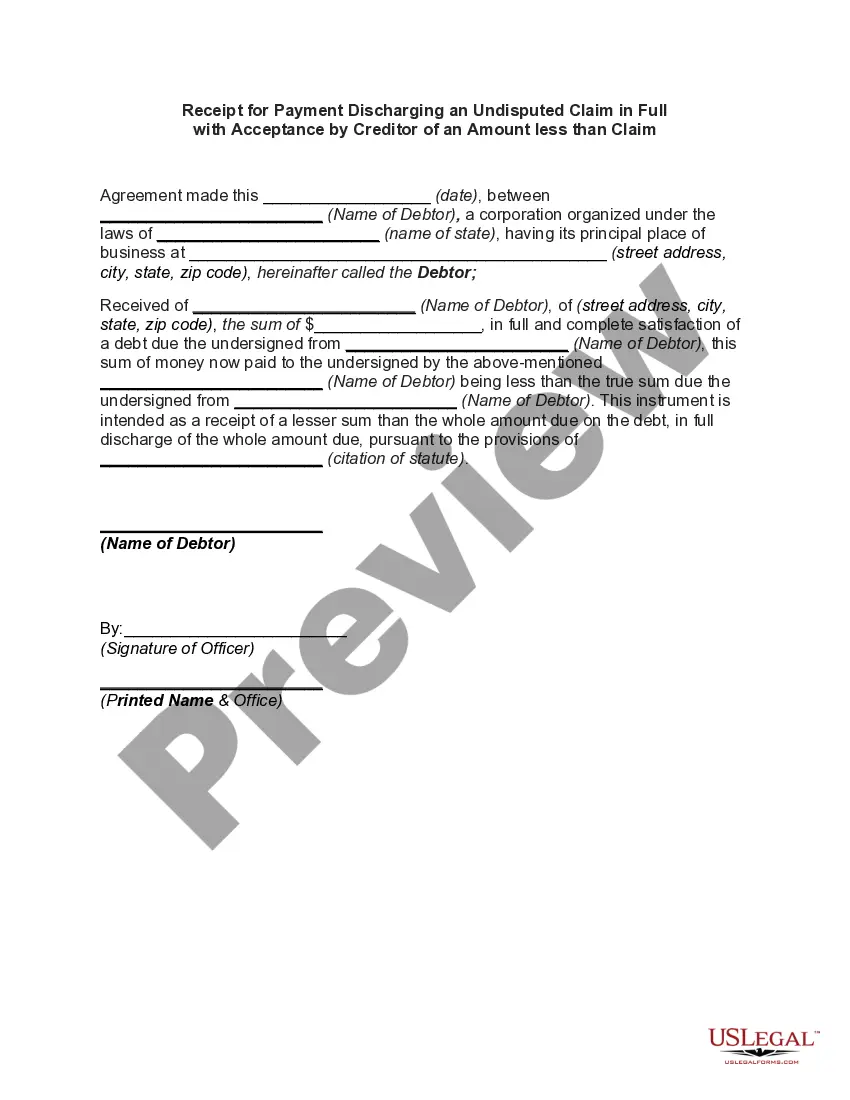

How to fill out Receipt For Payment Of Loss For Subrogation?

Are you currently in the placement where you need to have files for sometimes business or specific reasons nearly every working day? There are plenty of authorized file web templates available on the net, but locating versions you can rely on is not straightforward. US Legal Forms offers thousands of develop web templates, such as the Rhode Island Receipt for Payment of Loss for Subrogation, which are written to fulfill federal and state demands.

When you are currently informed about US Legal Forms website and also have an account, basically log in. After that, you can obtain the Rhode Island Receipt for Payment of Loss for Subrogation design.

If you do not offer an account and need to begin using US Legal Forms, follow these steps:

- Obtain the develop you require and ensure it is to the appropriate area/region.

- Utilize the Preview option to analyze the form.

- See the outline to actually have selected the proper develop.

- When the develop is not what you`re looking for, use the Lookup discipline to get the develop that meets your needs and demands.

- Whenever you get the appropriate develop, just click Acquire now.

- Pick the pricing strategy you want, complete the required details to make your account, and pay for the transaction with your PayPal or credit card.

- Select a practical file formatting and obtain your version.

Get all the file web templates you possess purchased in the My Forms menus. You can get a additional version of Rhode Island Receipt for Payment of Loss for Subrogation any time, if necessary. Just click the essential develop to obtain or produce the file design.

Use US Legal Forms, the most substantial collection of authorized varieties, to save time as well as prevent faults. The assistance offers skillfully created authorized file web templates that can be used for a selection of reasons. Produce an account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

Rights of subrogation vest by operation of law rather than as the product of express agreement. Whereas rights of subrogation can be enjoyed by the insurer as soon as payment in made , as assignment requires an agreement that the rights of the assured be assigned to the insurer.

?Subrogation? refers to the act of one person or party standing in the place of another person or party. It is a legal right held by most insurance carriers to pursue a third party that caused an insurance loss in order to recover the amount the insurance carrier paid the insured to cover the loss.

Subrogation in insurance is a legal right of the insurance company to legally pursue a third-party responsible for the damages/insurance loss caused to the insured. Subrogation is done to recover the claim amount insurance company pays to the insured for the damages.

No insurer shall request or require any first party claimant to submit to a polygraph examination unless authorized under the applicable insurance contract and state law. (1) Pursuant to R.I. Gen.

Right of Recourse in Rhode Island If, after the insurance company offers a claim amount to you- the insured, you find you can't purchase a comparable vehicle for fair market value, Rhode Island offers a Right of Recourse.

697, an insurer can assign its subrogation interest to the insured, with the parties agreeing that the insured will hold the amount paid by the insurer in trust in the event of recovery. The insured may then proceed to recover in its name.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

Subrogation, in the legal context, refers to when one party takes on the legal rights of another, especially substituting one creditor for another. Subrogation can also occur when one party takes over another's right to sue.