A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Rhode Island Check Disbursements Journal

Description

How to fill out Check Disbursements Journal?

Are you currently in a scenario where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides a vast assortment of template forms, such as the Rhode Island Check Disbursements Journal, which can be formatted to meet state and federal regulations.

Access all the templates you have purchased in the My documents section.

You may obtain an additional copy of the Rhode Island Check Disbursements Journal at any time, if needed. Simply click on the appropriate form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Rhode Island Check Disbursements Journal template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct state/region.

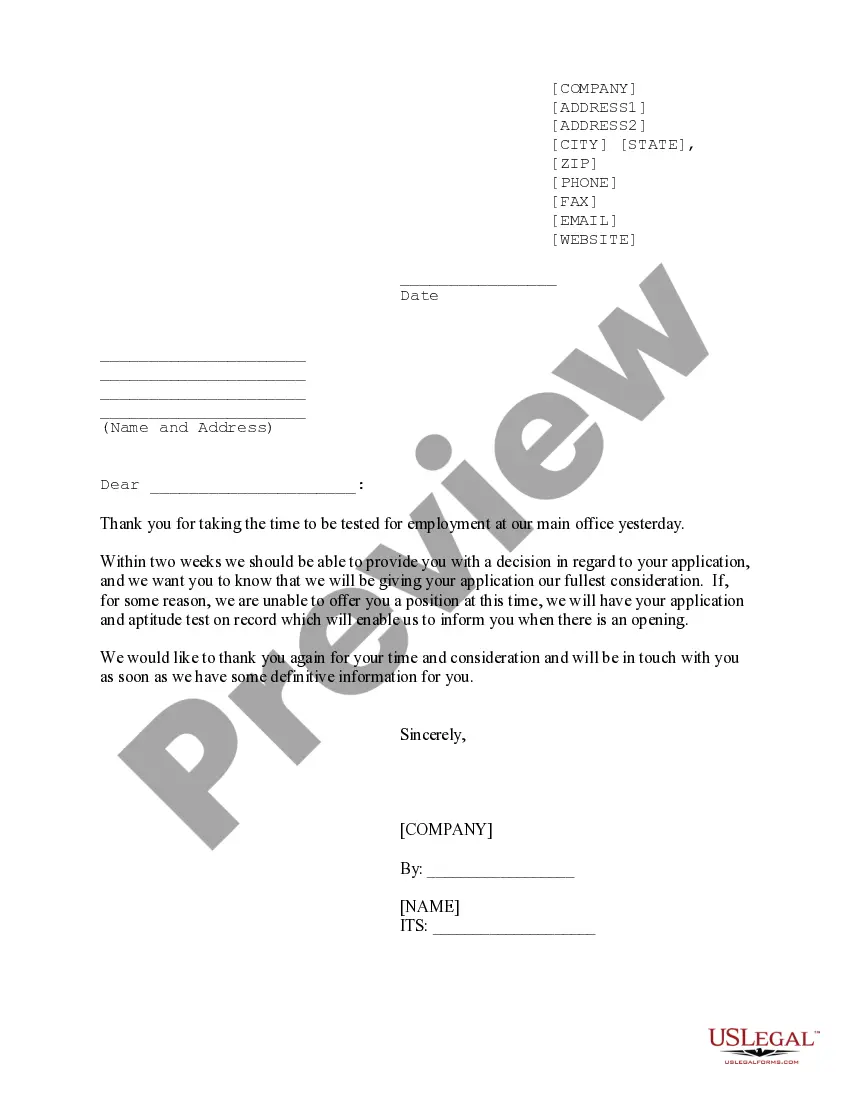

- Utilize the Preview button to review the form.

- Check the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the template that suits your needs.

- Once you find the correct form, click on Buy now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or a credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Yes, you can file your Rhode Island taxes online through the RI Division of Taxation's e-filing portal. This platform simplifies the process, making it quicker and more efficient for taxpayers. Using the Rhode Island Check Disbursements Journal in conjunction with online filing can help you monitor the progress of your submissions, offering peace of mind.

To check back on your Rhode Island taxes, you needed to review past filings or access your tax records through the RI Division of Taxation's online services. You can also get in touch with their helpline for assistance. Tracking related updates in the Rhode Island Check Disbursements Journal can further clarify your tax standing.

Delays in Rhode Island tax refunds can occur due to high volumes of returns, processing backlogs, or errors in submitted information. It’s essential to ensure that all your documentation is accurate and submitted on time. Using the Rhode Island Check Disbursements Journal can help identify the reasons for any delays and keep you informed.

The electronic filing mandate in Rhode Island requires most taxpayers to file their returns electronically if they meet specific income thresholds. This process streamlines tax filing and processing times. For easy access and to keep abreast of important tax documentation, consider using the Rhode Island Check Disbursements Journal.

Tracking your refund status in Rhode Island is simple through the official state tax website. Enter your personal information, and you can quickly see your refund's processing status. Also, by recording your interactions in the Rhode Island Check Disbursements Journal, you can maintain precise updates on your refund's journey.

To check the status of your tax refund check, navigate to the RI Division of Taxation's refund status tool. You will require your Social Security number and other relevant details. The Rhode Island Check Disbursements Journal provides updated information to help you understand your refund's current status.

Mail your Rhode Island tax returns to the address specified on the tax form you are using. Generally, this will be the Rhode Island Division of Taxation located in Warwick. Keeping track of this mailing with the Rhode Island Check Disbursements Journal can assist you in confirming your return's timely delivery.

To check your Rhode Island tax refund, visit the RI Division of Taxation website. You will need to provide your Social Security number, the amount of your refund, and your filing status. Utilizing the Rhode Island Check Disbursements Journal can help you track when your refund disburses, ensuring you remain informed throughout the process.

Currently, tax refunds in Rhode Island may take about 4 to 6 weeks for processing, but delays can occur depending on various factors. This includes high volumes of filings or changes in tax regulations. For an accurate picture of the situation, checking the Rhode Island Check Disbursements Journal will give you up-to-date information on refund timelines.

The Rhode Island state income tax is a progressive tax that varies depending on your income level. Tax rates can range from 3.75% to 5.99%, based on several brackets. For a comprehensive look at how this affects your refunds and disbursements, the Rhode Island Check Disbursements Journal can provide you with important insights.