Rhode Island Invoice Template for Designer

Description

How to fill out Invoice Template For Designer?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

By utilizing the website, you can find thousands of forms for both professional and personal use, categorized by types, states, or keywords. You can access the latest versions of forms like the Rhode Island Invoice Template for Designers in just moments.

If you have a subscription, Log In and download the Rhode Island Invoice Template for Designers from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously acquired forms within the My documents tab in your account.

Every template added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the Rhode Island Invoice Template for Designers with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

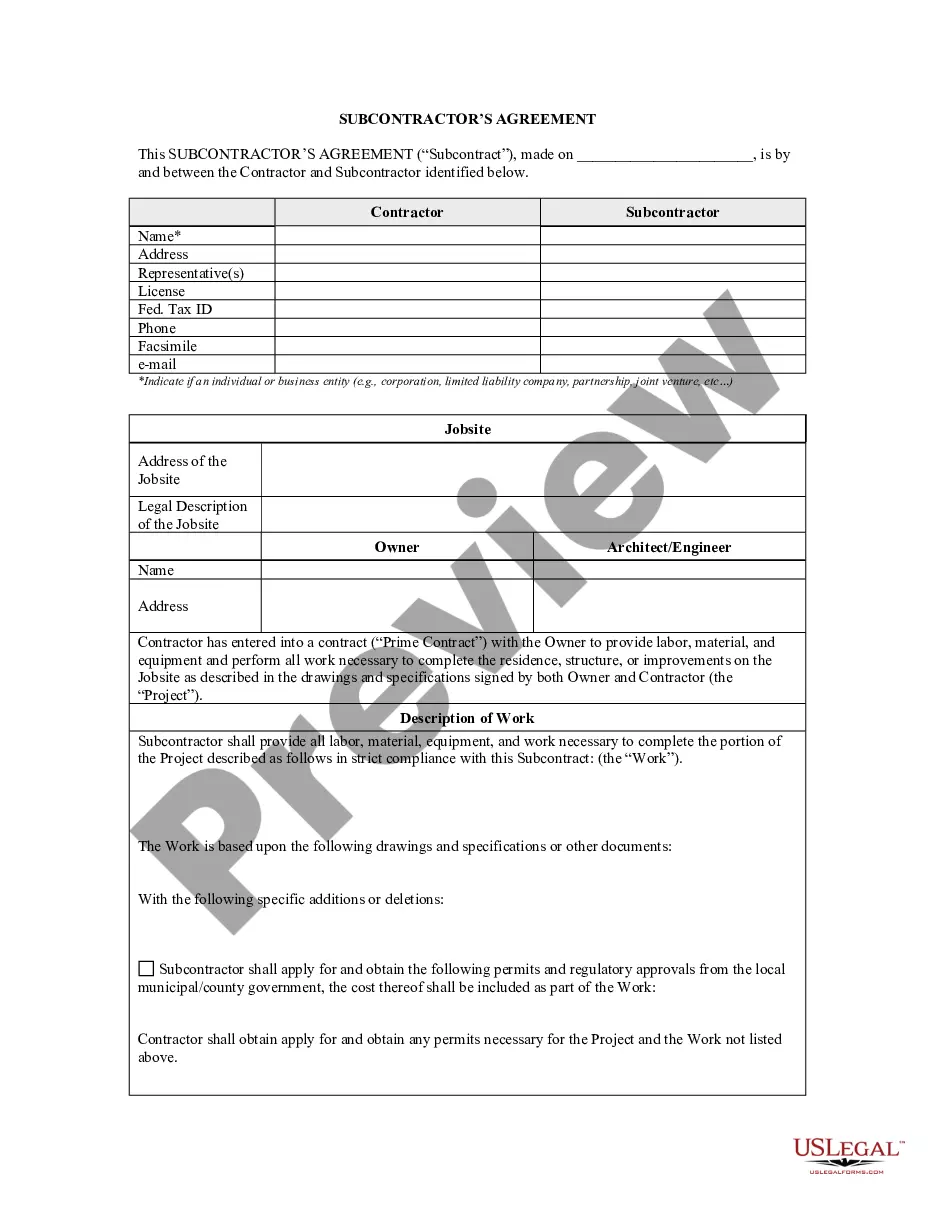

- Ensure you have selected the correct form for your city/region. Click the Review button to check the form's content. Refer to the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred pricing plan and provide your credentials to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

- Make modifications. Complete, edit, print, and sign the downloaded Rhode Island Invoice Template for Designers.

Form popularity

FAQ

The electronic filing mandate in Rhode Island requires certain tax returns to be filed online, particularly for businesses with annual gross receipts exceeding a specified threshold. This mandate helps streamline the process for businesses, including those that use the Rhode Island Invoice Template for Designer. It ensures faster processing and improved record keeping for your tax obligations.

Filing taxes for an LLC in Rhode Island typically involves reporting income on your personal tax return, depending on your LLC structure. Use the Rhode Island Invoice Template for Designer to track your revenues and expenses accurately. This organized approach will not only facilitate tax preparation but also help you maintain compliance with state tax regulations.

To file Rhode Island sales tax, you need to gather your sales data, including the amounts indicated on the invoices you created with the Rhode Island Invoice Template for Designer. You can file electronically or by mail, ensuring that all information is accurate. The state also provides guidelines to assist you during this process.

Tax sales in Rhode Island involve the sale of properties due to unpaid taxes. Municipalities auction off properties after notifying owners, and buyers acquire the property along with a lien. If you are a designer, understanding this process can be crucial if you invest in properties to use as a workspace while leveraging the Rhode Island Invoice Template for Designer for your financial transactions.

A single member LLC is typically considered a disregarded entity for federal tax purposes, meaning you do not need to file Form 1065 in Rhode Island. However, you should report LLC income on your personal tax return using Schedule C. Using the Rhode Island Invoice Template for Designer will help you track your income accurately for smoother tax reporting.

You can claim sales tax on your taxes by reporting the amount collected on your tax return. Make sure to accurately record the sales tax collected from your invoices, including those created using the Rhode Island Invoice Template for Designer. This record will help you when filing your annual or quarterly sales tax returns with the state.

To register for sales tax in Rhode Island, you must complete an application through the Rhode Island Division of Taxation. This process can be done online, and you will need to provide details about your business activities, including how you will utilize the Rhode Island Invoice Template for Designer. Upon approval, you’ll receive a seller’s permit, allowing you to collect sales tax.

Yes, you can file your Rhode Island taxes online through the state’s official tax website or various tax preparation software. These platforms often accept the Rhode Island Invoice Template for Designer, making it easier for designers to manage tax documentation. This method simplifies the filing process and allows for quicker processing of your tax returns.

To make a handwritten invoice, start by clearly writing your name, address, and contact information at the top. Then, list the client's details and provide a breakdown of services and costs in a neat manner. If you prefer a more structured approach, using a Rhode Island Invoice Template for Designer can guide you in formatting your invoice properly while adding a professional touch.

Yes, you can generate an invoice from yourself. Just make sure to include your business information, services rendered, and payment details. If you want to ensure a polished outcome, consider using a Rhode Island Invoice Template for Designer, available on platforms like uslegalforms, which makes creating invoices easy and efficient.