Rhode Island Invoice Template for Chef

Description

How to fill out Invoice Template For Chef?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are vetted by professionals.

It is easy to download or print the Rhode Island Invoice Template for Chef from their service.

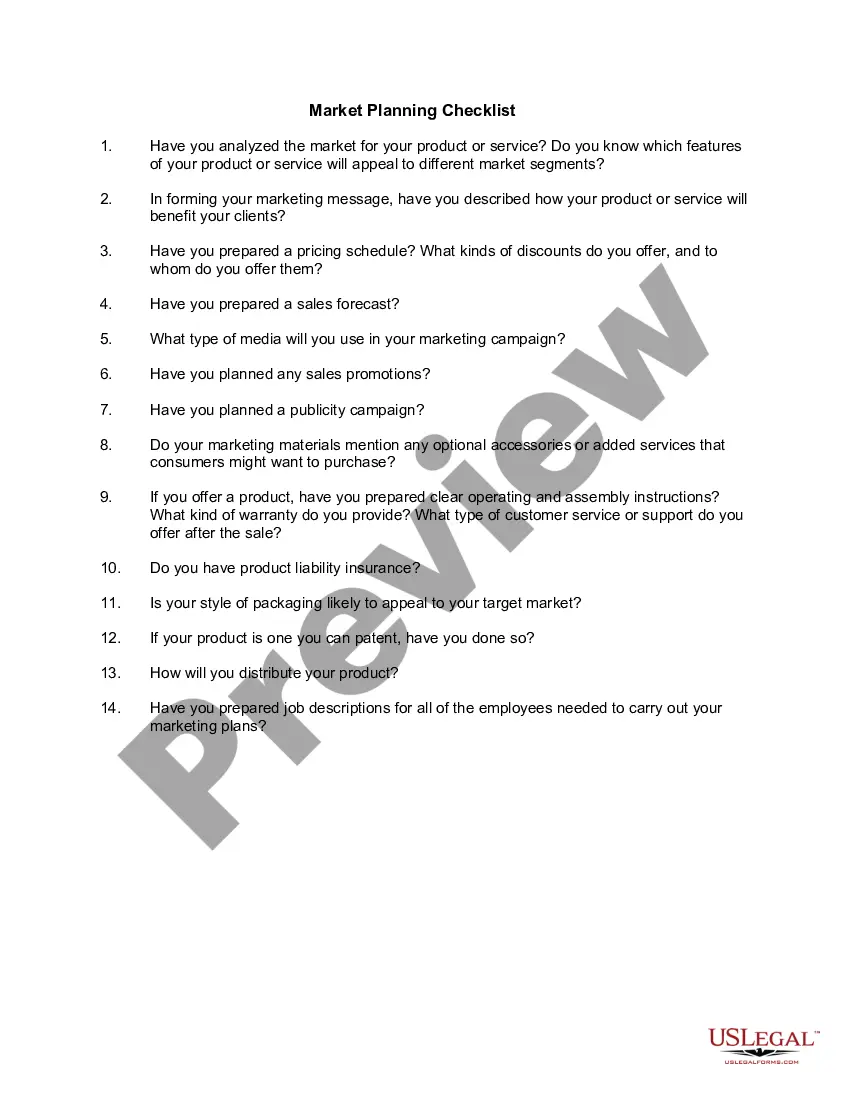

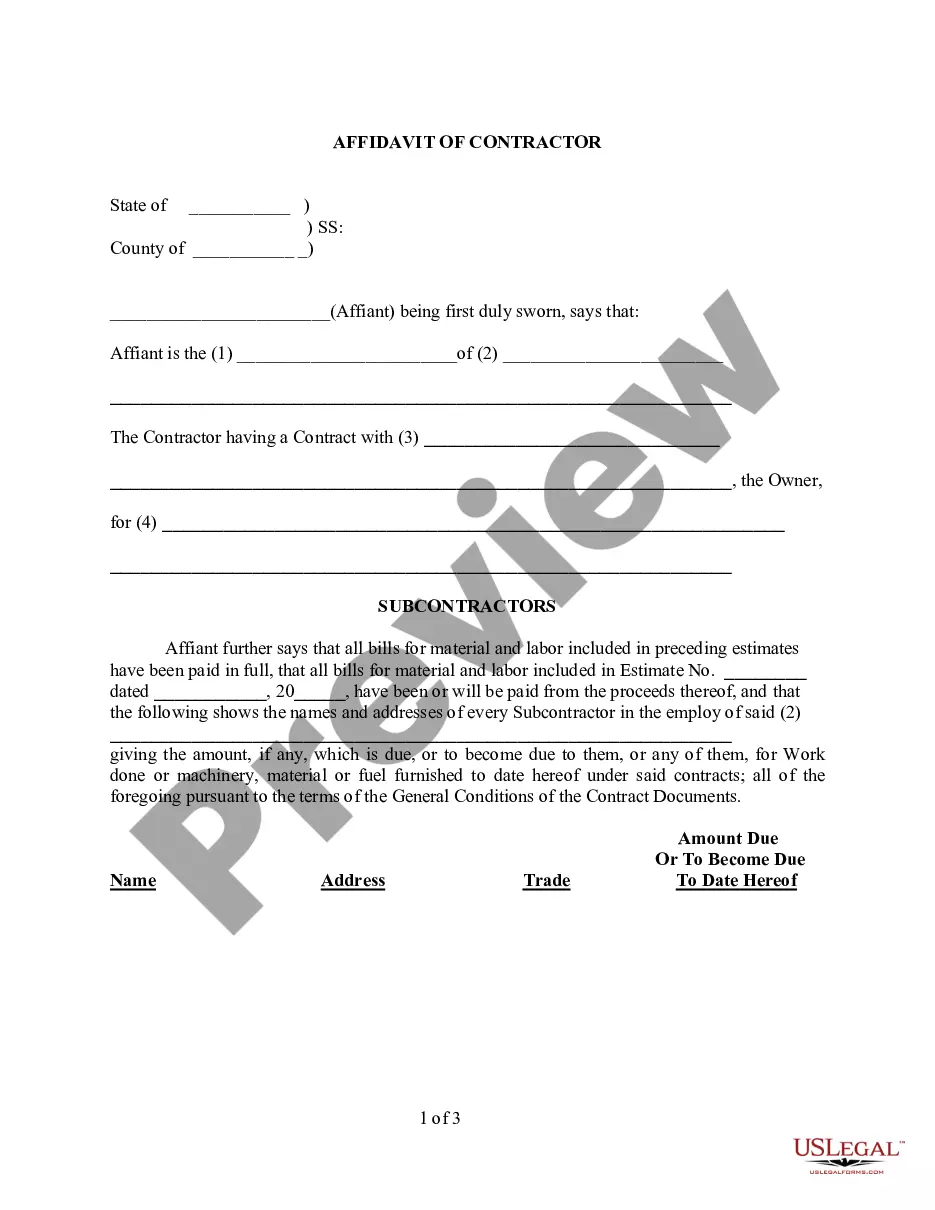

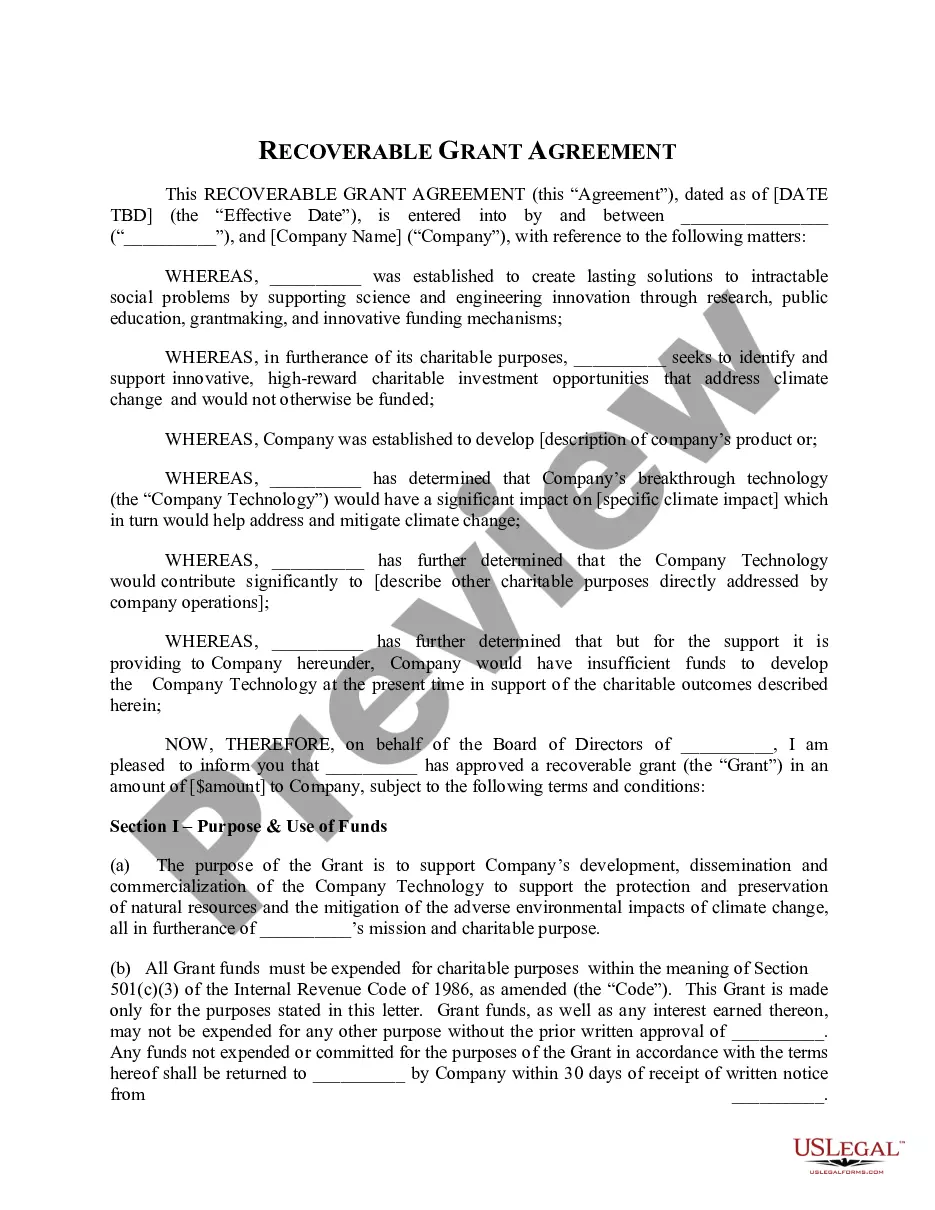

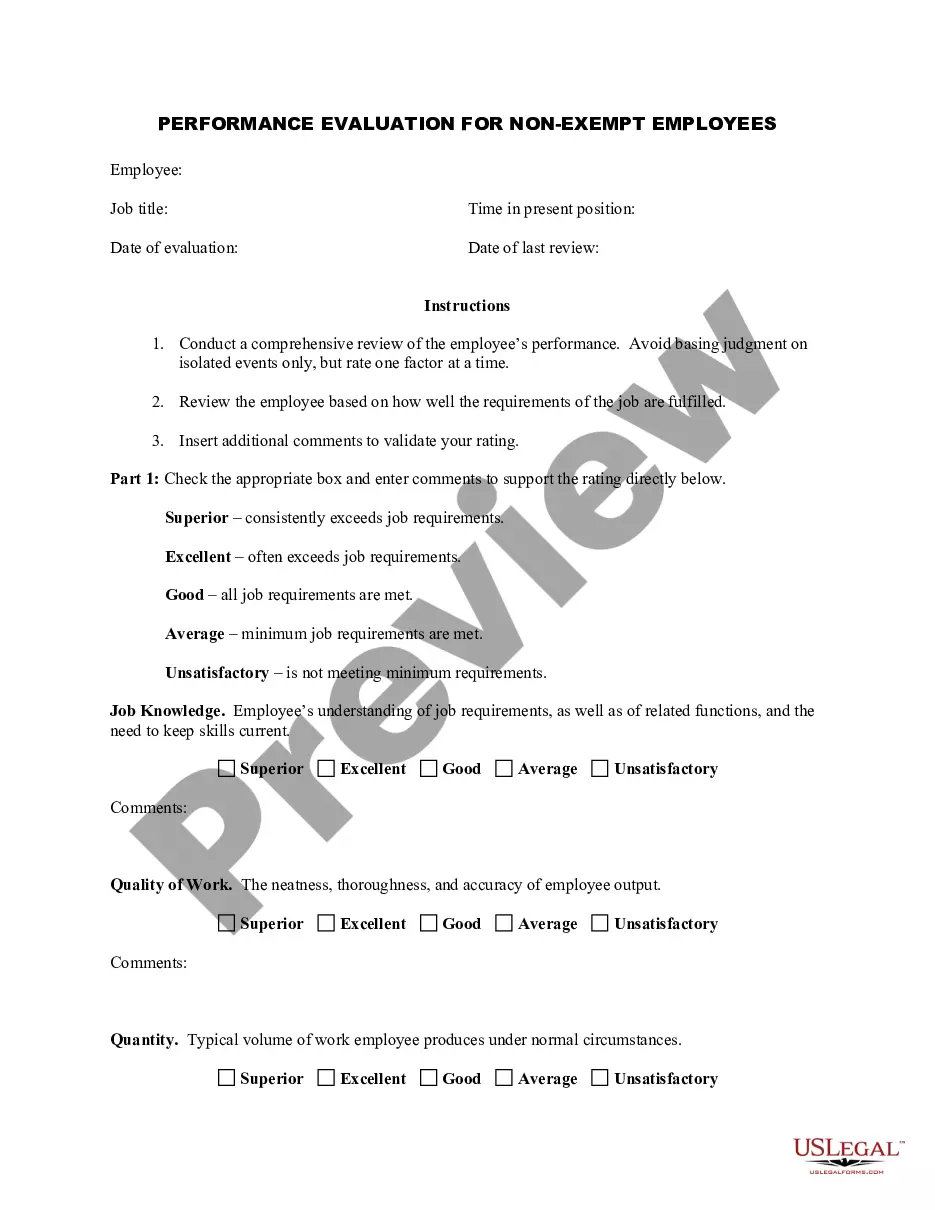

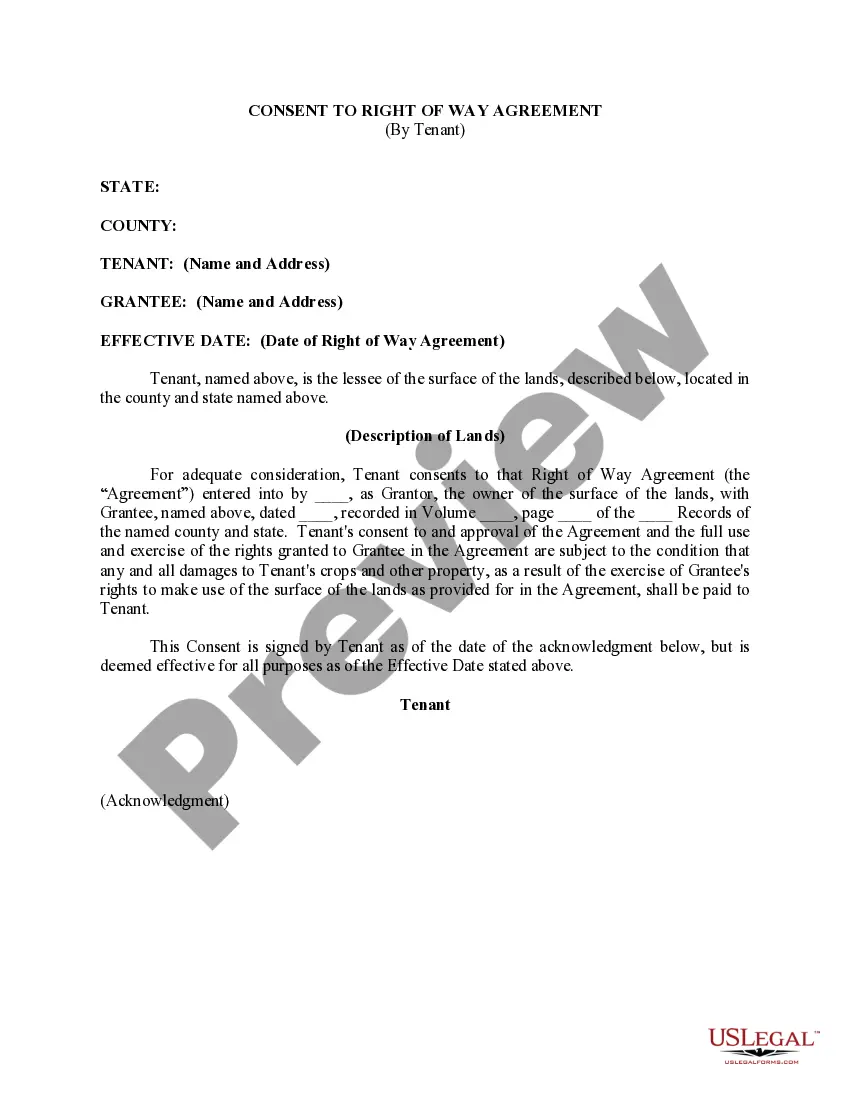

If available, use the Preview feature to view the document template as well.

- If you have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the Rhode Island Invoice Template for Chef.

- Every legal document template you obtain is yours permanently.

- To acquire another copy of a purchased form, go to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, make sure you have selected the correct document template for your desired state/region.

- Review the form description to ensure you have chosen the right form.

Form popularity

FAQ

Invoicing as a private chef requires a clear outline of your services and fees. Using the Rhode Island Invoice Template for Chef from UsLegalForms simplifies this process, allowing you to customize your invoice to reflect your unique offerings. Make sure to include details such as the service date, menu items, and total costs, thereby providing transparency to your clients.

Yes, you can generate an invoice for your services independently. Utilizing the Rhode Island Invoice Template for Chef from UsLegalForms can help ensure your invoices are clear and professional. This template includes all the necessary fields to outline your services and payment terms, making it easy to manage your clientele.

While Google does not have a dedicated invoicing program, you can use Google Sheets to create invoices. If you prefer a more structured approach, the Rhode Island Invoice Template for Chef from UsLegalForms provides a professional and easy-to-use solution. This template can streamline your billing process and make invoicing straightforward.

Google Forms does not specifically offer an invoice template, but you can create forms that collect necessary information. However, for a tailored solution, consider using the Rhode Island Invoice Template for Chef available on UsLegalForms. This template comes pre-formatted, ensuring you include all essential elements for your invoicing needs.

When it comes to generating invoices, UsLegalForms is an excellent choice. They offer a wide variety of customizable templates, including the Rhode Island Invoice Template for Chef. This platform is user-friendly and allows you to create professional invoices efficiently. Explore their site to see how easy invoicing can be.

In Rhode Island, most food items for home consumption are exempt from sales tax. However, prepared food items, often served in restaurants or catering services, may be subject to a sales tax rate. When using a Rhode Island Invoice Template for Chef, you can ensure your invoices reflect accurately whether food items are taxable, helping maintain compliance while you serve your delicious meals.

Most services are not subject to sales tax in Rhode Island. However, some specific services may incur tax obligations, so it is essential to reference state regulations for accuracy. A Rhode Island Invoice Template for Chef helps you track taxable services accurately, providing clarity when managing your business finances.

Rhode Island does not tax several services and products. Notably, services related to healthcare, various educational services, and many personal services are exempt from sales tax. By using a Rhode Island Invoice Template for Chef, you can clearly separate taxable and non-taxable items, ensuring compliance while you focus on your culinary creations.

In Rhode Island, services are generally not taxable unless they fall under specific categories defined by the state. For example, certain personal services, like hair styling, might attract tax. If you are a chef providing catering, the income you earn may not be subject to sales tax, making a Rhode Island Invoice Template for Chef a practical tool to accurately document your services.

To successfully advertise yourself as a private chef, start by creating a professional website showcasing your culinary skills and services. Utilize social media platforms to post engaging content, and consider using a Rhode Island Invoice Template for Chef to facilitate easy payments. Networking within local communities can also open doors to potential clients.