Rhode Island Acknowledgment of Modified Terms

Description

How to fill out Acknowledgment Of Modified Terms?

If you need to summarize, acquire, or produce legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online. Employ the site’s straightforward and user-friendly search feature to locate the documents you need.

A multitude of templates for business and personal purposes are organized by categories and regions, or keywords. Utilize US Legal Forms to obtain the Rhode Island Acknowledgment of Modified Terms in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Download button to find the Rhode Island Acknowledgment of Modified Terms. You can also access forms you have previously acquired within the My documents tab in your account.

All legal document formats you acquire are your property indefinitely. You have access to every document you purchased within your account. Navigate to the My documents section and select a document to print or download again.

Stay proactive and download, and print the Rhode Island Acknowledgment of Modified Terms with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

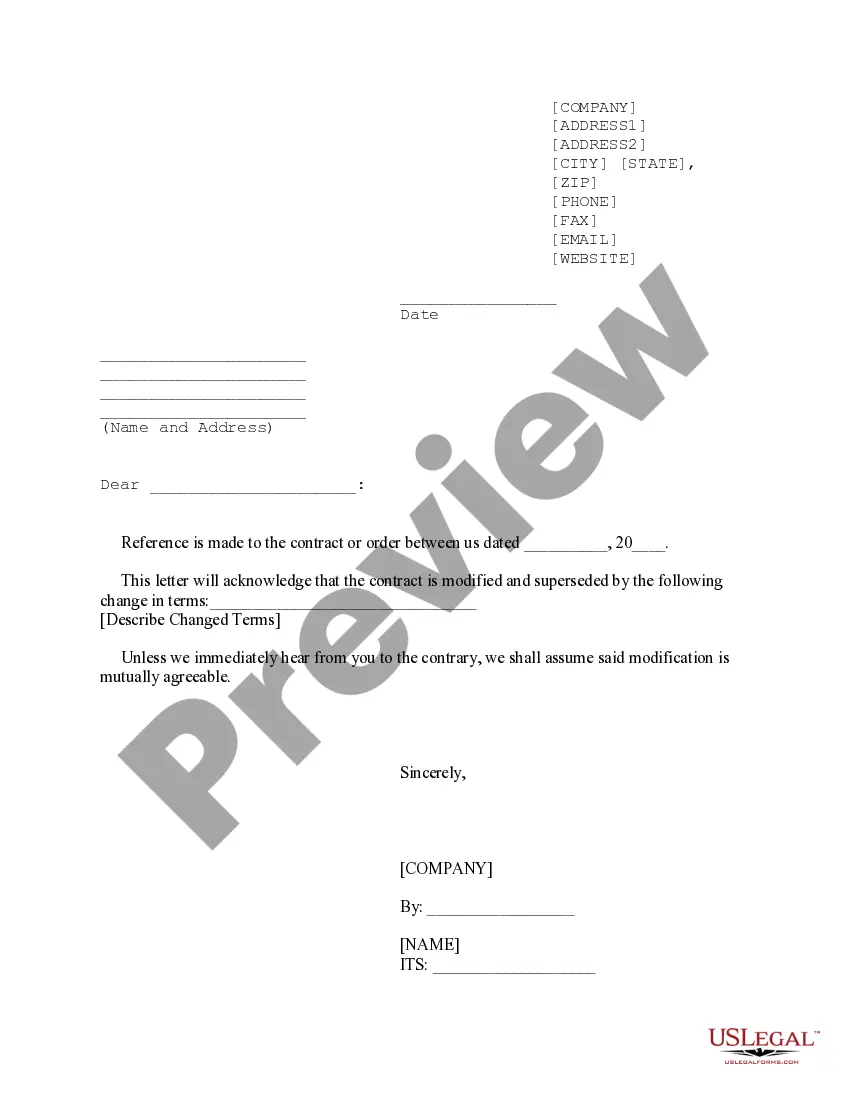

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Utilize the Review option to examine the form’s details. Remember to read through the description.

- Step 3. If you are dissatisfied with the template, use the Search field near the top of the screen to find other versions of the legal document format.

- Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Rhode Island Acknowledgment of Modified Terms.

Form popularity

FAQ

Schedule RI refers to forms related to income tax filings in Rhode Island, including various schedules that detail adjustments and modifications to your submitted information. These schedules are crucial for ensuring precise reporting and compliance with Rhode Island tax laws. Remember, using the Rhode Island Acknowledgment of Modified Terms can help you understand and navigate these requirements effectively.

Filling out a Rhode Island title involves providing necessary information regarding the vehicle and its ownership. Important details include the vehicle identification number, current owner information, and any lienholder data. Using resources like the Rhode Island Acknowledgment of Modified Terms can provide you with guidance on documentation and compliance in this process.

Schedule M is used to report specific modifications to your income that may differ from federal calculations. Taxpayers use this form to ensure they are accounting for state-specific deductions or adjustments. The Rhode Island Acknowledgment of Modified Terms simplifies this process, helping you to accurately complete your state tax return.

To be considered a resident of Rhode Island, you typically need to live in the state for at least one year. However, other factors, such as the intent to remain and physical presence, also play a role in determining residency status. Using the Rhode Island Acknowledgment of Modified Terms can assist you in clarifying your residency status and understanding its implications for state taxes.

The Rhode Island State Disability Insurance (SDI) is generally not tax deductible on your state taxes. However, understanding how SDI impacts your overall taxable income is crucial. With the Rhode Island Acknowledgment of Modified Terms, you can ensure that you report your income correctly and maintain compliance with tax laws.

You need to file Schedule M if you are a Rhode Island resident who has modifications to report that differ from your federal tax return. This form is essential for ensuring that your state tax obligations accurately reflect your financial situation. The Rhode Island Acknowledgment of Modified Terms guides you through this process, making it easier to comply with state regulations.

The purpose of the Schedule M is to document and clarify any modifications related to federal adjusted gross income for Rhode Island taxes. It helps the state identify specific adjustments that a taxpayer may need to claim or report. By utilizing the Rhode Island Acknowledgment of Modified Terms, taxpayers can ensure they accurately reflect their income and deductions on their state tax return.

The Rhode Island Schedule M is a form used by residents to report modifications to their federal adjusted gross income. This form allows taxpayers to add or subtract specific items that differ from federal calculations, ensuring accurate state tax reporting. Using the Rhode Island Acknowledgment of Modified Terms, residents can navigate these adjustments effectively, ensuring compliance with state tax laws.

In Rhode Island, the general rule is that you must live in the state for more than six months to qualify as a resident for tax purposes. However, additional factors such as your permanent address and where you conduct your daily life may influence this status. Being aware of these regulations is vital for fulfilling tax obligations, especially when dealing with legal matters such as the Rhode Island Acknowledgment of Modified Terms. Uslegalforms can provide clarity through the appropriate forms and resources for tax residency.

Residency in a state like Rhode Island is primarily determined by the physical presence and intent to remain in that location. Factors that influence this determination include where you live, work, and have established social connections. Legal documents often require proof of residency for verification, such as the Rhode Island Acknowledgment of Modified Terms. For more personalized guidance, you can explore forms from uslegalforms tailored to your residency situation.