This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

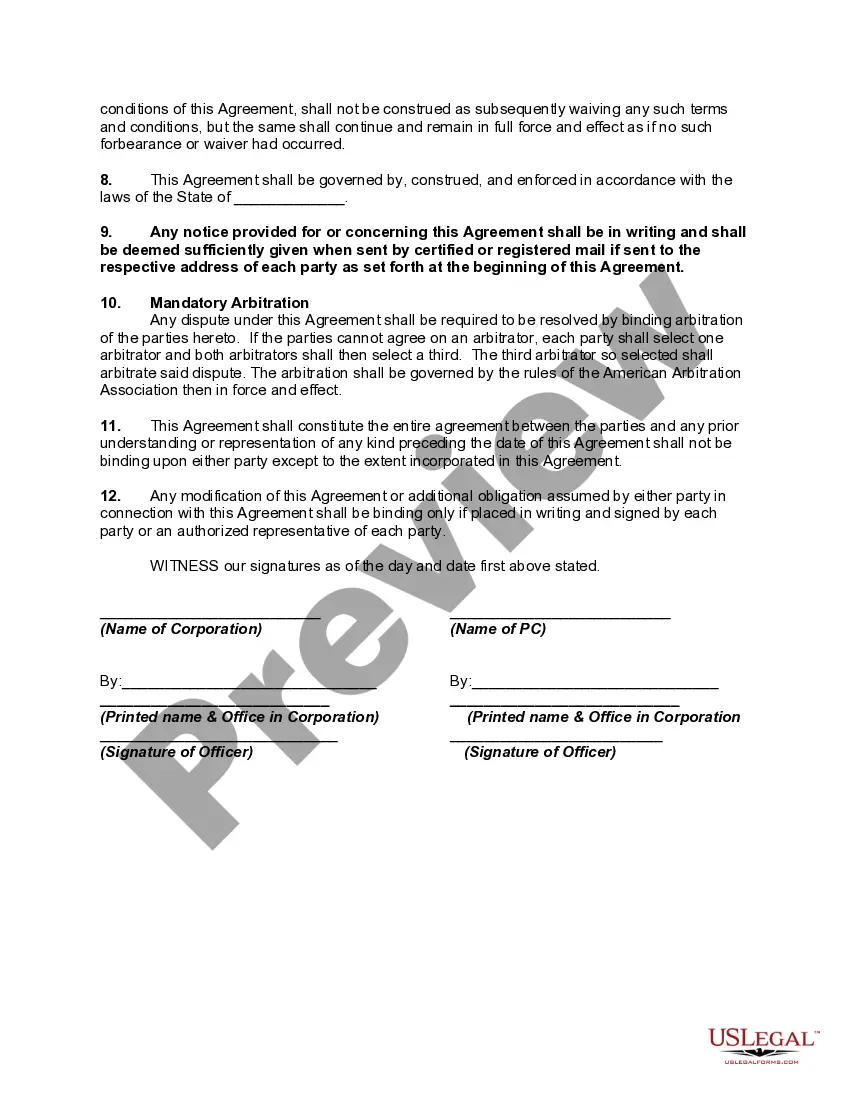

Rhode Island Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare

Description

How to fill out Agreement Between Professional Corporation And Non-Profit Corporation To Treat People Who Cannot Afford Healthcare?

Locating the appropriate legal document template can be rather challenging. Clearly, there is a multitude of templates available online, but how can you acquire the legal form you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Rhode Island Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals Who Cannot Afford Healthcare, which you may utilize for both business and personal purposes.

All templates are reviewed by professionals and comply with federal and state regulations.

Once you confirm that the form is suitable, click the Get now button to acquire the form. Choose the pricing plan you desire and input the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document template onto your device. Complete, modify, print, and sign the acquired Rhode Island Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals Who Cannot Afford Healthcare. US Legal Forms is the largest collection of legal forms where you can explore numerous document templates. Take advantage of the service to download professionally crafted papers that comply with state requirements.

- If you are currently registered, Log In to your account and then click the Download button to retrieve the Rhode Island Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals Who Cannot Afford Healthcare.

- Use your account to view the legal templates you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state. You can preview the document using the Review button and examine the document outline to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to locate the appropriate form.

Form popularity

FAQ

501(c)(3) charities are the most popular type of nonprofit. There are more than 1.5 million registered charitable organizations in the United States. 501(c)(3) organizations are funded primarily through charitable donations and government grants.

19 different types of nonprofits501(c)(1): Corporations organized under Act of Congress.501(c)(2): Title-holding corporations.501(c)(3): Charitable organizations.501(c)(4): Civic leagues, social welfare organizations, and employee associations.501(c)(5): Labor, agricultural, and horticultural organizations.More items...

IRS 557 provides details on the different categories of nonprofit organizations. Public charities, foundations, social advocacy groups, and trade organizations are common types of nonprofit organization.

So2026. how much does it cost to start a nonprofit? The answer is it's complicated. Generally, you need an investment of $500 at a bare minimum, but costs can be as high as $1,000 or more.

One way of starting a nonprofit without money is by using a fiscal sponsorship. A fiscal sponsor is an already existing 501(c)(3) corporation that will take a new organization under its wing" while the new company starts up. The sponsored organization (you) does not need to be a formal corporation.

There Are Three Main Types of Charitable Organizations Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.

Here are three possible functions of a nonprofit:Charity or Social Welfare.Religious Functions.Trade, Research, and Education.Nonprofits Use All Revenue and Resources to Further Advance the Organization.Nonprofits Benefit Social Welfare.Nonprofits Rely on Donations and Grants.Nonprofits Are Tax Exempt.UNICEF.More items...?

Here are some easy steps to start a charity.Start by developing your vision and mission. A vision is an inspiration and aspirational destination on the horizon.Next you need a name.Differentiate your charity.Write a plan.Register as a 501(c)(3).Start your website.Fundraising.Establish an Advisory Board.More items...?

Most states, including Rhode Island and Massachusetts, follow the so-called employment at will doctrine. This means that in the absence of a contract (either through a union or otherwise), an employee may be fired for any reason or no reason at all.

Despite how the name sounds, nonprofits can and do sometimes make a profit. Nonprofit corporations, unlike other forms of business, are not designed to make money for owners or shareholders. Instead, nonprofits are formed to serve a government-approved purpose, and are accorded special tax treatment as a result.