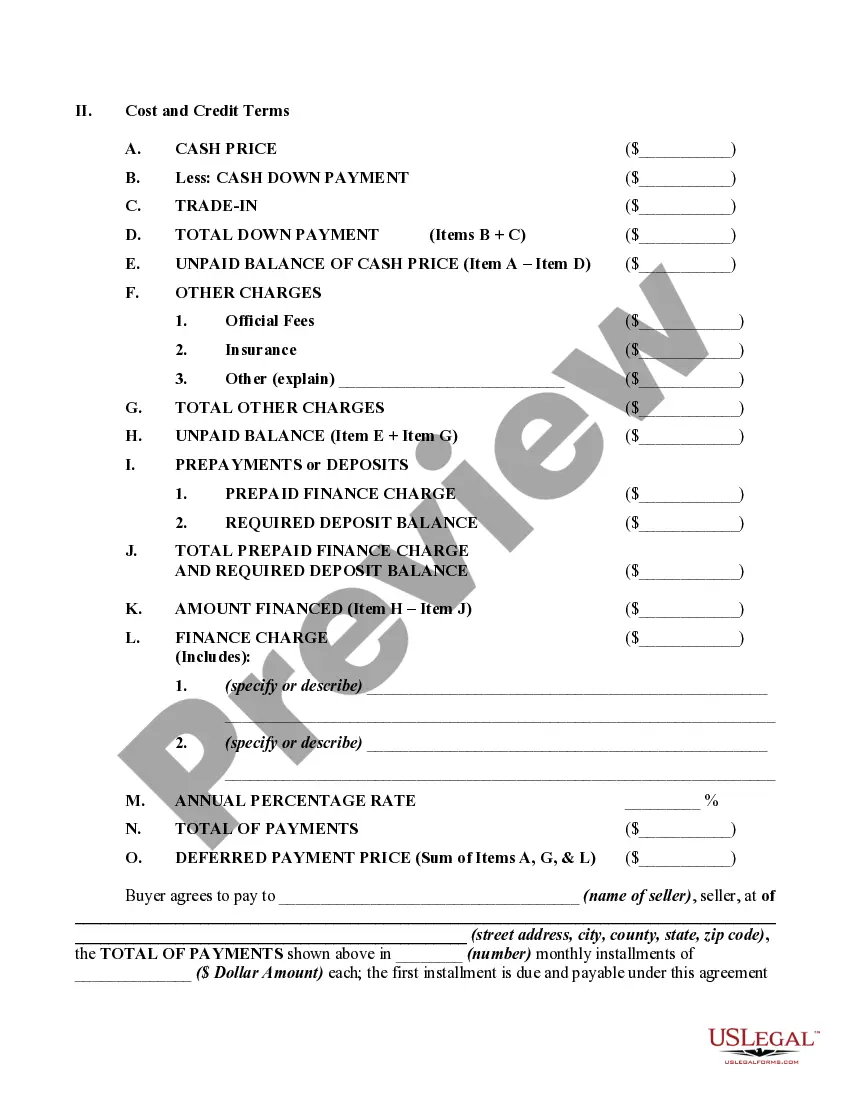

In a retail installment sale to a consumer as defined by Regulation Z of the Federal Trade Commission (FTC), the creditor must make the disclosures required by Regulation Z clearly and conspicuously in writing, in a form that the consumer may keep. The disclosures must be grouped, must be segregated from everything else, and must not contain any information not directly related to the disclosures required by Regulation Z (although the disclosures may include an acknowledgment of receipt, the date of the transaction, and the consumer's name, address, and account number). 12 C.F.R. § 226.17(a)(1). Regulation Z sets forth several closed-end model forms and clauses which illustrate other formats for these disclosures. 12 C.F.R. Part 226, Appendix H.

A federal notice regarding preservation of the consumer's claims and defenses is

required on all consumer credit contracts by Federal Trade Commission regulation. 16

C.F.R. § 433.2. The notice must appear in at least 10- point, bold face, type or print and

must be worded as shown if the form.