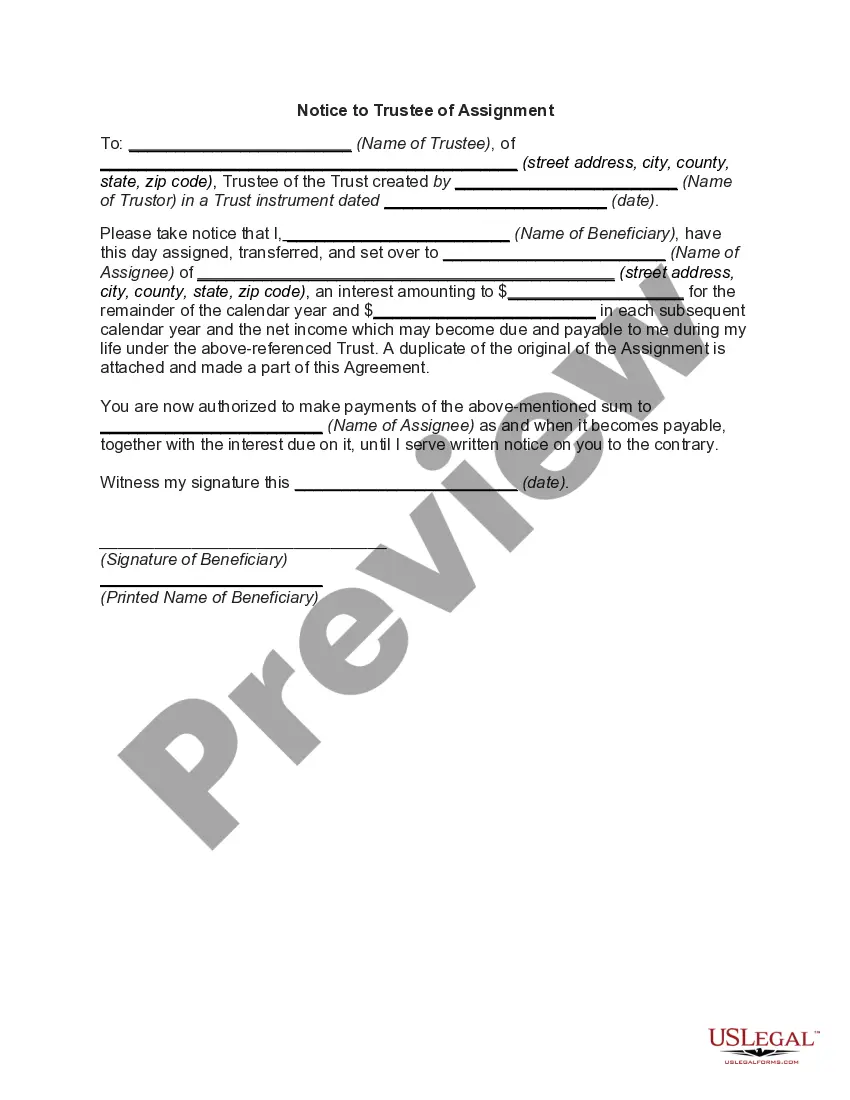

This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust

Description

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

Are you currently in the situation where you require documents for either business or personal purposes every single day.

There are numerous legitimate document templates accessible online, but locating ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust, designed to fulfill federal and state requirements.

Select the pricing plan you prefer, fill in the required information to create your account, and process the payment using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can download an additional version of the Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust whenever desired. Just click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Preview button to review the document.

- Check the information to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you obtain the correct form, click on Purchase now.

Form popularity

FAQ

To put your house in a trust in Rhode Island, you must first decide which type of trust best suits your circumstances. After that, you will need to draft a trust agreement and identify a trustee. The final step is to transfer the property title to the trust. Remember to execute a Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust to inform all relevant parties of this change.

The best trust to put your house in generally depends on your individual needs and goals. For many, a revocable living trust works well because it allows for flexibility and control while avoiding probate. However, if you're interested in protecting your assets from creditors or ensuring distribution after death, an irrevocable trust may be more suitable. In either case, understanding the implications of a Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust is crucial.

Yes, a trustee can also be a beneficiary of the trust. However, this arrangement can create potential conflicts of interest, so it is essential to set clear guidelines in the trust document. When structuring your trust, consider the implications of having overlapping roles. This is particularly relevant if you're dealing with a Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

To place your property in a trust in Florida, start by selecting the right type of trust for your needs. You will then need to draft a trust document, which outlines the terms of the trust and identifies the trustee. Once you have the trust established, you will transfer the ownership of your property to the trust by changing the title. It’s important to follow legal procedures to ensure compliance and create a Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust where necessary.

The Rhode Island Code of Professional Responsibility outlines the ethical obligations of attorneys practicing in the state. This code emphasizes the importance of integrity, competence, and respect in legal matters. It also provides guidelines for maintaining client confidentiality and proper conduct in representation. Understanding the Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust can help legal professionals navigate their responsibilities regarding trust assignments effectively.

Three fundamental duties of a trustee include the duty to administer the trust, the duty to keep accurate records, and the duty to act in the best interest of the beneficiaries. These duties ensure that the trust is managed efficiently and ethically, providing peace of mind for all parties involved. Being aware of these duties is important, especially when considering the implications of the Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

The relationship between a trustee and a beneficiary is one of trust and responsibility. The trustee manages the trust’s assets on behalf of the beneficiaries, ensuring their rights and interests are honored. Effective communication and transparency are essential in this relationship, especially when dealing with documents related to the Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

Trustees have several fiduciary duties to their beneficiaries, including duty of loyalty, duty of prudence, and duty of impartiality. These duties require trustees to avoid conflicts of interest, manage trust investments wisely, and treat all beneficiaries fairly. Recognizing these responsibilities enhances your understanding of the Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

Yes, trustees have a fiduciary duty to act in the best interests of the beneficiaries. This responsibility includes managing trust assets responsibly, maintaining accurate records, and providing beneficiaries with timely information. Understanding this duty is crucial, as it also encompasses obligations related to the Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

To avoid probate in Rhode Island, consider establishing a living trust. This allows your assets to be transferred directly to your beneficiaries without court involvement. Other strategies include making joint ownership arrangements and using payable-on-death designations. Always consult with a legal expert to understand how the Rhode Island Notice to Trustee of Assignment by Beneficiary of Interest in Trust factors into your estate planning.