Rhode Island Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

Description

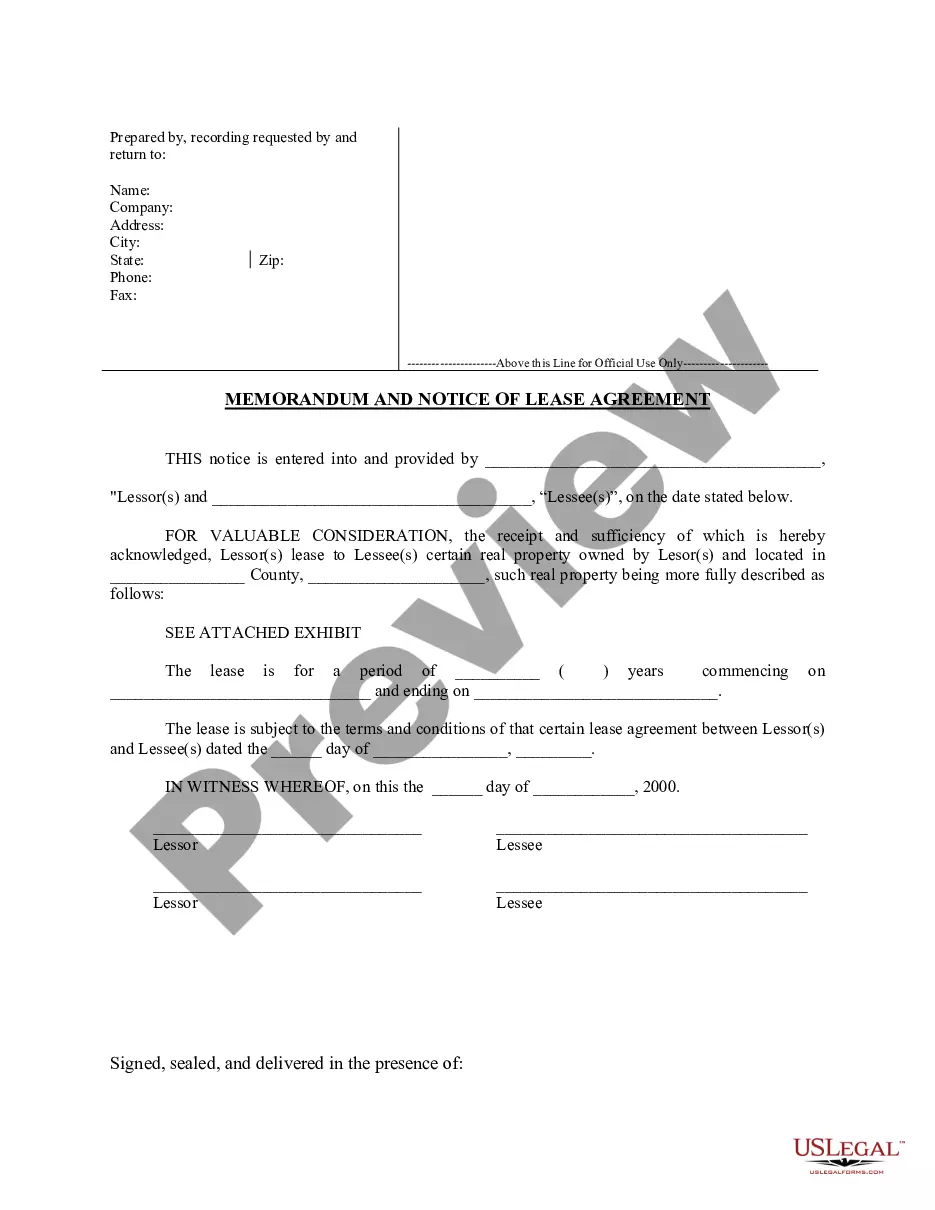

How to fill out Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

If you want to total, down load, or print out lawful papers web templates, use US Legal Forms, the biggest variety of lawful kinds, that can be found online. Make use of the site`s easy and handy look for to obtain the papers you will need. Numerous web templates for company and person reasons are categorized by types and claims, or key phrases. Use US Legal Forms to obtain the Rhode Island Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death in just a couple of clicks.

Should you be currently a US Legal Forms buyer, log in to your bank account and click the Down load option to get the Rhode Island Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death. You can also gain access to kinds you formerly downloaded from the My Forms tab of your respective bank account.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have selected the form for the proper town/country.

- Step 2. Take advantage of the Review option to look over the form`s articles. Never overlook to see the outline.

- Step 3. Should you be unhappy with the form, take advantage of the Look for area at the top of the monitor to find other types of the lawful form template.

- Step 4. When you have found the form you will need, go through the Get now option. Choose the pricing plan you prefer and add your references to sign up to have an bank account.

- Step 5. Procedure the transaction. You should use your bank card or PayPal bank account to perform the transaction.

- Step 6. Pick the structure of the lawful form and down load it on the device.

- Step 7. Comprehensive, revise and print out or indication the Rhode Island Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death.

Every single lawful papers template you buy is your own eternally. You have acces to every single form you downloaded with your acccount. Select the My Forms section and choose a form to print out or down load again.

Compete and down load, and print out the Rhode Island Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death with US Legal Forms. There are millions of specialist and state-particular kinds you can use to your company or person needs.

Form popularity

FAQ

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

Certain types of debt, such as individual credit card debt, can't be inherited. However, shared debt will likely still need to be paid by a surviving debtholder. There are laws that protect family members from aggressive debt collectors who may use questionable methods to collect debts.

You have the right to send what's referred to as a ?drop dead letter. '' It's a cease-and-desist motion that will prevent the collector from contacting you again about the debt. Be aware that you still owe the money, and you can be sued for the debt.

When someone dies, their debts are generally paid out of the money or property left in the estate. If the estate can't pay it and there's no one who shared responsibility for the debt, it may go unpaid. Generally, when a person dies, their money and property will go towards repaying their debt.

However, once the three nationwide credit bureaus ? Equifax, Experian and TransUnion ? are notified someone has died, their credit reports are sealed and a death notice is placed on them. That notification can happen one of two ways ? from the executor of the person's estate or from the Social Security Administration.

Family members are generally not held responsible for paying off debt of the deceased, especially not from their own pocketbooks. The division of an estate's assets, however, occurs before any allotted inheritance is passed on to heirs.

When a parent dies, their children are not personally liable to creditors for their debt. A creditor cannot go after a child to collect on a parent's debt if there is no contractual agreement between the child and their parents' creditors.

It's important to remember that credit card debt does not automatically go away when someone dies. It must be paid by the estate or the co-signers on the account.