Rhode Island Affidavit by an Individual in Connection with a Forgery of the Individual's Name to a Check

Description

How to fill out Affidavit By An Individual In Connection With A Forgery Of The Individual's Name To A Check?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates that you can download or print.

By using the website, you can find numerous forms for business and personal purposes, organized by categories, states, or keywords. You can discover the latest editions of forms such as the Rhode Island Affidavit by an Individual Regarding a Forgery of the Individual's Name on a Check in just moments.

If you already have a subscription, Log In and access the Rhode Island Affidavit by an Individual Regarding a Forgery of the Individual's Name on a Check from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the file format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the downloaded Rhode Island Affidavit by an Individual Regarding a Forgery of the Individual's Name on a Check. Every template you purchased has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Make sure you have chosen the correct form for your city/region.

- Click the Review button to examine the form's details.

- Check the form description to ensure you have selected the right one.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

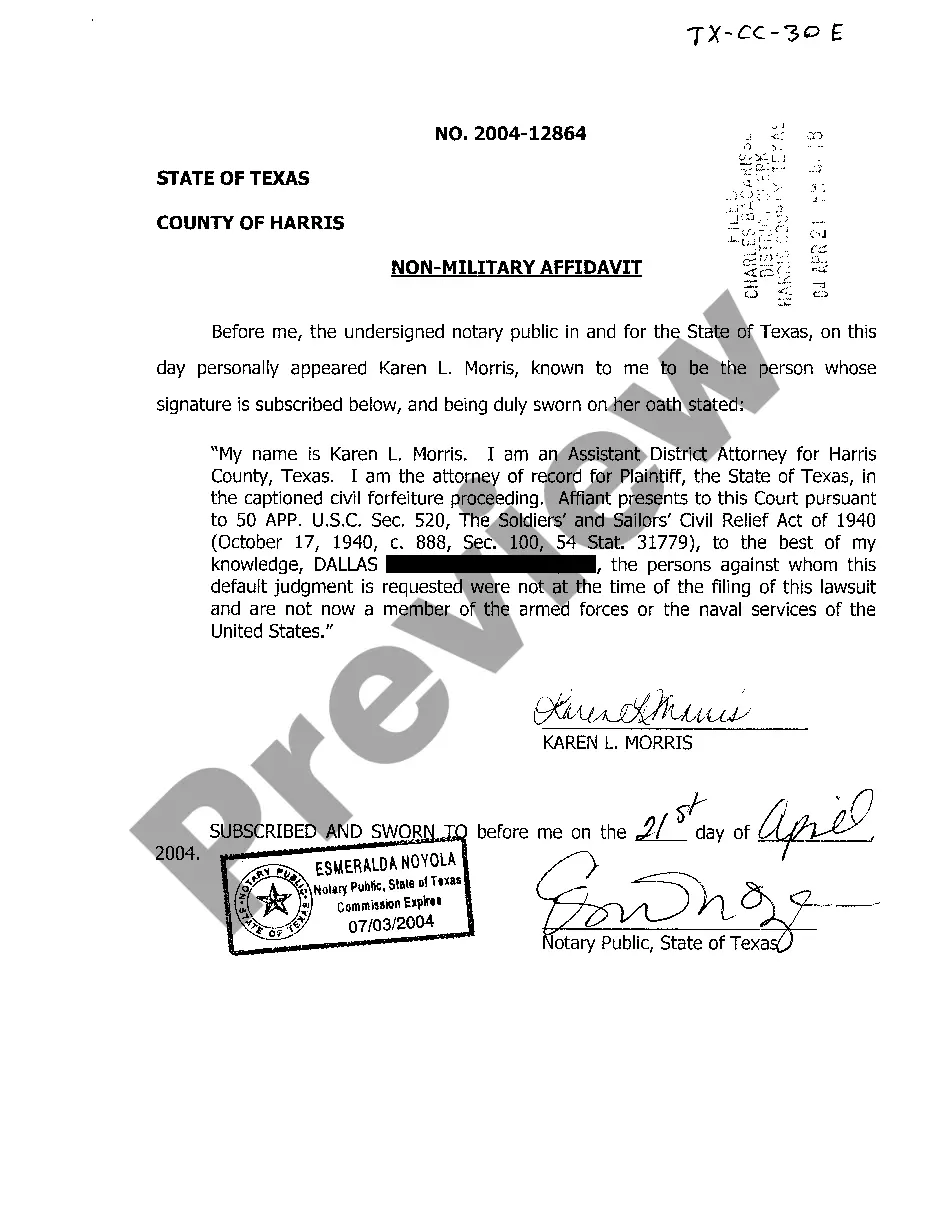

This affidavit has two parts: Part One ? the ID Theft Affidavit ? is where you report general informa- tion about yourself and the theft. Part Two ? the Fraudulent Account Statement ? is where you describe the fraudulent account(s) opened in your name.

Criminals do crafty things like apply for a credit card at 10 different banks using SSNs that are only one digit away from each other. Or they use slightly different first names or street addresses in an attempt to evade a poor credit history or crime record.

Warning signs of identity theft Bills for items you did not buy. Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

Use this checklist to protect yourself from identity theft. Keep your mail safe. ... Read your account statements. ... Check your credit reports. ... Shred! ... Store personal documents at home. ... Be wary of unknown phone calls and emails. ... Create difficult logins and passwords. ... Use one credit card for online shopping.

If you previously contacted the IRS and did not have a resolution, contact us for specialized assistance at 800-908-4490. We have teams standing by to help you. If you believe someone has filed a fraudulent return in your name, you can get a copy of the return.

Changes in your credit score can indicate identity theft. For example, if someone takes out utility bills in your name and doesn't pay them, your credit score may dip. Checking your credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion can help pinpoint the problem.

How To Know if Someone Stole Your Identity Track what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address. Review your bills. ... Check your bank account statement. ... Get and review your credit reports.

Check credit reports. Similarly, monitor your credit reports from all three credit-reporting bureaus for any unknown accounts or inaccurate information. Your credit score isn't enough information to check for identity theft; rather, you'll need the complete credit files.