Rhode Island Credit Agreement

Description

How to fill out Credit Agreement?

Are you presently in a situation where you need documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of form templates, including the Rhode Island Credit Agreement, that are designed to meet state and federal requirements.

Select the pricing plan you want, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

Choose a convenient format and download your copy. Find all the document templates you have purchased in the My documents section. You can acquire another version of the Rhode Island Credit Agreement anytime, if needed. Just select the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. This service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Rhode Island Credit Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

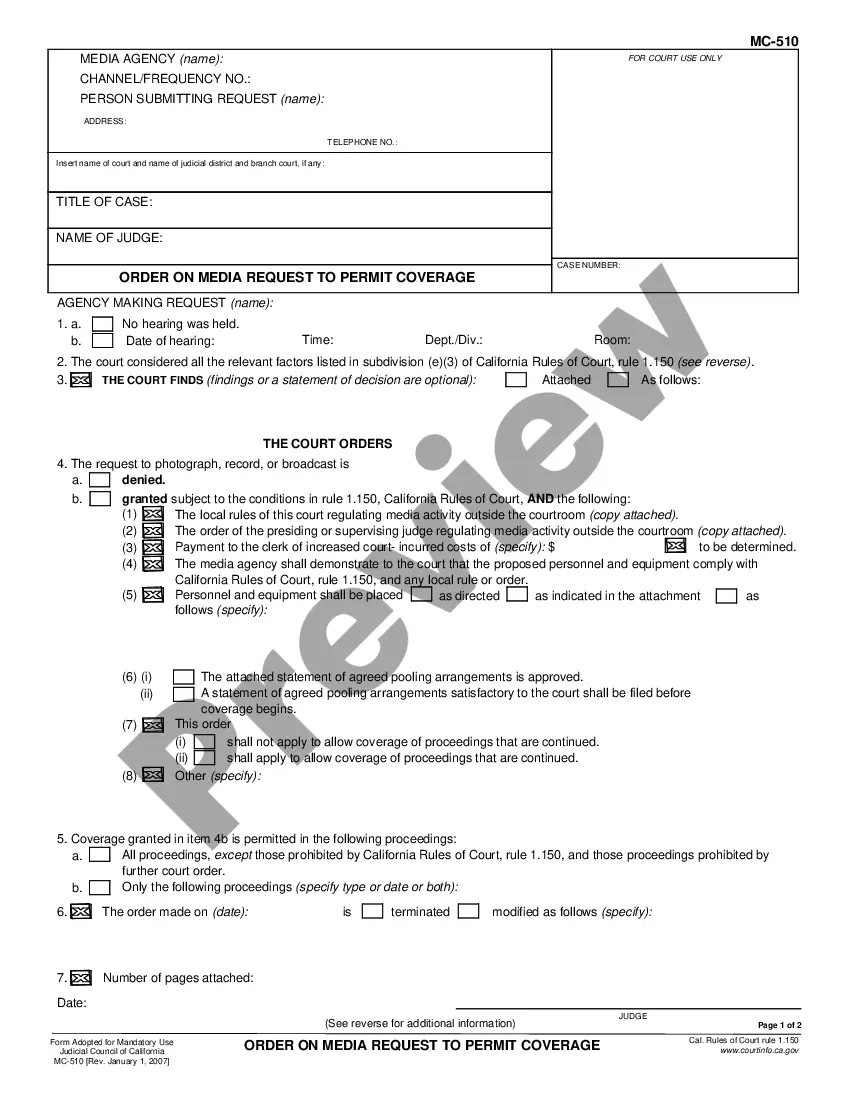

- Use the Preview button to view the form.

- Read the summary to make sure you have selected the right form.

- If the form is not what you are looking for, utilize the Search box to find the form that fits your needs and requirements.

- Once you find the correct form, click Get now.

Form popularity

FAQ

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

Rhode Island Debt Statistics Rhode Island had average debt per person of $8,401 in June of 2021. That is the debt of the state. When it comes to individual debt, the average mortgage debt in Rhode Island is $217,019, $12,200 less than the national average.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

The term includes, without limitation, all amounts owed by the Borrower to the Lender at such date as a result of draws on letters of credit paid by the Lender for which the Borrower has not reimbursed the Lender, all principal, interest, fees, charges, expenses, attorneys' fees, and any other sum chargeable to any ...

Rhode Island Statute Of Limitations Creditors in Rhode Island have ten years to sue you for an unpaid loan, promissory note, or credit card. A creditor can still call and send you bills even after the statute of limitations has expired.

Laws § 34-25.2-1 et seq., The Rhode Island Home Loan Protection Act, which protects consumers from certain loan brokering and lending practices. One of these statutory protections, R.I. Gen. Laws § 34-25.2-6, imposes certain requirements and prohibited practices upon ?High-Cost Home Loans.?

Any of your Credit Agreements that have been shared with the Credit Reference Agencies, thereby appearing on your Credit Report, will directly influence your Credit Rating. Whether a Credit Agreement helps or hurts your Credit Report depends on how the account itself has been managed.

You have the right to cancel a credit agreement if it's covered by the Consumer Credit Act 1974. You're allowed to cancel within 14 days - this is often called a 'cooling off' period. If it's longer than 14 days since you signed the credit agreement, find out how to pay off a credit agreement early.