Rhode Island Corporation - Minutes

Description

How to fill out Corporation - Minutes?

Have you ever found yourself in a scenario where you require documentation for both business or particular purposes nearly every time.

There are numerous legal document templates available online, but locating reliable ones is not easy.

US Legal Forms offers thousands of document templates, such as the Rhode Island Corporation - Minutes, which can be generated to meet state and federal requirements.

Select the pricing plan you prefer, fill in the required details to create your account, and process the payment using PayPal or a credit card.

Choose a suitable paper format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Rhode Island Corporation - Minutes template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for your respective city/state.

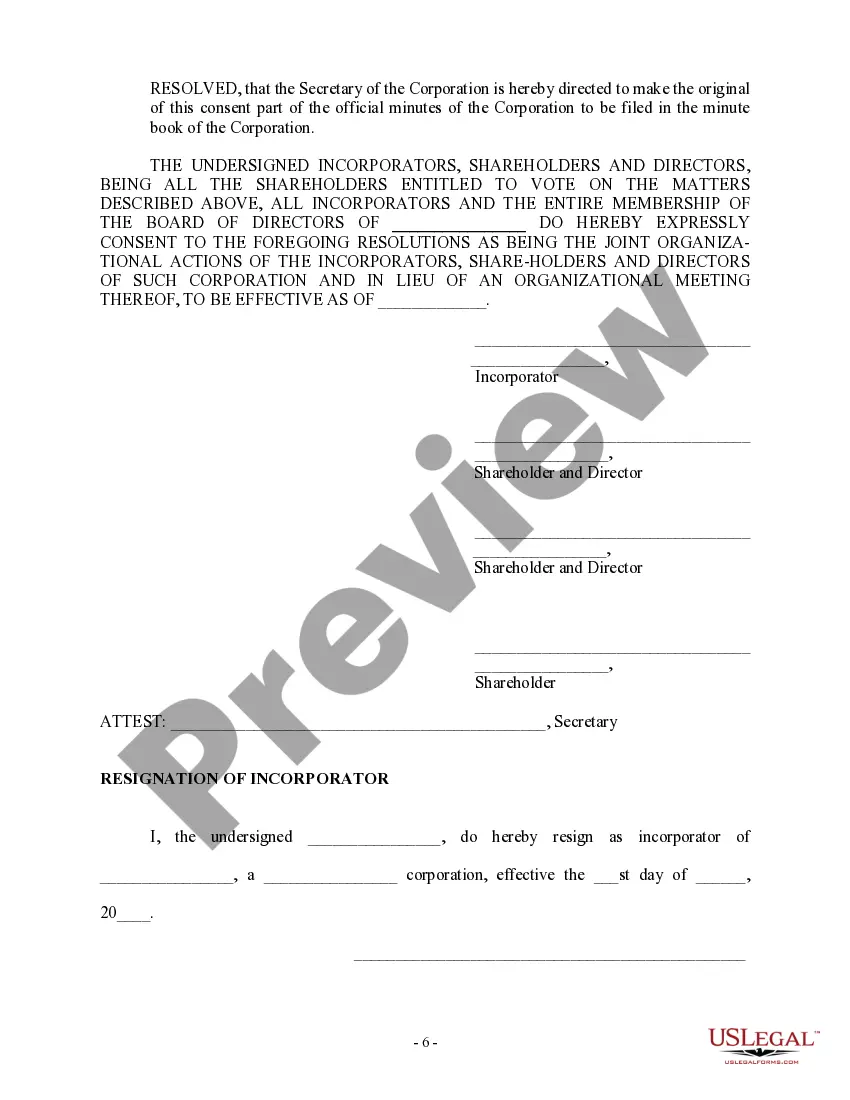

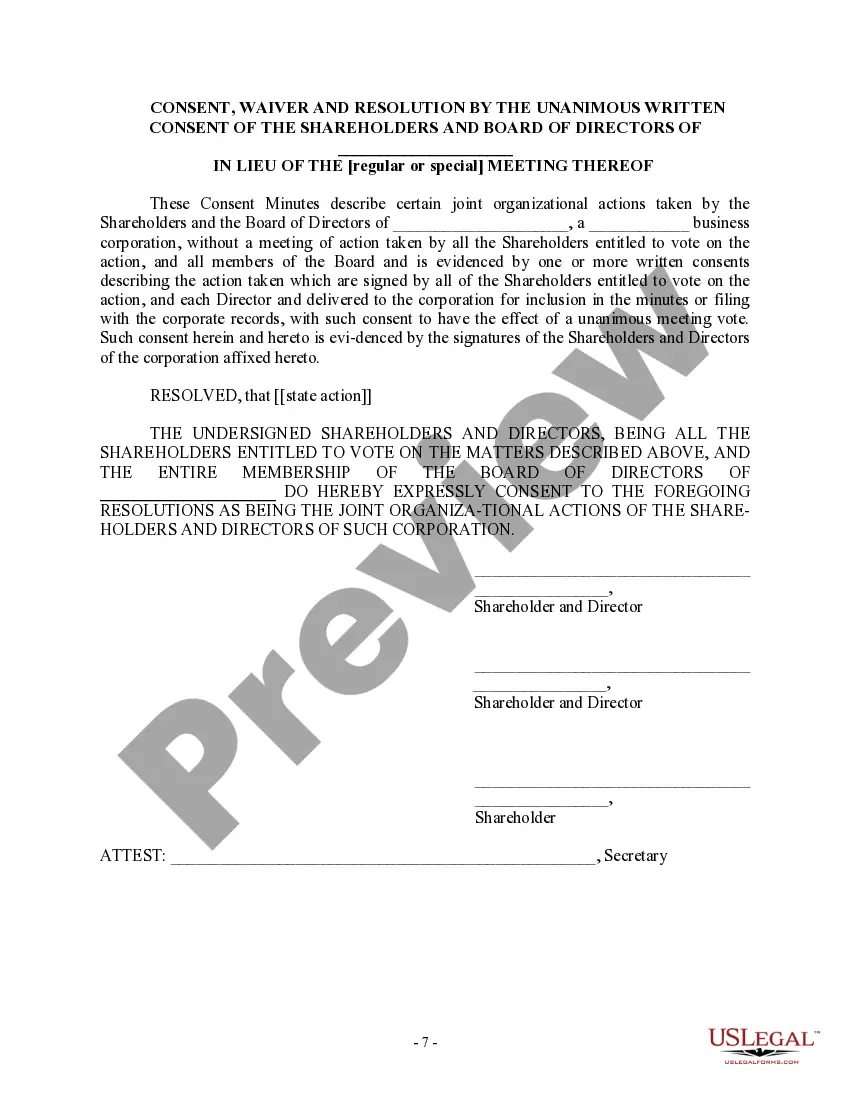

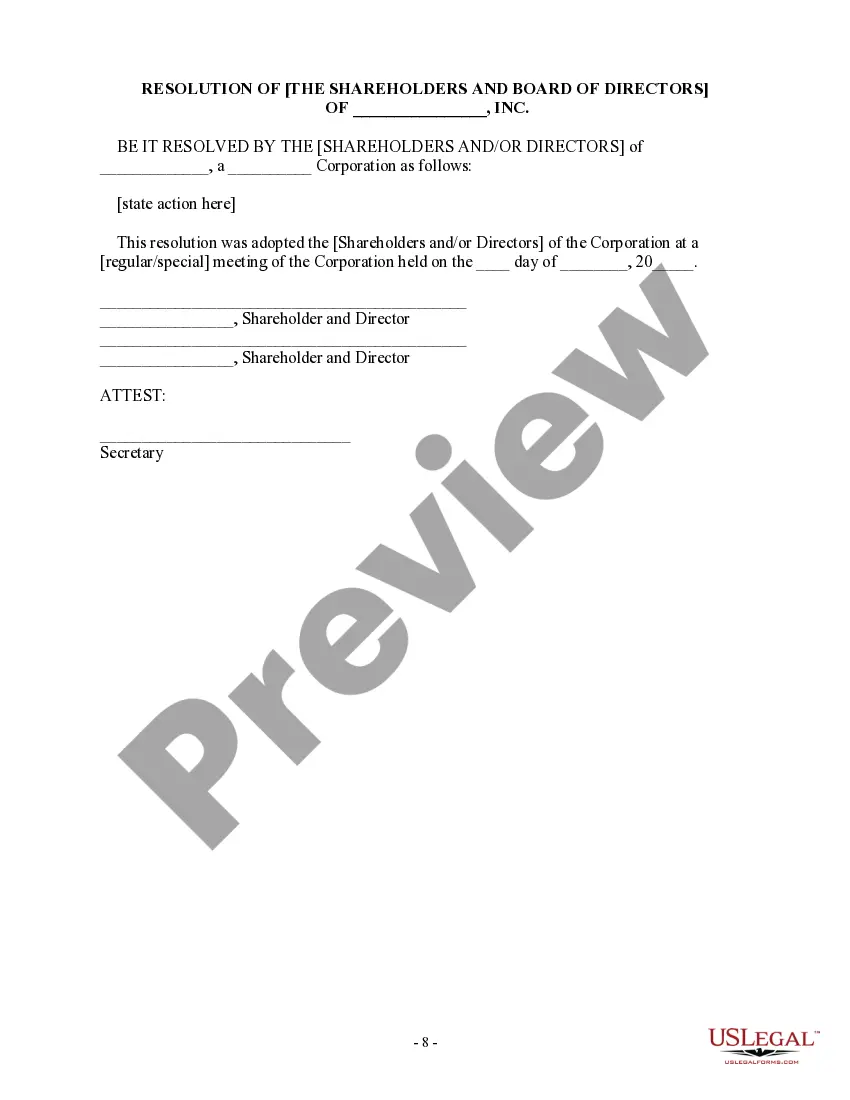

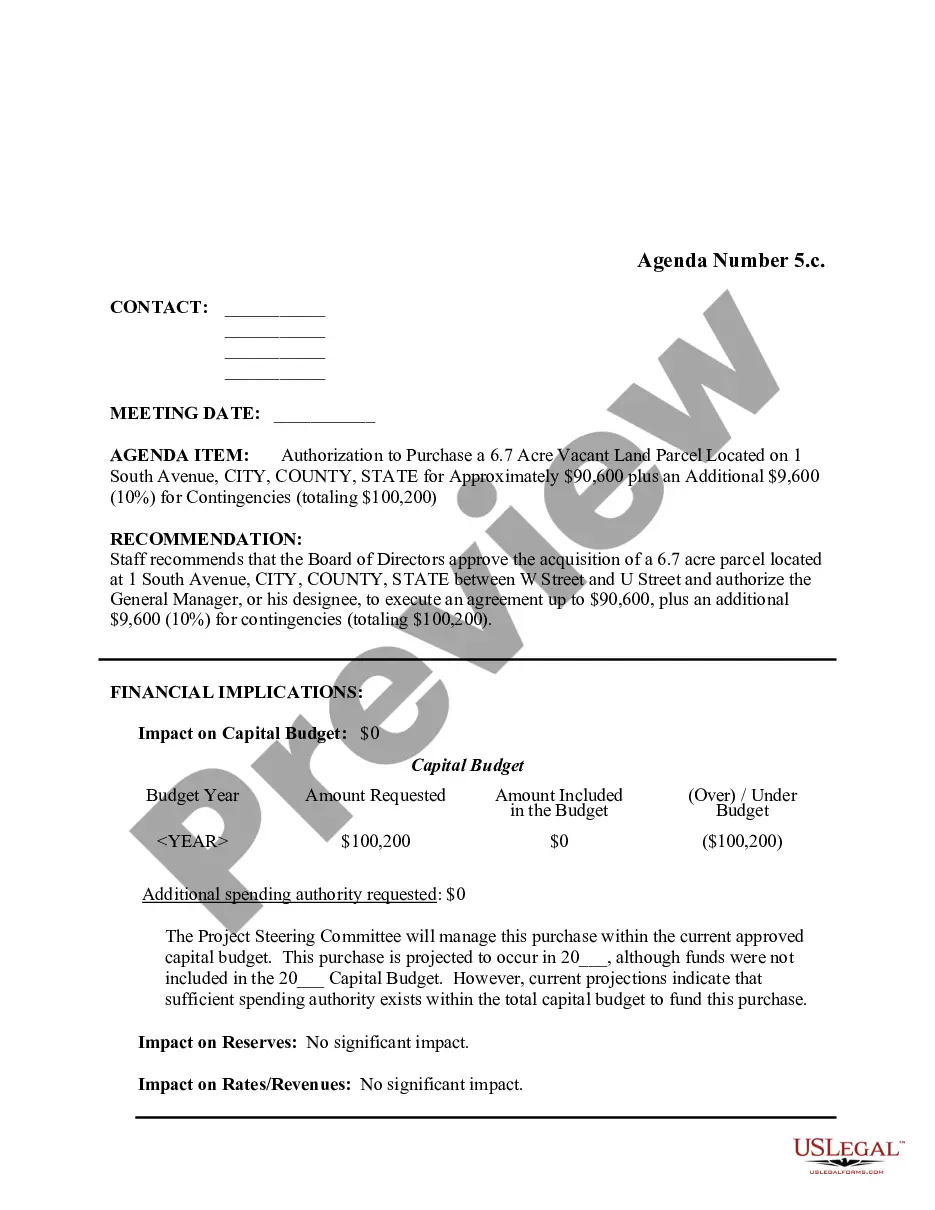

- Use the Review option to examine the form.

- Read the description to confirm you have selected the correct document.

- If the document is not what you are looking for, utilize the Search area to find the document that fits your needs.

- Once you find the appropriate document, click on Purchase now.

Form popularity

FAQ

In Rhode Island, the minimum tax for an S corporation is set at $500. This tax applies annually and is important for all corporations operating in the state. Being aware of this tax obligation allows Rhode Island corporations to budget effectively and maintain compliance. Recording all tax-related discussions in your Rhode Island Corporation - Minutes is crucial for proper documentation.

The secretary of commerce in Rhode Island is appointed by the governor to oversee various economic initiatives. This position plays a significant role in fostering business development in the state. Understanding who holds this office can benefit Rhode Island corporations, especially when considering strategic partnerships. Keeping updated Rhode Island Corporation - Minutes can aid in tracking engagements with state officials.

The Rhode Island Open Meeting Law mandates that meetings of public bodies must be open to the public. This law promotes transparency and accountability in government. For Rhode Island corporations, adhering to this law is vital when organizing meetings, and taking comprehensive Rhode Island Corporation - Minutes is essential for compliance. Using platforms like uslegalforms can help ensure you follow all necessary protocols.

Law 28 14 4 in Rhode Island pertains to employment relationships and the rights of employees. It emphasizes the importance of fair treatment in the workplace. For Rhode Island corporations, awareness of this law can impact how they handle employee relations and document their meetings. Keeping accurate Rhode Island Corporation - Minutes helps ensure compliance with such regulations.

Yes, there is a federal open meetings law. This law aims to ensure transparency in governmental proceedings. However, it primarily applies to federal agencies, while state and local governments, including Rhode Island corporations, have their own regulations. Understanding these laws is crucial for maintaining proper Rhode Island Corporation - Minutes.

Rhode Island requires certain businesses to file documents electronically through its online system. This electronic filing mandate helps streamline the process and reduces paperwork. As part of your Rhode Island Corporation - Minutes, understanding these requirements is essential for compliant and timely submissions. To assist with electronic filings, uslegalforms is a reliable resource for all necessary forms and guidance.

Single member LLCs in Rhode Island are generally considered disregarded entities for tax purposes. This means they do not need to file Form 1065, which is typically required for partnerships, making tax filing simpler. If you operate under a Rhode Island Corporation - Minutes, understanding your filing obligations is key. The uslegalforms platform can provide clarity on compliance and necessary forms.

The minimum tax on corporate profits in Rhode Island is designed to make sure that every corporation pays its fair share, regardless of profit levels. This applies to all established Rhode Island Corporations - Minutes. Understanding the tax implications can significantly affect your business planning. For assistance in managing these requirements, consider using uslegalforms for expert guidance.

Rhode Island imposes a minimum corporate tax rate to ensure all businesses contribute to the state's economy. As a Rhode Island Corporation - Minutes, it's essential to understand that the minimum tax rate can vary based on specific business factors. Ensuring proper documentation with uslegalforms makes navigating these regulations easier. This can help you maintain compliance and avoid penalties.

The minimum corporate income tax in Rhode Island is a baseline requirement for businesses operating as corporations. This tax helps fund the state's infrastructure and services. As a Rhode Island Corporation - Minutes holder, you must be aware of your tax obligations, as they help maintain good standing with the state. Using the uslegalforms platform can simplify the process of complying with these requirements.