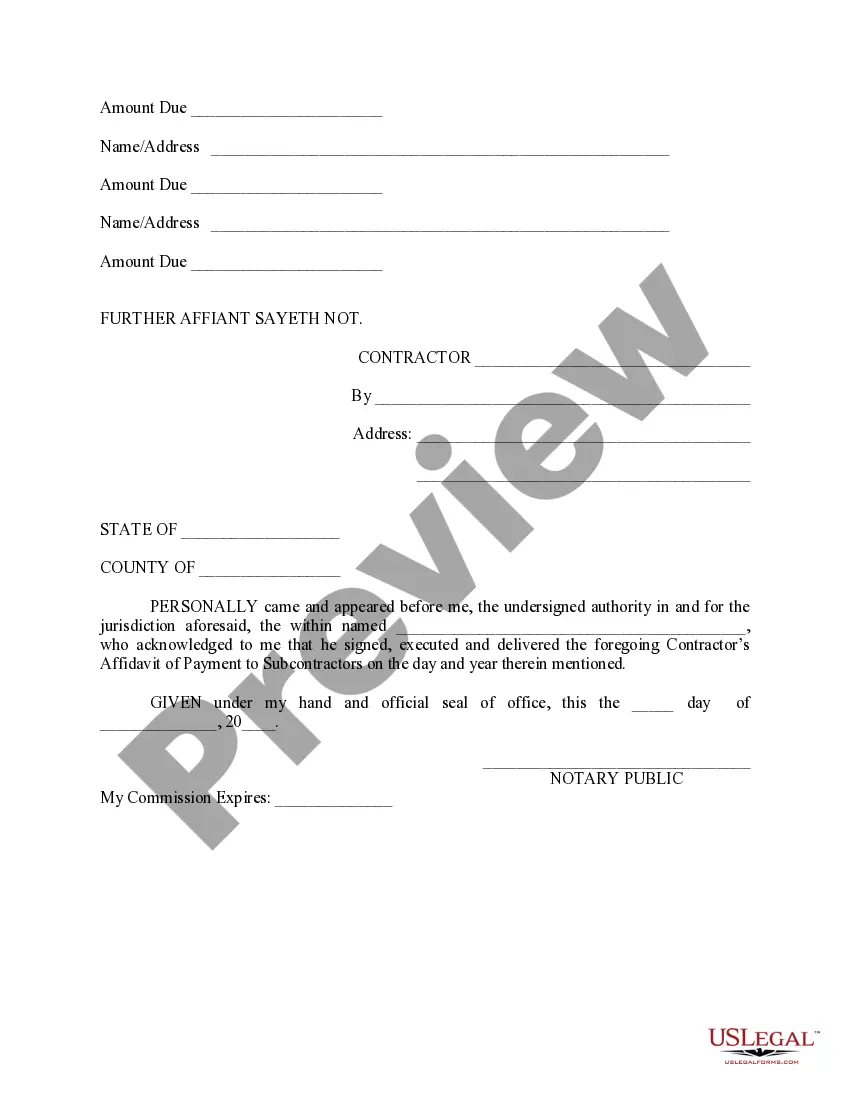

Rhode Island Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

If you want to finalize, obtain, or create legal document templates, utilize US Legal Forms, the most extensive assortment of legal documents available online.

Take advantage of the site’s straightforward and convenient research feature to find the documents you need.

A range of templates for commercial and personal purposes are categorized by types and titles, or search keywords.

Every legal document template you purchase is yours indefinitely.

You will have access to each document you obtained within your account. Navigate to the My documents section and select a document to print or download again. Complete, obtain, and print the Rhode Island Contractor's Affidavit of Payment to Subs with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to acquire the Rhode Island Contractor's Affidavit of Payment to Subs in just a few clicks.

- If you're already a US Legal Forms user, sign in to your account and hit the Obtain button to get the Rhode Island Contractor's Affidavit of Payment to Subs.

- You can also find forms you've previously obtained in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to peruse the form's details. Don't forget to read the description.

- Step 3. If you’re dissatisfied with the form, utilize the Search box at the top of the page to find alternative versions of the legal document template.

- Step 4. Once you've found the form you need, click the Buy now button. Choose your preferred pricing plan and input your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Rhode Island Contractor's Affidavit of Payment to Subs.

Form popularity

FAQ

Building and Construction Prime contractors looking for subcontractors hire electricians, plumbers, carpenters, carpet layers, painters, landscapers, roofers and flooring specialists to do most of the work.

A direct payment clause says that if you have paid the main contractor for work done by subcontractors and your money is not passed on to them, you can pay the subcontractor directly and deduct the payment from any other monies due to the main contractor.

If the contractor defaults or otherwise doesn't take care of your wages, you can file a claim with the surety company to get at least part of your money. The surety company then takes the contractor to court to recover the amount.

PURPOSE: To provide for methodical and orderly effort in which a subcontractor or vendor is legally notified to address contractual deficiencies and/or to be terminated.

The most common causes of back charges are defective work, damages to the property caused by performance of your work, costs for use of contractor's equipment, and site clean-up costs.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

What does Payment Notice mean? A notice given under HGCRA 1996, s 110A by a payer (or specified person) or the payee setting out the amount to be paid and how it is calculated. Most standard form contracts provide that the notice is to be given by the payer (or specified person).

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

200dA 'Payment Notice' is the document the contractor (the employer) serves the subcontractor (the employee) providing details of what's payable and why. This is known as the 'Notified Sum' and this is what will be paid on the 'Final Date for Payment' (see below).