Rhode Island Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

You might spend multiple hours online trying to locate the legal document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

It’s easy to obtain or create the Rhode Island Direct Deposit Form for IRS from the service.

If available, utilize the Review button to look at the document format as well. If you wish to find another version of the form, use the Search field to find the format that suits your needs and requirements. Once you have located the format you desire, click Purchase now to proceed. Select the payment plan you prefer, enter your information, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format from the document and download it to your device. Make alterations to your document if applicable. You can complete, modify, sign, and print the Rhode Island Direct Deposit Form for IRS. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Rhode Island Direct Deposit Form for IRS.

- Every legal document format you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document format for your county/city of choice.

- Review the form details to confirm you have chosen the right template.

Form popularity

FAQ

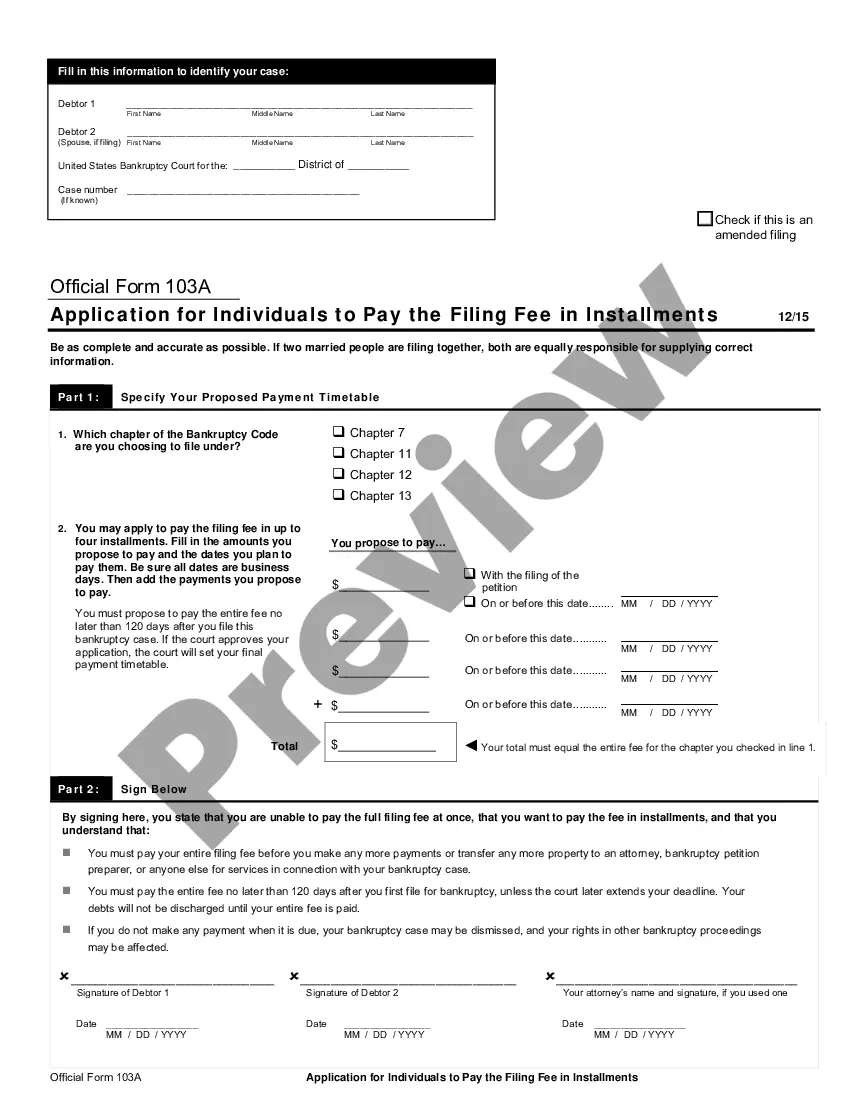

To set up direct deposit with the IRS, you can use the Rhode Island Direct Deposit Form for IRS while filing your tax return. Include your bank account number and routing number on the form. This method ensures that your refunds are deposited directly into your account, providing a quicker and more convenient way to receive your funds.

Setting up direct deposit with the IRS is easy. You need to complete the Rhode Island Direct Deposit Form for IRS and provide your banking details when you file your tax return. Once the IRS processes your return, your refunds will be directly deposited into your designated account.

Yes, you can update your direct deposit information with the IRS at any time. If you need to change your banking details, simply fill out the Rhode Island Direct Deposit Form for IRS with your new information. It's essential to keep this information current to ensure you receive your refunds without delays.

IRS Form 8888 is used when you want to allocate your tax refund to multiple accounts through direct deposit. If you are expecting a refund and want to split it among several accounts, complete the Rhode Island Direct Deposit Form for IRS alongside Form 8888. This gives you greater control over your funds and can help you manage savings more effectively.

Filing taxes while using direct deposit is straightforward. You need to include your banking details on your Rhode Island Direct Deposit Form for IRS when submitting your tax return. This way, any refund will be directly deposited into your account, allowing you to receive your funds more quickly.

Typically, the IRS processes direct deposit refunds within 21 days of receiving your tax return. However, the exact timeframe can vary based on several factors, including the accuracy of your Rhode Island Direct Deposit Form for IRS. To expedite your refund, file your taxes electronically and choose direct deposit as your payment method.

To update your direct deposit information with the IRS, you can use the IRS Direct Deposit Form, or you may opt to file your tax return electronically. Generally, you need to provide your bank account details, including the account number and routing number. If you are using the Rhode Island Direct Deposit Form for IRS, ensure that all details are accurate to avoid delays.