Rhode Island Direct Deposit Form for Employer

Description

How to fill out Direct Deposit Form For Employer?

Have you found yourself in a situation where you need documents for either business or personal purposes almost every day.

There are many valid document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms provides a vast array of form templates, such as the Rhode Island Direct Deposit Form for Employers, designed to meet state and federal regulations.

Once you find the correct form, click Buy now.

Select the payment plan you prefer, fill in the necessary information to create your account, and complete the order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Rhode Island Direct Deposit Form for Employers template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it corresponds to the correct city/region.

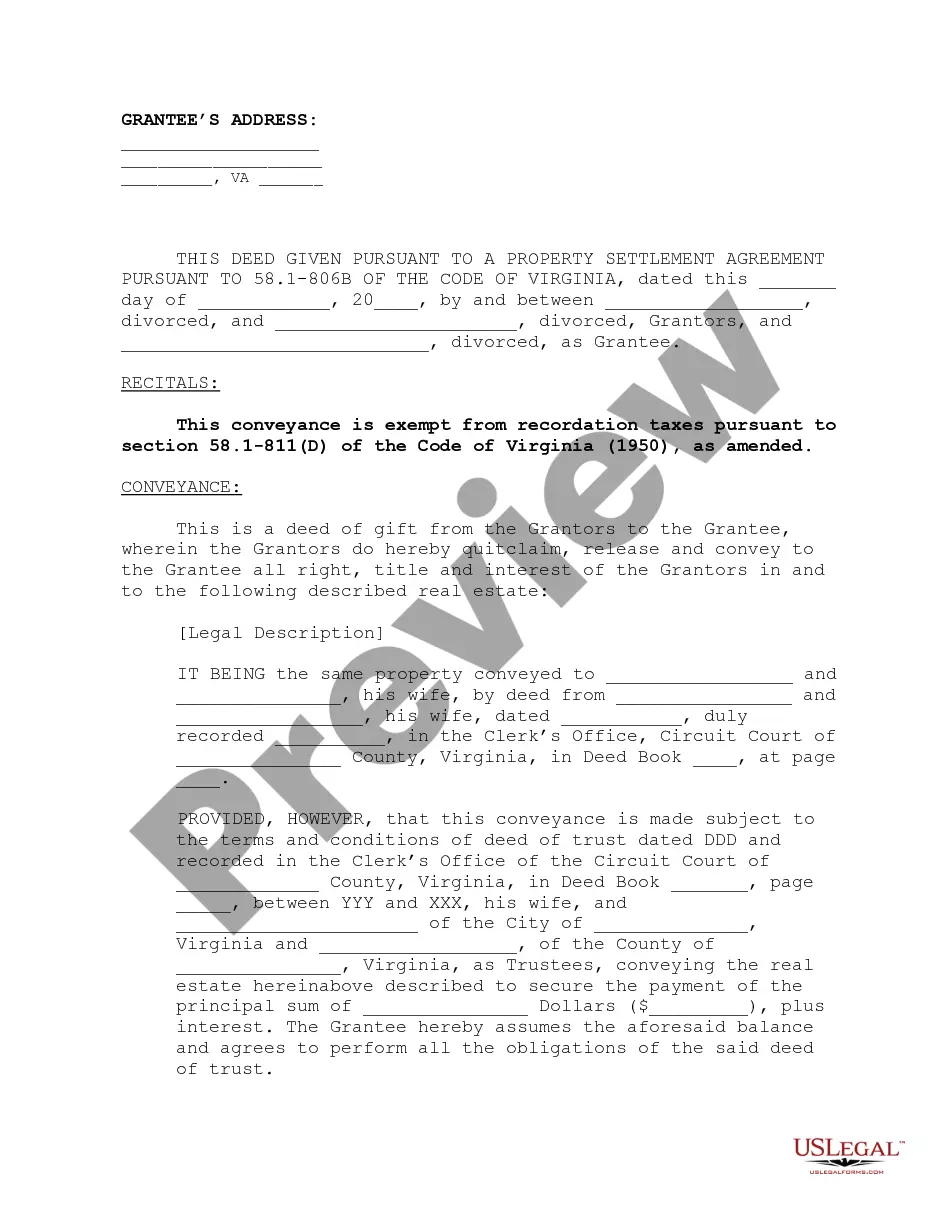

- Utilize the Preview option to review the form.

- Check the description to confirm that you have chosen the correct form.

- If the form does not meet your expectations, use the Search field to locate the form that fits your needs and requirements.

Form popularity

FAQ

Your employer (or other payer) will ask you to complete a direct deposit form that will ask for several personal details, including your name, address, Social Security number and signature for authorization of the direct deposit. Include your account information.

Verify account information When an employee's direct deposit doesn't hit their bank account, employers should verify the employee's bank account and routing number. If the account and routing numbers are correct, have the employee reach out to their bank to see if the transaction is pending.

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. Commonly, an employer requesting authorization will require a voided check to ensure that the account is valid.

Your account type (checking or savings) and number. Name and address of your bank. Your 9-digit routing number. The percentage to be deposited into the account.

How to Set Up Direct DepositGet a direct deposit form from your employer.Fill in account information.Confirm the deposit amount.Attach a voided check or deposit slip, if required.Submit the form.

Your employer (or other payer) will ask you to complete a direct deposit form that will ask for several personal details, including your name, address, Social Security number and signature for authorization of the direct deposit.

How to set up direct deposit for employees: A step-by-step guideStep 1: Decide on a direct deposit provider.Step 2: Initiate the direct deposit setup process.Step 3: Collect information from your employees.Step 4: Enter the employee information into your system.Step 5: Create a direct deposit and payroll schedule.More items...

How to set up direct deposit for employees: A step-by-step guideStep 1: Decide on a direct deposit provider.Step 2: Initiate the direct deposit setup process.Step 3: Collect information from your employees.Step 4: Enter the employee information into your system.Step 5: Create a direct deposit and payroll schedule.More items...

How to set up direct deposit for employees: A step-by-step guideStep 1: Decide on a direct deposit provider.Step 2: Initiate the direct deposit setup process.Step 3: Collect information from your employees.Step 4: Enter the employee information into your system.Step 5: Create a direct deposit and payroll schedule.More items...

Table of ContentsCompany Information.Employee Information.Bank Account Information.I hereby authorize2026 Statement.Employee Signature and Date.Space for Attached Physical Check (Optional)