Rhode Island Lease Form for Car

Description

How to fill out Lease Form For Car?

If you intend to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the website's easy and user-friendly search to find the documents you need.

Many templates for business and personal applications are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan that suits you and enter your details to register for an account.

Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Rhode Island Lease Document for Vehicle in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Acquire button to access the Rhode Island Lease Document for Vehicle.

- You can also retrieve documents you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct state/territory.

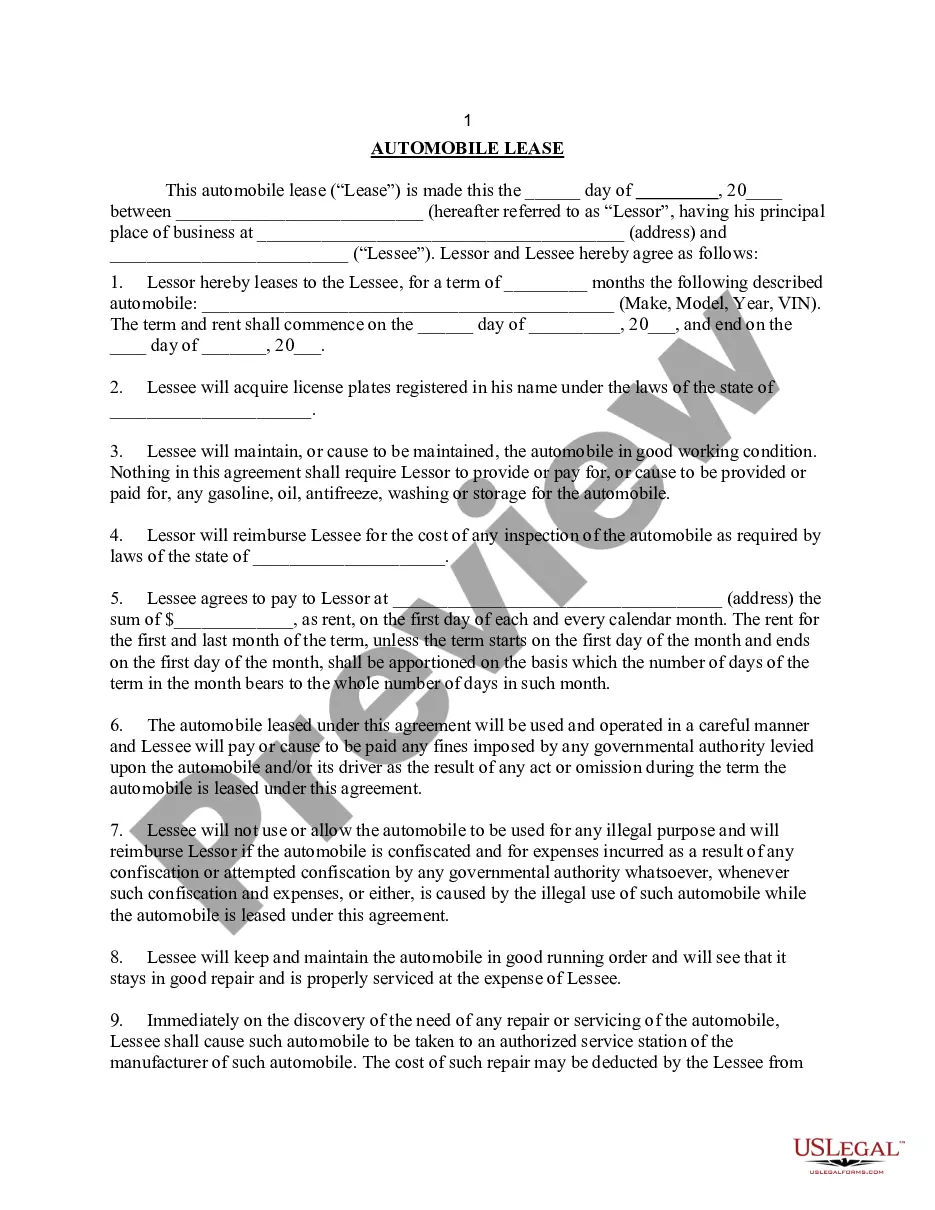

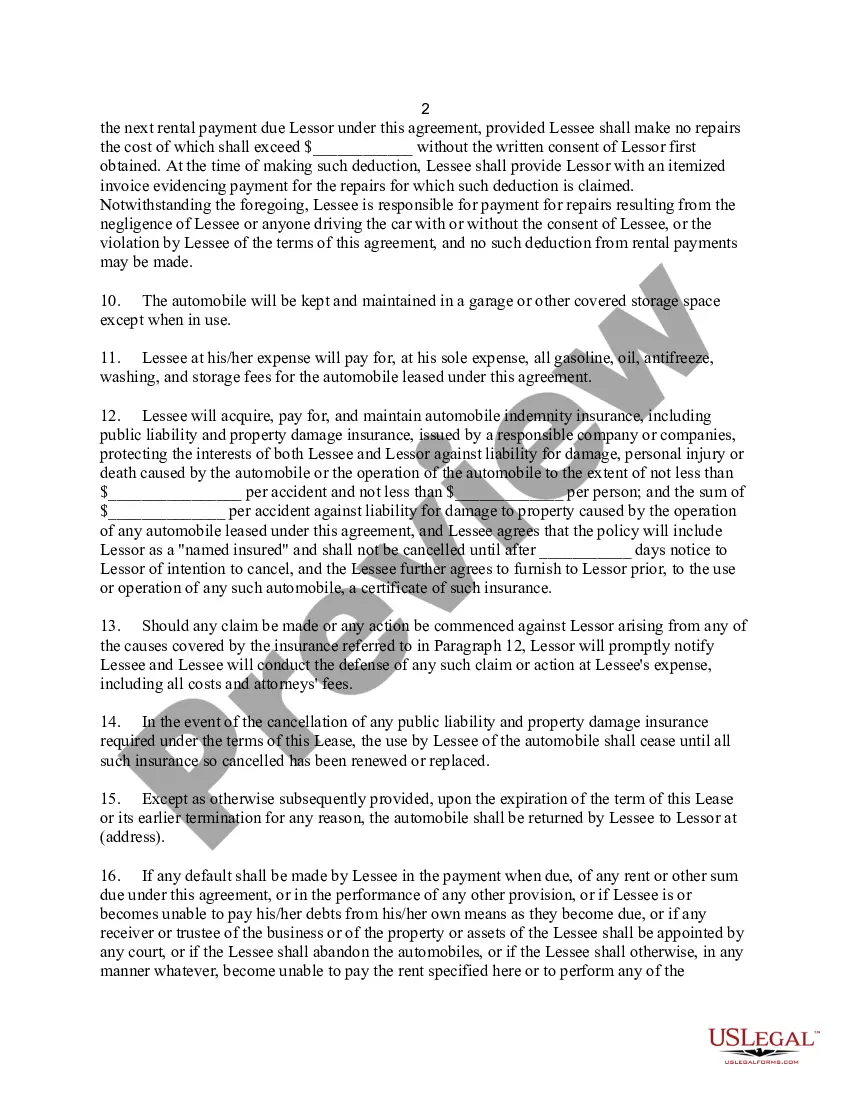

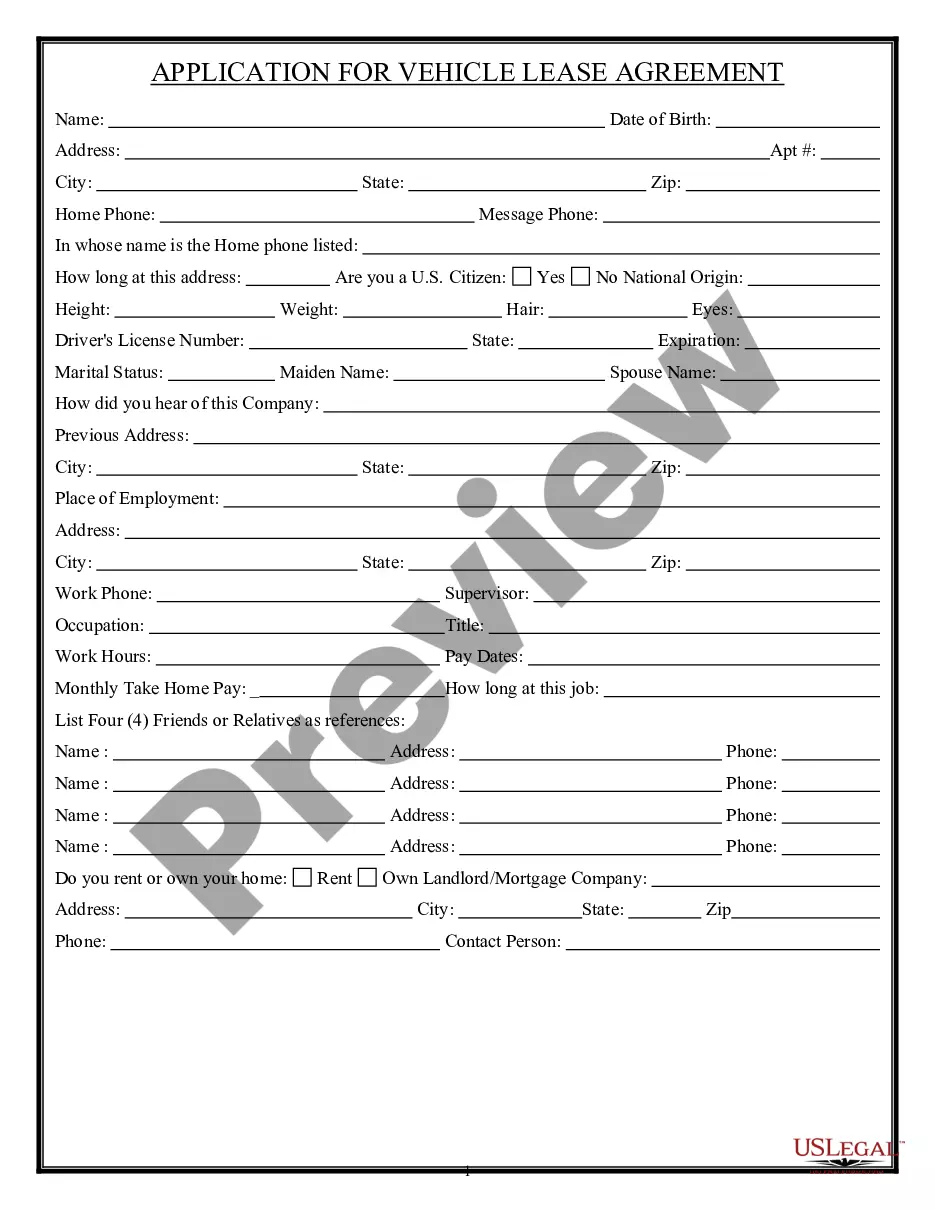

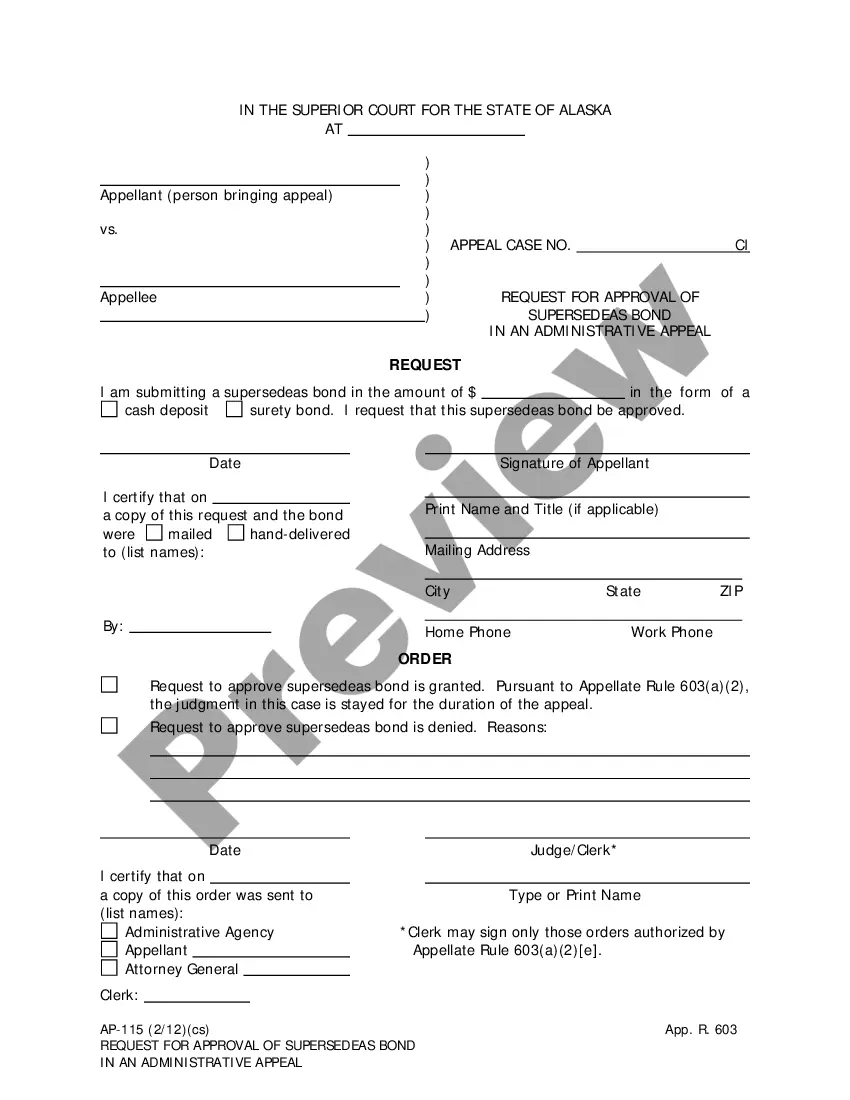

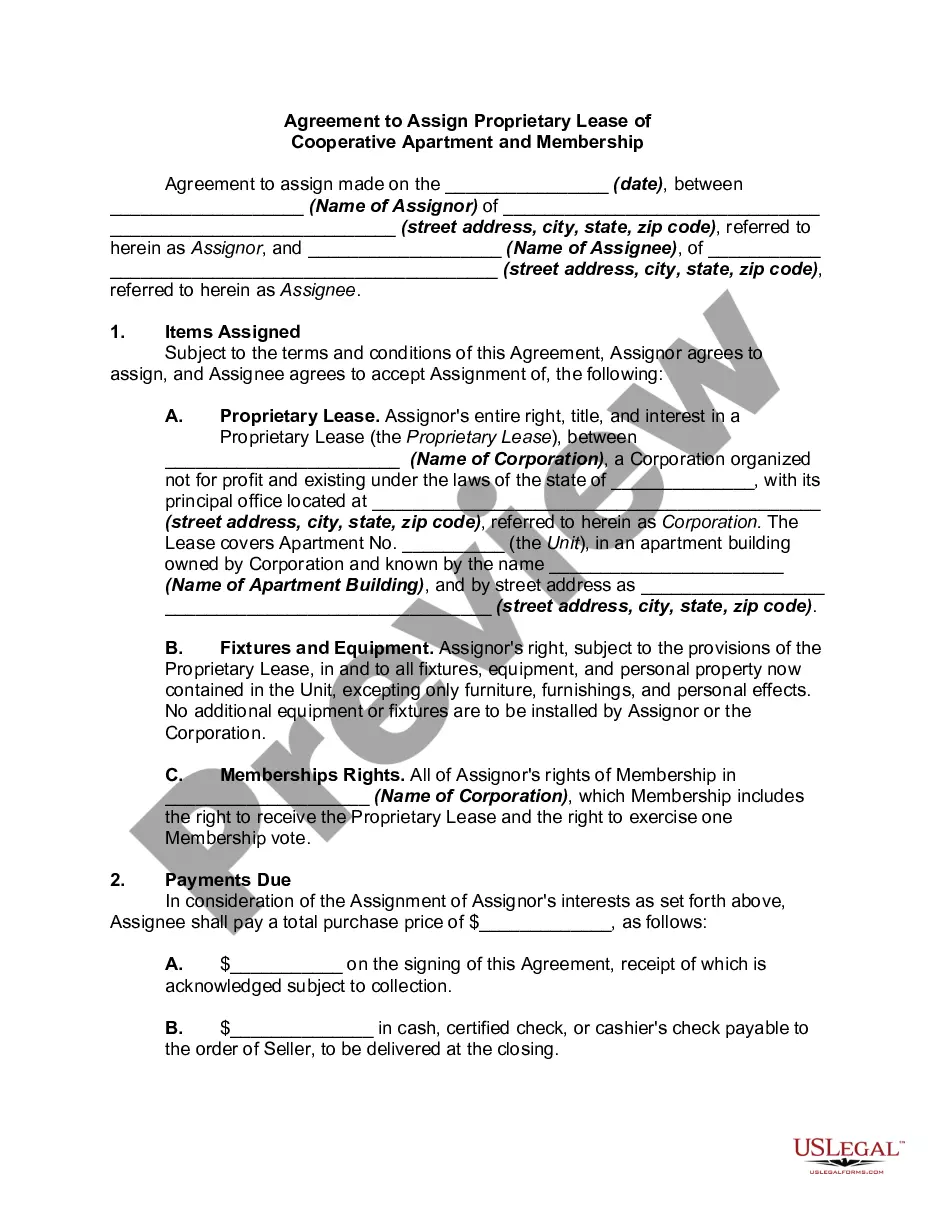

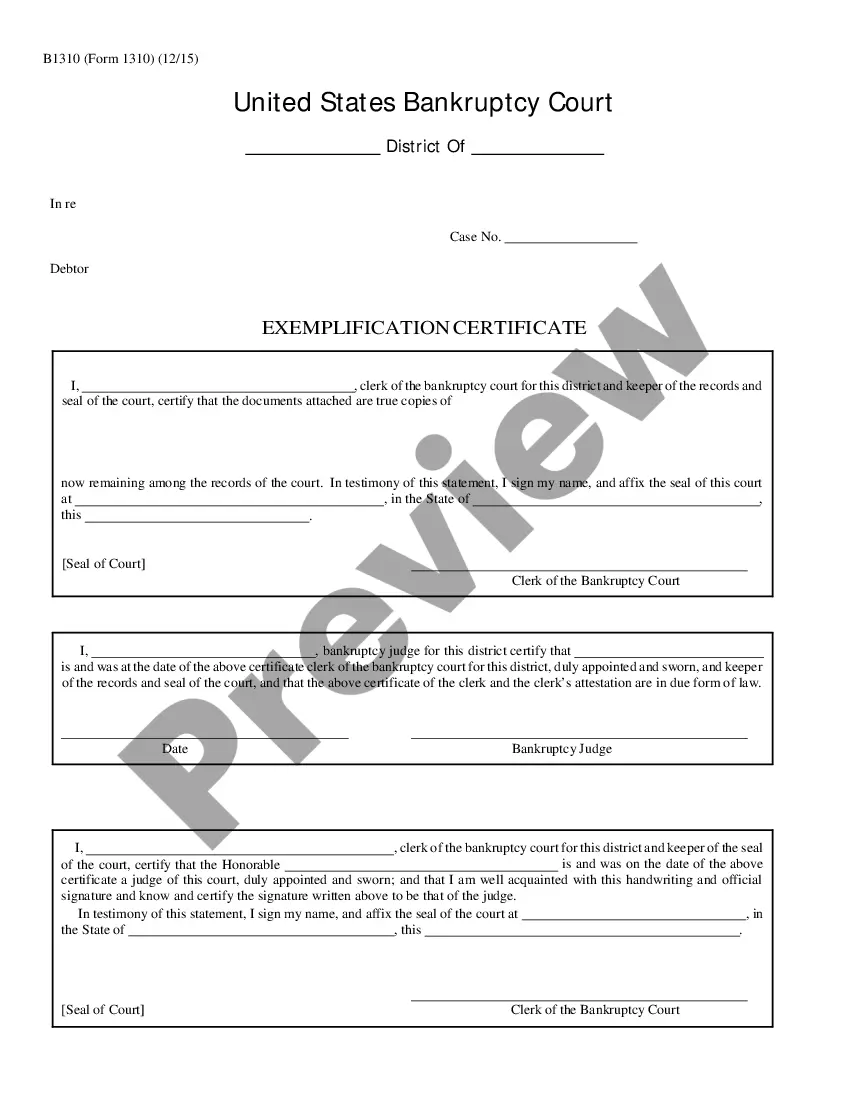

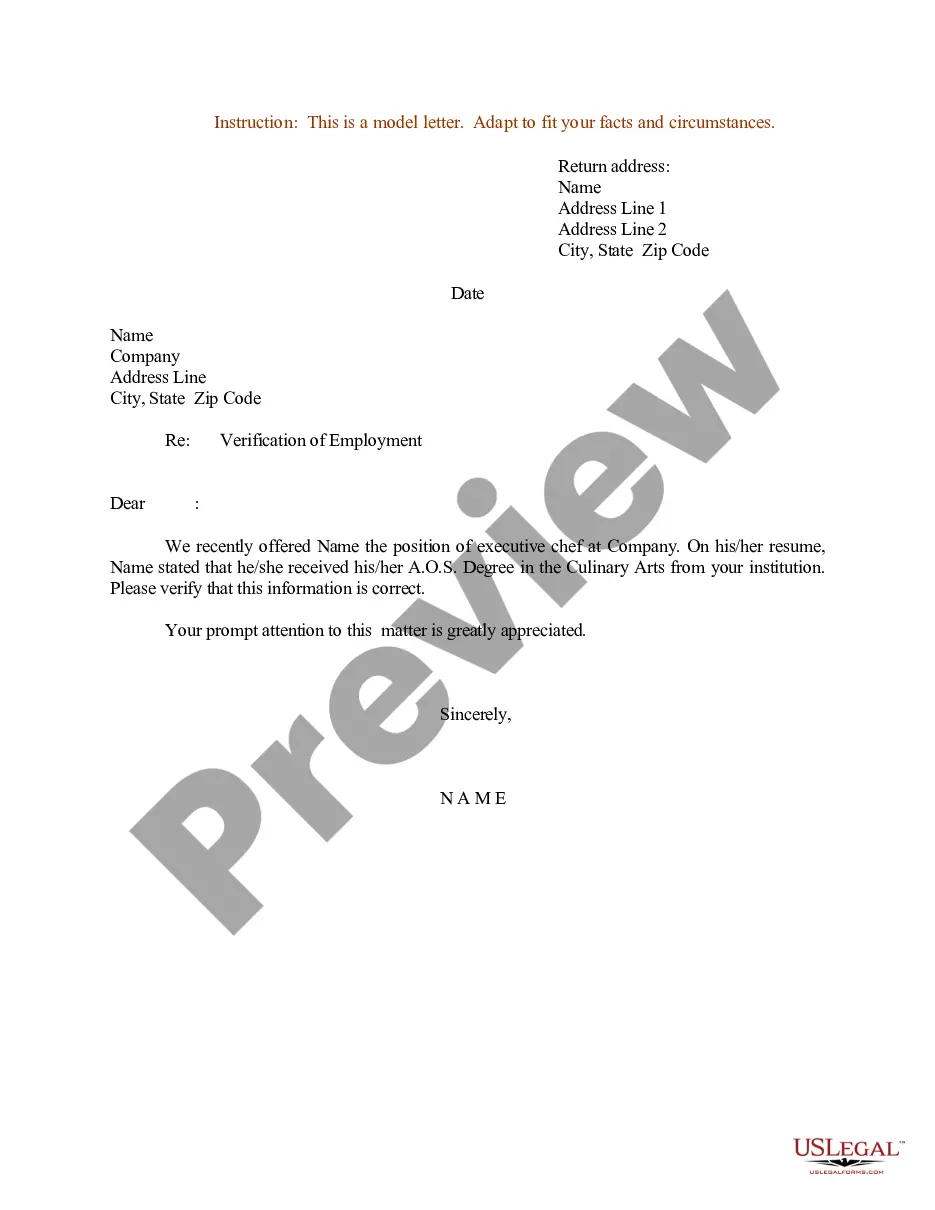

- Step 2. Use the Review option to examine the form's content. Make sure to read the details carefully.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form category.

Form popularity

FAQ

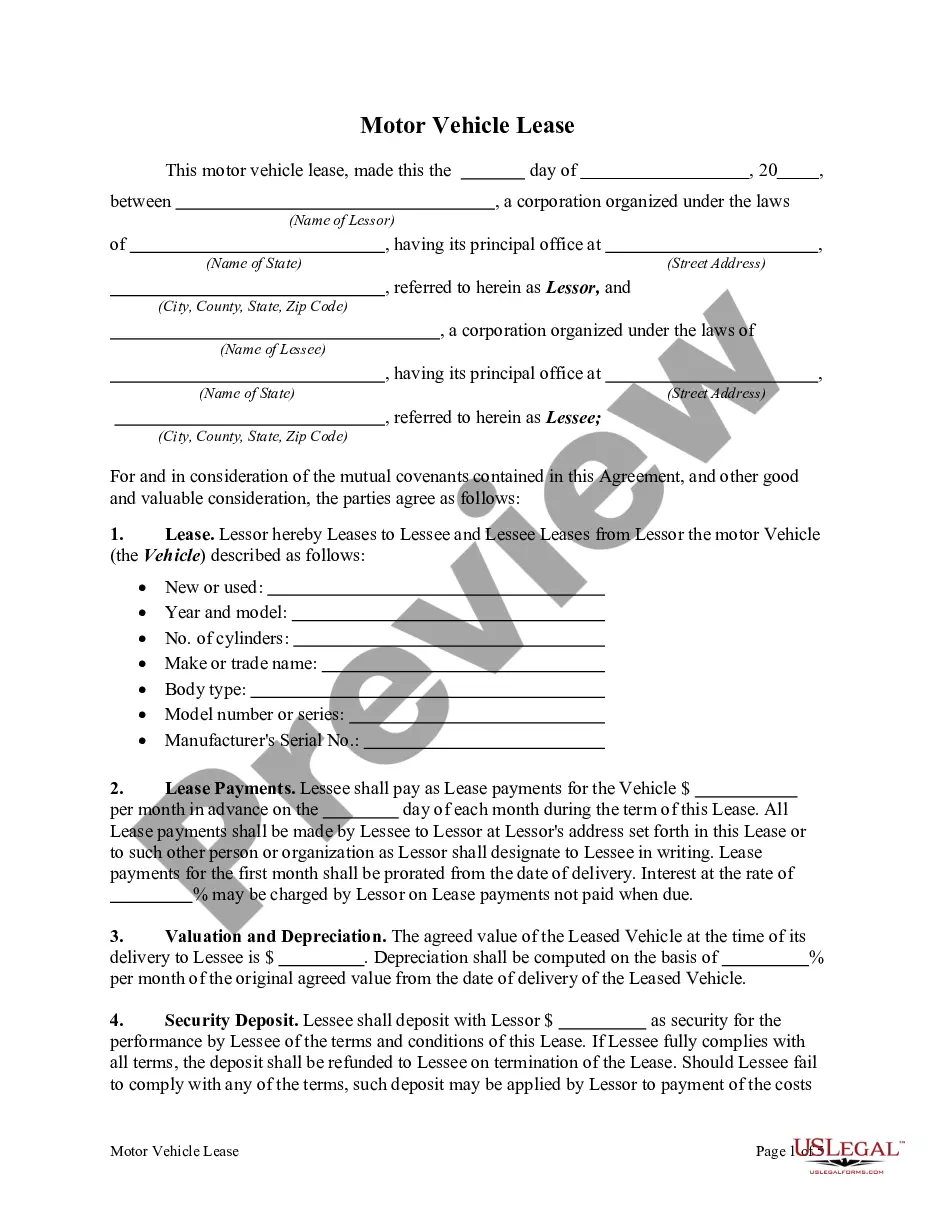

Leased vehicles must be registered in the names of both the lessor and the lessee. The lessor is designated as LSR; the lessee is designated as LSE.

The Motor Vehicle Tax (commonly known as the Car Tax) is a property tax collected by each Rhode Island municipality based on the value of each motor vehicle owned. There are three components that determine how much each individual car is taxed: valuation, tax rate and exemption.

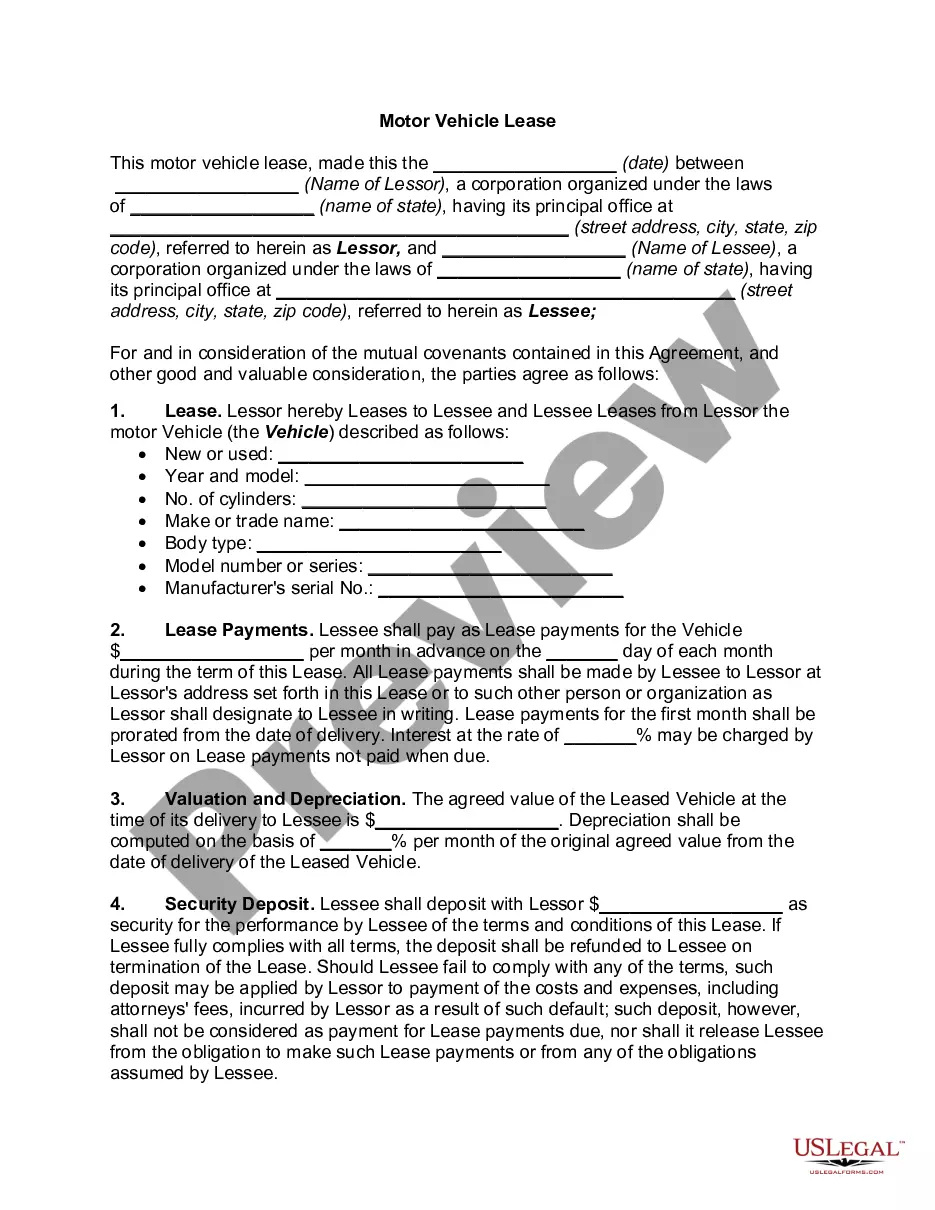

Who taxes a leased car? People often get confused about who pays for the tax on a leased car technically these vehicles don't belong to the person leasing but to the finance company. This is why for most leases, the tax will be covered within your monthly rental so you don't need to worry about it.

When you purchase a vehicle in Rhode Island, you are required to pay sales tax on the vehicle and obtain a title in your own name, even if you do not register the vehicle. You will need to complete both a Sales Tax form and a Application for Title (TR-2/TR-9) form.

The Division of Motor Vehicles (DMV) allows you to complete a number of transactions online from the comfort of your home. Find out how to reserve a vanity plate, renew your vehicle registration, or obtain your certified driver record online.

Rhode Island vehicle registration requires a trip to the local Rhode Island DMV with the vehicle's title, valid driver's license, proof of emissions inspection (if applicable), proof of insurance, and payment for the registration fee, plus any bills of sale and sales tax documents if the vehicle was purchased from a

The GU1338 is a special form of proof of auto insurance required by Rhode Island Department of Motor Vehicles for specific classes of risks. This form must be on file with the DMV before they will register the following types of vehicles: Minor DOB (under the age of 18)

New Registration of a Leased Vehicle:A certificate of origin or original title assigned to the leasing company.A TR-5 form (VIN verification) from a local police department if the title is from another state.A Power of Attorney from the leasing company for the person signing the Application for Registration.More items...?

Leased vehicles are subject to Rhode Island's annual motor vehicle excise tax, which is based on motor vehicle values and locally set rates (R.I. General Laws § 44-34-1). Tax bills are usually billed to the leasing company, according to Providence's tax collector.