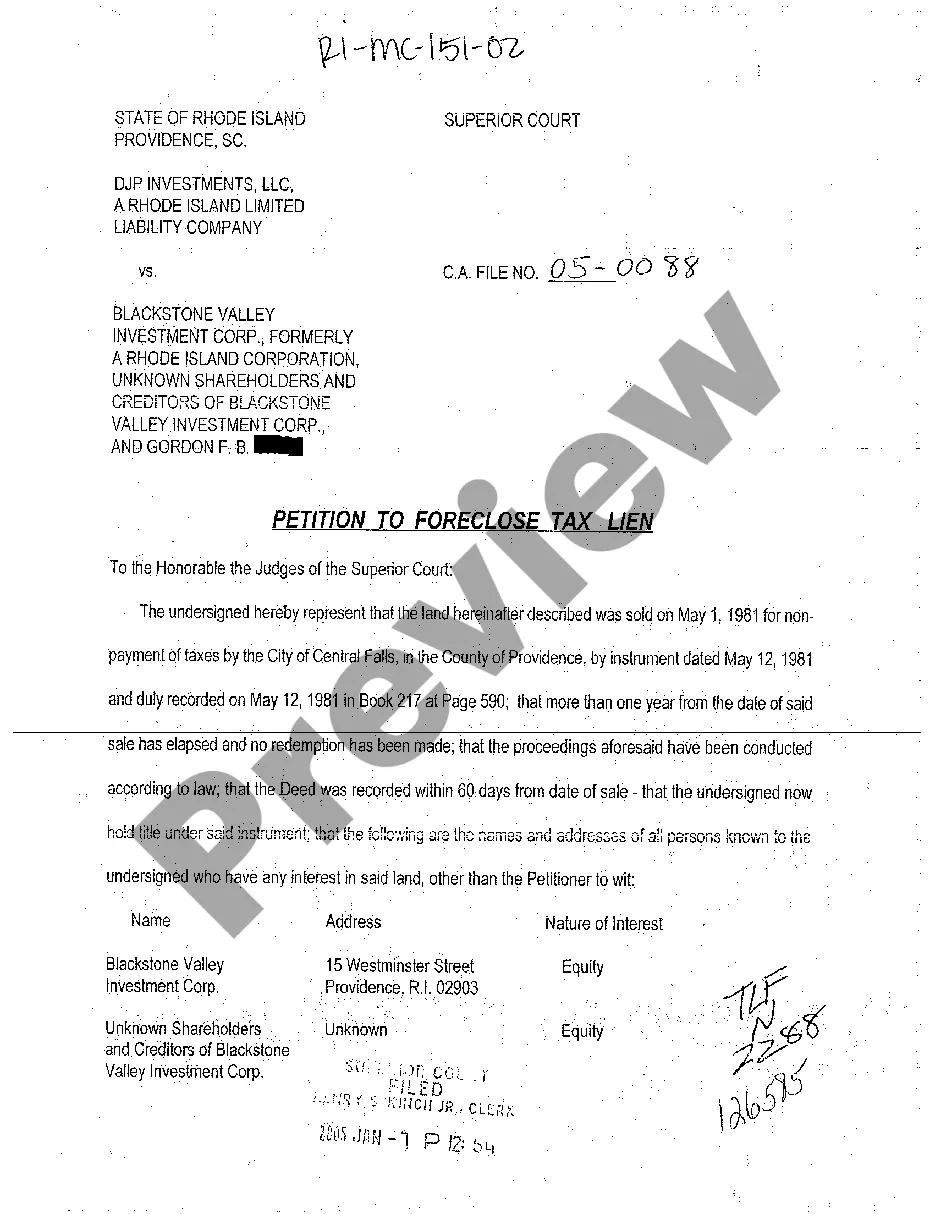

Rhode Island Petition to Foreclose Tax Lien

Description

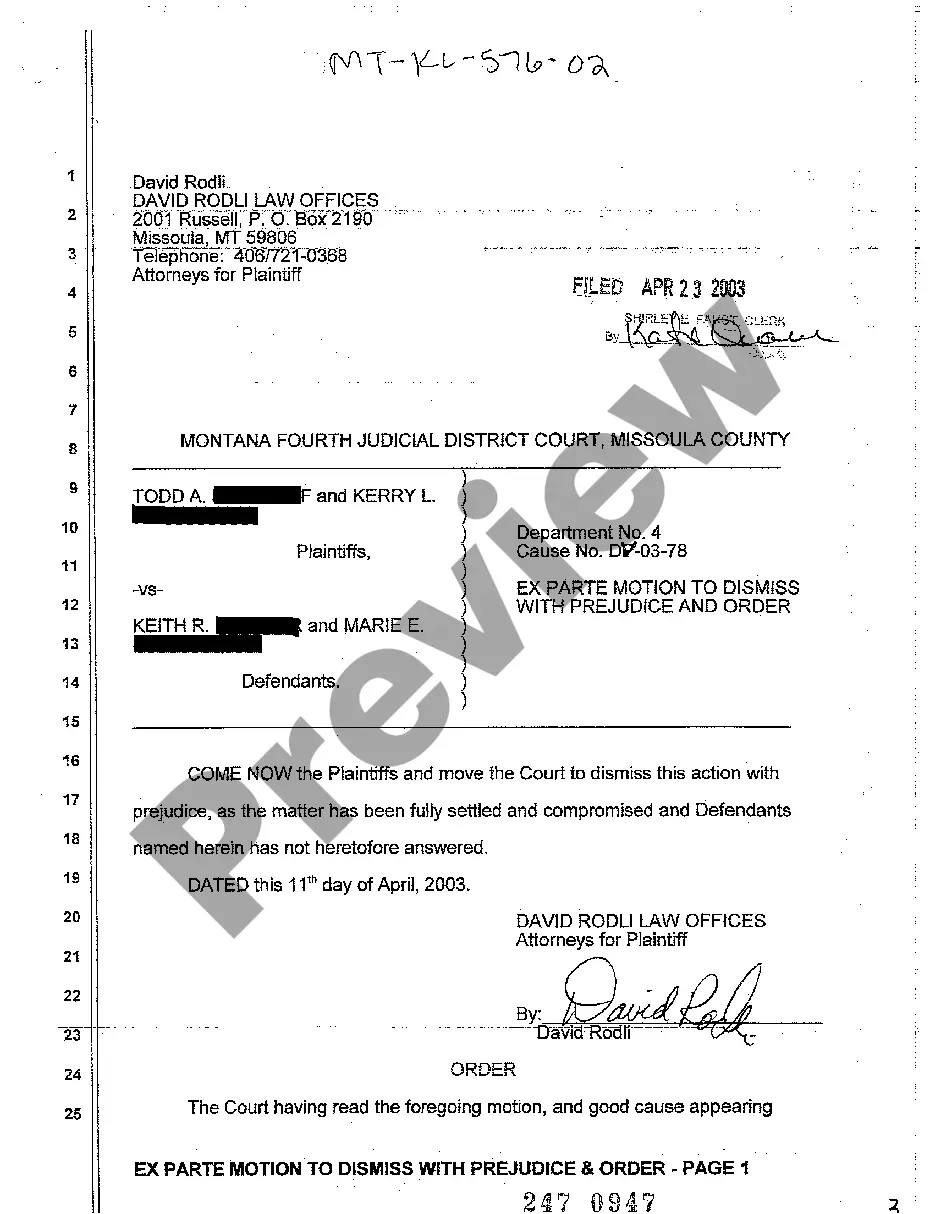

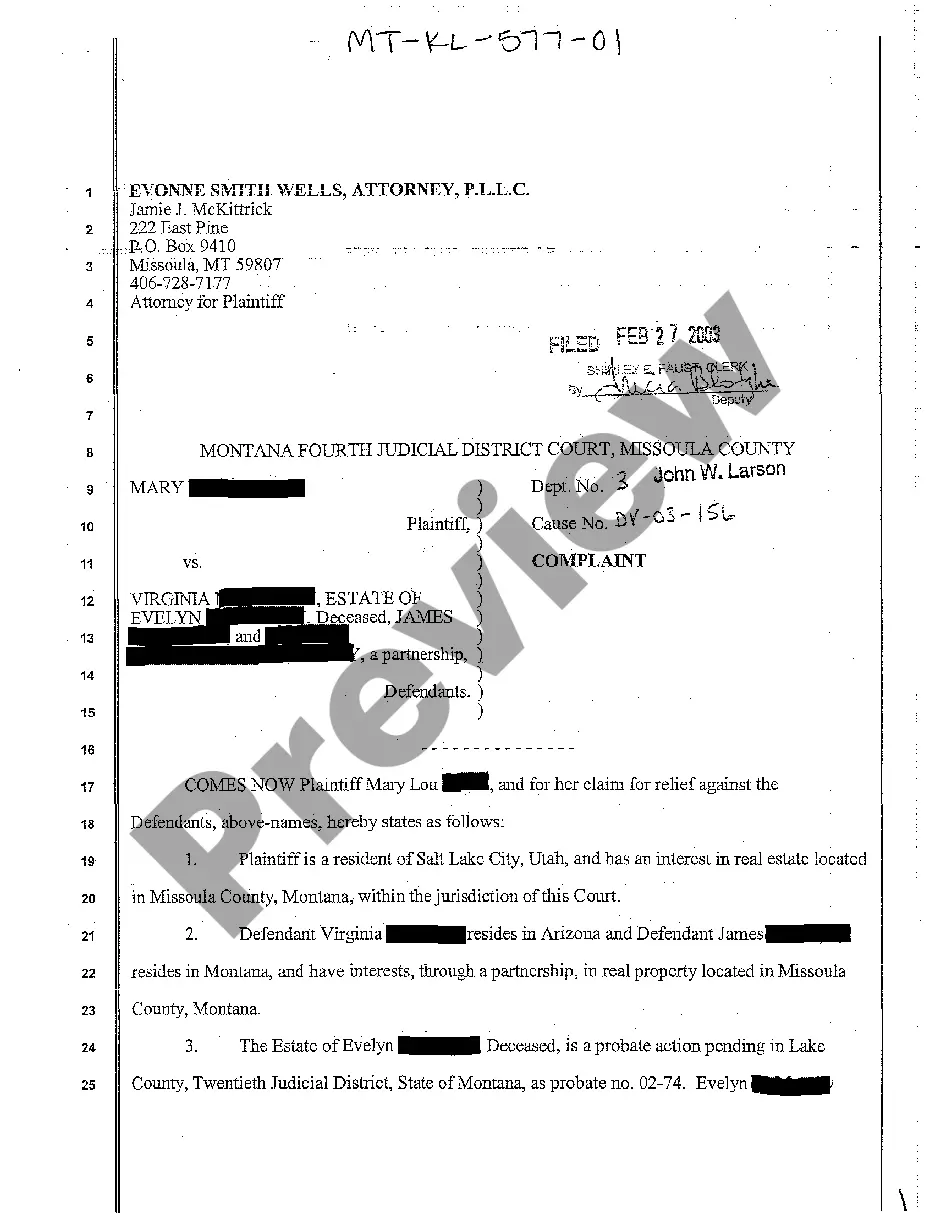

How to fill out Rhode Island Petition To Foreclose Tax Lien?

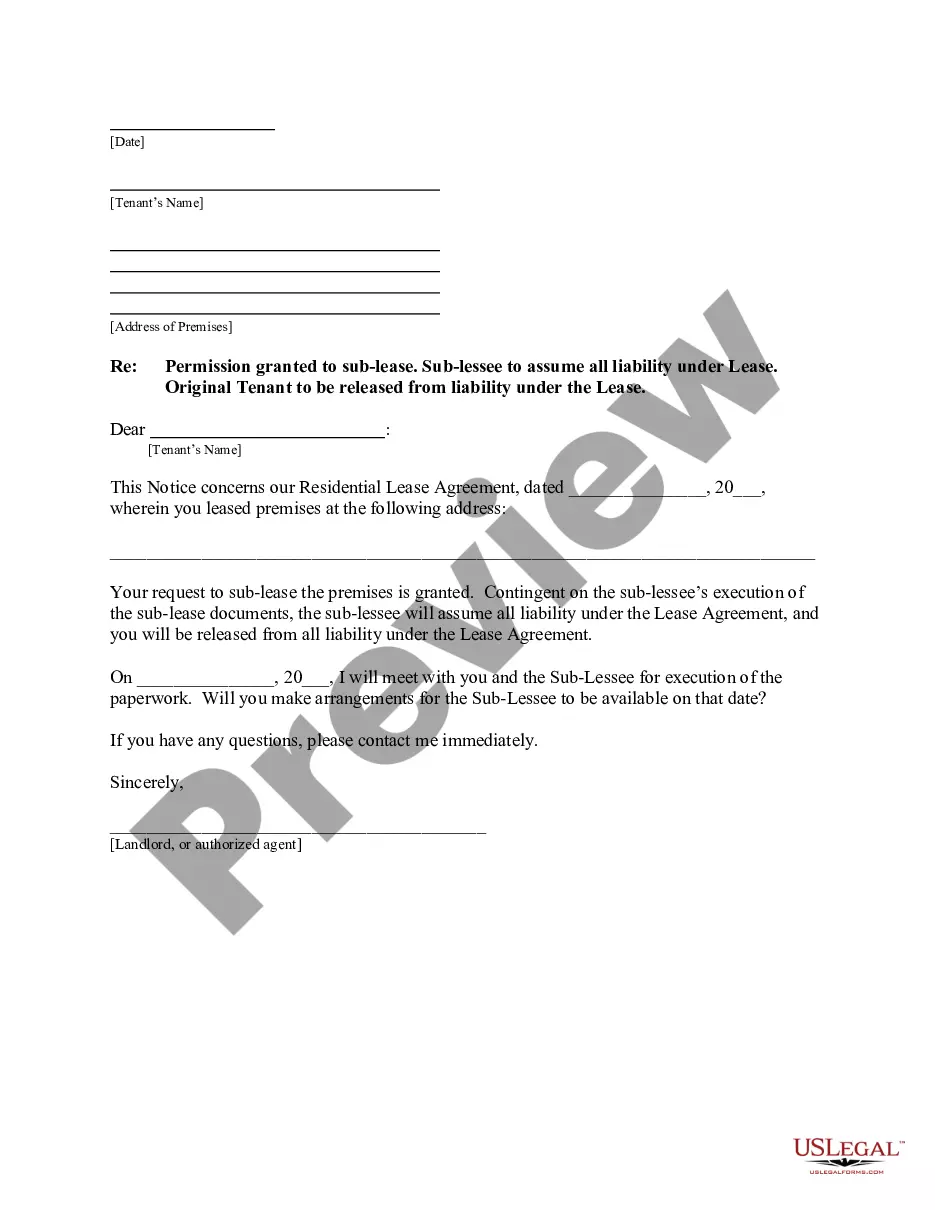

Among numerous free and paid examples which you find on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they’re qualified enough to deal with what you require them to. Always keep calm and use US Legal Forms! Discover Rhode Island Petition to Foreclose Tax Lien templates developed by skilled attorneys and avoid the high-priced and time-consuming process of looking for an lawyer and then having to pay them to write a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you’re looking for. You'll also be able to access all of your earlier saved files in the My Forms menu.

If you are making use of our website for the first time, follow the guidelines below to get your Rhode Island Petition to Foreclose Tax Lien quickly:

- Make certain that the document you find is valid in the state where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another sample using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you’ve signed up and bought your subscription, you can use your Rhode Island Petition to Foreclose Tax Lien as many times as you need or for as long as it remains valid in your state. Change it with your favored editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

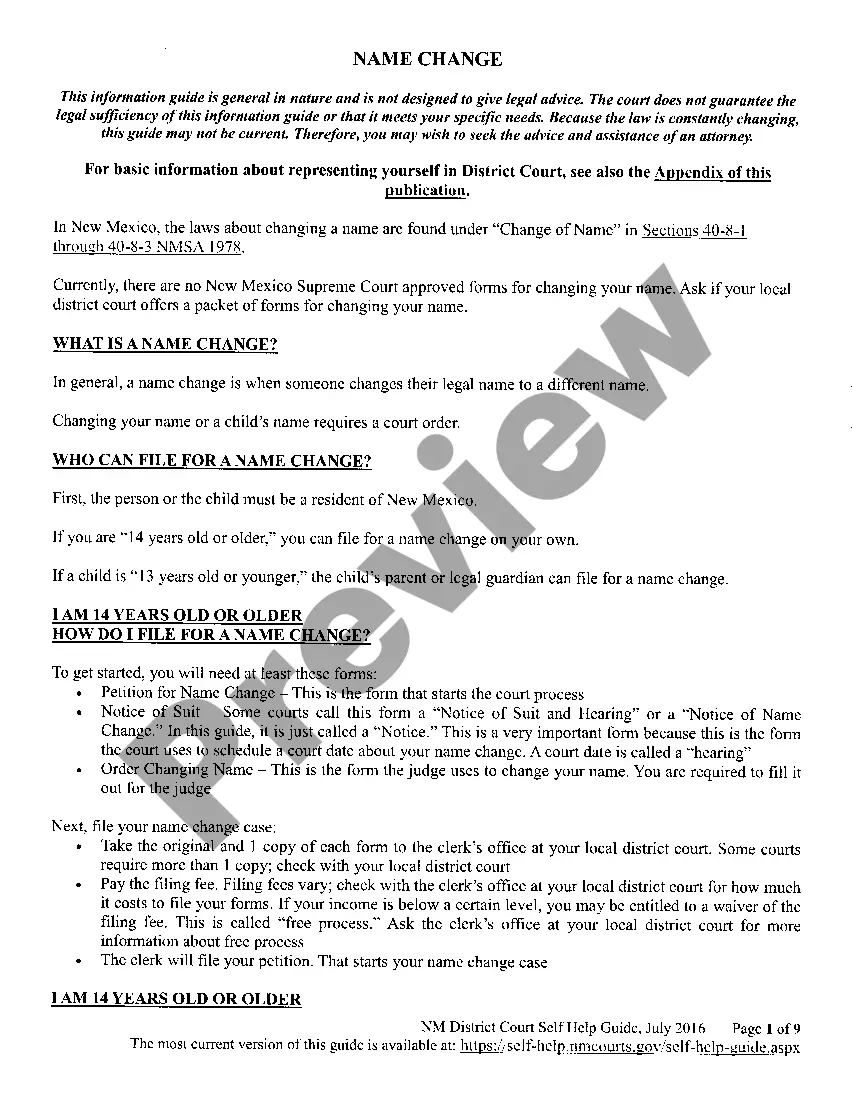

The taxes will be paid by your lender. After your lender forecloses, all sums that you owed, including the taxes, are satisfied by the transfer of the property to the lender under a foreclosure deed. The property taxes are actually a debt against the property, not against you personally.

If all attempts to collect on the delinquent taxes have been exhausted and the redemption period expires, the lien holder can initiate a judicial foreclosure proceeding against the property itself. The court then orders a foreclosure auction be held to collect the money to satisfy the unpaid tax lien.

Pay Back Taxes in Year 1. If you're able, it's best to pay back any missed taxes in the first year of tax delinquency. Pay Back Taxes in Year 2. If you were unable to pay back the property taxes you owe in the first year, you still have a chance to avoid tax foreclosure. Sell Your Home.

Normally, because property tax liens are superior to all other liens, their foreclosure eliminates all junior liens, including those for mortgages. Occasionally, buyers of tax-foreclosed properties have discovered that the property actually carries a surviving mortgage lien.

Foreclosure Eliminates Liens, Not Debt Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title.

This means that if the lender forecloses, the federal tax lien on the homebut not the debt itselfwill be wiped out in the foreclosure. If there are any excess proceeds after the foreclosure sale, the IRS may seek to recover that money and apply it to the outstanding debt.

In California, you generally have five years to get current on delinquent property taxes. Otherwise, you could lose your home in a tax sale.

A tax lien sale is a method many states use to force an owner to pay unpaid taxes.The highest bidder gets the lien against the property. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. The homeowner has to pay back the lien holder, plus interest, or face foreclosure.