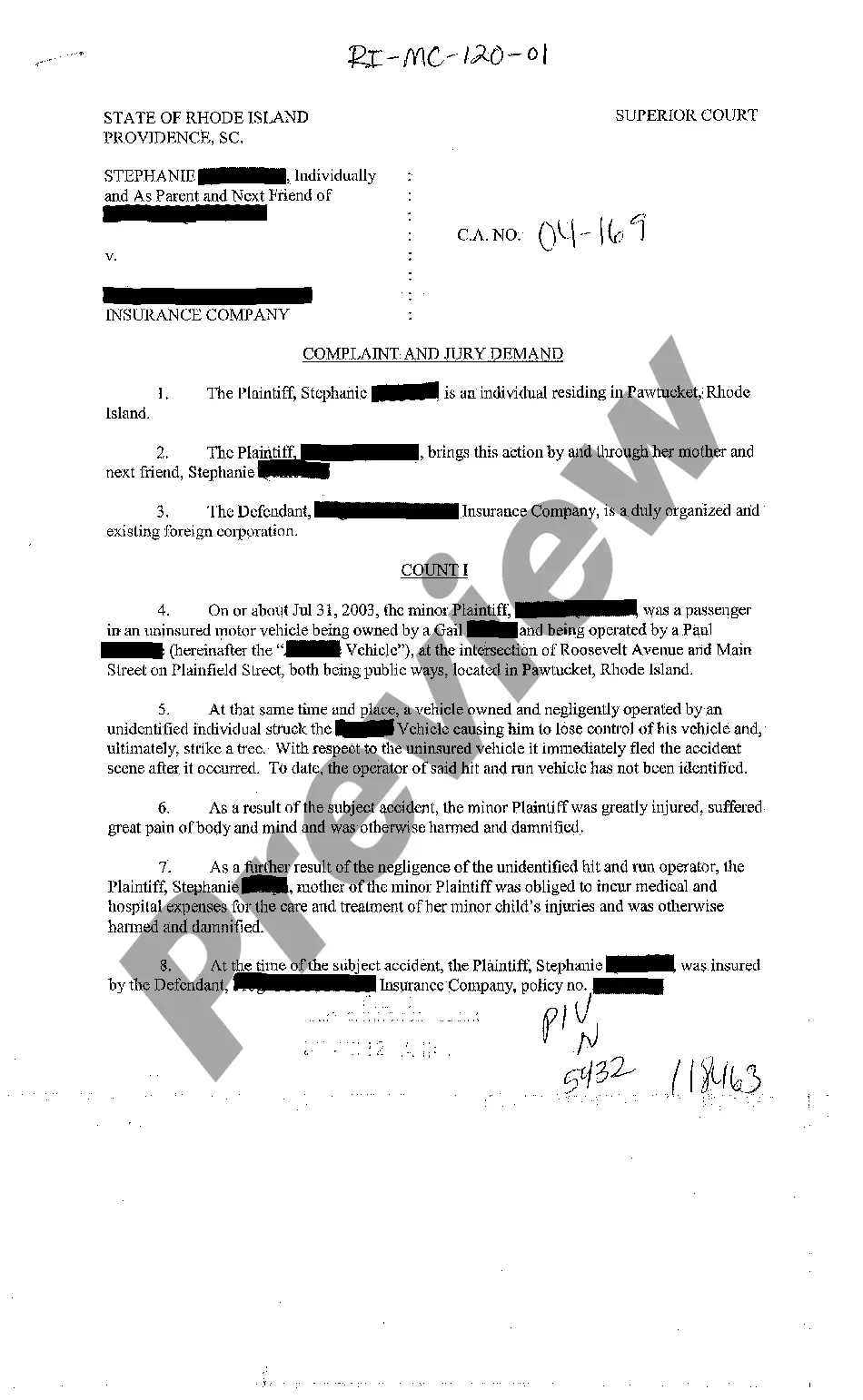

Rhode Island Complaint Against Insurance Company for Personal Injury to Minor Passenger Involved in Motor Vehicle Accident

Description

Form popularity

FAQ

Always notify your insurers if you are involved in an accident, however minor it may be and regardless of whether there is any damage. If you are involved in an accident and do not wish to make a claim on your policy you can simply advise your insurers about the accident 'For notification purposes only'.

Stay Calm. It's easy to fly off the handle and get angry at the other driver, but this will only escalate the situation. Document the Scene. Alert the Police. Exchange Information. Move Your Vehicle. Turn on Your Hazard Lights. Locate Witnesses. Contact Your Insurer.

A passenger in a car accident is usually covered by the at-fault driver's bodily injury liability insurance and PIP. Depending on the circumstances, passengers in a car accident can file a claim with their driver's insurance company, the other driver's insurance provider, or their own personal insurer.

You should file an insurance claim when you can't afford to pay cash for damages or medical bills that your insurance policy will cover. You should pay out of pocket instead of filing an insurance claim if the repairs or medical bills incurred in an accident that you cause will cost less than your deductible.

Yes. Regardless of fault, it is important to call your insurance company and report any accident that involved injuries or property damage. A common myth is that you do not need to contact your insurance company if you were not at fault.

Should I call my insurance company after a minor accident? Yes, you should call your insurance company after a minor accident. You should contact your insurer anytime you're in an accident involving another driver, but it's even more important to call promptly if the accident resulted in property damage or injuries.

It's usually best to involve the insurance company unless you're positive the damage to your car is minimal or you were the only driver involved. You might also consider covering the repairs yourself if you've filed a lot of claims in the past.

When you've been injured by another person in California, you have a right to file an injury claim against them.If you were a passenger in the at-fault driver's vehicle or a passenger in another vehicle involved in the accident, you can file a claim against the person who was to blame.

Coverage SummaryCalifornia law requires you to have this coverage. See pages 67. Uninsured/Underinsured Motorist Coverage is for accidents when the other driver is at fault and does not have insurance or does not have enough insurance. Bodily injury coverage pays medical expenses for you and passengers.