Rhode Island Assignment to Living Trust

Overview of this form

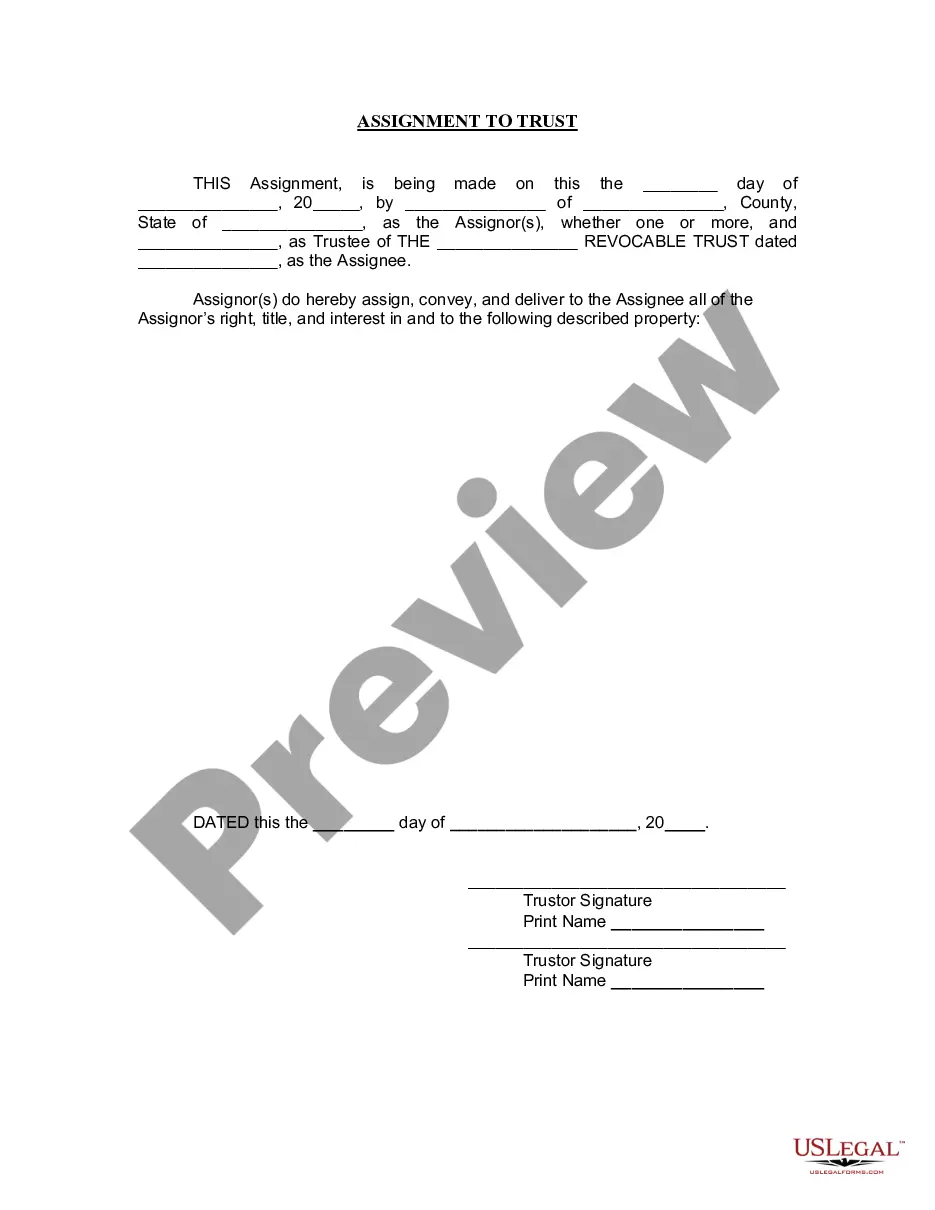

The Assignment to Living Trust form is a legal document used to transfer ownership of specific property into a living trust. A living trust is created during an individual's lifetime to manage their assets and ensure they are distributed according to their wishes after their death. This form is essential for estate planning, as it provides a mechanism for assigning all rights, title, and interest in the property to the designated trustee of the trust.

Key parts of this document

- Date of assignment.

- Name and details of the Assignor(s).

- Identification of the property being assigned.

- Name of the Trustee and the trustâs details.

- Signature of the Assignor(s) in the presence of a notary public.

When this form is needed

This form should be used when you want to transfer assets such as real estate, bank accounts, or other valuable items into a living trust. It is commonly utilized by individuals engaging in estate planning to ensure that their assets are managed according to their preferences and to avoid probate after death.

Who can use this document

- Individuals creating or maintaining a living trust.

- Persons who wish to assign specific property to their trust for estate planning purposes.

- Anyone looking to simplify the transfer of assets to heirs.

Steps to complete this form

- Identify the date of the assignment.

- Fill in the names and details of the Assignor(s) and the Trustee.

- Clearly specify the property being assigned to the trust.

- Have the Assignor(s) sign the document in front of a notary public.

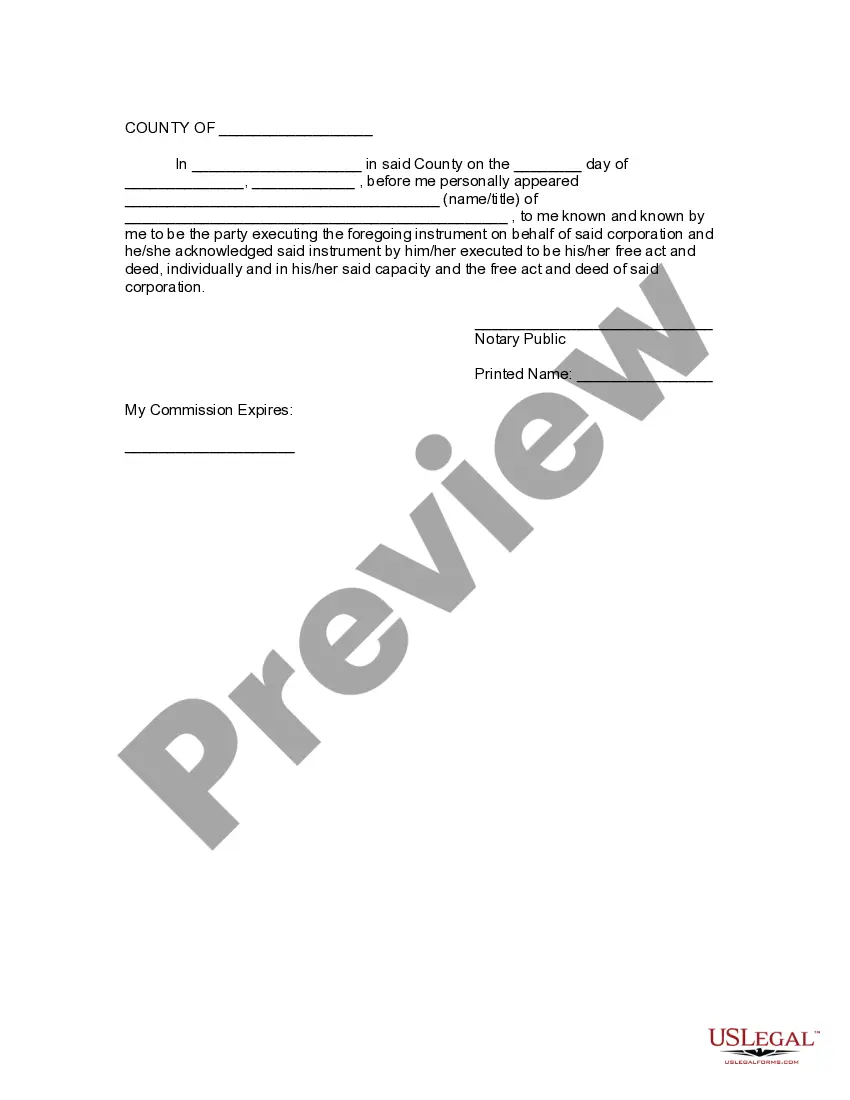

- Ensure the notary public completes their section, confirming the validity of the signatures.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all necessary details about the property.

- Not having the document notarized as required.

- Inaccurate or incomplete information about the Assignor or Trustee.

- Not specifying the date of assignment properly.

Why complete this form online

- Access to professionally drafted legal forms, ensuring accuracy.

- Convenient editing options to personalize the form as needed.

- Instant download for immediate use, saving time.

- Secure and reliable way to manage important estate planning documents.

Looking for another form?

Form popularity

FAQ

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

Ownership in a business can also be transferred through a living trust. To do this, the business owner must first transfer the business to the trust, then name the intended successor as successor trustee to the trust. The business owner, while living, would serve as both trustee and beneficiary of the trust.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

List Your Assets and Decide Which You'll Include in the Trust. Gather the Paperwork. Decide Whether You Will Be the Sole Grantor. Choose Beneficiaries. Choose a Successor Trustee. Choose Someone to Manage Property for Minor Children. Prepare the Trust Document. Sign and Notarize.

Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own. Find the Paperwork for Your Assets. Choose Beneficiaries. Choose a Successor Trustee. Choose a Guardian for Your Minor Children.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.