This office lease form is regarding the renewal or other extension of the lease as it relates to the "Base Year Taxes" and the "Base Year for Operating Expenses".

Puerto Rico Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

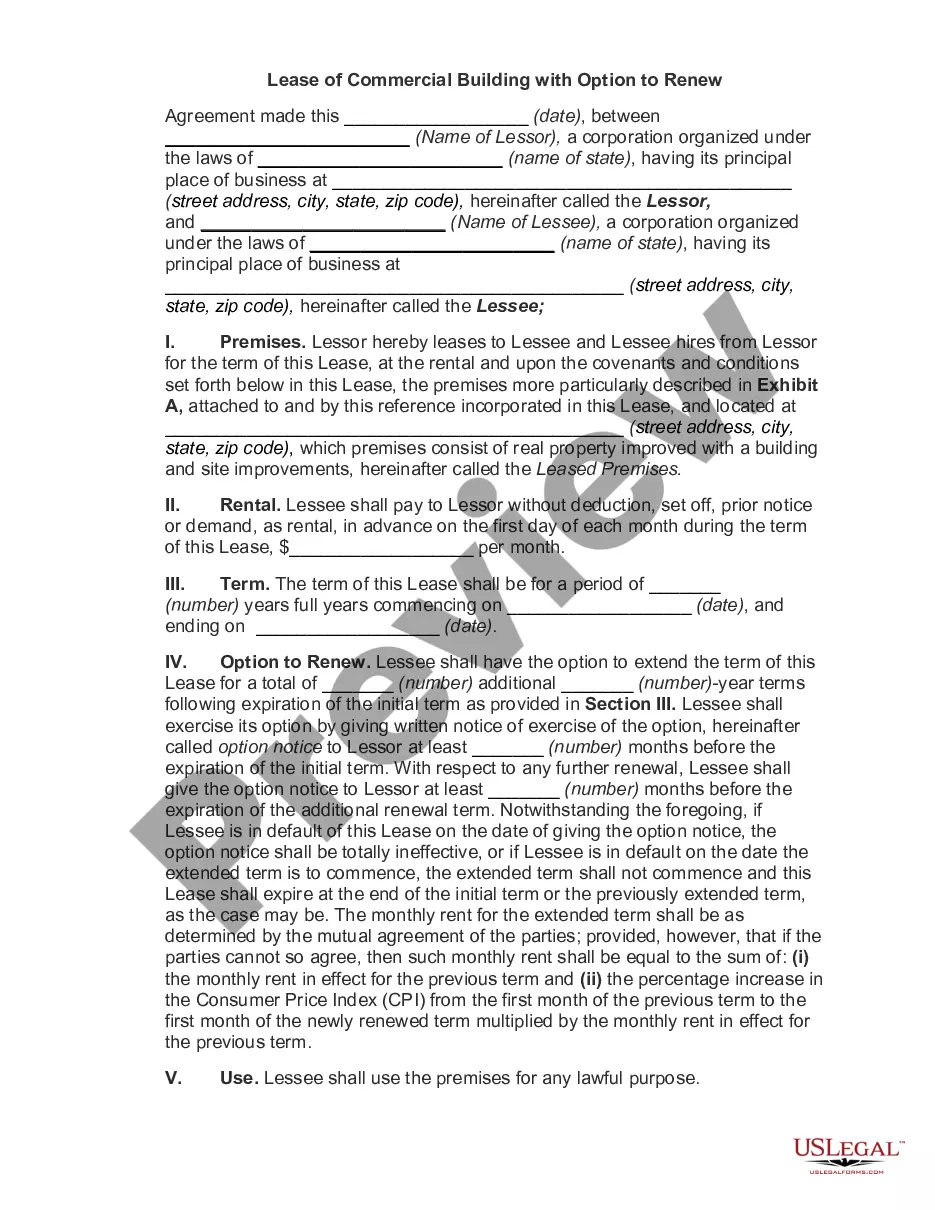

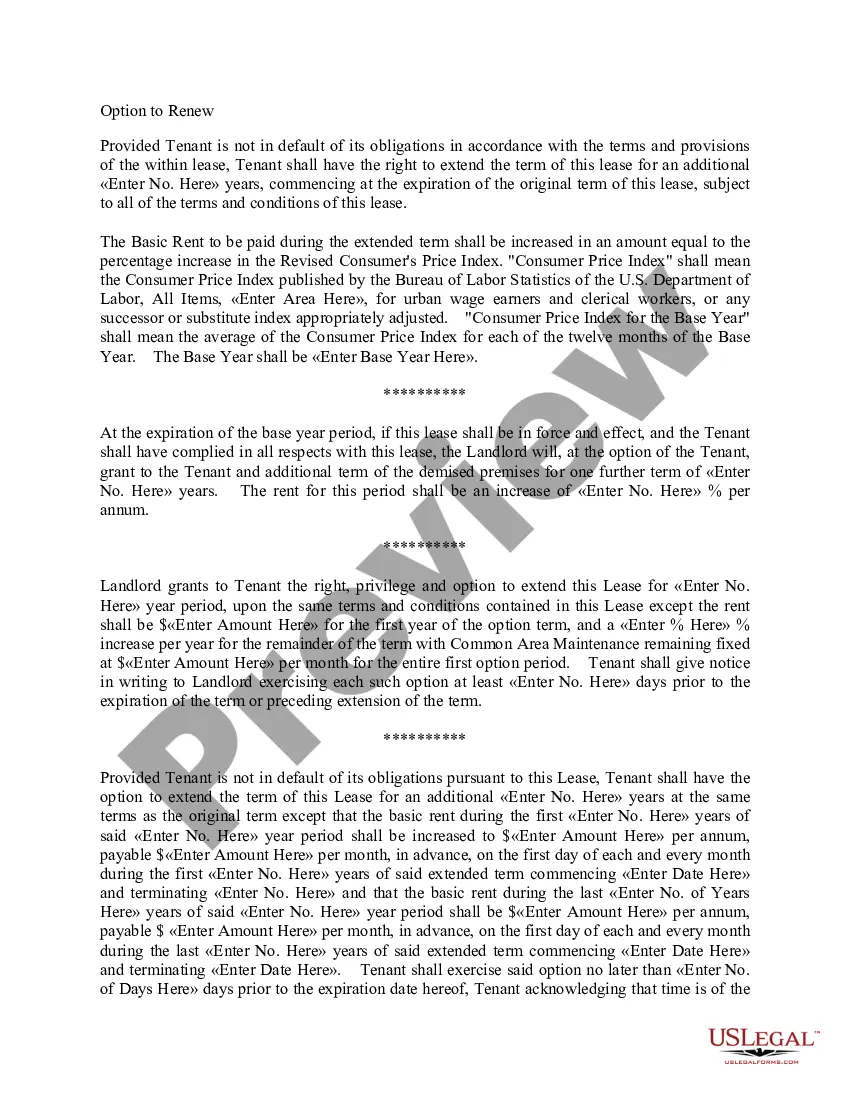

How to fill out Option To Renew That Updates The Tenant Operating Expense And Tax Basis?

US Legal Forms - among the biggest libraries of legitimate forms in America - delivers an array of legitimate papers layouts you can obtain or printing. Utilizing the web site, you can find a huge number of forms for enterprise and individual reasons, sorted by types, suggests, or key phrases.You will discover the most recent types of forms such as the Puerto Rico Option to Renew that Updates the Tenant Operating Expense and Tax Basis within minutes.

If you already possess a monthly subscription, log in and obtain Puerto Rico Option to Renew that Updates the Tenant Operating Expense and Tax Basis from the US Legal Forms local library. The Down load option will show up on each develop you perspective. You get access to all formerly downloaded forms in the My Forms tab of the accounts.

If you wish to use US Legal Forms for the first time, listed here are basic instructions to get you started out:

- Ensure you have selected the proper develop to your city/state. Click on the Preview option to analyze the form`s content. Read the develop explanation to ensure that you have chosen the proper develop.

- In case the develop doesn`t satisfy your specifications, make use of the Search discipline at the top of the screen to get the the one that does.

- In case you are pleased with the shape, confirm your decision by clicking on the Buy now option. Then, choose the rates strategy you favor and give your references to sign up for an accounts.

- Approach the transaction. Use your credit card or PayPal accounts to perform the transaction.

- Choose the file format and obtain the shape on the system.

- Make modifications. Load, change and printing and sign the downloaded Puerto Rico Option to Renew that Updates the Tenant Operating Expense and Tax Basis.

Every single template you put into your bank account lacks an expiry time which is your own property for a long time. So, if you would like obtain or printing yet another version, just go to the My Forms area and click on about the develop you will need.

Get access to the Puerto Rico Option to Renew that Updates the Tenant Operating Expense and Tax Basis with US Legal Forms, the most considerable local library of legitimate papers layouts. Use a huge number of specialist and status-distinct layouts that fulfill your small business or individual demands and specifications.

Form popularity

FAQ

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

Law 68: Promotes acquisition and investment into the housing market on the island LEARN MORE. Law 187: Exempts buyers from paying property taxes for five years as well as certain closing costs for the purchase of the new residence as a primary residence, second home or investment property.

The U.S. tax code (Section 933) allows a bona fide resident of Puerto Rico to exclude Puerto Rico-source income from his or her U.S. gross income for U.S. tax purposes.

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

Attention all property owners in Puerto Rico! Don't forget that your property tax bills are due at the end of this month, January 2023. As a reminder, property taxes in Puerto Rico are paid twice a year, with the first installment due at the end of June and the second at the end of January.

Therefore, in many cases, a U.S. citizen or resident cannot avoid U.S. income taxation on gains associated with appreciation in investment assets by establishing bona fide residence in Puerto Rico unless recognized after 10 years of bona fide residence in Puerto Rico.

No, the IRS does not impose taxes on foreign inheritance or gifts if the recipient is a U.S. citizen or resident alien. However, you may need to pay taxes on your inheritance depending on your state's tax laws.

If your financial statements are issued on a tax or cash basis of accounting, the ASC 842 lease standard does not apply to you.