Puerto Rico Ratification of Memorandum of Operating Agreement and Financing Statement - Form 2

Description

How to fill out Ratification Of Memorandum Of Operating Agreement And Financing Statement - Form 2?

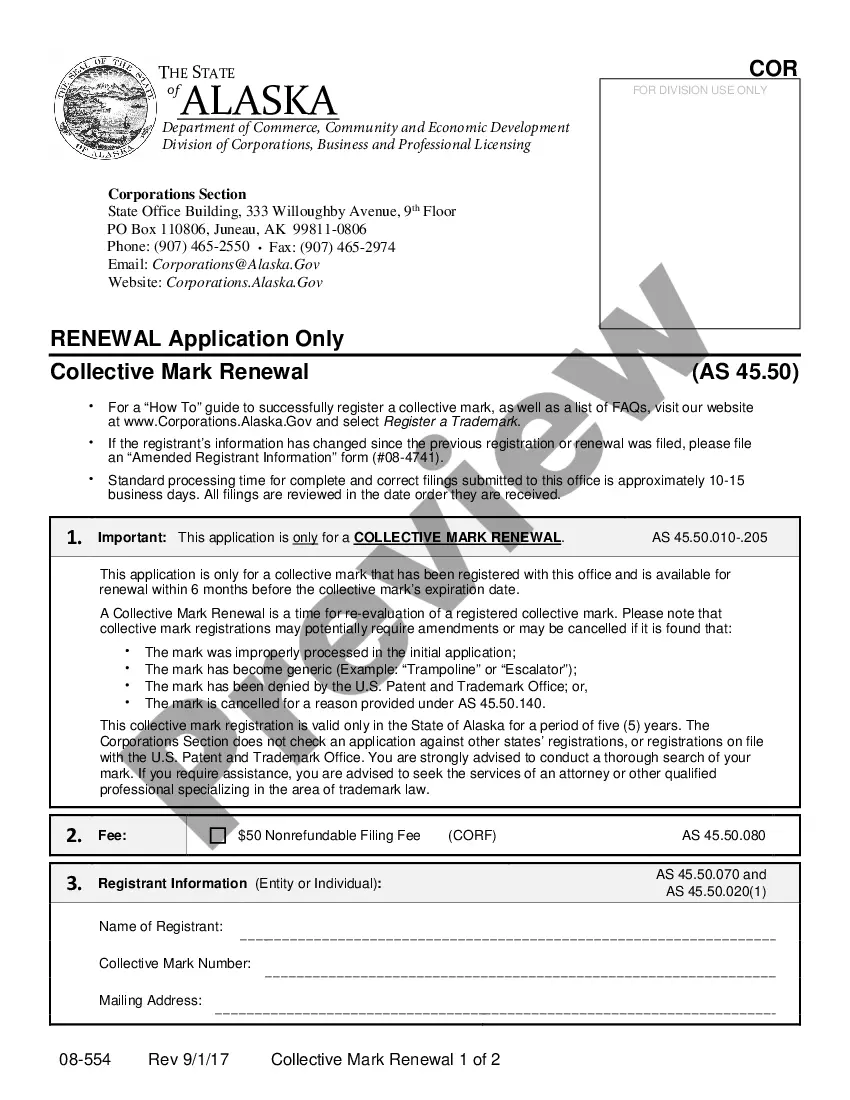

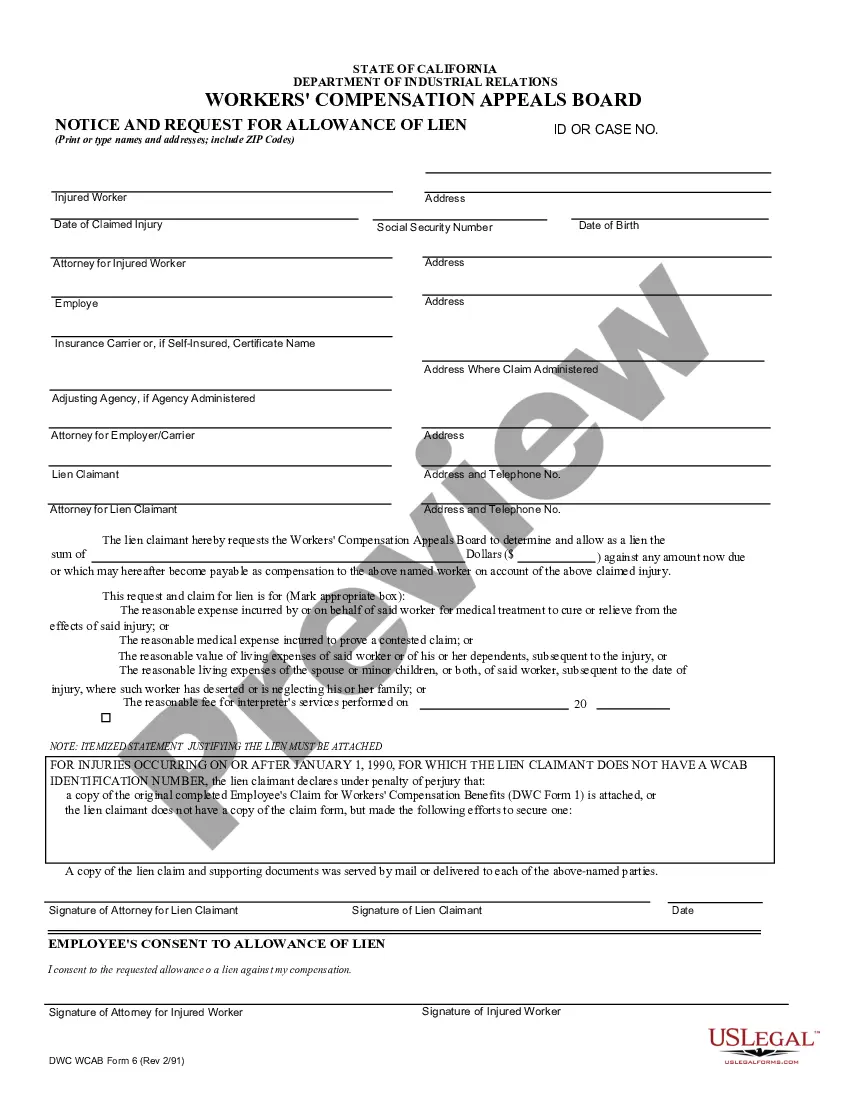

If you wish to total, acquire, or produce legal papers themes, use US Legal Forms, the most important variety of legal forms, that can be found on the web. Take advantage of the site`s easy and practical lookup to obtain the documents you need. Various themes for company and specific functions are sorted by classes and suggests, or key phrases. Use US Legal Forms to obtain the Puerto Rico Ratification of Memorandum of Operating Agreement and Financing Statement - Form 2 with a couple of clicks.

If you are presently a US Legal Forms buyer, log in for your account and click on the Down load button to find the Puerto Rico Ratification of Memorandum of Operating Agreement and Financing Statement - Form 2. You can even accessibility forms you in the past saved in the My Forms tab of your respective account.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your appropriate metropolis/nation.

- Step 2. Use the Review option to look through the form`s articles. Never forget about to read through the description.

- Step 3. If you are unhappy using the form, make use of the Look for industry near the top of the screen to get other versions in the legal form format.

- Step 4. After you have discovered the form you need, select the Purchase now button. Select the pricing plan you choose and include your accreditations to register for the account.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal account to perform the deal.

- Step 6. Select the formatting in the legal form and acquire it on the product.

- Step 7. Complete, edit and produce or signal the Puerto Rico Ratification of Memorandum of Operating Agreement and Financing Statement - Form 2.

Each and every legal papers format you get is the one you have for a long time. You might have acces to each form you saved in your acccount. Click the My Forms section and select a form to produce or acquire yet again.

Contend and acquire, and produce the Puerto Rico Ratification of Memorandum of Operating Agreement and Financing Statement - Form 2 with US Legal Forms. There are many expert and status-particular forms you can use for your company or specific needs.

Form popularity

FAQ

Louisiana and Puerto Rico have enacted most of the provisions of the UCC with only minimal changes, except Articles 2 and 2A, preferring instead to maintain their own civil law tradition for governing the sale and lease of goods.

An LLC is required to obtain an Employer Identification Number from the United States Internal Revenue Service. It also must register with the Puerto Rico Treasury Department. An LLC also needs to have in place an Operating Agreement, which will serve as the ground rules for the management of the LLC.

To officially start your Puerto Rico LLC, you need name your business, appoint a registered agent, and file a Certificate of Formation with the Puerto Rico Department of State. The certificate costs $250 to file and typically takes between a day and a week to process depending on how you file.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

Puerto Rico LLC Cost. The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.

If your LLC is taxed as a Puerto Rico corporation, you'll need to pay corporate income tax. Puerto Rico's corporate tax rate is 37.5%. However, under the Puerto Rico Incentives Code (Act 60), businesses based in Puerto Rico only need to pay a 4% corporate income tax on goods and services exported from the commonwealth.