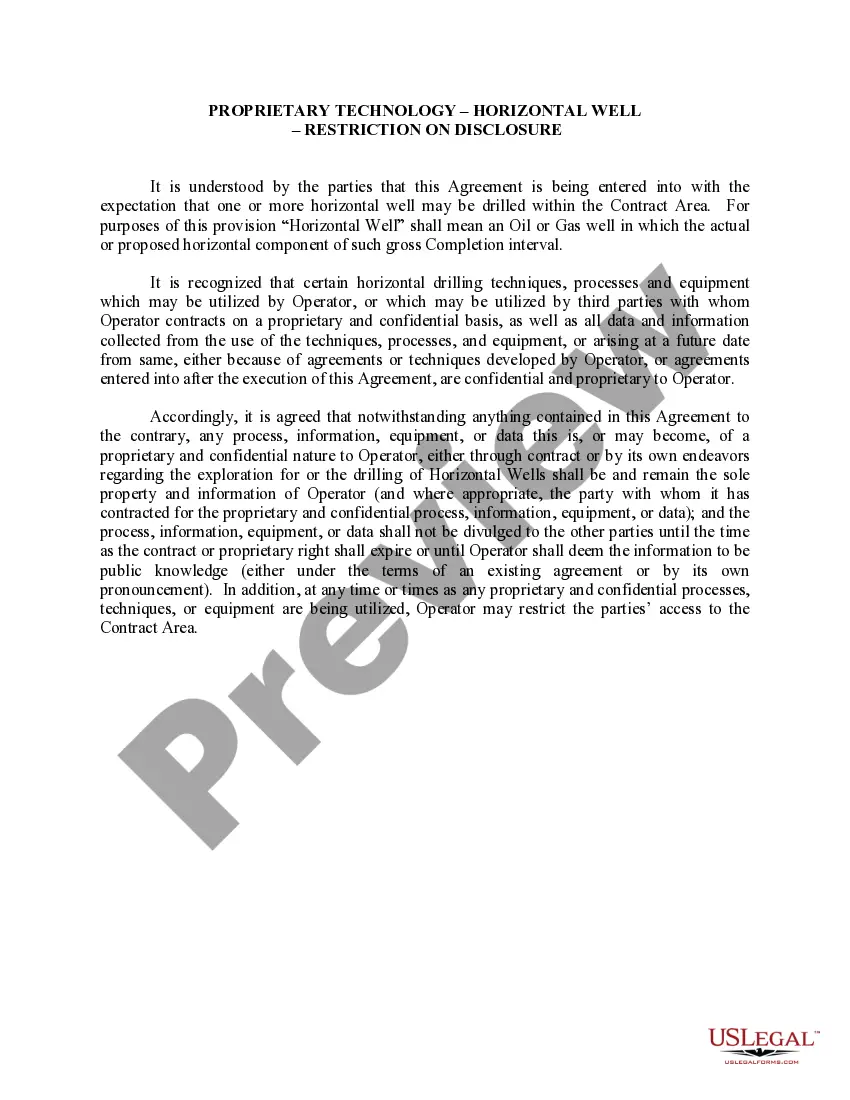

This provision is for an Agreement where there is the expectation that one or more horizontal wells may be drilled within the Contract Area. This section addresses the drilling of Horizontal Wells and that they shall remain the sole property and information of the Operator

Puerto Rico Proprietary Technology - Horizontal Well - Restriction on Disclosure

Description

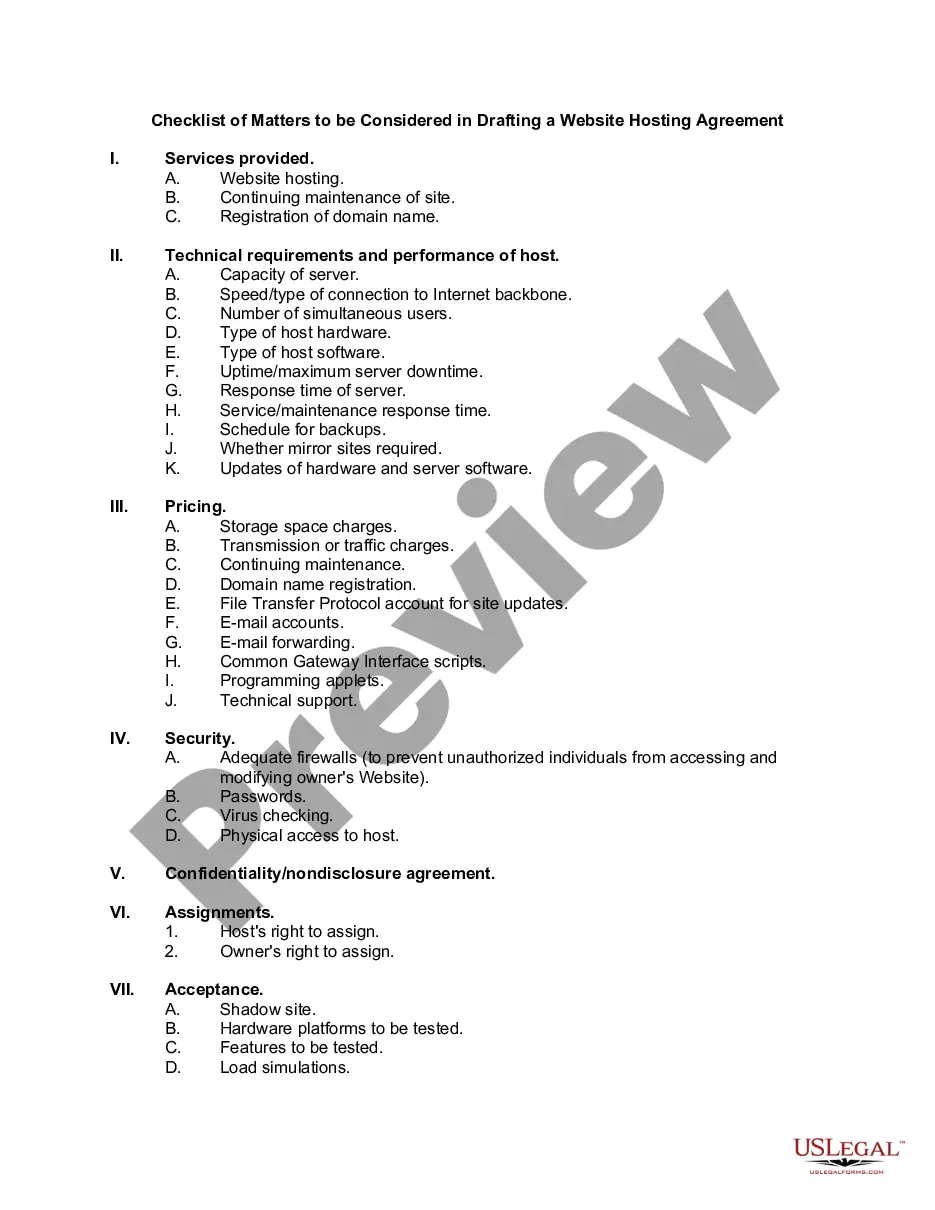

How to fill out Proprietary Technology - Horizontal Well - Restriction On Disclosure?

You can spend time online trying to find the lawful document template that suits the state and federal demands you will need. US Legal Forms provides 1000s of lawful types that are examined by professionals. It is possible to obtain or print the Puerto Rico Proprietary Technology - Horizontal Well - Restriction on Disclosure from our services.

If you already possess a US Legal Forms accounts, you may log in and then click the Acquire switch. Following that, you may full, modify, print, or sign the Puerto Rico Proprietary Technology - Horizontal Well - Restriction on Disclosure. Every lawful document template you buy is the one you have forever. To have an additional duplicate associated with a obtained develop, go to the My Forms tab and then click the related switch.

Should you use the US Legal Forms web site the first time, follow the easy instructions listed below:

- Very first, be sure that you have selected the best document template for your state/city of your choice. Look at the develop explanation to ensure you have picked the appropriate develop. If available, make use of the Preview switch to search from the document template too.

- In order to locate an additional variation from the develop, make use of the Research field to get the template that suits you and demands.

- Once you have discovered the template you would like, click on Buy now to carry on.

- Choose the costs program you would like, type in your credentials, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal accounts to pay for the lawful develop.

- Choose the formatting from the document and obtain it in your system.

- Make modifications in your document if needed. You can full, modify and sign and print Puerto Rico Proprietary Technology - Horizontal Well - Restriction on Disclosure.

Acquire and print 1000s of document themes making use of the US Legal Forms site, which offers the biggest collection of lawful types. Use expert and express-particular themes to tackle your business or specific demands.

Form popularity

FAQ

Law 68: Promotes acquisition and investment into the housing market on the island LEARN MORE. Law 187: Exempts buyers from paying property taxes for five years as well as certain closing costs for the purchase of the new residence as a primary residence, second home or investment property.

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

As has been widely reported, Puerto Rico's Act #20 and Act #22 provides incentives for high net worth U.S. citizens to move to Puerto Rico and potentially reduce their 39.6% federal income tax (plus any applicable state tax) to a 0% ? 4% Puerto Rico income tax rate.

Attention all property owners in Puerto Rico! Don't forget that your property tax bills are due at the end of this month, January 2023. As a reminder, property taxes in Puerto Rico are paid twice a year, with the first installment due at the end of June and the second at the end of January.

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

No, the IRS does not impose taxes on foreign inheritance or gifts if the recipient is a U.S. citizen or resident alien. However, you may need to pay taxes on your inheritance depending on your state's tax laws.

Therefore, in many cases, a U.S. citizen or resident cannot avoid U.S. income taxation on gains associated with appreciation in investment assets by establishing bona fide residence in Puerto Rico unless recognized after 10 years of bona fide residence in Puerto Rico.