Puerto Rico Gift Deed

Description

How to fill out Gift Deed?

Choosing the right lawful papers design can be a have difficulties. Needless to say, there are a variety of templates available online, but how can you find the lawful type you will need? Use the US Legal Forms web site. The services gives 1000s of templates, such as the Puerto Rico Gift Deed, that can be used for organization and personal demands. All of the forms are examined by pros and satisfy federal and state specifications.

In case you are presently authorized, log in to the profile and then click the Down load option to have the Puerto Rico Gift Deed. Use your profile to look throughout the lawful forms you may have ordered previously. Go to the My Forms tab of your profile and get yet another duplicate in the papers you will need.

In case you are a whole new end user of US Legal Forms, listed here are straightforward directions so that you can adhere to:

- First, be sure you have chosen the correct type for the metropolis/area. You may examine the shape utilizing the Review option and read the shape information to make sure it is the best for you.

- In case the type will not satisfy your needs, use the Seach field to obtain the right type.

- Once you are positive that the shape would work, click the Get now option to have the type.

- Pick the rates program you want and enter in the necessary information and facts. Build your profile and purchase an order utilizing your PayPal profile or charge card.

- Select the file format and obtain the lawful papers design to the gadget.

- Complete, edit and printing and indication the attained Puerto Rico Gift Deed.

US Legal Forms will be the greatest local library of lawful forms in which you can discover a variety of papers templates. Use the company to obtain expertly-created documents that adhere to state specifications.

Form popularity

FAQ

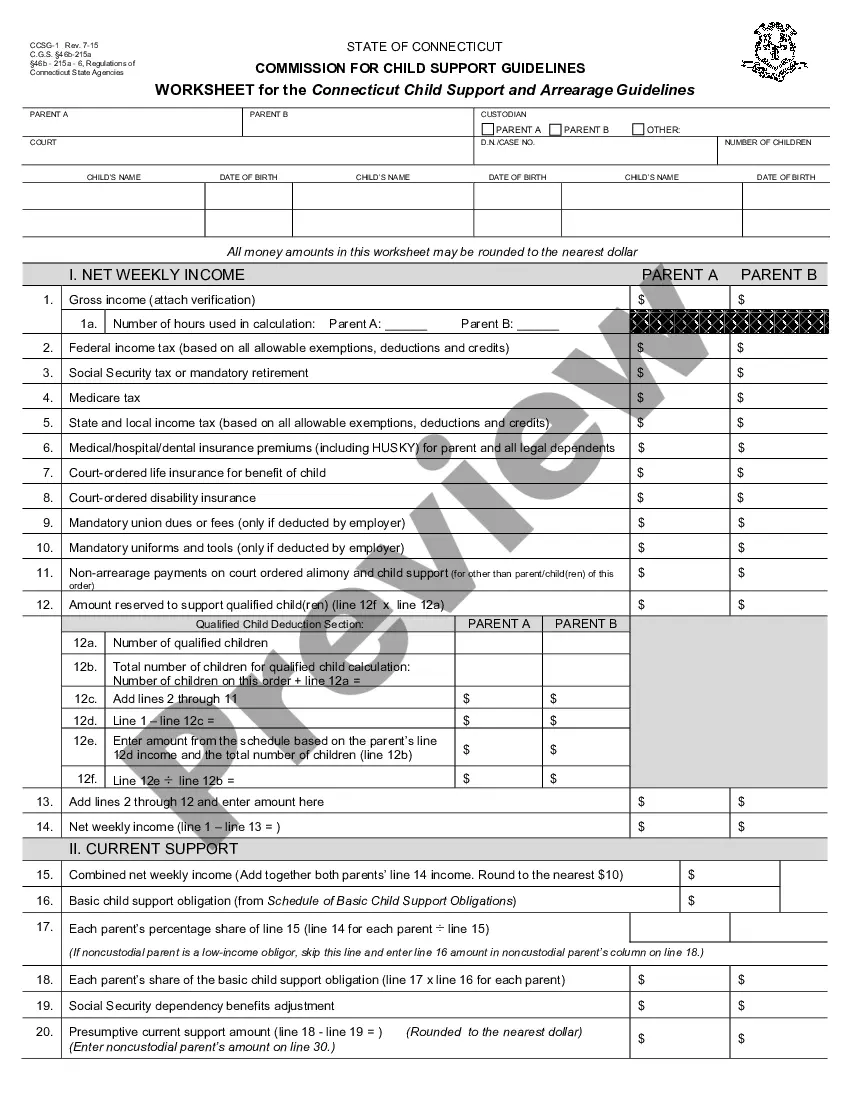

As a rule, there is no inheritance tax applied. Once the declaration of heirs has been issued by the Puerto Rico courts, you need to procure a certification of value and a certification of debt from CRIM.

Sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate or gift. Act 76 eliminates the 10% tax on transfers that occur after December 31, 2017, for both residents and nonresidents of Puerto Rico.

Puerto Rico laws grant rights of forced heirship to the children of the deceased. In the absence of children, or other descendants of such children, then to the parents of the deceased. In the absence of children, grandchildren or other direct descendants, the parents are considered forced heirs.

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.

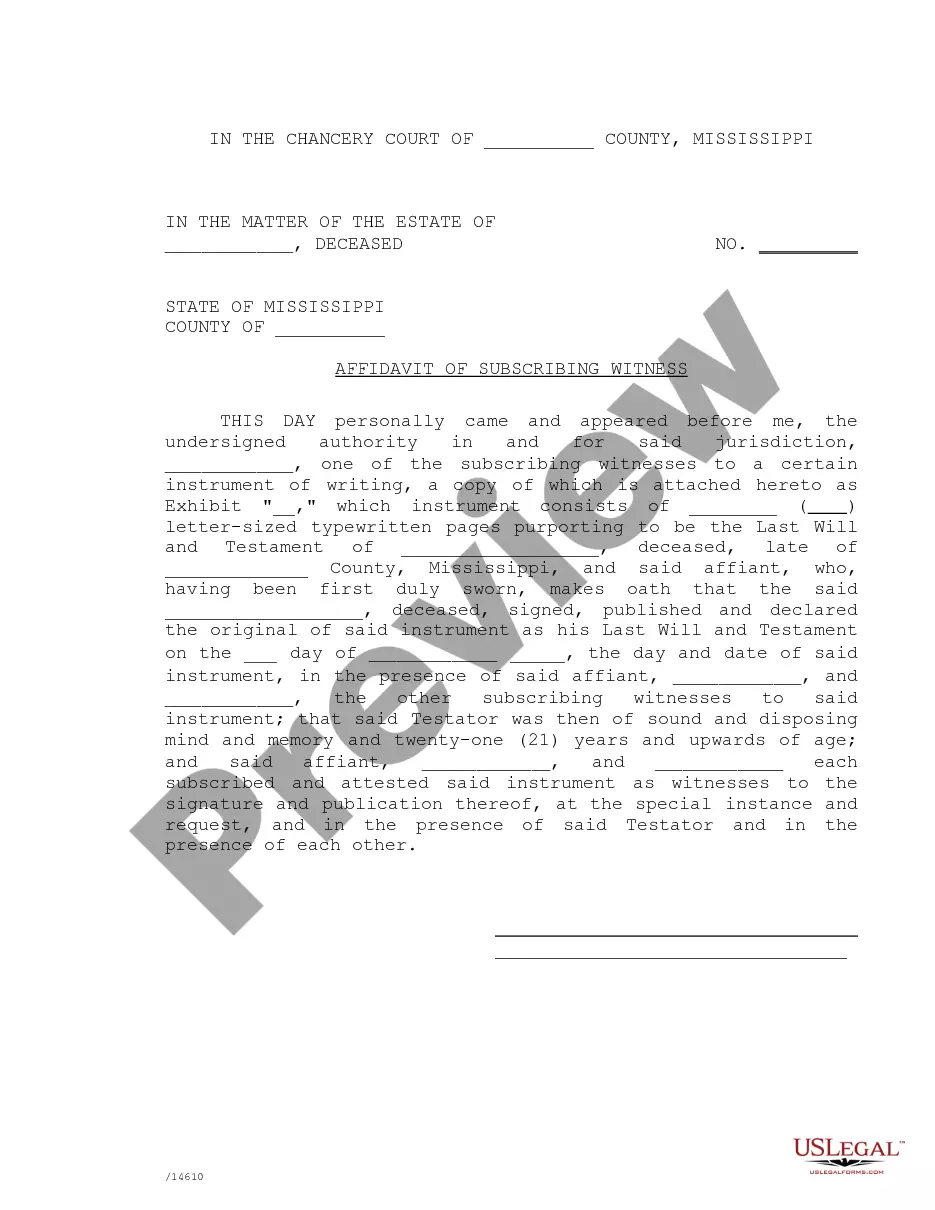

Notary Law is very important because unlike many places in the U.S., Puerto Rico uses notary attorneys to execute all deeds that transfer property. All public documents, affidavit, and sworn statements must be drafted by and signed by a notary attorney.

A: After November 28, 2020, Puerto Rico rule of law determines that the heirs of an estate are the deceased's spouse and children. Before that date, the estate belongs to the deceased's children with an inheritance lien in favor of your widowed mother (called in Spanish, "la cuota viudal").

No, the IRS does not impose taxes on foreign inheritance or gifts if the recipient is a U.S. citizen or resident alien. However, you may need to pay taxes on your inheritance depending on your state's tax laws.

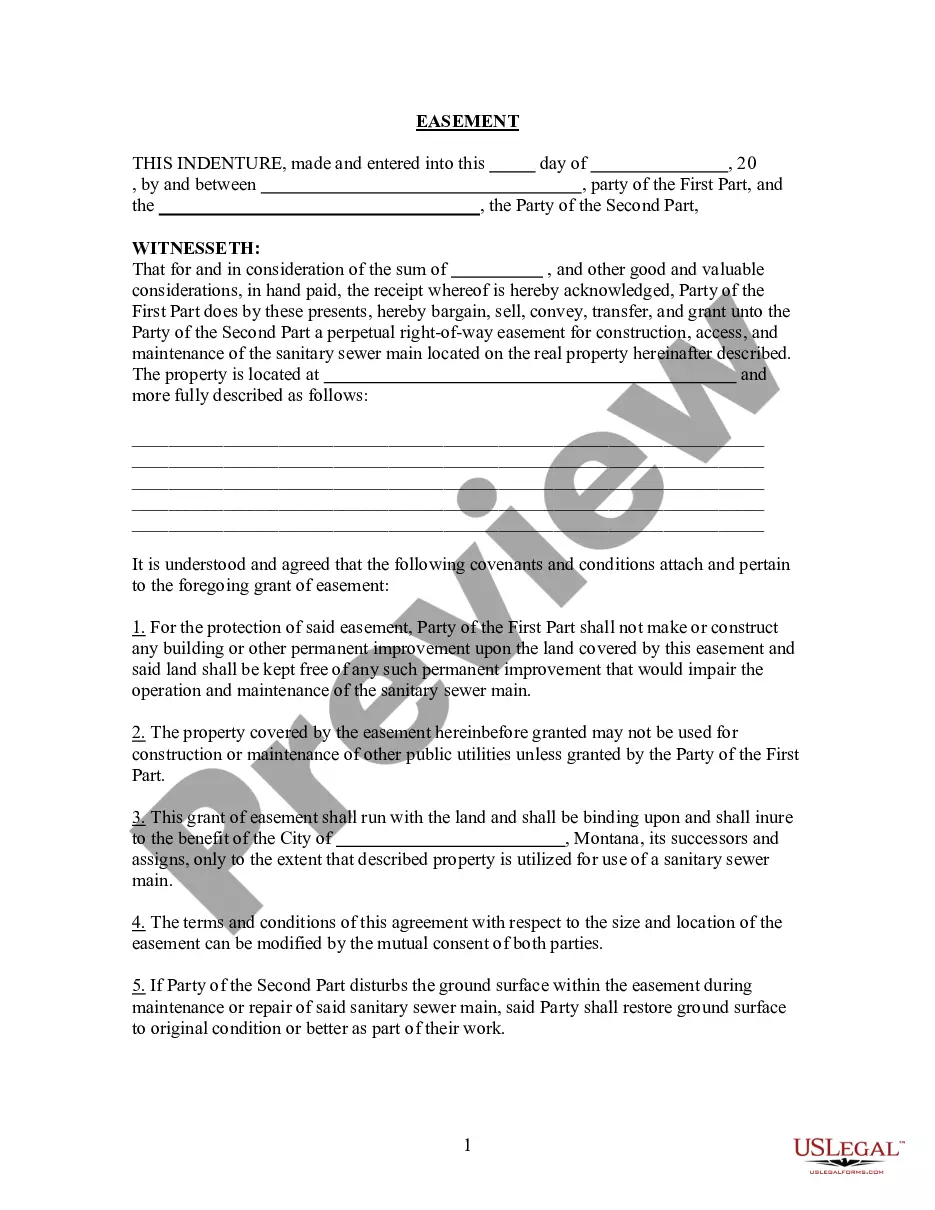

Property That May Avoid Probate Property held in a trust3 Jointly held property (but not common property) Death benefits from insurance policies (unless payable to the estate)4 Property given away before you die. Assets in a pay-on-death account. Retirement accounts with a named beneficiary.