Puerto Rico Entire Municipal Code

Description

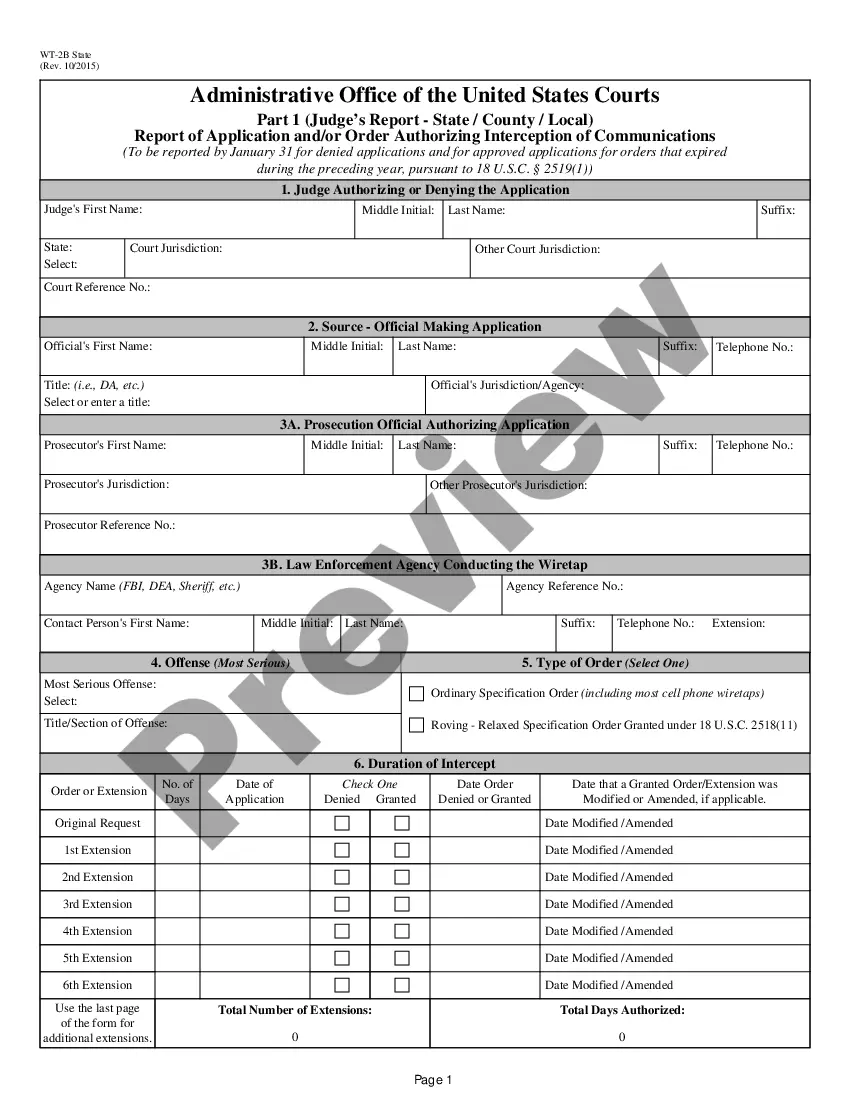

How to fill out Entire Municipal Code?

Discovering the right lawful file format could be a struggle. Needless to say, there are a variety of themes available on the Internet, but how can you discover the lawful kind you want? Make use of the US Legal Forms website. The service delivers 1000s of themes, like the Puerto Rico Entire Municipal Code, that you can use for company and private needs. All the forms are inspected by experts and meet up with federal and state specifications.

Should you be already authorized, log in to the account and click on the Acquire switch to obtain the Puerto Rico Entire Municipal Code. Utilize your account to appear from the lawful forms you possess acquired formerly. Go to the My Forms tab of your respective account and obtain an additional backup of your file you want.

Should you be a new consumer of US Legal Forms, listed below are straightforward guidelines that you should comply with:

- First, make sure you have selected the appropriate kind for your area/county. You are able to look over the shape while using Preview switch and study the shape outline to make certain this is the best for you.

- When the kind fails to meet up with your requirements, make use of the Seach area to get the appropriate kind.

- Once you are certain that the shape is acceptable, click on the Acquire now switch to obtain the kind.

- Opt for the rates strategy you would like and enter the needed info. Create your account and pay for your order utilizing your PayPal account or bank card.

- Pick the file structure and download the lawful file format to the gadget.

- Full, revise and print out and signal the obtained Puerto Rico Entire Municipal Code.

US Legal Forms is the greatest local library of lawful forms where you can see numerous file themes. Make use of the service to download professionally-made files that comply with status specifications.

Form popularity

FAQ

Puerto Rico offers great tax incentives to LLCs and individuals who move to Puerto Rico, including a 4% income tax and exemptions from paying taxes on capital gains, interest, or dividends (for individuals and businesses that meet the requirements).

The Municipal License Tax Act imposes penalties for failure to file a complete tax return unless it is shown that such failure is due to reasonable causes and not to wilful neglect.

The Internal Revenue Code of Puerto Rico (Spanish: Codigo de Rentas Internas de Puerto Rico) is the main body of domestic statutory tax law of Puerto Rico organized topically, including laws covering income taxes, payroll taxes, gift taxes, estate taxes, and statutory excise taxes.

Therefore, in many cases, a U.S. citizen or resident cannot avoid U.S. income taxation on gains associated with appreciation in investment assets by establishing bona fide residence in Puerto Rico unless recognized after 10 years of bona fide residence in Puerto Rico.

PR Code Section 4010.01(ddd) includes a detailed list of the Marketplace Facilitator Activities. Merchants are generally required to collect, report and remit the SUT, unless they are considered non-withholding agents for SUT purposes.

The U.S. tax code (Section 933) allows a bona fide resident of Puerto Rico to exclude Puerto Rico-source income from his or her U.S. gross income for U.S. tax purposes.

? Regulation 9237 issued on December 2020 In this Regulation, the Puerto Rico Treasury Department established the rules for taxpayers engaged in mail order sales to be considered a Merchant for purposes of the PR SUT (Merchant).