Puerto Rico Self-Employed Route Sales Contractor Agreement

Description

How to fill out Self-Employed Route Sales Contractor Agreement?

You can dedicate hours on the Internet trying to locate the legal document template that fits the state and federal requirements you need. US Legal Forms provides thousands of legal forms that are vetted by professionals.

You can download or print the Puerto Rico Self-Employed Route Sales Contractor Agreement from our platform. If you already have a US Legal Forms account, you can Log In and then click the Obtain button. After that, you can fill out, edit, print, or sign the Puerto Rico Self-Employed Route Sales Contractor Agreement.

Every legal document template you purchase is yours permanently. To get another copy of any acquired form, go to the My documents tab and click the corresponding button. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, make sure you have selected the correct document template for the area/region of your choice. Review the form description to ensure you have chosen the right one. If available, use the Preview button to view the document template as well.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you want to find another version of your form, use the Lookup field to search for the template that meets your needs and specifications.

- Once you have found the template you want, click Acquire now to proceed.

- Select the pricing plan you prefer, enter your credentials, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal form.

- Choose the format of your document and download it to your device.

- Make edits to your document if necessary. You can fill out, edit, sign, and print the Puerto Rico Self-Employed Route Sales Contractor Agreement.

- Obtain and print thousands of document templates through the US Legal Forms site, which offers the largest selection of legal forms. Use professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Law 75, often synonymous with Act 75, regulates the rights and obligations of franchisees and franchisors in Puerto Rico. It establishes guidelines for franchise agreements, ensuring that franchisees receive proper information and support from franchisors. For individuals looking to create a Puerto Rico Self-Employed Route Sales Contractor Agreement, understanding Law 75 is essential for protecting your rights and ensuring a successful business relationship. US Legal Forms offers resources to help navigate these legal requirements effectively.

Act 75, also known as the Franchise Law, governs franchise relationships in Puerto Rico. This law aims to protect franchisees by requiring franchisors to provide necessary disclosures and adhere to fair practices. Understanding Act 75 is crucial for anyone entering into a franchise agreement, especially for those considering a Puerto Rico Self-Employed Route Sales Contractor Agreement. Legal resources like those offered by US Legal Forms can provide valuable insights into compliance with Act 75.

To write an independent contractor agreement, start by clearly outlining the scope of work, including specific tasks and deadlines. Next, define payment terms, such as how and when the contractor will be compensated. Additionally, include clauses regarding confidentiality, ownership of work, and termination conditions. Utilizing a template for a Puerto Rico Self-Employed Route Sales Contractor Agreement from platforms like US Legal Forms can simplify this process and ensure compliance with local laws.

Writing an independent contractor agreement involves clearly outlining the terms of your working relationship. Start by defining the scope of work, payment schedules, and deadlines. Include clauses about confidentiality and termination to protect both parties. For a polished agreement, consider using the Puerto Rico Self-Employed Route Sales Contractor Agreement template available on uslegalforms, which can save you time and ensure compliance with local laws.

To set up as a self-employed contractor, begin by registering your business with the relevant state authorities in Puerto Rico. Next, obtain any necessary licenses and permits that pertain to your specific industry. It's also essential to draft a comprehensive contract, like the Puerto Rico Self-Employed Route Sales Contractor Agreement, to outline your services and payment terms clearly. Utilizing platforms like uslegalforms can simplify this process, providing templates and guidance.

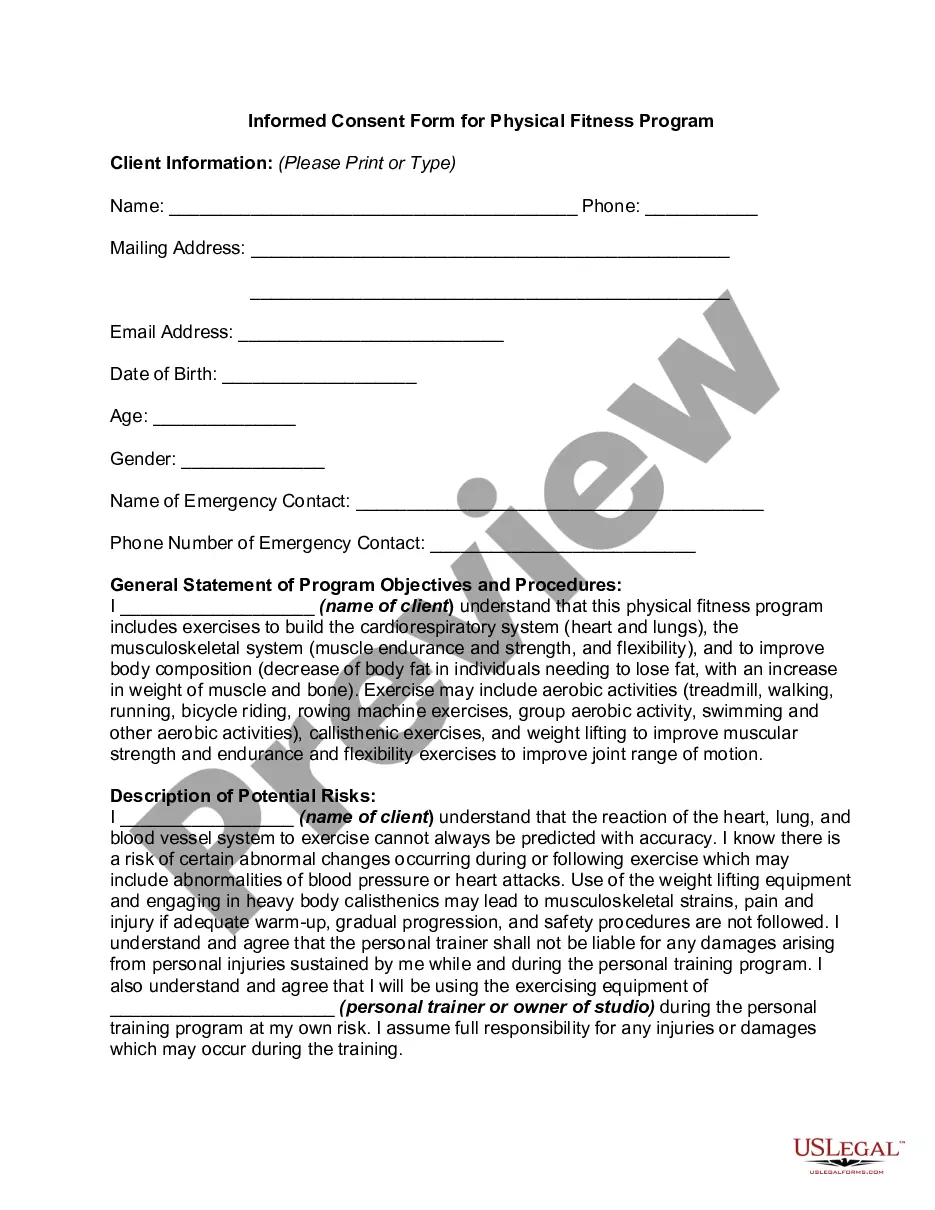

Filling out an independent contractor form is straightforward. Start by gathering your personal information, including your name, address, and tax identification number. Next, provide details about the services you offer and any agreed-upon payment terms. If you are using the Puerto Rico Self-Employed Route Sales Contractor Agreement, ensure you include any specific terms relevant to your route sales operations.

To create an independent contractor agreement, start by outlining the terms of the relationship, including payment, responsibilities, and duration. Incorporating the Puerto Rico Self-Employed Route Sales Contractor Agreement template from US Legal Forms can streamline this process. This template provides a structured format, ensuring that all necessary components are included. Taking these steps helps establish a clear and enforceable agreement.

Yes, a salesperson can operate as an independent contractor, offering flexibility and autonomy in their work. The Puerto Rico Self-Employed Route Sales Contractor Agreement outlines the relationship and responsibilities between the salesperson and the business. This agreement helps clarify expectations and ensures compliance with local laws. Leveraging US Legal Forms can simplify the creation of this essential document.

Typically, the business owner or employer drafts the independent contractor agreement. However, it is advisable to seek legal assistance to ensure that the Puerto Rico Self-Employed Route Sales Contractor Agreement meets all legal requirements and protects both parties. Utilizing templates from platforms like US Legal Forms can expedite this process. These resources provide clear and comprehensive agreements tailored to your specific needs.

Writing a contract for a 1099 employee involves specifying the nature of the work, compensation, and any responsibilities. Clearly outline the deliverables and deadlines to avoid misunderstandings later. The Puerto Rico Self-Employed Route Sales Contractor Agreement can serve as a valuable template, guiding you through the essential elements needed for a legally sound arrangement.