Puerto Rico Self-Employed Independent Contractor Payment Schedule

Description

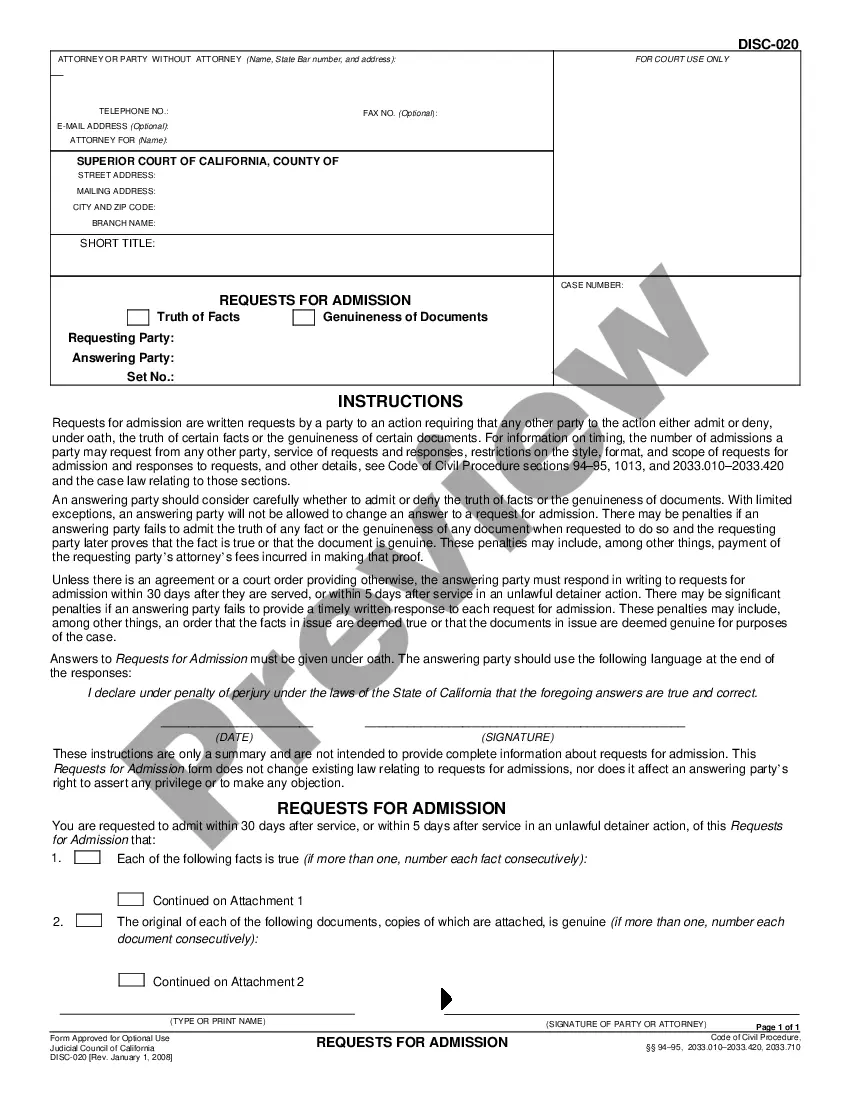

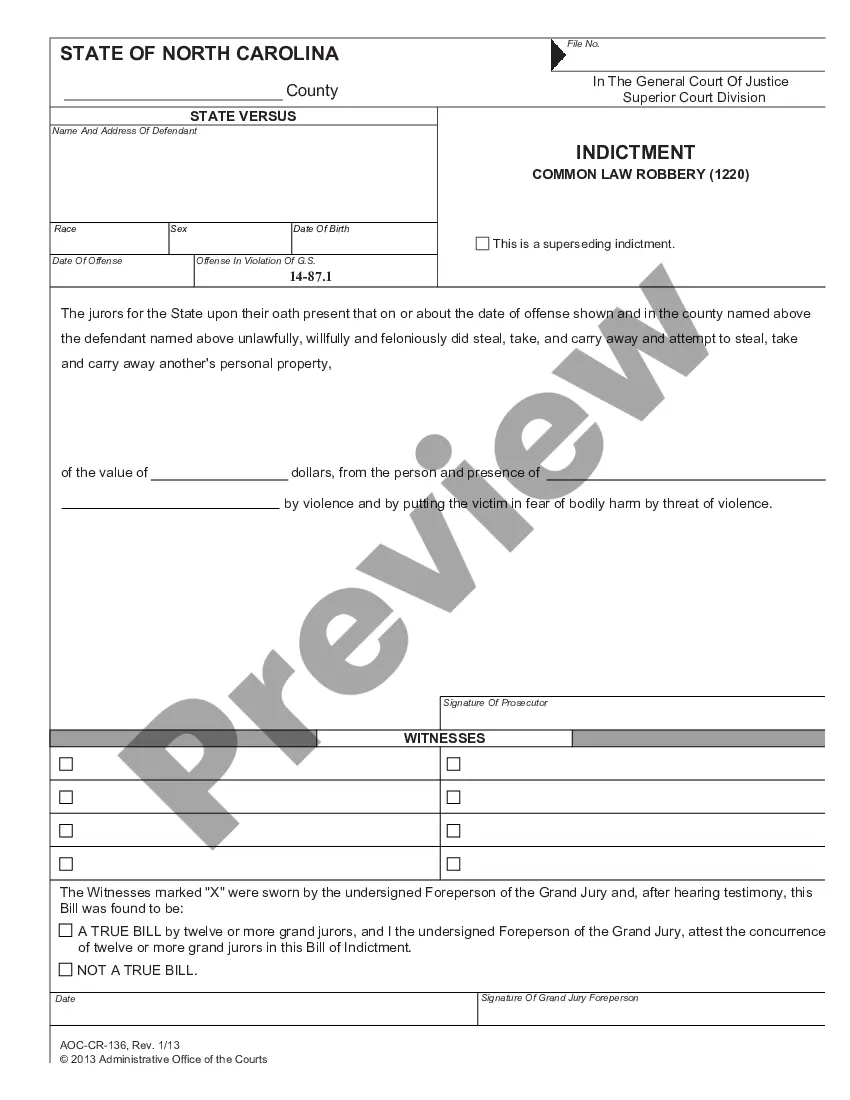

How to fill out Self-Employed Independent Contractor Payment Schedule?

Are you currently in the location where you require documents for either professional or personal purposes every day.

There are numerous authentic document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Puerto Rico Self-Employed Independent Contractor Payment Schedule, that are designed to meet state and federal requirements.

Once you acquire the correct form, click on Get now.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms site and have an account, just Log In.

- After that, you can download the Puerto Rico Self-Employed Independent Contractor Payment Schedule template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/county.

- Utilize the Preview button to examine the form.

- Review the description to ensure you have selected the correct document.

- If the form is not what you are looking for, use the Search box to find the form that suits your needs.

Form popularity

FAQ

Contractors typically accept payments through various methods such as online payment processors, bank transfers, or physical checks. It is crucial to establish a clear payment method that aligns with client preferences and project requirements. By implementing a Puerto Rico Self-Employed Independent Contractor Payment Schedule, you can ensure that payments are received on time and that your financial records remain organized.

The 183 day rule in Puerto Rico refers to the tax residency requirement, which states that individuals who spend 183 days or more in Puerto Rico within a calendar year may be considered residents for tax purposes. This designation can affect your tax obligations, including those related to your Puerto Rico Self-Employed Independent Contractor Payment Schedule. Understanding this rule is essential for managing your finances and compliance effectively.

Independent contractors in Puerto Rico typically do not receive paystubs like traditional employees do. Instead, they provide invoices to clients detailing the work performed and the agreed-upon payment. However, maintaining a consistent payment schedule is important. To manage your finances effectively, consider using organized invoicing tools available through platforms like USLegalForms that support the Puerto Rico Self-Employed Independent Contractor Payment Schedule.

The equivalent of a 1099 form in Puerto Rico is Form 480. This form is used to report payments made to independent contractors and is essential for tax compliance. When you’re working through the Puerto Rico Self-Employed Independent Contractor Payment Schedule, understanding this form is essential. Resources like uslegalforms can assist you in understanding how to utilize Form 480 effectively.

To report payments to independent contractors, businesses should issue a 1099 form or the appropriate local form, such as Form 480 in Puerto Rico. It is important to keep accurate records of payments throughout the year. Following a clear Puerto Rico Self-Employed Independent Contractor Payment Schedule can simplify this process. For comprehensive solutions, consider using uslegalforms to help manage documentation and compliance.

Yes, Puerto Rico imposes a self-employment tax on income earned by self-employed individuals. This tax covers contributions to Social Security and Medicare. Understanding the self-employment tax is essential for anyone navigating the Puerto Rico Self-Employed Independent Contractor Payment Schedule. Keeping track of your income and taxes will help you avoid surprises during tax season.

Form 480 is a tax form used in Puerto Rico to report income earned by independent contractors and other self-employed individuals. It plays a crucial role in the Puerto Rico Self-Employed Independent Contractor Payment Schedule. Completing this form helps ensure accurate reporting of your earnings, thus aiding in fulfilling your tax responsibilities. You can get more detailed guidance on this through platforms like uslegalforms.

Yes, Puerto Ricans do receive 1099 forms if they work as independent contractors or self-employed individuals. Businesses in the U.S. may issue a 1099 to report payments made to these contractors. As you manage your finances, understanding the Puerto Rico Self-Employed Independent Contractor Payment Schedule is vital. This knowledge helps you stay compliant and informed about your tax obligations.