Puerto Rico Self-Employed Independent Contractor Construction Worker Contract

Description

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

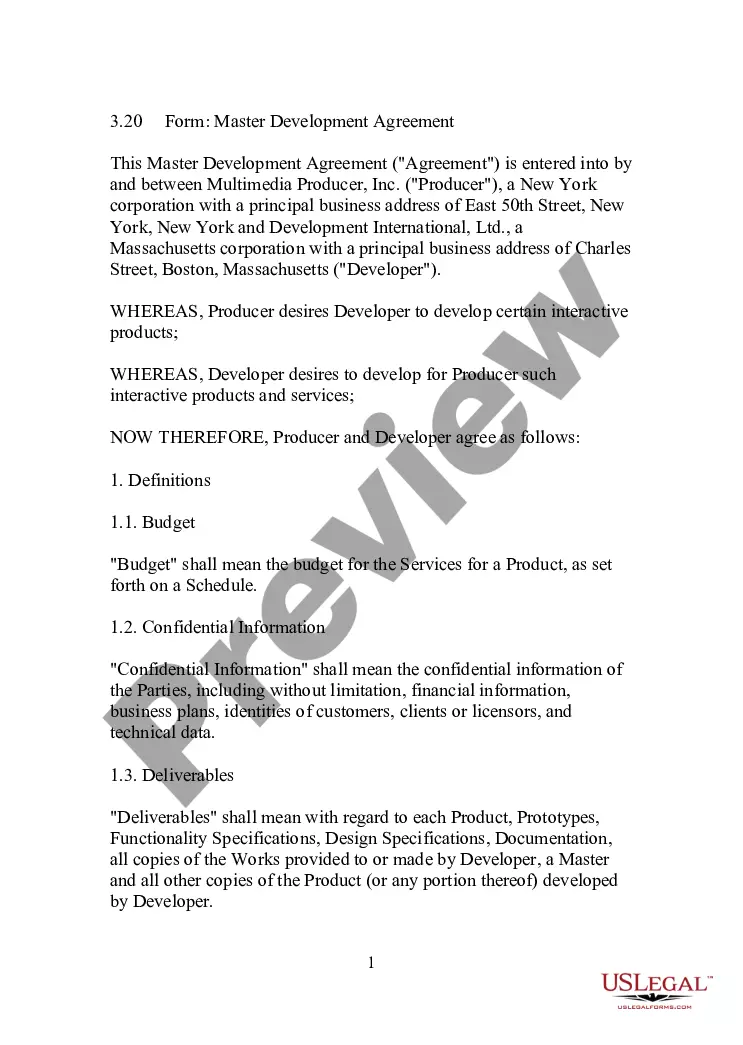

You can dedicate several hours online trying to locate the valid document format that meets the federal and state requirements you have. US Legal Forms provides thousands of valid templates that can be reviewed by experts.

You can download or print the Puerto Rico Self-Employed Independent Contractor Construction Worker Contract from the platform.

If you already have a US Legal Forms account, you can Log In and click the Obtain button. Then, you can fill out, edit, print, or sign the Puerto Rico Self-Employed Independent Contractor Construction Worker Contract. Every legal document template you purchase is yours permanently. To obtain another copy of any purchased form, go to the My documents section and click the corresponding button.

Select the document format and download it to your device. Make adjustments to your document if necessary. You can fill out, edit, sign, and print the Puerto Rico Self-Employed Independent Contractor Construction Worker Contract. Access and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the county/city that you choose. Review the form details to confirm you have chosen the appropriate template.

- If available, use the Preview button to view the document format as well.

- To find another version of the form, use the Lookup field to locate the template that meets your needs and requirements.

- Once you have found the template you want, click Purchase now to proceed.

- Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal template.

Form popularity

FAQ

In Puerto Rico, the equivalent of a 1099 form is the Form 480.6A, which independent contractors use to report their earned income. If you are working under a Puerto Rico Self-Employed Independent Contractor Construction Worker Contract, be sure to understand your tax obligations and file the necessary forms correctly. This will help you stay compliant and avoid penalties.

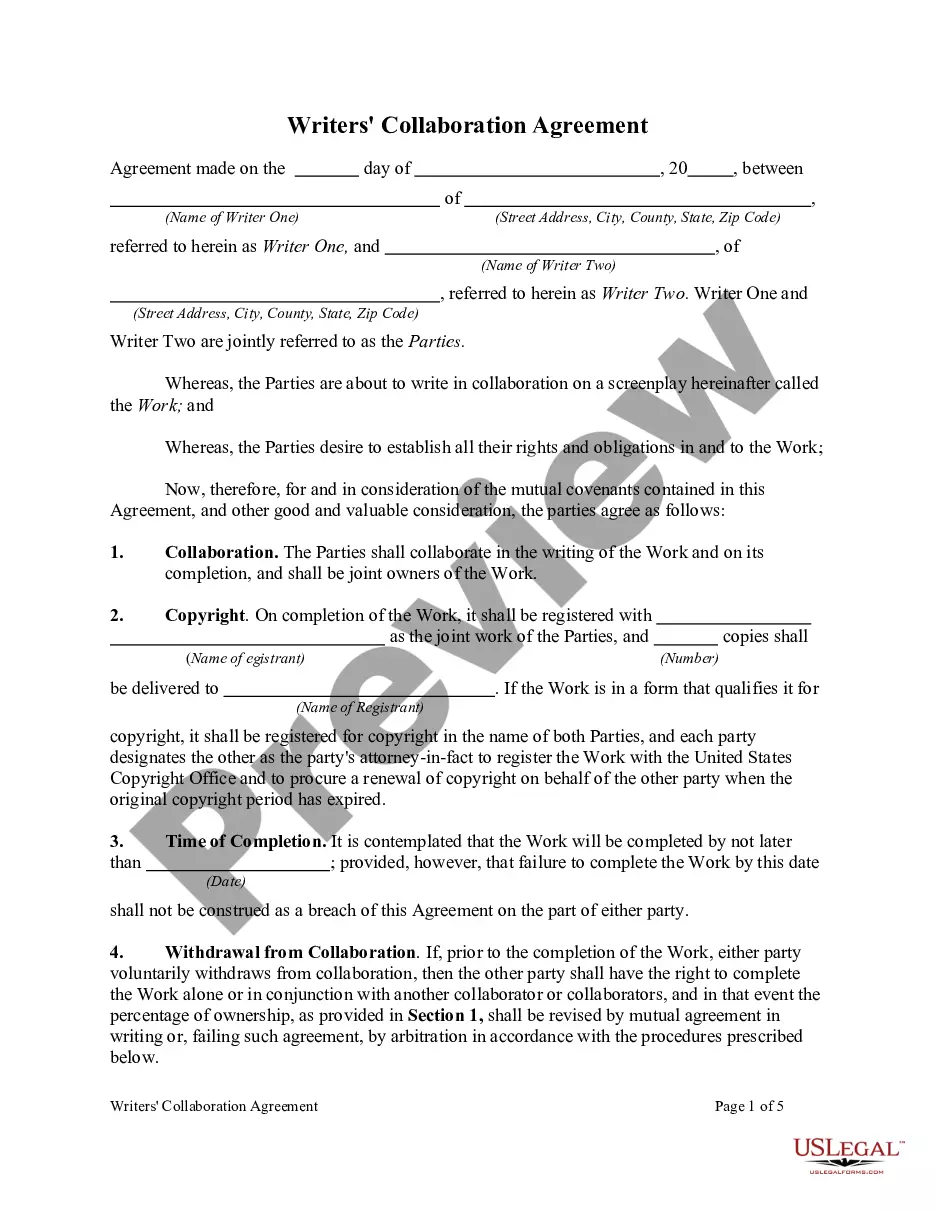

Filling out an independent contractor agreement requires attention to detail. Start by stating the parties involved, then outline the work to be done, payment details, and termination conditions. Ensure that your Puerto Rico Self-Employed Independent Contractor Construction Worker Contract is clear and mutual understanding is reached to avoid future disputes.

An independent contractor typically fills out a W-9 form to provide their taxpayer identification number. In addition, if you're working under a Puerto Rico Self-Employed Independent Contractor Construction Worker Contract, you might need to complete local business permits or licenses. Always check local requirements to ensure you have all necessary documentation in place.

Writing an independent contractor agreement involves clearly defining the terms of your engagement. Include the scope of work, payment structure, and deadlines to ensure clarity for both parties. For a Puerto Rico Self-Employed Independent Contractor Construction Worker Contract, consider referencing laws specific to Puerto Rico to ensure compliance and protect your rights.

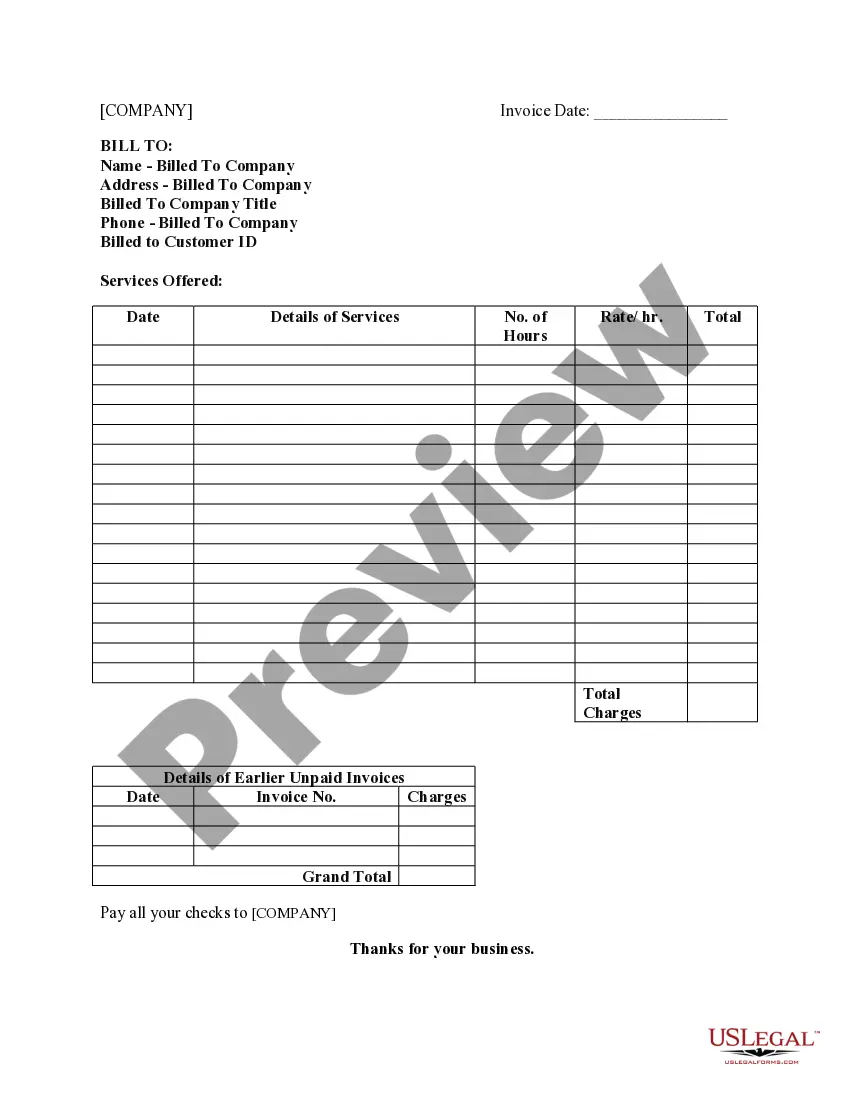

To fill out an independent contractor form in relation to the Puerto Rico Self-Employed Independent Contractor Construction Worker Contract, start by ensuring all your personal information is accurate. Include details such as your full name, contact information, and Social Security number. Be sure to specify the services you will provide, the agreed compensation, and any timelines for the project.

Both terms are often used interchangeably, but they can carry different connotations. Self-employed generally refers to someone who runs their own business, while independent contractor suggests a specific contractual relationship with a client. Knowing how to market yourself appropriately in the context of a Puerto Rico Self-Employed Independent Contractor Construction Worker Contract can enhance your business opportunities.

The 183 day rule refers to the residency requirement for tax purposes. If you spend 183 days or more in Puerto Rico during the tax year, you may be considered a resident for tax obligations. Understanding this rule is crucial for individuals operating under a Puerto Rico Self-Employed Independent Contractor Construction Worker Contract to determine their tax residency status.

Yes, Puerto Rico has a self-employment tax that applies to net earnings from self-employment. This tax contributes to social security and Medicare benefits, similar to federal requirements. As a Puerto Rico Self-Employed Independent Contractor Construction Worker, it is essential to budget for this tax when calculating your income.

Being self-employed typically means that you operate your own business, earn income directly from clients, and have the flexibility to set your terms. You are responsible for your taxes and business expenses. A Puerto Rico Self-Employed Independent Contractor Construction Worker Contract can provide clarity on your responsibilities and rights as a self-employed individual.

To become a legal independent contractor, you first need to register your business and obtain any necessary licenses. Ensure that you keep detailed records of your income and expenses, and track your hours for accurate reporting. Utilizing a Puerto Rico Self-Employed Independent Contractor Construction Worker Contract can help define your working relationship and ensure compliance with local regulations.