Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor

Description

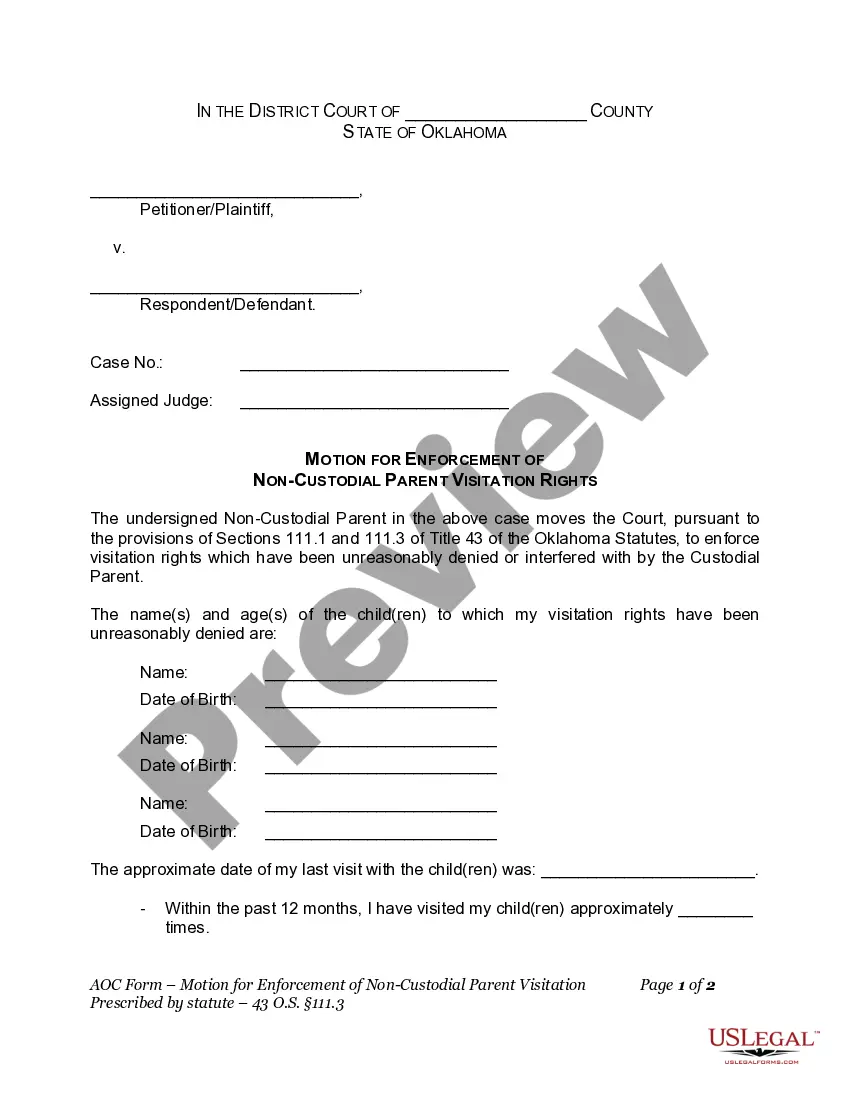

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most prominent collections of legal forms in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor in just seconds.

If the form doesn't meet your needs, utilize the Search field at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your choice by clicking the Acquire now button. Then, select your preferred pricing plan and provide your information to register for an account.

- If you have a subscription, Log In to download the Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor from the US Legal Forms library.

- The Download button appears on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have chosen the correct form for your city/state.

- Click the Review button to examine the form's details.

- Read the form description to verify you have selected the appropriate form.

Form popularity

FAQ

Both terms are generally interchangeable, but 'self-employed' is broader. It encompasses anyone who runs their own business, while 'independent contractor' specifically refers to those who perform services under a contract. When working within the framework of a Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor, using either term is acceptable depending on your audience's familiarity and preferences.

The 183-day rule in Puerto Rico determines tax residency based on the number of days spent in the territory. If you reside in Puerto Rico for 183 days or more in a tax year, you may be considered a resident for tax purposes. This rule is important for individuals entering agreements like the Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor, as it affects tax obligations.

Indeed, an independent contractor is classified as self-employed. This status applies because independent contractors work for themselves and handle their own business operations. By recognizing this classification, you can effectively engage in agreements like the Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor.

Yes, if you receive a 1099 form, you are typically considered self-employed. This form indicates that you have earned income as an independent contractor, which further cements your self-employed status. This classification is important when entering into legal agreements, such as a Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor.

Law 75 in Puerto Rico governs the relationship between independent contractors and companies. This law provides specific protections for agents and independent contractors, ensuring fair treatment and compensation. Understanding this law can be crucial when navigating agreements like the Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor.

To qualify as self-employed, you must do business for yourself. This entails receiving income directly from your clients or customers rather than through an employer. Typically, self-employed individuals manage their own taxes, which commonly comes into play in the context of a Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor.

Yes, an independent contractor counts as self-employed. When you operate as an independent contractor, you are essentially creating your own business. This status allows you to manage your work and responsibilities independently while entering into agreements, such as the Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor.

To employ an independent contractor, you will need a formal agreement that details the scope of work, payment arrangement, and confidentiality terms. A Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor will provide clear guidance and protect both parties. Also, ensure you maintain records of all agreements, tax forms, and communications for transparency.

When hiring an independent contractor, you should prepare a written agreement that outlines the terms of the arrangement. This can include a Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor, which specifies the services to be rendered, payment terms, and deadlines. Additionally, you may need the contractor's tax identification information and relevant documentation to maintain compliance.

Independent contractors in Puerto Rico typically need to fill out several forms, including the W-9 for tax identification and the 1099 form for income reporting. Depending on your specific situation, additional forms might be required. To ensure clarity and compliance, consider preparing a Puerto Rico Social Worker Agreement - Self-Employed Independent Contractor that details your obligations and rights.