Puerto Rico Breeder Agreement - Self-Employed Independent Contractor

Description

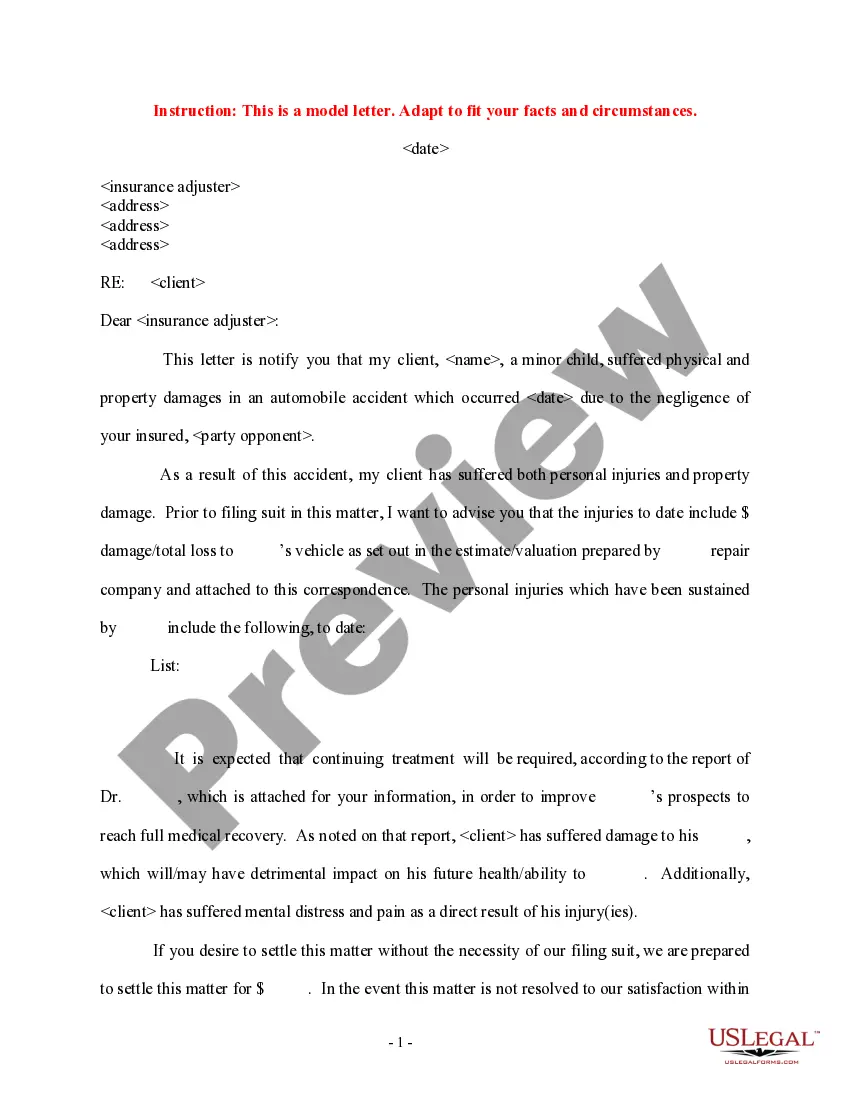

How to fill out Breeder Agreement - Self-Employed Independent Contractor?

You might invest hours online trying to discover the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal templates that can be reviewed by experts.

You can conveniently download or print the Puerto Rico Breeder Agreement - Self-Employed Independent Contractor from this service.

If you wish to find another version of your form, use the Search box to locate the template that meets your requirements and needs. Once you have found the template you need, click on Get now to continue. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal document. Choose the format of your document and download it to your device. Make modifications to your document if necessary. You may complete, edit, sign, and print the Puerto Rico Breeder Agreement - Self-Employed Independent Contractor. Obtain and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, edit, print, or sign the Puerto Rico Breeder Agreement - Self-Employed Independent Contractor.

- Every legal document format you purchase belongs to you for years.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/region of choice.

- Review the document outline to confirm you have chosen the correct form.

- If available, utilize the Preview button to view the document template at the same time.

Form popularity

FAQ

Yes, you do issue a 1099 to contractors based in Puerto Rico if they meet certain payment thresholds. This requirement is crucial for proper tax reporting and compliance. Including a clear reference to this aspect in your Puerto Rico Breeder Agreement - Self-Employed Independent Contractor can help avoid future complications and ensure that both parties fulfill their tax obligations.

Yes, Puerto Ricans can receive a 1099 form for services rendered, just like individuals on the mainland. If you are working as an independent contractor in Puerto Rico, ensure your agreement specifies payment methods and tax information. Incorporating aspects of the Puerto Rico Breeder Agreement - Self-Employed Independent Contractor can enhance clarity and compliance.

Yes, Puerto Rico is part of the U.S. customs territory. This means that it shares the same customs regulations as the mainland U.S. Understanding this is crucial for businesses and independent contractors operating in Puerto Rico. It influences contracts like the Puerto Rico Breeder Agreement - Self-Employed Independent Contractor by shaping how goods and services are traded.

A 1099 independent contractor agreement is a contract that outlines the relationship between a business and an independent contractor. This agreement specifies payment details, work expectations, and other essential terms. For those utilizing a Puerto Rico Breeder Agreement - Self-Employed Independent Contractor, including 1099 requirements helps clarify tax responsibilities and protects both parties.

Typically, if a service is performed by a foreign individual outside the U.S., you may not need to issue a 1099. However, if the work relates to a Puerto Rican entity, tax obligations can vary. When creating your Puerto Rico Breeder Agreement - Self-Employed Independent Contractor, it's important to consult a tax professional to ensure compliance with these nuances.

No, Puerto Rico is not considered foreign for IRS purposes. While it has a unique tax status, it remains a U.S. territory. As such, residents often have different tax obligations compared to individuals in the states. It’s essential to understand these differences, especially when drafting agreements like the Puerto Rico Breeder Agreement - Self-Employed Independent Contractor.

To create an independent contractor agreement, you should start by outlining the scope of work, payment terms, and duration of the contract. Clearly define the relationship between the contractor and the client to avoid misclassification issues. Using a template specific to Puerto Rico Breeder Agreement - Self-Employed Independent Contractor can simplify this process. Consider utilizing platforms like USLegalForms for legally vetted templates that cater to your needs.

An independent contractor typically fills out several key documents. These include the Puerto Rico Breeder Agreement - Self-Employed Independent Contractor, a W-9 form for tax purposes, and any specialized contracts related to their services. By organizing these essential forms, you can clearly define your work relationship and responsibilities, paving the way for a successful freelance career.

Filling out a declaration of independent contractor status form is straightforward. Begin by providing your personal information, such as your name, address, and contact details. Next, outline the nature of your work as it relates to the Puerto Rico Breeder Agreement - Self-Employed Independent Contractor. Finally, sign and date the form to validate your independent contractor status, ensuring all details are accurate for compliance.

Yes, independent contractors typically file taxes as self-employed individuals. This means they report their income and expenses on a Schedule C form when filing their tax returns. To navigate this process smoothly, incorporating a Puerto Rico Breeder Agreement - Self-Employed Independent Contractor can clarify your business operational setup and help you maintain accurate records for tax purposes.