Puerto Rico Fuel Delivery And Storage Services - Self-Employed

Description

How to fill out Fuel Delivery And Storage Services - Self-Employed?

If you wish to complete, acquire, or print out authorized file templates, use US Legal Forms, the biggest variety of authorized types, that can be found on the Internet. Use the site`s simple and easy practical look for to get the paperwork you want. Different templates for company and personal purposes are categorized by types and says, or search phrases. Use US Legal Forms to get the Puerto Rico Fuel Delivery And Storage Services - Self-Employed with a number of mouse clicks.

In case you are currently a US Legal Forms buyer, log in for your bank account and then click the Download option to have the Puerto Rico Fuel Delivery And Storage Services - Self-Employed. Also you can accessibility types you formerly acquired in the My Forms tab of your bank account.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that appropriate town/land.

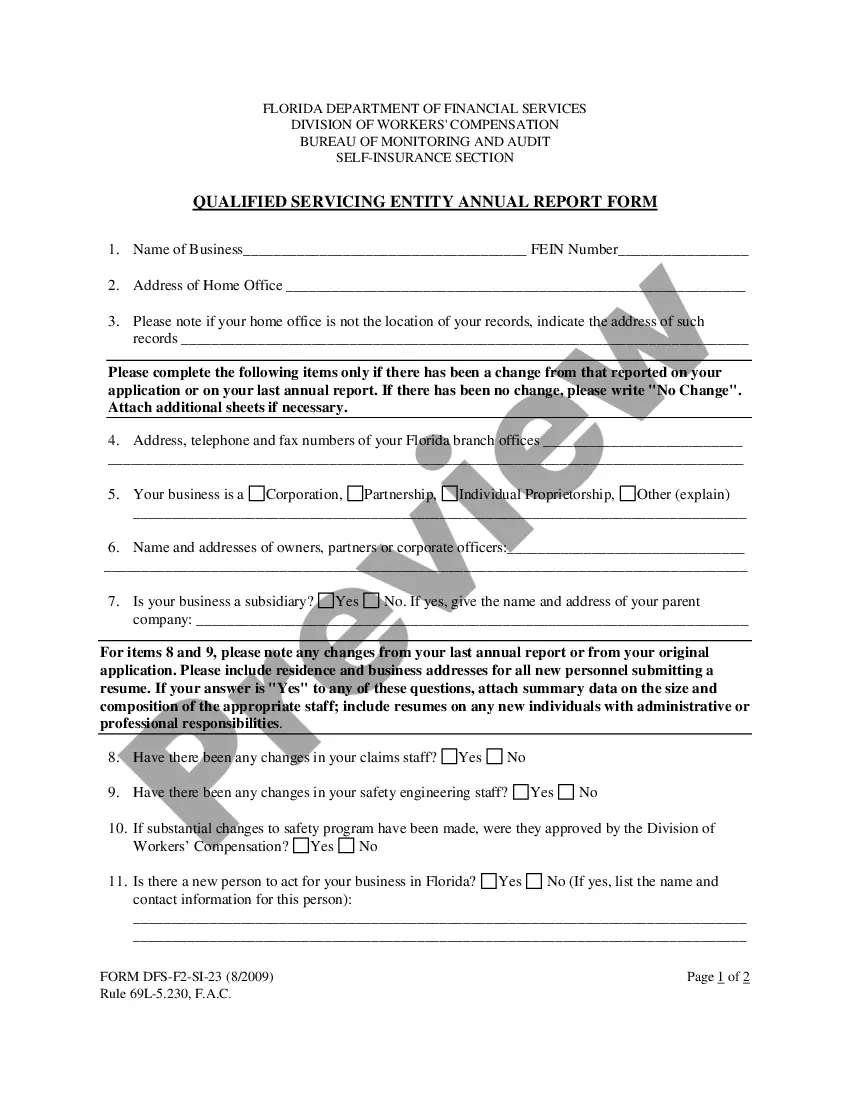

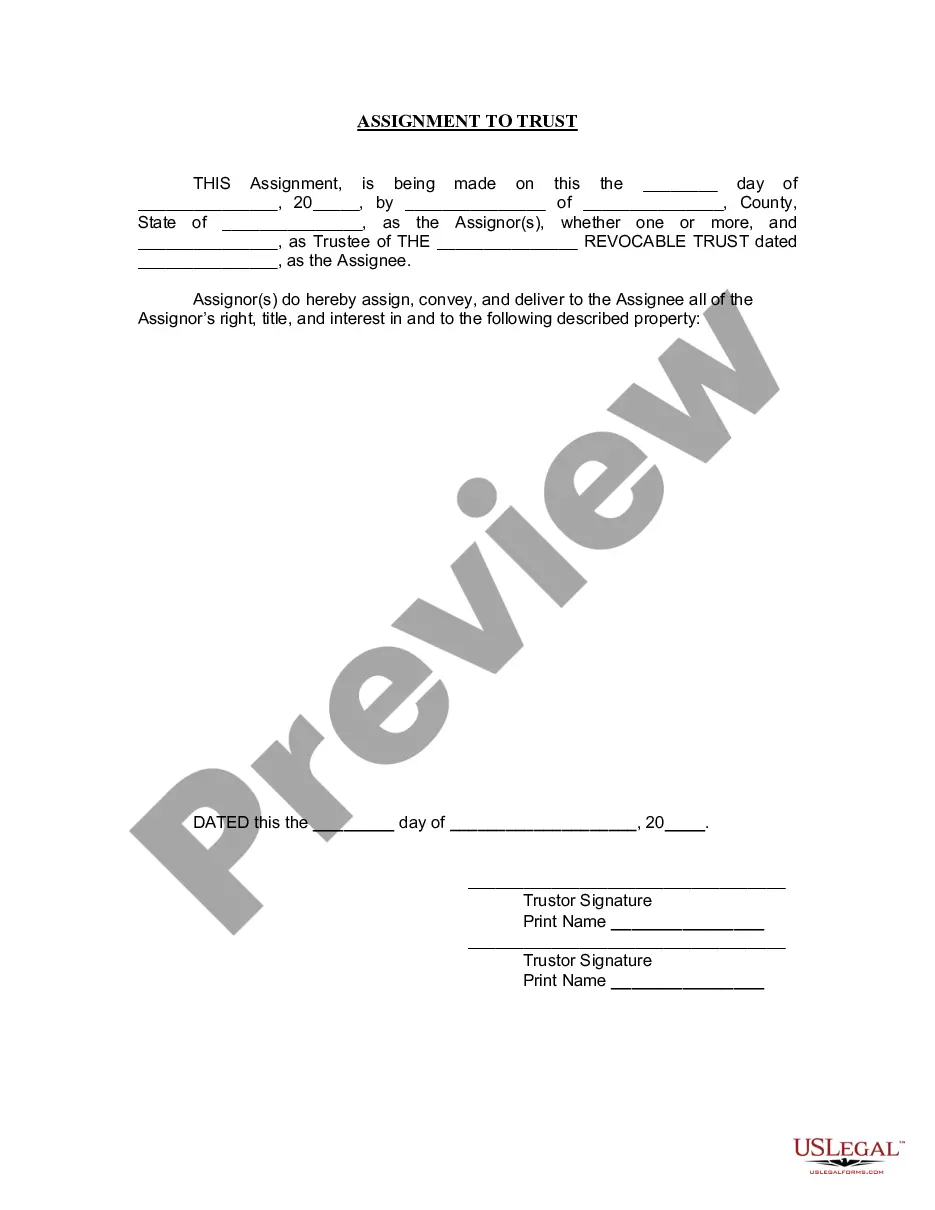

- Step 2. Take advantage of the Preview option to look through the form`s information. Do not neglect to see the explanation.

- Step 3. In case you are unsatisfied with the type, take advantage of the Search industry near the top of the display to get other versions in the authorized type format.

- Step 4. Once you have identified the shape you want, select the Purchase now option. Choose the rates strategy you choose and add your accreditations to register for an bank account.

- Step 5. Approach the deal. You should use your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Choose the file format in the authorized type and acquire it on your own product.

- Step 7. Comprehensive, change and print out or signal the Puerto Rico Fuel Delivery And Storage Services - Self-Employed.

Every single authorized file format you purchase is your own property permanently. You might have acces to each type you acquired with your acccount. Click on the My Forms portion and pick a type to print out or acquire yet again.

Remain competitive and acquire, and print out the Puerto Rico Fuel Delivery And Storage Services - Self-Employed with US Legal Forms. There are millions of skilled and status-specific types you can use for the company or personal demands.

Form popularity

FAQ

To obtain a merchant certificate in Puerto Rico, you must apply through the Puerto Rico Department of Treasury. The application process requires documentation that verifies your business, especially if you provide services like Puerto Rico Fuel Delivery And Storage Services - Self-Employed. Once your application is approved, you'll receive a certificate that allows you to legally operate your business.

Yes, services provided in Puerto Rico are generally subject to sales tax, including those from Puerto Rico Fuel Delivery And Storage Services - Self-Employed. Tax exemptions may apply depending on the nature of the service, so it's important to check local regulations. Understanding these tax implications helps you remain compliant while operating your business efficiently.

To report income from Puerto Rico, you must file a tax return with the Puerto Rico Department of Treasury. It's crucial to accurately report all your earnings from Puerto Rico Fuel Delivery And Storage Services - Self-Employed on your return. Ensure you keep detailed records of your income and expenses to simplify this process. You may also need to file an additional federal tax return if applicable.

Law 60, also known as the Incentives Code, offers various tax incentives to individuals and businesses in Puerto Rico. This legislation aims to attract self-employed professionals, particularly in sectors like Puerto Rico Fuel Delivery And Storage Services - Self-Employed. Understanding Law 60 can help you maximize your benefits while operating a business in Puerto Rico.

In Puerto Rico, the equivalent of a 1099 form is the Informative Return 480.6A. This form is used to report income earned by self-employed individuals, including those involved in Puerto Rico Fuel Delivery And Storage Services - Self-Employed. It is essential for accurate tax reporting and ensures that you remain compliant with local regulations.

How do I value my inventory for tax purposes?Cost. Simply value the item at your purchase price plus any shipping fees etc.Lower of cost or market. You would compare the cost of each item with the market value on a specific valuation date each year.Retail.20-Jan-2016

You can either deduct or amortize start-up expenses once your business begins rather than filing business taxes with no income. If you were actively engaged in your trade or business but didn't receive income, then you should file and claim your expenses.

How to take IRS deductions. The IRS allows you to deduct $5,000 in business startup costs and $5,000 in organizational costs, but only if your total startup costs are $50,000 or less. If your startup costs in either area exceed $50,000, the amount of your allowable deduction will be reduced by the overage.

If a service for export business qualifies for the tax benefits under Chapter 3 of the Incentives Act, the net income stemming from the business is subject to a 4% Puerto Rican corporate tax. Further, distributions from earnings and profits is not subject to Puerto Rican income tax.