Puerto Rico Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

It is feasible to invest time online trying to locate the official document template that complies with the national and local requirements you require.

US Legal Forms provides thousands of legal documents that can be reviewed by experts.

You can download or print the Puerto Rico Door Contractor Agreement - Self-Employed from this service.

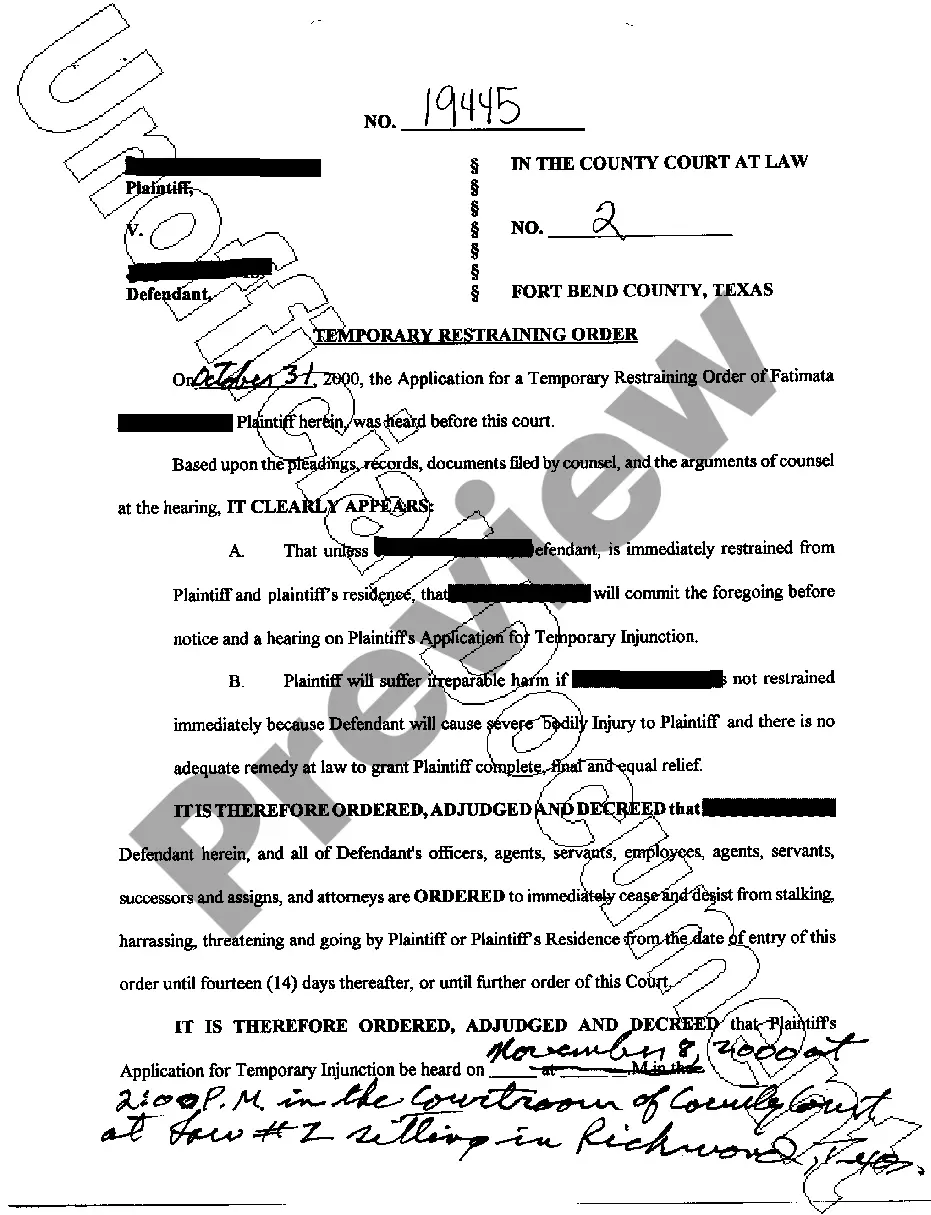

If available, utilize the Review button to examine the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After, you can complete, modify, print, or sign the Puerto Rico Door Contractor Agreement - Self-Employed.

- Each legal document template you acquire is exclusively yours forever.

- To obtain another copy of a purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have selected the correct document template for your desired area/town.

- Review the form description to confirm that you have chosen the appropriate form.

Form popularity

FAQ

To write a self-employed contract, begin by outlining the services you offer and the payment structure. It is imperative to include clauses related to confidentiality, liability, and duration of the contract. By focusing on the details provided in the Puerto Rico Door Contractor Agreement - Self-Employed, you can protect your interests while fostering good business relationships. Platforms such as USLegalForms offer templates that simplify the contract writing process.

Writing an independent contractor agreement involves detailing the work to be done, including deadlines and payment methods. Be specific about the terms of engagement and the rights of each party. Remember, the Puerto Rico Door Contractor Agreement - Self-Employed should reflect your unique business needs while complying with local laws. Consider using resources like USLegalForms to draft a clear and legally binding document.

To fill out an independent contractor form, start by providing your personal information, such as your name and address. Next, clearly define the scope of work and outline payment terms. Make sure to understand the implications of the Puerto Rico Door Contractor Agreement - Self-Employed, as this document will serve as a foundation for your working relationship. Utilizing platforms like USLegalForms can guide you through the completion process, ensuring accuracy and compliance.

While both terms are often used interchangeably, 'self-employed' encompasses a broader range of work arrangements. When you have a Puerto Rico Door Contractor Agreement - Self-Employed, referring to yourself as self-employed may clarify your status in a business context. It is beneficial to choose the term that best reflects your working relationship.

Law 75 in Puerto Rico regulates the relationship between manufacturers and distributors. This law impacts many self-employed individuals, especially those with a Puerto Rico Door Contractor Agreement - Self-Employed. Understanding Law 75 is essential for contractors as it outlines rights and obligations regarding terminations and commissions.

A person qualifies as self-employed if they operate their own business or work independently through agreements like a Puerto Rico Door Contractor Agreement - Self-Employed. This includes those who earn income without working for an employer. Key factors include managing your income, expenses, and having the freedom to make decisions about your work.

Absolutely, an independent contractor is indeed categorized as self-employed. This status applies to individuals who work under a Puerto Rico Door Contractor Agreement - Self-Employed, offering services to clients without being under the control of an employer. It is important to understand the benefits and obligations that come with this classification.

Receiving a 1099 form often indicates that you are self-employed. If you provide services and receive a 1099 for those services, it typically means you have a Puerto Rico Door Contractor Agreement - Self-Employed. This classification affects how you report your income to the tax authorities.

Yes, an independent contractor is generally considered self-employed. This means they operate their own business, set their own hours, and manage their projects, such as those outlined in a Puerto Rico Door Contractor Agreement - Self-Employed. Understanding this classification helps in managing taxes and legal responsibilities.

Yes, Puerto Rico does impose a self-employment tax. This tax applies to individuals who earn income through self-employment, including those with a Puerto Rico Door Contractor Agreement - Self-Employed. It is important for self-employed individuals to understand their tax obligations to remain compliant and avoid penalties.