Puerto Rico Withhold Issuance of Service of Process Request

Description

How to fill out Withhold Issuance Of Service Of Process Request?

Finding the right legitimate record format can be quite a have a problem. Of course, there are a lot of templates available on the net, but how do you discover the legitimate form you want? Use the US Legal Forms internet site. The assistance offers a huge number of templates, such as the Puerto Rico Withhold Issuance of Service of Process Request, which you can use for organization and personal demands. Each of the types are checked by professionals and meet up with federal and state requirements.

When you are presently listed, log in for your bank account and click the Download option to get the Puerto Rico Withhold Issuance of Service of Process Request. Make use of your bank account to check with the legitimate types you might have ordered formerly. Visit the My Forms tab of your respective bank account and get one more copy of your record you want.

When you are a fresh consumer of US Legal Forms, listed below are straightforward instructions that you should follow:

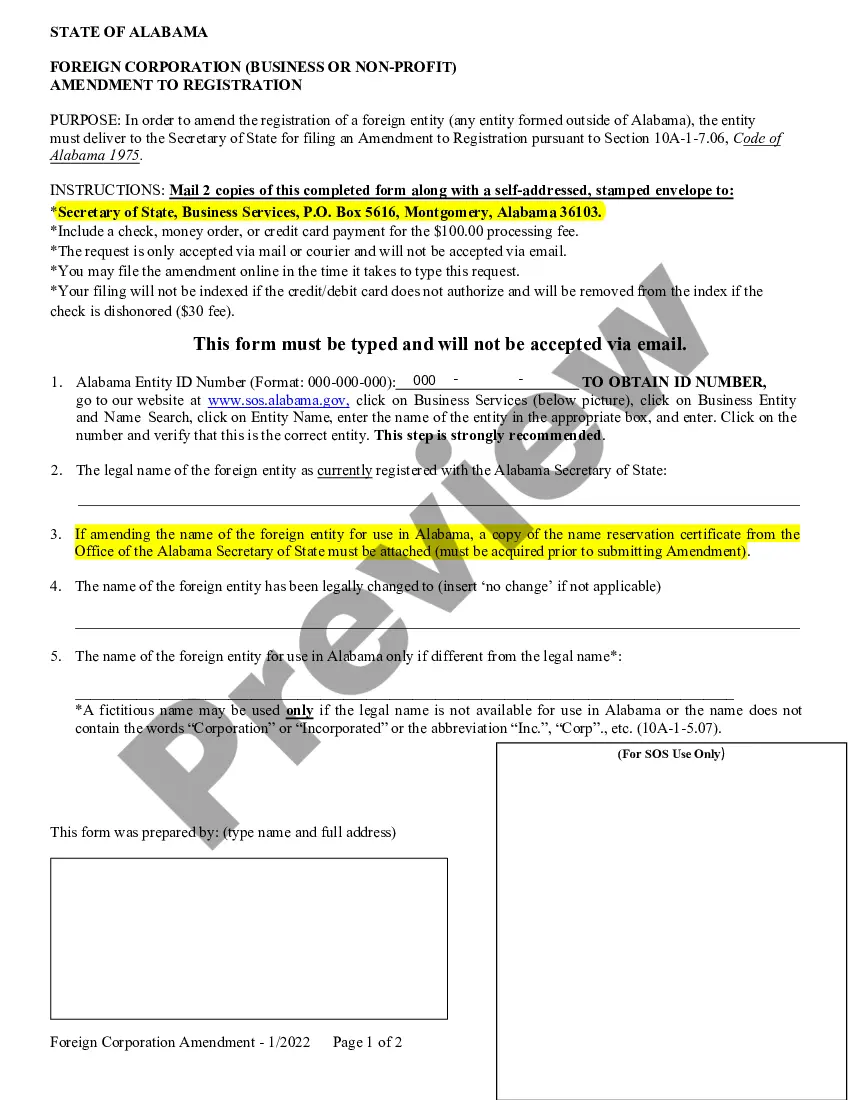

- Initial, ensure you have chosen the appropriate form for your metropolis/area. You are able to look through the form using the Review option and browse the form explanation to ensure this is the right one for you.

- In the event the form does not meet up with your needs, use the Seach field to discover the right form.

- When you are positive that the form is proper, click on the Purchase now option to get the form.

- Select the rates program you would like and enter the essential details. Design your bank account and purchase the order making use of your PayPal bank account or credit card.

- Opt for the document file format and acquire the legitimate record format for your device.

- Comprehensive, revise and print out and sign the obtained Puerto Rico Withhold Issuance of Service of Process Request.

US Legal Forms will be the largest catalogue of legitimate types for which you will find different record templates. Use the company to acquire appropriately-produced documents that follow condition requirements.

Form popularity

FAQ

While the Commonwealth government has its own tax laws, Puerto Rico residents are also required to pay US federal taxes, but most residents do not have to pay the federal personal income tax.

480.6C - Form 480.6C is intended for non-residents of Puerto Rico. It covers investment income that has been subject to Puerto Rico source withholding. 480.6D - Form 480.6D is intended for residents of Puerto Rico. It covers exempt income and income subject to the Puerto Rico Alternate Basic Tax (ABT).

Taxable items consist of tangible personal property, taxable services, admissions, digital products and ?bundled transactions.? Excluded from this definition include professional associations and certain membership fees; stamps issued by professional associations, the Commonwealth of Puerto Rico or the federal ...

Any natural or legal person doing business in Puerto Rico who makes payments (Payer) for rendered services must deduct and withhold 10% from such payment. Services provided include payments for professional services, repairs, maintenance, promotional services, legal services, services in general, among others.

In the case of a non-resident foreign corporation, a 29% withholding tax (WHT) rate is applicable on its Puerto Rico-source gross income not effectively connected with a Puerto Rico trade or business.

You must withhold the employee portion of FICA taxes from your employees' wages and contribute the employer portion of FICA tax. The current tax rate for Social Security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.

Not any different than the USA. Number of house Name of Street. City, puerto Rico. Zip code. One thing that is added is the name of the barrio or urbanization (subdivision) So a typucal address may be: 1645 Asomante St. Urb Altamesa. Carolina, Puerto Rico. 00934.