Puerto Rico Qualified Investor Certification Application

Description

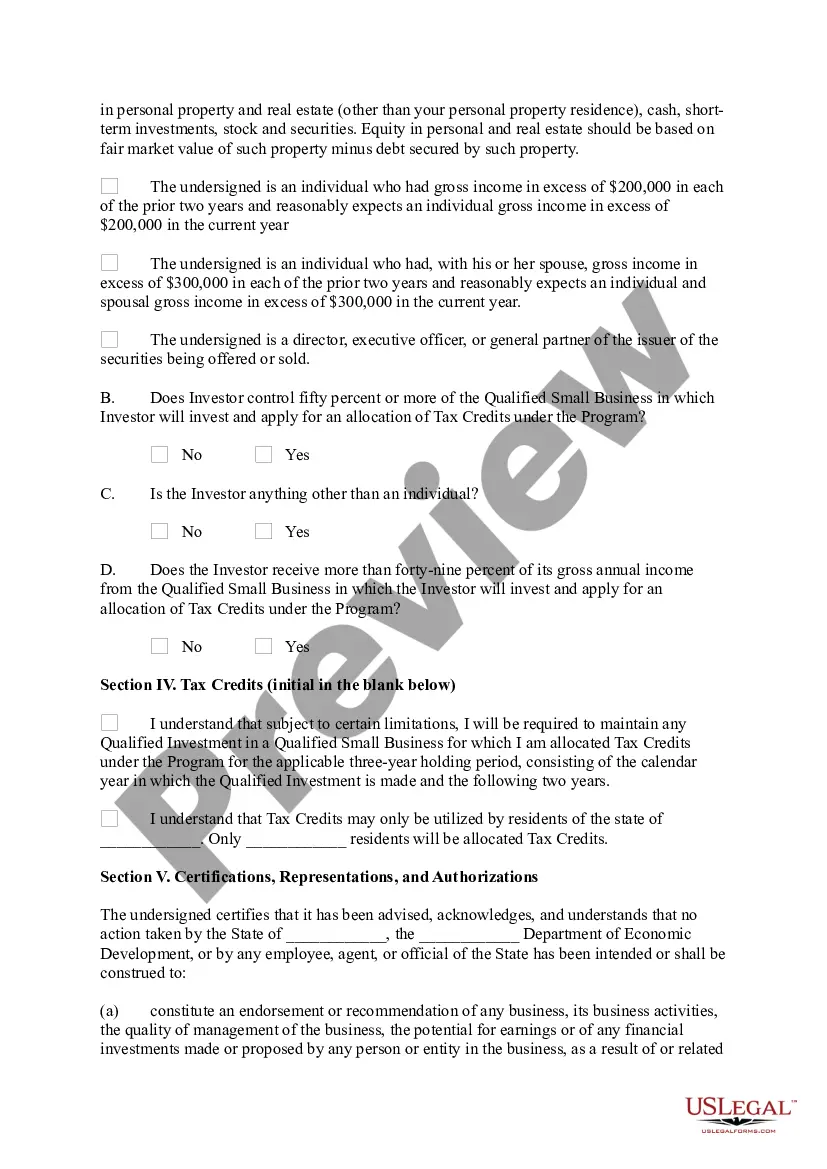

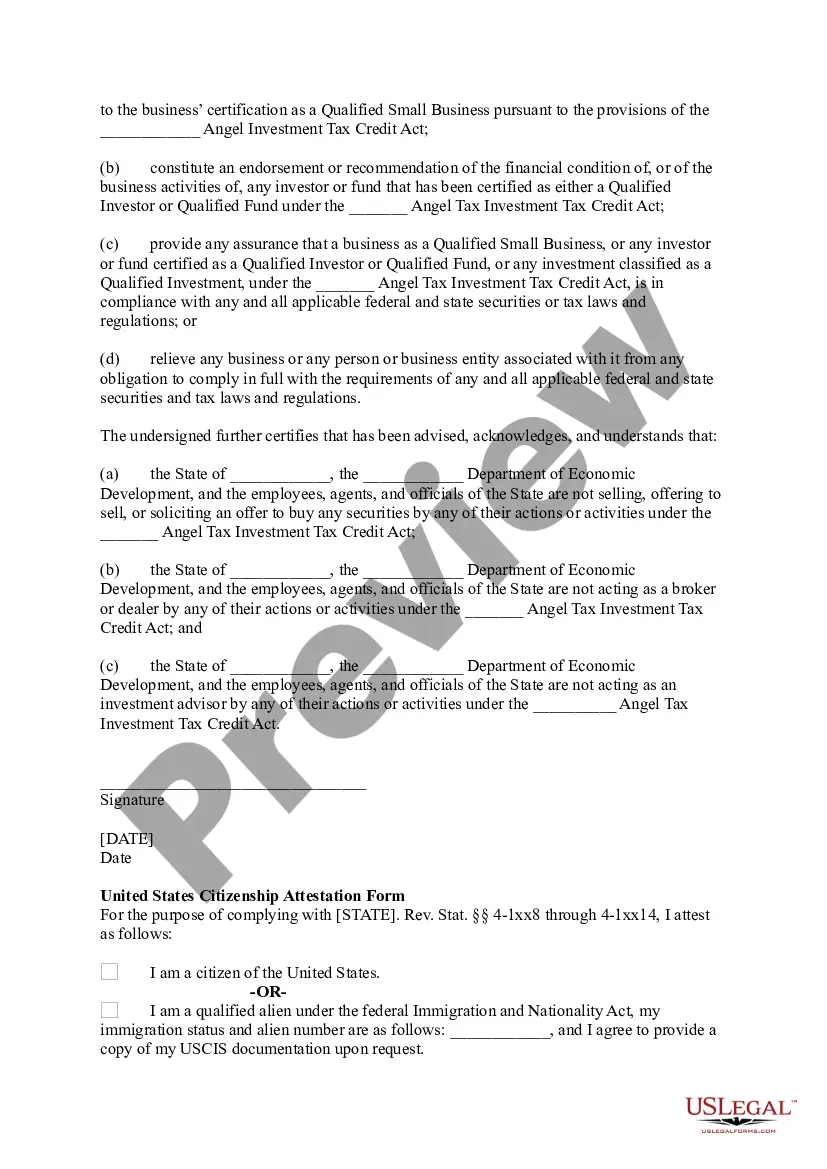

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Qualified Investor Certification Application?

US Legal Forms - among the most significant libraries of legal varieties in the States - delivers a wide array of legal record web templates you are able to acquire or print. While using website, you can get a huge number of varieties for enterprise and individual reasons, sorted by groups, says, or search phrases.You will find the latest models of varieties such as the Puerto Rico Qualified Investor Certification Application within minutes.

If you already have a subscription, log in and acquire Puerto Rico Qualified Investor Certification Application in the US Legal Forms library. The Download button can look on every single type you look at. You gain access to all formerly delivered electronically varieties within the My Forms tab of your respective bank account.

If you wish to use US Legal Forms the first time, listed below are basic instructions to help you started off:

- Ensure you have chosen the best type for the town/area. Click on the Preview button to analyze the form`s information. Look at the type information to actually have selected the proper type.

- If the type does not fit your demands, use the Lookup field towards the top of the display screen to obtain the one who does.

- If you are content with the form, validate your option by clicking on the Purchase now button. Then, select the pricing program you want and provide your credentials to sign up for an bank account.

- Procedure the purchase. Make use of bank card or PayPal bank account to complete the purchase.

- Pick the file format and acquire the form on your product.

- Make alterations. Fill out, modify and print and signal the delivered electronically Puerto Rico Qualified Investor Certification Application.

Each and every template you included in your bank account lacks an expiration particular date which is yours permanently. So, if you wish to acquire or print yet another backup, just visit the My Forms area and click on in the type you want.

Obtain access to the Puerto Rico Qualified Investor Certification Application with US Legal Forms, by far the most considerable library of legal record web templates. Use a huge number of professional and state-distinct web templates that satisfy your small business or individual requires and demands.

Form popularity

FAQ

Use Form 8996 to certify that the corporation or partnership is a qualified opportunity fund (QOF). It is also used to annually report whether the QOF met the investment standard during its tax year. About Form 8996, Qualified Opportunity Fund - IRS IRS (.gov) ? forms-pubs ? about-form-8996 IRS (.gov) ? forms-pubs ? about-form-8996

To qualify as a bona fide resident of Puerto Rico for any tax year, a person must satisfy each of three distinct tests: (1) the ?Presence Test?; (2) the ?Tax Home Test?; and (3) the ?Closer Connection Test?. [4] It is not enough merely to be present in Puerto Rico for 183 days in a given tax year.

Enter all sales and exchanges of capital assets, including stocks, bonds, and real estate (if not reported on line 1a or 8a of Schedule D or on Form 4684, 4797, 6252, 6781, or 8824). Include these transactions even if you didn't receive a Form 1099-B or 1099-S (or substitute statement) for the transaction. Instructions for Form 8949 (2022) | Internal Revenue Service irs.gov ? instructions irs.gov ? instructions

180 days Generally, you have 180 days to invest an eligible gain in a QOF. The first day of the 180-day period is the date the gain would be recognized for federal income tax purposes if you did not elect to defer the recognition of the gain. Opportunity Zones Frequently Asked Questions | Internal Revenue Service irs.gov ? credits-deductions ? opportunity-z... irs.gov ? credits-deductions ? opportunity-z...

The business and/or individual must submit an application through the Single Business Portal. Upon approval, they are granted a tax exemption decree which provides full details of tax rates and conditions mandated by the Law. This decree stands as a contract between the grantee and the Government of Puerto Rico.

A corporation or partnership that is organized and operated as a QOF must file Form 8996 annually with one of the following tax returns, as applicable. Form 1120, U.S. Corporation Income Tax Return.

Form 8986 is used by BBA partnerships to furnish and transmit each partner's share of adjustments to partnership-related items. Definitions. AAR partnership is a BBA partnership (see below) that has filed an administrative adjustment request (AAR) under section 6227. Instructions for Form 8986 - (December 2021) - IRS irs.gov ? pub ? irs-pdf irs.gov ? pub ? irs-pdf

Puerto Rico Resident Requirements 183-day physical presence in Puerto Rico, to establish a presumption of residency under the Puerto Rico Tax Code. No tax home outside of Puerto Rico during the year. ... Have a closer connection to Puerto Rico than to the US or another country.