Puerto Rico Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.

Description

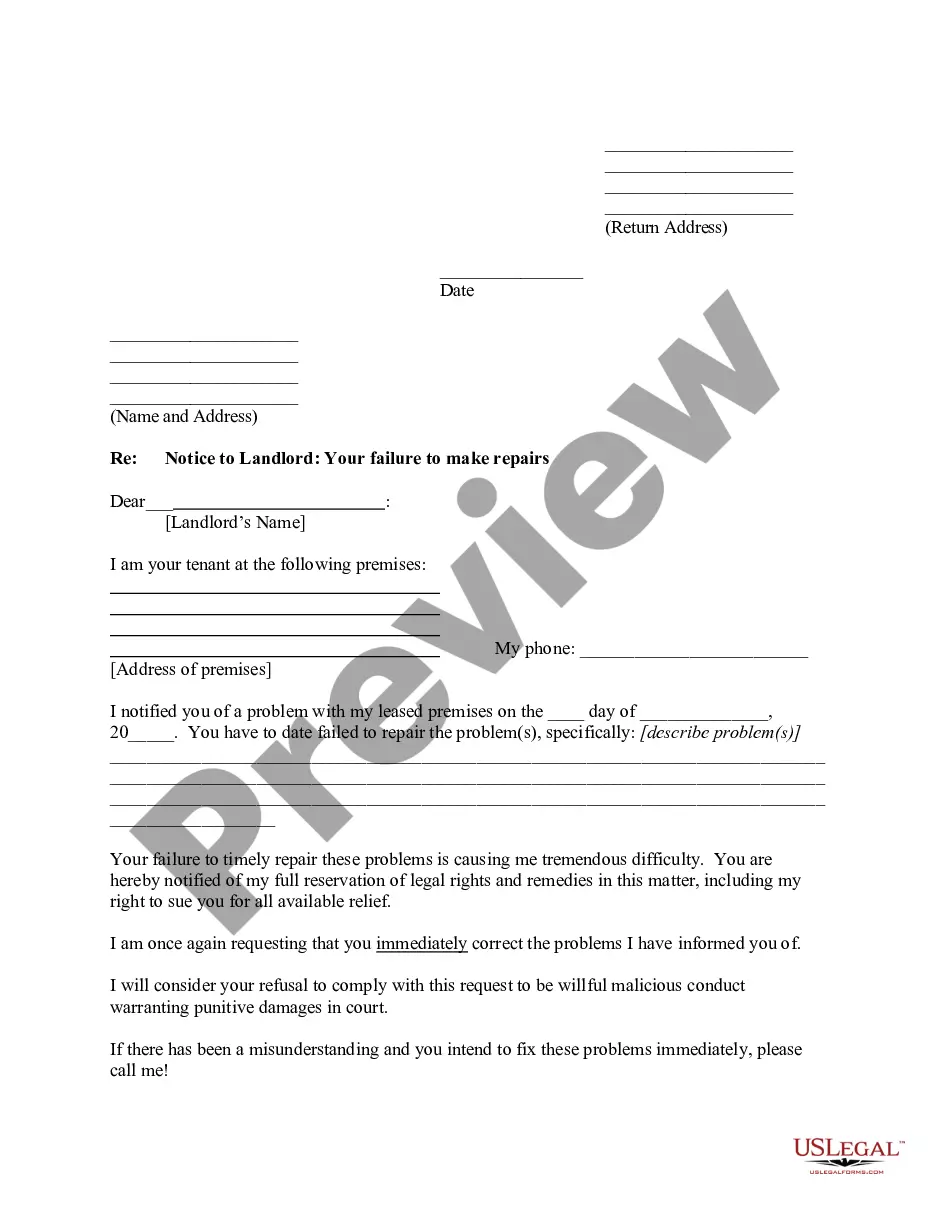

How to fill out Investment Advisory Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Assoc.?

US Legal Forms - one of many biggest libraries of legitimate types in the USA - provides a wide array of legitimate document themes it is possible to down load or printing. While using website, you will get a huge number of types for business and person functions, sorted by categories, suggests, or key phrases.You will find the most up-to-date models of types such as the Puerto Rico Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. in seconds.

If you currently have a registration, log in and down load Puerto Rico Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. from your US Legal Forms collection. The Acquire option will appear on every kind you perspective. You gain access to all earlier downloaded types in the My Forms tab of your accounts.

If you want to use US Legal Forms initially, allow me to share easy directions to help you get started off:

- Be sure to have chosen the right kind to your area/area. Click the Preview option to analyze the form`s content. Look at the kind description to actually have chosen the proper kind.

- If the kind doesn`t fit your requirements, use the Lookup field near the top of the display to get the one who does.

- When you are satisfied with the shape, confirm your selection by clicking the Acquire now option. Then, pick the costs plan you favor and supply your credentials to sign up for an accounts.

- Approach the financial transaction. Make use of your Visa or Mastercard or PayPal accounts to perform the financial transaction.

- Choose the file format and down load the shape in your product.

- Make alterations. Fill out, change and printing and indication the downloaded Puerto Rico Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc..

Every template you added to your bank account lacks an expiry time which is your own eternally. So, if you would like down load or printing another version, just go to the My Forms segment and then click in the kind you will need.

Get access to the Puerto Rico Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. with US Legal Forms, by far the most considerable collection of legitimate document themes. Use a huge number of skilled and state-certain themes that satisfy your organization or person requirements and requirements.

Form popularity

FAQ

The records required of investment advisers who have custody of client assets include: Journals showing securities transactions. Separate client ledger. Copies of trade confirmations. Record for each security held by client showing amount and location.

The investment advisory agreement should clearly outline the fee structure that the advisor will charge for their services. This may include a flat fee, a percentage of assets under management, or a performance-based fee. The agreement should also specify how the fee will be calculated and when it will be due.

A financial advisor contract, also known as an advisory agreement, specifies that the advisor is legally required to serve their client's needs. This agreement outlines the legal relationship between the advisor and the client.

They provide clear guidelines of what is expected of each party in order for your needs to be met. Investment advisory agreements typically include terms related to the advisors fee structure, investment methodology, level of risk a client is willing to take, and more.

Your advisory contract with a client must be in writing and disclose the services to be provided, the term of the contract, the advisory fee or the formula for computing the fee the amount or the manner of calculation of the amount of the prepaid fee to be returned in the event of contract termination or nonperformance ...

The brochure rule is a requirement under the Investment Advisers Act of 1940 that requires investment advisors to provide a written disclosure statement to their clients.