This due diligence form provides a list of meeting compliances and requirements for company directors regarding business transactions.

Puerto Rico Directors Meeting Compliance with Requirements

Description

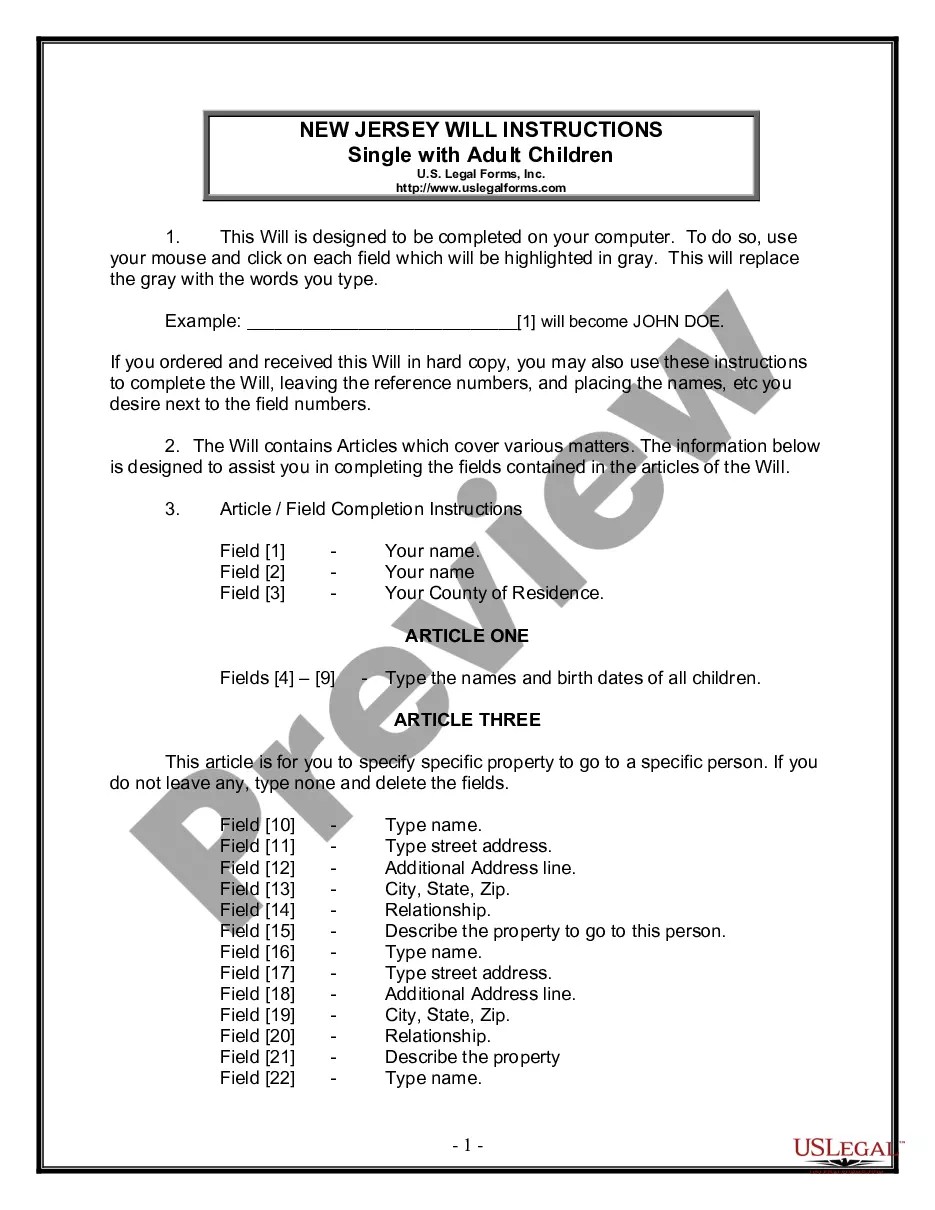

How to fill out Directors Meeting Compliance With Requirements?

You can allocate numerous hours online trying to locate the authentic document template that satisfies the state and federal stipulations you need.

US Legal Forms offers thousands of valid forms that can be assessed by professionals.

It is straightforward to obtain or print the Puerto Rico Directors Meeting Compliance with Requirements through the service.

To find another variation of the form, utilize the Search field to locate the template that meets your needs and specifications.

- If you hold a US Legal Forms account, you can sign in and click the Acquire button.

- Afterward, you can complete, modify, print, or sign the Puerto Rico Directors Meeting Compliance with Requirements.

- Each legitimate document template you obtain is yours permanently.

- To retrieve another version of the obtained form, navigate to the My documents tab and select the appropriate option.

- If you’re using the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for the area/town that you choose.

- Review the form details to confirm you have chosen the correct document.

Form popularity

FAQ

The 183 day rule in Puerto Rico determines whether you qualify as a resident for tax purposes. If you spend at least 183 days in Puerto Rico within a tax year, you are likely considered a resident. This rule is crucial for understanding Puerto Rico Directors Meeting Compliance with Requirements, as residency status can influence your business obligations and tax responsibilities.

Living on $2000 a month in Puerto Rico is feasible, but it largely depends on your lifestyle and location. Many residents manage to live comfortably within this budget by choosing affordable housing and cutting unnecessary expenses. Understanding local costs can help you plan better, particularly if your business needs to ensure Puerto Rico Directors Meeting Compliance with Requirements pertaining to employee compensation and operations.

To file your annual report in Puerto Rico online, visit the Puerto Rico Department of State’s website. You’ll need to gather essential information about your business and complete the online form. Staying compliant with Puerto Rico Directors Meeting Compliance with Requirements is critical, and completing your annual report accurately helps maintain your business standing.

To establish residency in Puerto Rico, you must physically reside in the territory for at least 183 days during the tax year. Additionally, you should maintain a permanent home and demonstrate your intent to live there. This is important for understanding Puerto Rico Directors Meeting Compliance with Requirements, as residing in Puerto Rico can affect your business operations and compliance status.

Ley 22 qualifications encompass individuals who have established residency in Puerto Rico and plan to remain for an extended period. They must not have tax residency in other jurisdictions while enjoying the advantages of this law. Understanding who qualifies helps potential beneficiaries align their plans with Puerto Rico Directors Meeting Compliance with Requirements, ensuring a seamless experience.

Ongoing requirements of Ley 22 stipulate that beneficiaries must maintain their resident status in Puerto Rico to retain tax benefits. Additionally, they need to file various tax forms and provide proof of residency when required. Staying compliant with these ongoing requirements is essential for anyone looking to enjoy the benefits while adhering to Puerto Rico Directors Meeting Compliance with Requirements.

The Puerto Rico Oversight Management and Economic Stability Act was enacted to address the island's fiscal crisis by establishing oversight mechanisms. This act aims to stabilize the economy and oversee budgetary compliance, impacting how businesses operate within Puerto Rico. Understanding this context is crucial for effective Puerto Rico Directors Meeting Compliance with Requirements.

Tax Code 22 in Puerto Rico refers to the legislation that governs individual investors and offers significant tax exemptions for those who qualify. This often includes no tax on dividends and reduced rates on capital gains. Having a solid grasp of Tax Code 22 is vital for anyone navigating Puerto Rico Directors Meeting Compliance with Requirements.

Eligibility for Act 22 includes individuals who can establish residency in Puerto Rico and are not tax residents of any other location. This offers significant tax benefits aimed at attracting new residents, particularly those in business and investment sectors. Staying informed about eligibility helps individuals maximize their advantages while ensuring Puerto Rico Directors Meeting Compliance with Requirements.

The General Corporation Act in Puerto Rico establishes the legal framework for corporations in the territory. It covers formation, governance, and dissolution of corporations, ensuring they operate within the law. This act is crucial for those focused on Puerto Rico Directors Meeting Compliance with Requirements, as it provides guidelines for corporate meetings and record-keeping.