Puerto Rico Management Questionnaire Employee Benefit Matters

Description

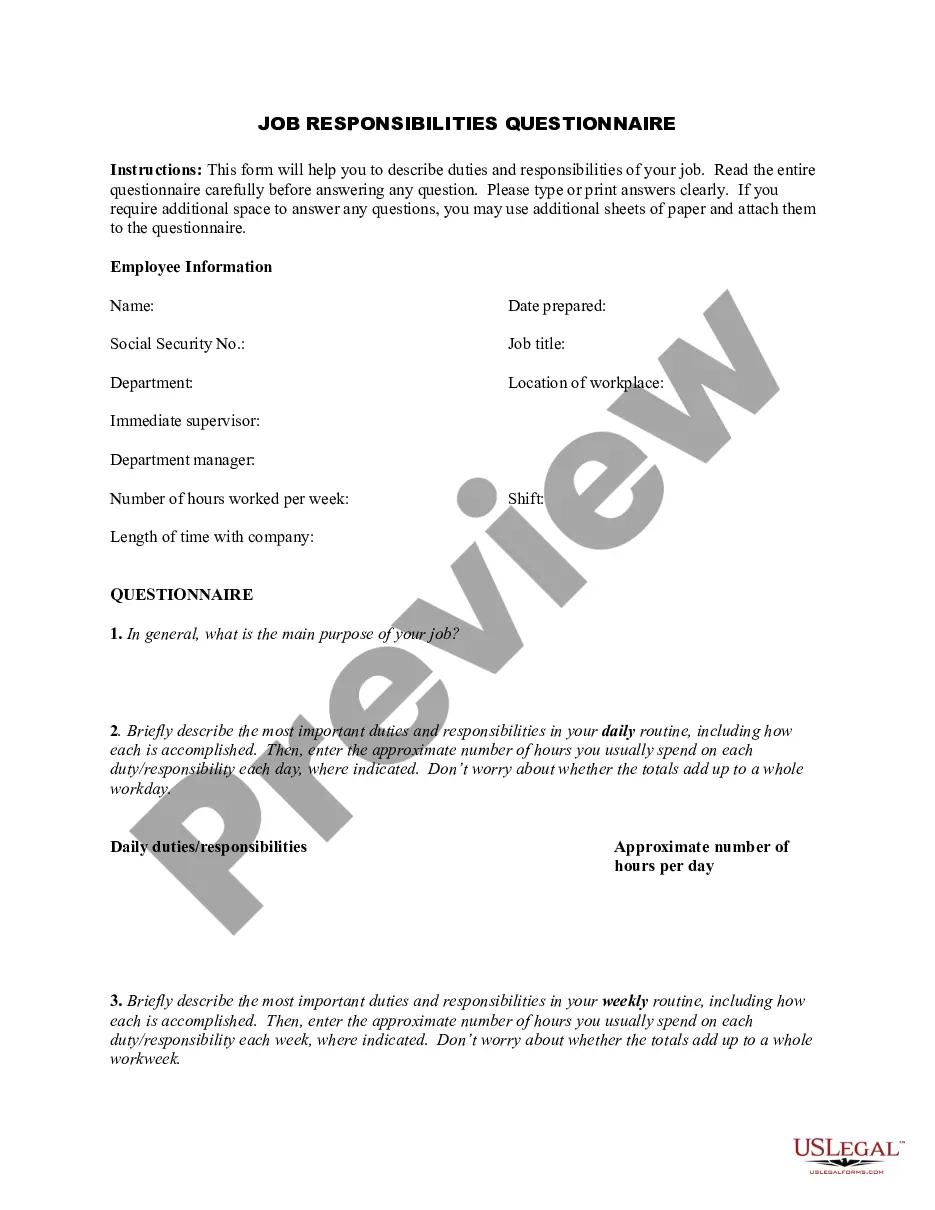

How to fill out Management Questionnaire Employee Benefit Matters?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print. By using the website, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Puerto Rico Management Questionnaire Employee Benefit Matters within minutes. If you already have an account, Log In and download the Puerto Rico Management Questionnaire Employee Benefit Matters from the US Legal Forms library. The Download button will appear on each form you view.

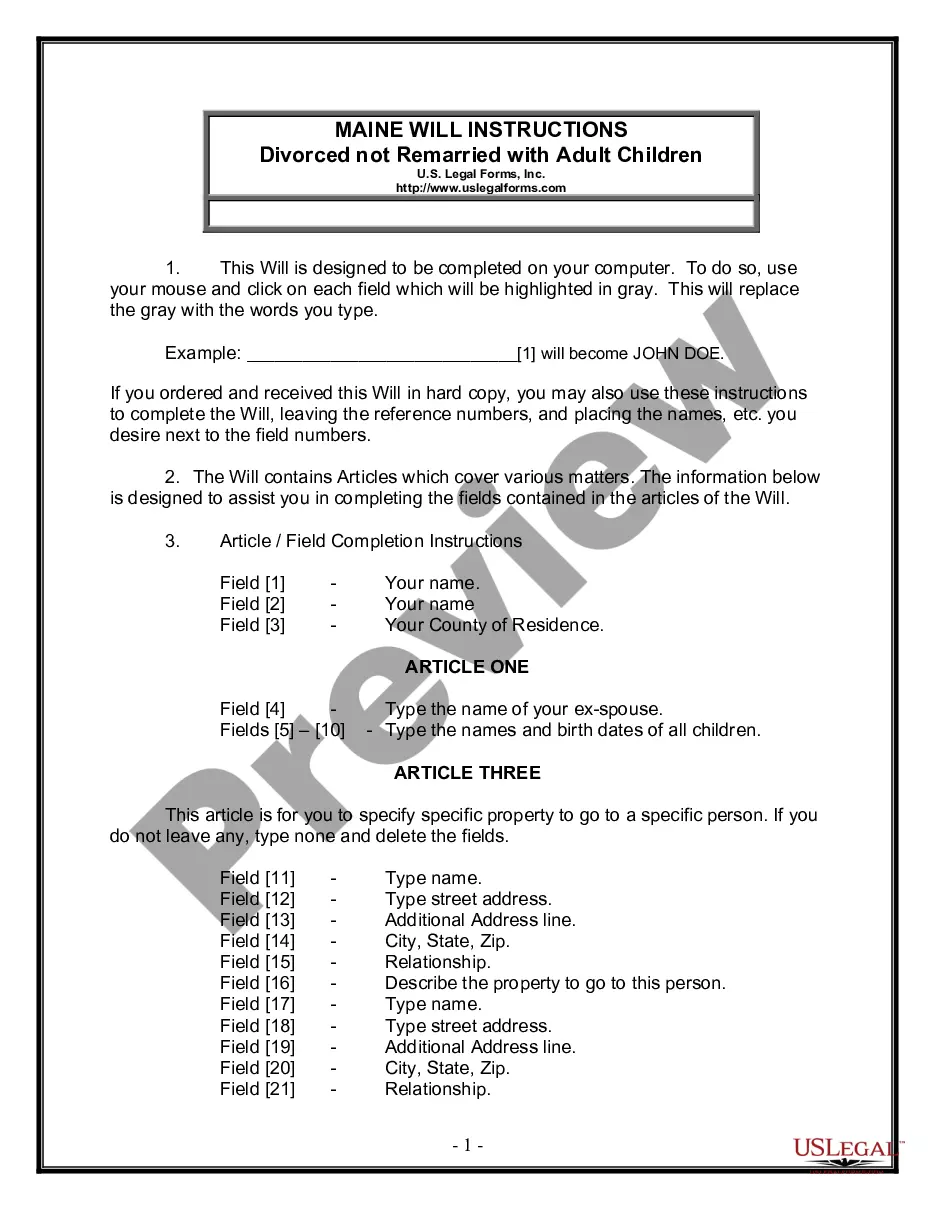

You have access to all previously downloaded forms in the My documents section of your account. If you are using US Legal Forms for the first time, here are simple instructions to get you started: Ensure you have selected the correct form for your region/county. Click the Preview button to examine the form's content. Review the form description to make sure you have chosen the right form.

Each template you add to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just visit the My documents section and click on the form you need.

Access the Puerto Rico Management Questionnaire Employee Benefit Matters with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements and demands.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you want and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Choose the file format and download the form to your device.

- Make modifications. Complete, edit, print, and sign the downloaded Puerto Rico Management Questionnaire Employee Benefit Matters.

Form popularity

FAQ

This includes measurable indicators such as, average task completion rate, revenue per employee, profit per employee, overtime per employee, and employee capacity. Another reliable way to measure the success of employee benefits packages is to take into account staff turnover rates.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

What's your benefits package? This question is fair gamebut only after you receive the job offer. Employers want to hire people who are passionate about the job, the work and the organization, Templin explains. When questions about benefits are asked too early, you're not giving off that perception.

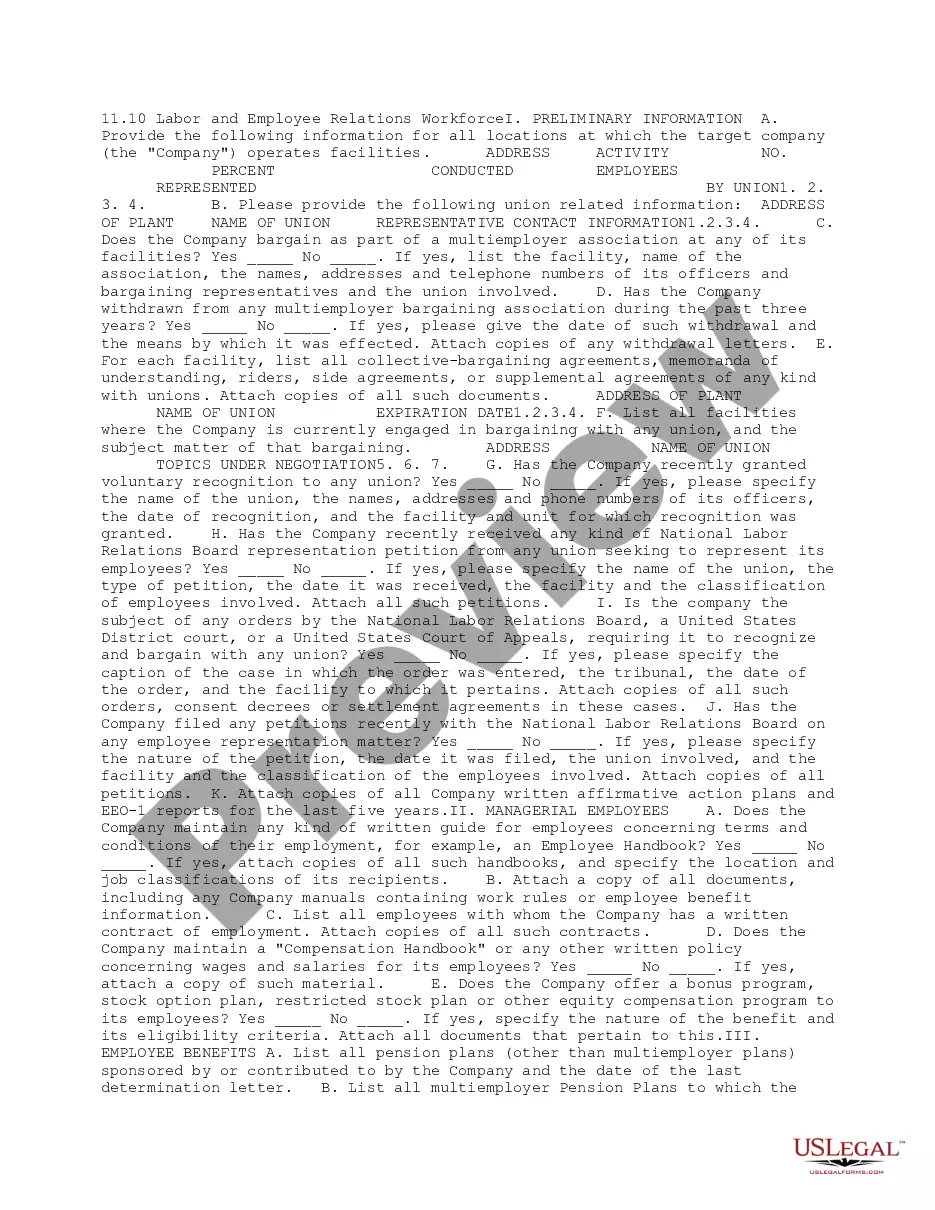

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

How to answer "What are your total compensation expectations?"Research the industry and geographic area.Emphasize your flexibility.State a range rather than a fixed amount.Consider offering high compensation.Be honest.Focus on why you expect the amount.Prepare for price negotiation.

In Puerto Rico, the payroll frequency is bi-weekly, monthly or semi-monthly. An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory.

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Questions to Ask About Employee BenefitsDoes the company offer health insurance?Will it cover members or my family as well as myself?How much of the premium costs do I have to pay for myself?Can I choose different levels of coverage?What kind of coverage is there for dental, vision and disability insurance?More items...