Puerto Rico Proposed Amendment to articles of incorporation regarding preemptive rights

Description

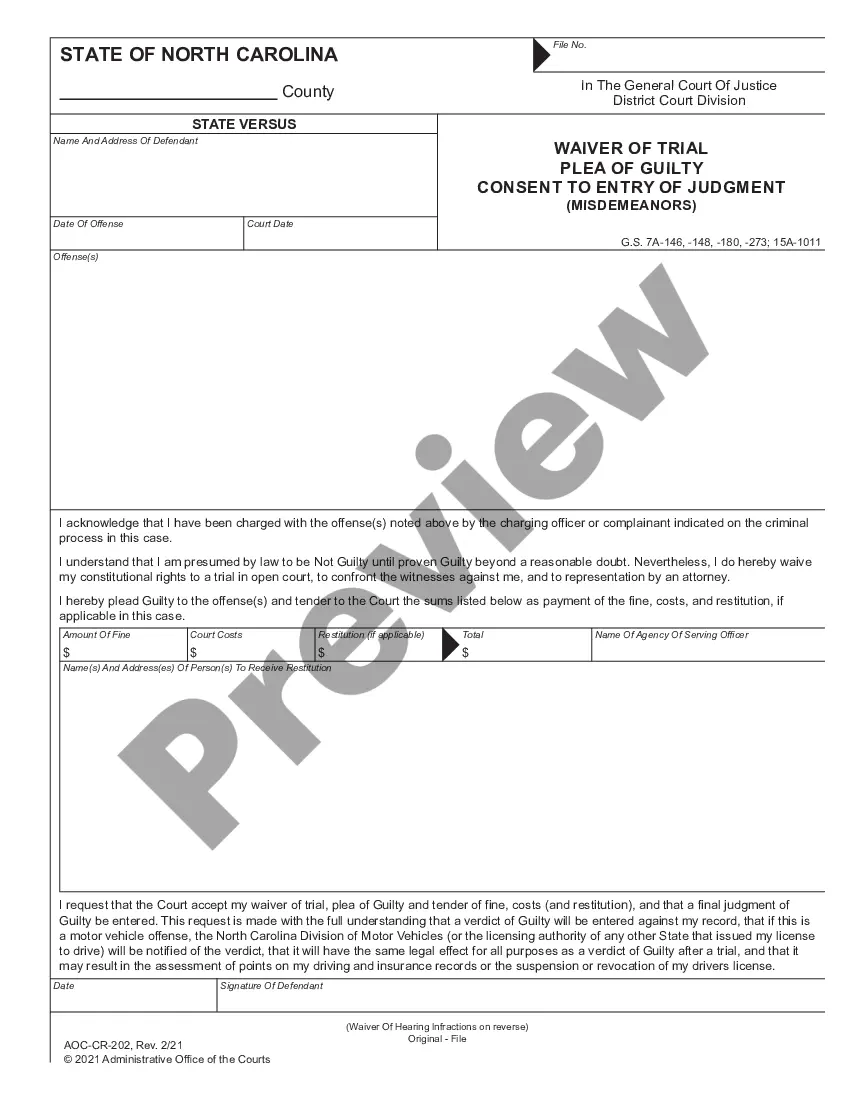

How to fill out Proposed Amendment To Articles Of Incorporation Regarding Preemptive Rights?

US Legal Forms - one of many most significant libraries of lawful varieties in America - delivers a variety of lawful document themes it is possible to acquire or print out. Making use of the web site, you can find a large number of varieties for company and individual reasons, sorted by categories, claims, or search phrases.You can get the most up-to-date versions of varieties like the Puerto Rico Proposed Amendment to articles of incorporation regarding preemptive rights within minutes.

If you already possess a subscription, log in and acquire Puerto Rico Proposed Amendment to articles of incorporation regarding preemptive rights from your US Legal Forms local library. The Download key will appear on every type you view. You have accessibility to all in the past saved varieties in the My Forms tab of the profile.

If you wish to use US Legal Forms the first time, allow me to share easy directions to obtain started:

- Ensure you have picked out the correct type for the town/region. Select the Review key to analyze the form`s articles. Look at the type description to ensure that you have selected the appropriate type.

- In case the type does not fit your needs, use the Research field at the top of the screen to discover the the one that does.

- If you are satisfied with the shape, validate your choice by visiting the Purchase now key. Then, pick the prices plan you prefer and give your references to sign up for the profile.

- Procedure the transaction. Make use of your credit card or PayPal profile to accomplish the transaction.

- Select the file format and acquire the shape in your device.

- Make modifications. Fill up, revise and print out and indicator the saved Puerto Rico Proposed Amendment to articles of incorporation regarding preemptive rights.

Every design you put into your bank account does not have an expiration date and is also yours eternally. So, if you would like acquire or print out one more duplicate, just go to the My Forms segment and click in the type you need.

Obtain access to the Puerto Rico Proposed Amendment to articles of incorporation regarding preemptive rights with US Legal Forms, one of the most extensive local library of lawful document themes. Use a large number of specialist and condition-certain themes that satisfy your business or individual needs and needs.

Form popularity

FAQ

U.S. citizens who become bona fide residents of Puerto Rico can maintain their U.S. citizenship, avoid U.S. federal income tax on capital gains, including U.S.-source capital gains, and avoid paying any income tax on interest and dividends from Puerto Rican sources.

4% corporate tax rate. 100% tax-exempt dividends. 60% exemption on municipal taxes. No federal taxes on Puerto Rico source income.

Puerto Rico Business Taxes No income tax on dividends and interest. No capital gains tax. Fixed income tax rate of 4 percent on income gained from export services. No property tax for the first five years (Only 10% of the usual property tax rate afterwards) 60% reduction of the municipal tax rate.

A domestic corporation is taxable in Puerto Rico on its worldwide income. A foreign corporation engaged in trade or business in Puerto Rico is taxed at the regular corporate tax rates on income from Puerto Rico sources that is effectively connected income.

Application for Registration CostDescriptionDownload$150.00 o 5.00Foreign Corporation - Certificated of Authorization to do businessDownload$150.00Close CorporationDownload$150.00Professional CorporationDownload$110.00Limited Liability SocietyDownload2 more rows

In terms of tax benefits, Puerto Rico is a sunny place for US residents to start a business, especially if they plan to export products out of Puerto Rico to the rest of the world. The Puerto Rico government offers tax incentives to attract US business owners to emigrate to Puerto Rico.

Protection by the U.S.: As a U.S. Territory, Puerto Rico is protected by the U.S. military and government. Exempt from U.S. Taxes: Puerto Rico's Controlled Foreign Corporation (CFC) structure allows income generated from selling products to the United States exempt from U.S. Taxes.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.